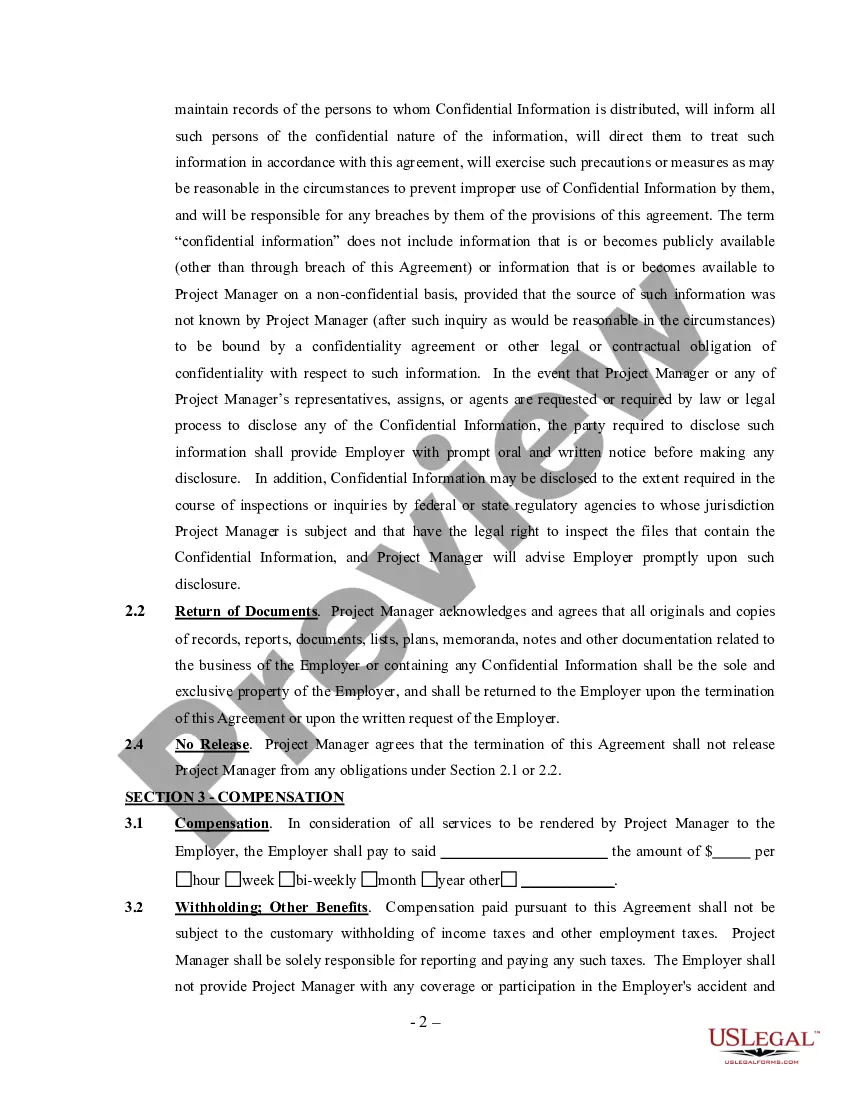

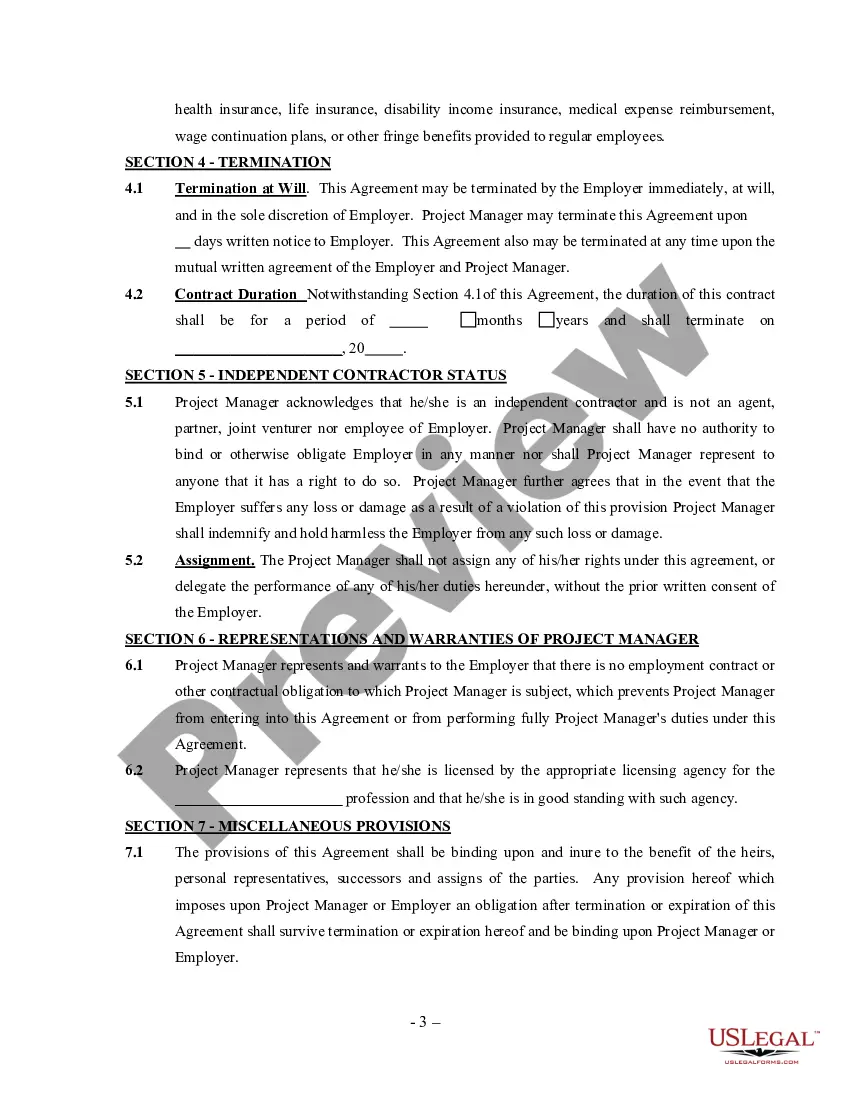

South Dakota Outside Project Manager Agreement - Self-Employed Independent Contractor

Description

How to fill out South Dakota Outside Project Manager Agreement - Self-Employed Independent Contractor?

Have you been in a position where you need to have paperwork for either business or specific uses virtually every day time? There are plenty of legitimate document web templates available on the net, but getting types you can rely on isn`t simple. US Legal Forms gives 1000s of type web templates, such as the South Dakota Outside Project Manager Agreement - Self-Employed Independent Contractor, that are composed to meet state and federal needs.

Should you be presently informed about US Legal Forms internet site and have an account, basically log in. After that, you can obtain the South Dakota Outside Project Manager Agreement - Self-Employed Independent Contractor design.

Should you not offer an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Get the type you want and ensure it is for the appropriate area/region.

- Take advantage of the Review key to review the form.

- Look at the explanation to ensure that you have chosen the right type.

- In the event the type isn`t what you`re trying to find, take advantage of the Search field to get the type that fits your needs and needs.

- Whenever you discover the appropriate type, simply click Acquire now.

- Select the prices strategy you would like, complete the required details to produce your bank account, and buy your order utilizing your PayPal or bank card.

- Select a convenient paper file format and obtain your duplicate.

Locate all of the document web templates you possess bought in the My Forms menus. You can aquire a further duplicate of South Dakota Outside Project Manager Agreement - Self-Employed Independent Contractor whenever, if needed. Just click on the essential type to obtain or print the document design.

Use US Legal Forms, one of the most substantial variety of legitimate types, in order to save efforts and avoid faults. The assistance gives expertly produced legitimate document web templates that you can use for a variety of uses. Produce an account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.