South Dakota Public Relations Agreement - Self-Employed Independent Contractor

Description

How to fill out South Dakota Public Relations Agreement - Self-Employed Independent Contractor?

Choosing the right legitimate file format can be a struggle. Obviously, there are a lot of templates available online, but how will you find the legitimate kind you want? Take advantage of the US Legal Forms internet site. The support delivers thousands of templates, such as the South Dakota Public Relations Agreement - Self-Employed Independent Contractor, which can be used for organization and personal demands. All the forms are checked by professionals and fulfill federal and state requirements.

In case you are already signed up, log in for your accounts and then click the Download button to obtain the South Dakota Public Relations Agreement - Self-Employed Independent Contractor. Utilize your accounts to look with the legitimate forms you may have bought in the past. Visit the My Forms tab of the accounts and acquire another version from the file you want.

In case you are a brand new end user of US Legal Forms, allow me to share easy directions so that you can stick to:

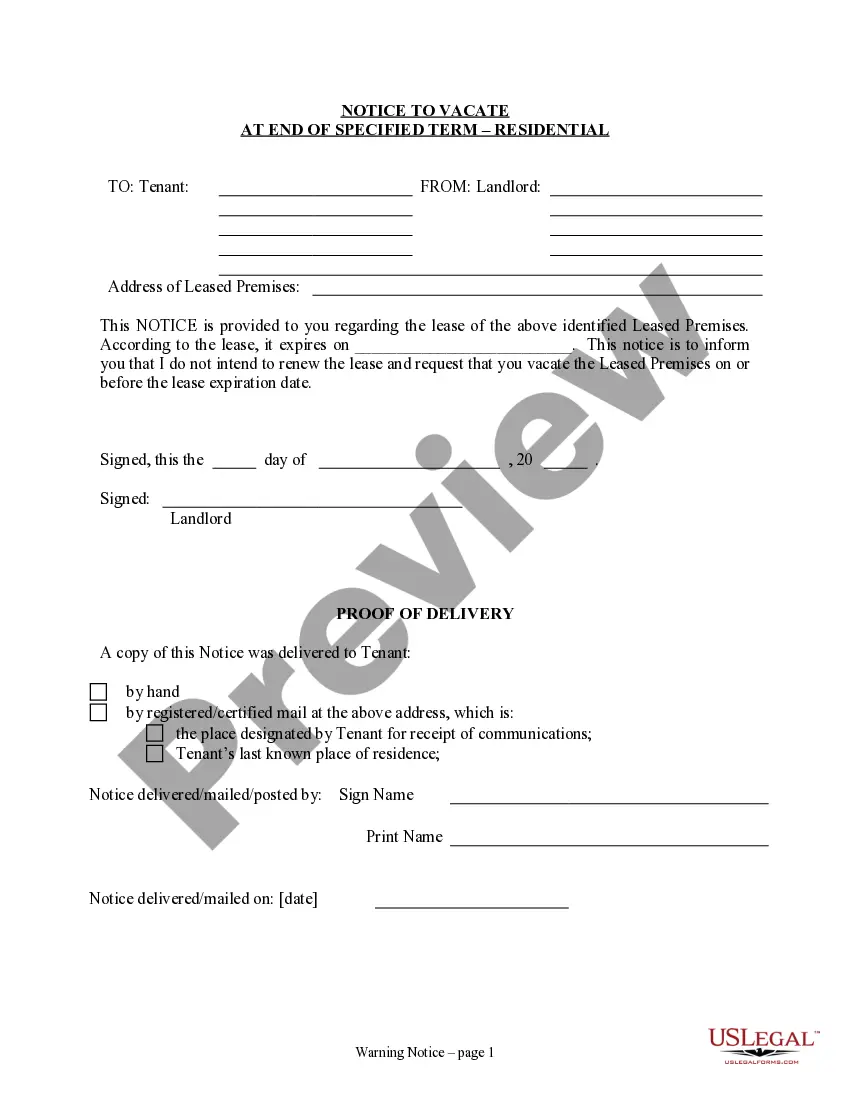

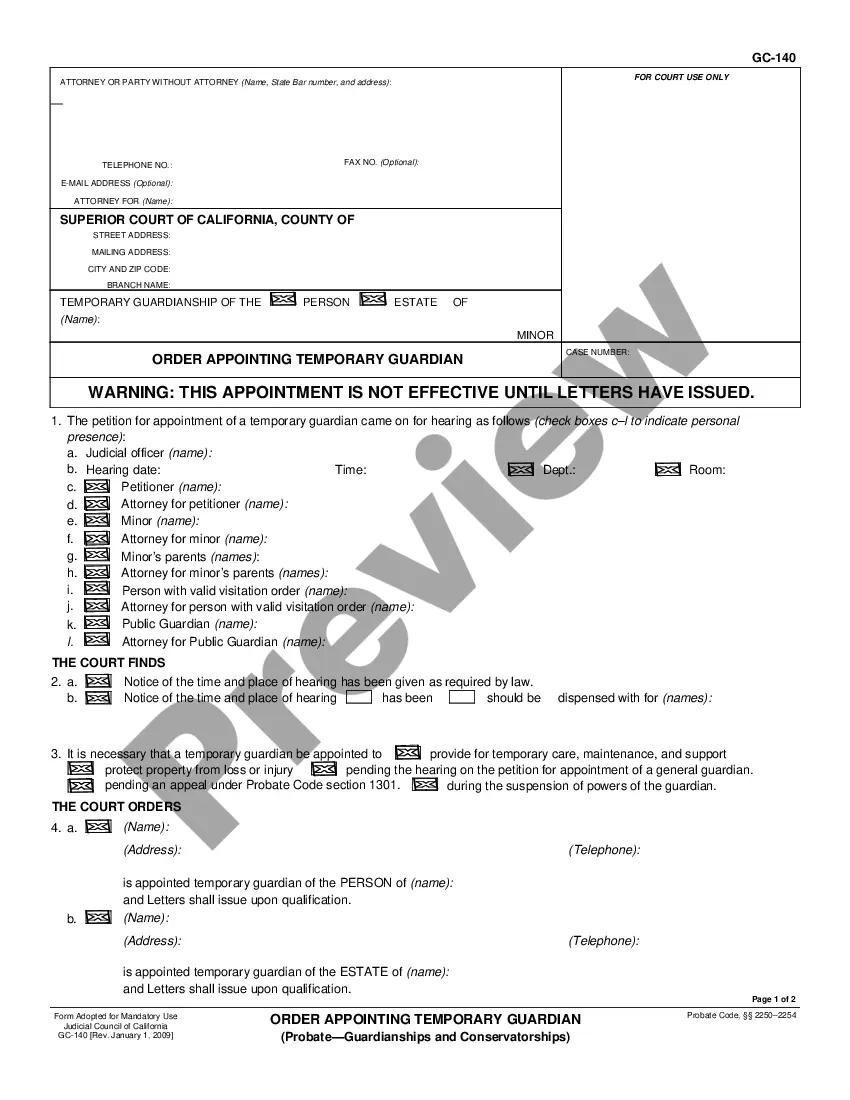

- First, ensure you have chosen the right kind for your personal town/area. It is possible to look through the shape making use of the Preview button and browse the shape outline to make certain it will be the right one for you.

- When the kind does not fulfill your requirements, utilize the Seach industry to obtain the right kind.

- Once you are sure that the shape is suitable, go through the Purchase now button to obtain the kind.

- Pick the prices strategy you would like and enter the necessary details. Build your accounts and buy an order with your PayPal accounts or Visa or Mastercard.

- Opt for the data file file format and down load the legitimate file format for your product.

- Comprehensive, edit and print out and sign the acquired South Dakota Public Relations Agreement - Self-Employed Independent Contractor.

US Legal Forms may be the biggest collection of legitimate forms for which you can discover numerous file templates. Take advantage of the company to down load skillfully-made paperwork that stick to state requirements.

Form popularity

FAQ

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

The other contract (Independent contractor) is a Contract for Service, and is usually a contract where the contractor undertakes to perform a specific service or task, and upon completion of the agreed service or task, or upon production of the result agreed upon, the contractor will be paid.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.