South Dakota Moving Services Contract - Self-Employed

Description

How to fill out South Dakota Moving Services Contract - Self-Employed?

Choosing the right legitimate papers design can be a have difficulties. Naturally, there are tons of themes available on the net, but how can you obtain the legitimate develop you require? Take advantage of the US Legal Forms internet site. The assistance gives thousands of themes, such as the South Dakota Moving Services Contract - Self-Employed, that can be used for organization and personal requirements. All the varieties are checked by professionals and fulfill federal and state specifications.

Should you be already signed up, log in in your accounts and then click the Acquire option to have the South Dakota Moving Services Contract - Self-Employed. Make use of your accounts to search with the legitimate varieties you may have ordered in the past. Check out the My Forms tab of your accounts and obtain an additional backup in the papers you require.

Should you be a fresh customer of US Legal Forms, listed below are easy directions so that you can adhere to:

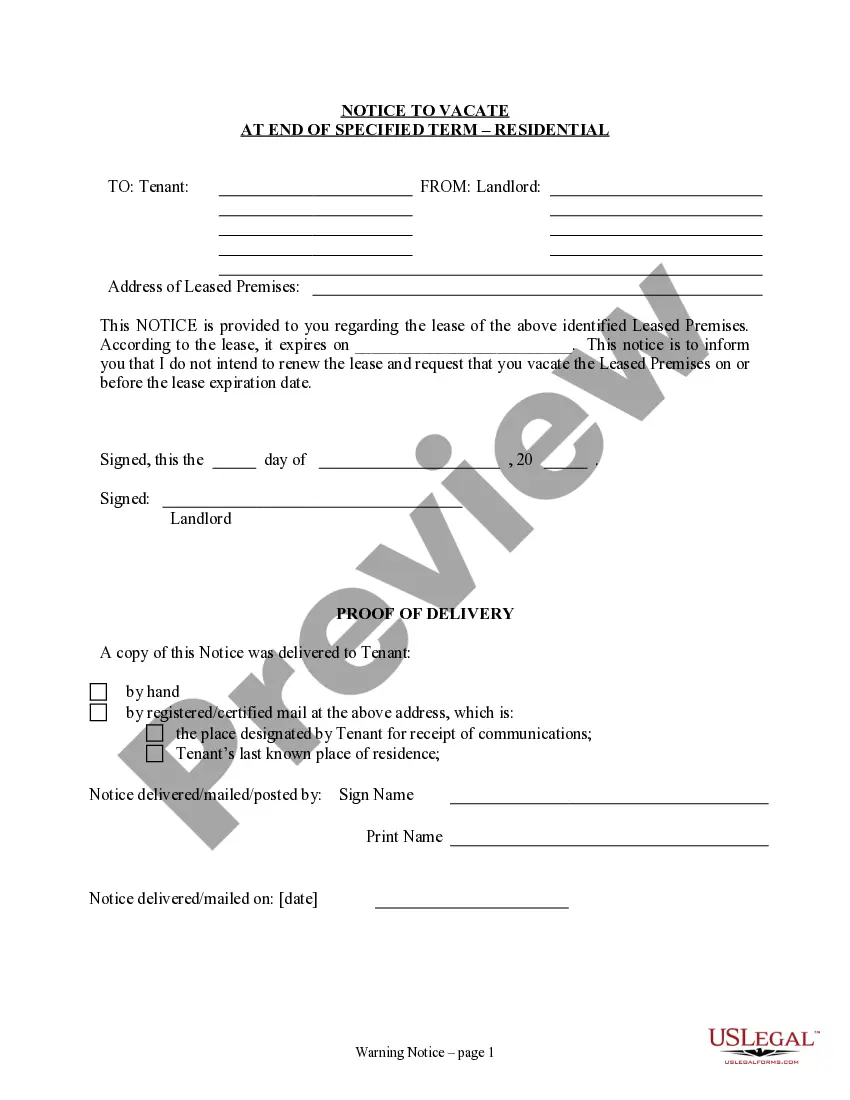

- Initial, ensure you have chosen the proper develop for your city/region. It is possible to examine the form using the Preview option and study the form description to guarantee it will be the right one for you.

- In the event the develop is not going to fulfill your expectations, make use of the Seach field to find the right develop.

- When you are certain the form is proper, select the Purchase now option to have the develop.

- Choose the pricing prepare you need and enter the necessary details. Create your accounts and pay money for your order with your PayPal accounts or credit card.

- Select the data file formatting and download the legitimate papers design in your product.

- Comprehensive, revise and print out and sign the received South Dakota Moving Services Contract - Self-Employed.

US Legal Forms may be the greatest library of legitimate varieties in which you can find numerous papers themes. Take advantage of the service to download professionally-manufactured papers that adhere to state specifications.

Form popularity

FAQ

Yes, in some cases individuals can legitimately be self-employed and only work for one company. For example, if they are just starting out as a freelancer and are searching for new clients.

To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center. You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done). This applies even if you are given freedom of action.

You can be both employed and self-employed at the same time, for example if you work for an employer during the day and run your own business in the evenings.

You are required to complete a 1099-MISC reporting form for an independent worker or unincorporated business if you paid that independent worker or business $600 or more. You add up all payments made to a payee during the year, and if the amount is $600 or more for the year, you must issue a 1099 for that payee.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

1099 Worker Defined A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

The IRS says that someone is self-employed if they meet one of these conditions: Someone who carries on a trade or business as a sole proprietor or independent contractor, A member of a partnership that carries on a trade or business, or. Someone who is otherwise in business for themselves, including part-time business