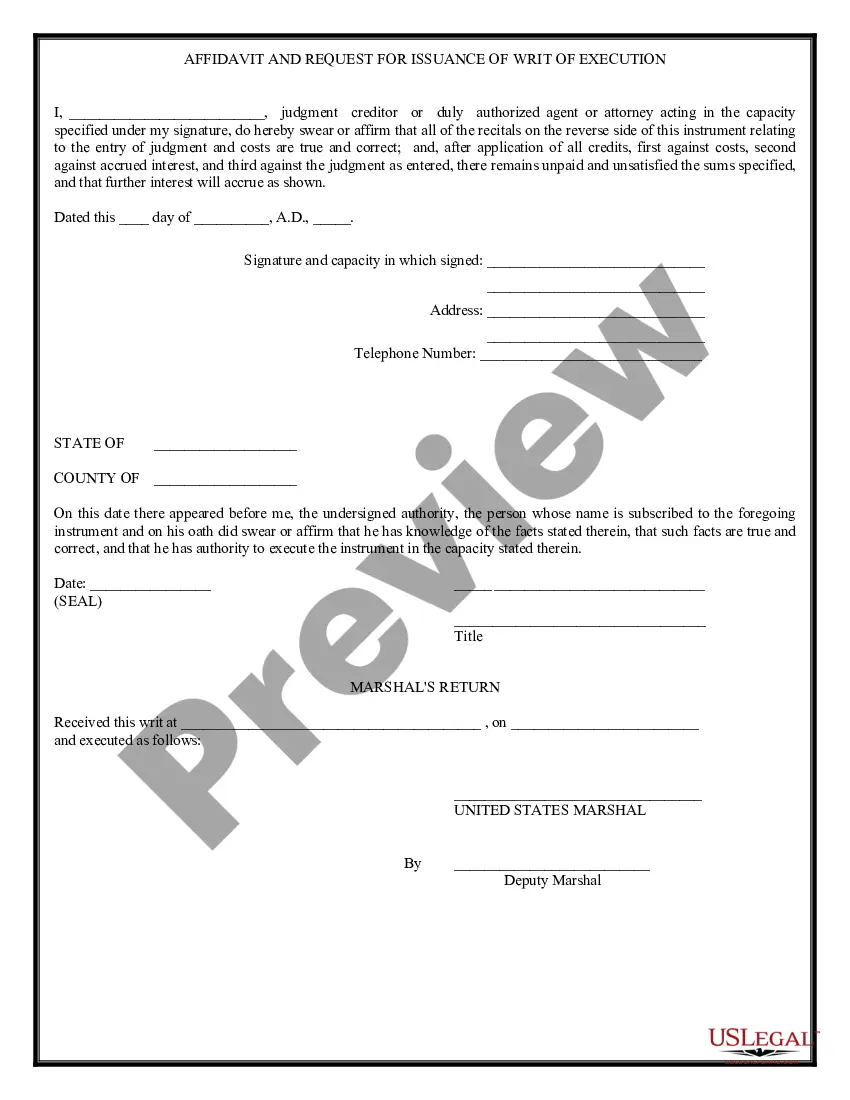

South Dakota Writ of Execution

Description

How to fill out Writ Of Execution?

US Legal Forms - one of several greatest libraries of lawful types in the United States - provides a wide range of lawful document layouts you can down load or print out. Making use of the website, you will get thousands of types for organization and specific functions, sorted by groups, suggests, or keywords.You can find the latest models of types much like the South Dakota Writ of Execution in seconds.

If you already have a monthly subscription, log in and down load South Dakota Writ of Execution from your US Legal Forms catalogue. The Download key can look on every kind you view. You have accessibility to all in the past saved types in the My Forms tab of the accounts.

In order to use US Legal Forms for the first time, here are easy directions to help you began:

- Be sure to have selected the correct kind to your area/area. Go through the Preview key to check the form`s content. Look at the kind explanation to ensure that you have selected the proper kind.

- In the event the kind doesn`t match your demands, utilize the Lookup field near the top of the monitor to obtain the the one that does.

- In case you are pleased with the form, confirm your decision by visiting the Acquire now key. Then, select the rates plan you favor and give your qualifications to sign up for an accounts.

- Approach the deal. Make use of bank card or PayPal accounts to complete the deal.

- Choose the formatting and down load the form on your own device.

- Make modifications. Load, modify and print out and indication the saved South Dakota Writ of Execution.

Every single template you included in your money lacks an expiry date and is your own forever. So, if you want to down load or print out another duplicate, just check out the My Forms portion and then click about the kind you will need.

Get access to the South Dakota Writ of Execution with US Legal Forms, one of the most considerable catalogue of lawful document layouts. Use thousands of skilled and state-specific layouts that satisfy your company or specific needs and demands.

Form popularity

FAQ

Terms: Execution of Judgment: Execution refers to an official document that directs a sheriff to take possession of a judgment debtor's property so that it either (a) may be turned over to the judgment creditor or (b) may be sold at public sale so that the proceeds may be turned over to the judgment creditor. Foundations of Law - Enforcement of Judgments - LawShelf lawshelf.com ? coursewarecontentview ? enforce... lawshelf.com ? coursewarecontentview ? enforce...

A writ of execution is a process issued by the court directing the U.S. Marshal to enforce and satisfy a judgment for payment of money. (Federal Rules of Civil Procedure 69).

The Supreme and circuit courts and the judges thereof shall have power to issue writs of habeas corpus for the purpose of bringing any person imprisoned in any prison before any court or magistrate, to testify in any criminal action or proceeding in any county of the state, and returning such person to such prison.

Final judgment may be satisfied from any kind of property of the judgment obligor, not exempt from execution. In the case of judgment for money, the execution shall be carried out by demanding from the judgment obligor the immediate payment to the judgment obligee the full amount stated in the writ of execution. Enforcement of Civil Case Judgment in the Philippines led.go.th ? inter ? pdf ? 1_Phillipines led.go.th ? inter ? pdf ? 1_Phillipines

A writ of execution may be requested from the court once a civil lawsuit has been won in Civil Court or Small Claims Court. Once a party has been awarded a judgment, an execution grants the Sheriff's Office power to attempt to collect the money owed.

If the liability of one party to another has been determined by verdict or order or judgment, but the amount or extent of the liability remains to be determined by further proceedings, the party adjudged liable may make an offer of judgment, which shall have the same effect as an offer made before trial if it is served ... Codified Law 15-6-68 - South Dakota Legislature sdlegislature.gov ? Statutes sdlegislature.gov ? Statutes

§ 15-35-810. A judgment becomes a lien on real property for a period of 10 years. S.D. Codified Laws § 15-16-7.