South Dakota Bookkeeping Agreement - Self-Employed Independent Contractor

Description

How to fill out South Dakota Bookkeeping Agreement - Self-Employed Independent Contractor?

Choosing the right legal papers design can be quite a struggle. Obviously, there are plenty of templates available online, but how can you discover the legal type you will need? Utilize the US Legal Forms site. The assistance gives thousands of templates, for example the South Dakota Bookkeeping Agreement - Self-Employed Independent Contractor, which you can use for organization and private needs. All the kinds are examined by professionals and fulfill federal and state requirements.

If you are currently registered, log in to your account and click the Acquire button to obtain the South Dakota Bookkeeping Agreement - Self-Employed Independent Contractor. Use your account to check from the legal kinds you have purchased earlier. Visit the My Forms tab of your account and have an additional duplicate of your papers you will need.

If you are a new customer of US Legal Forms, listed here are simple directions so that you can adhere to:

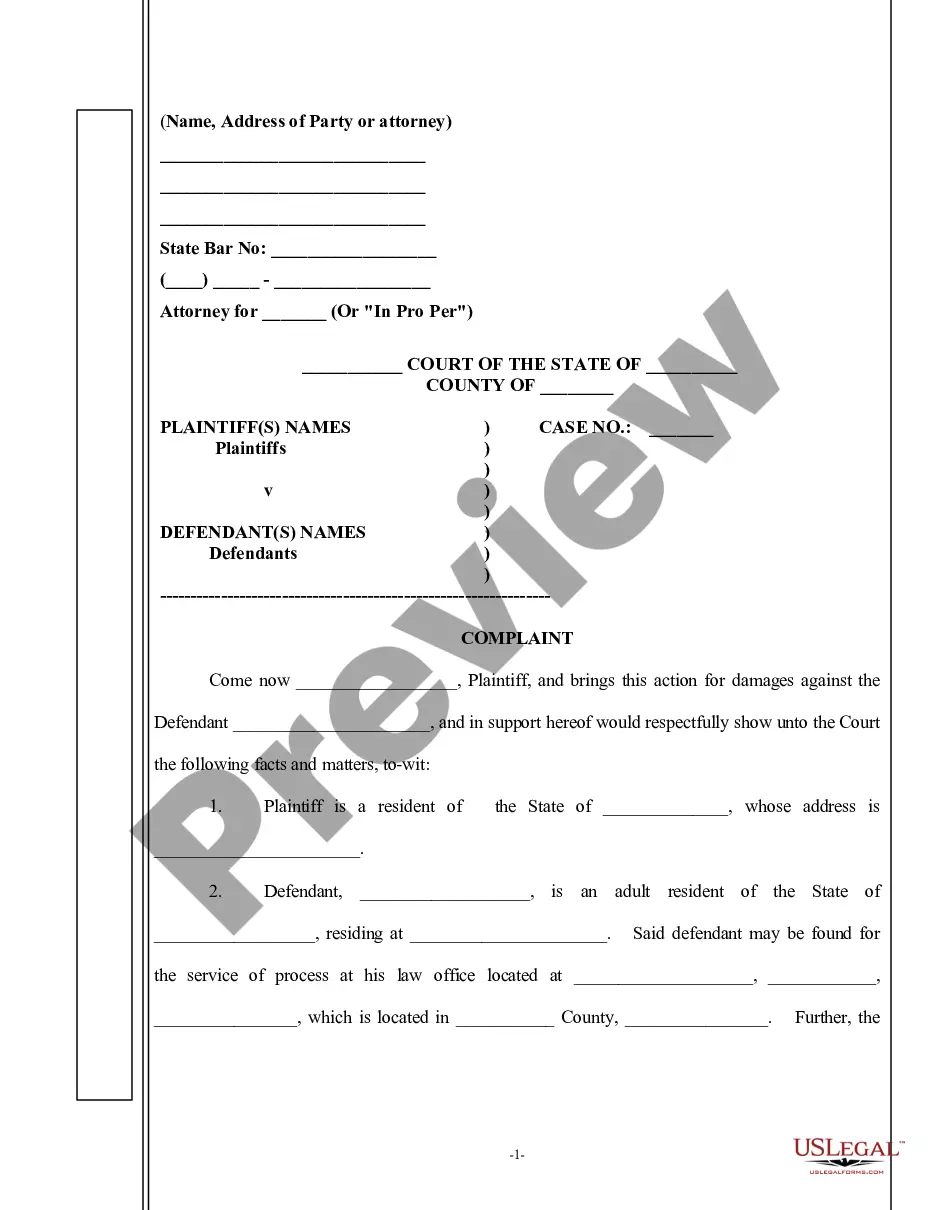

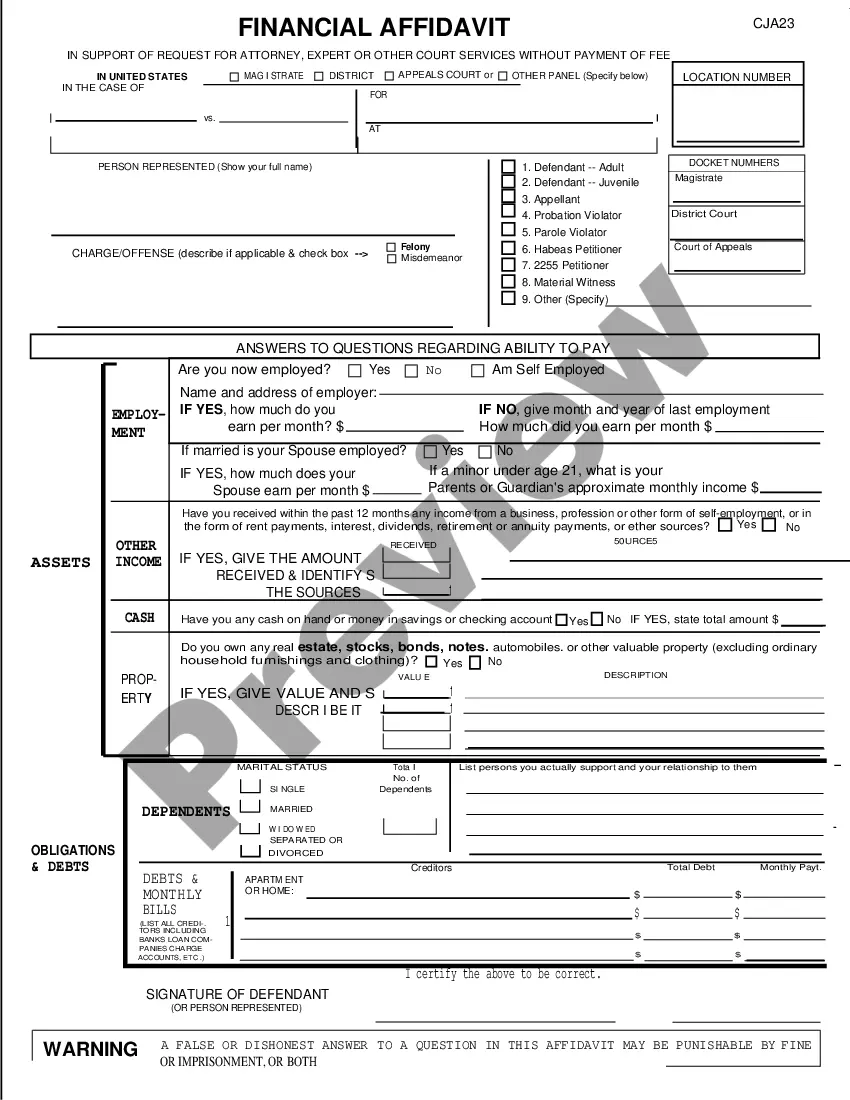

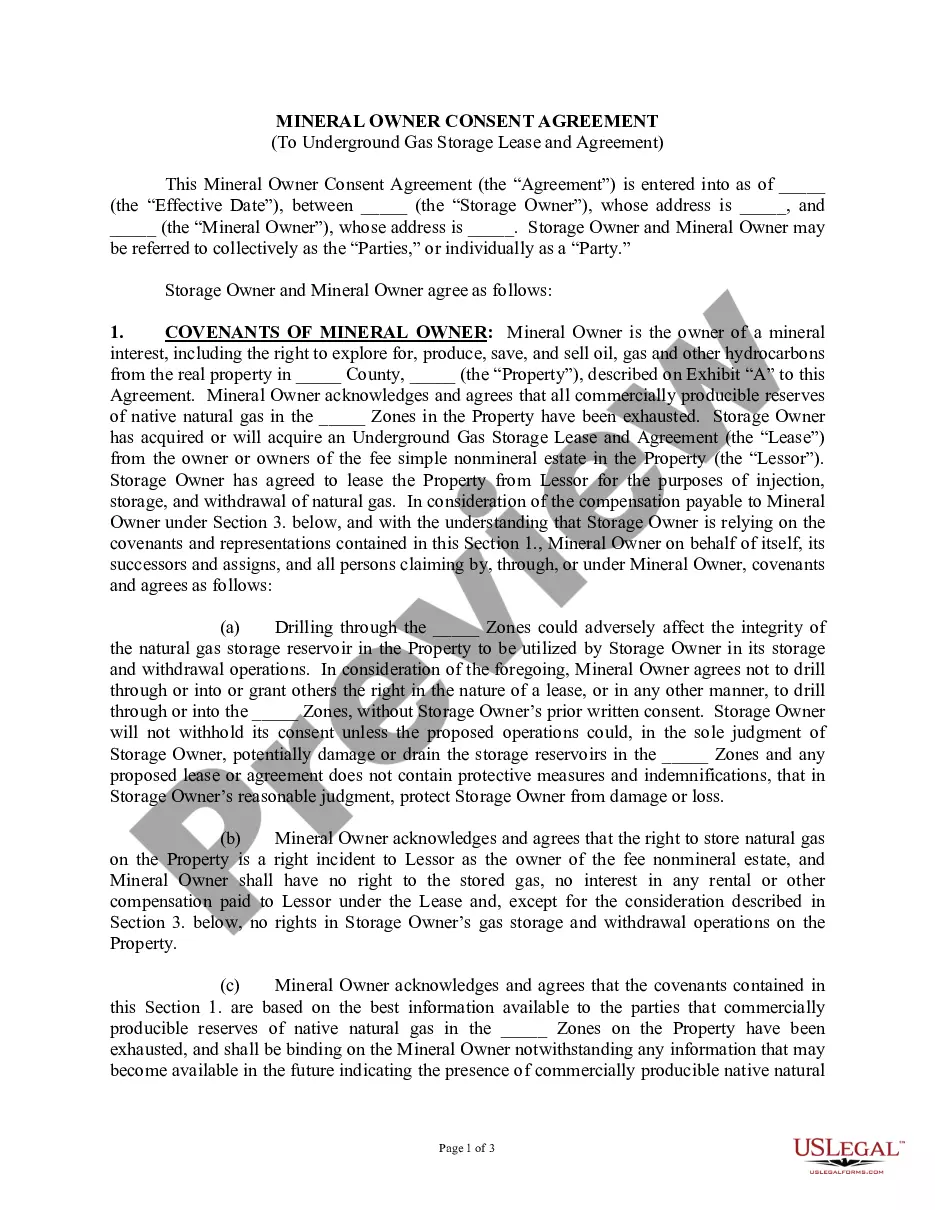

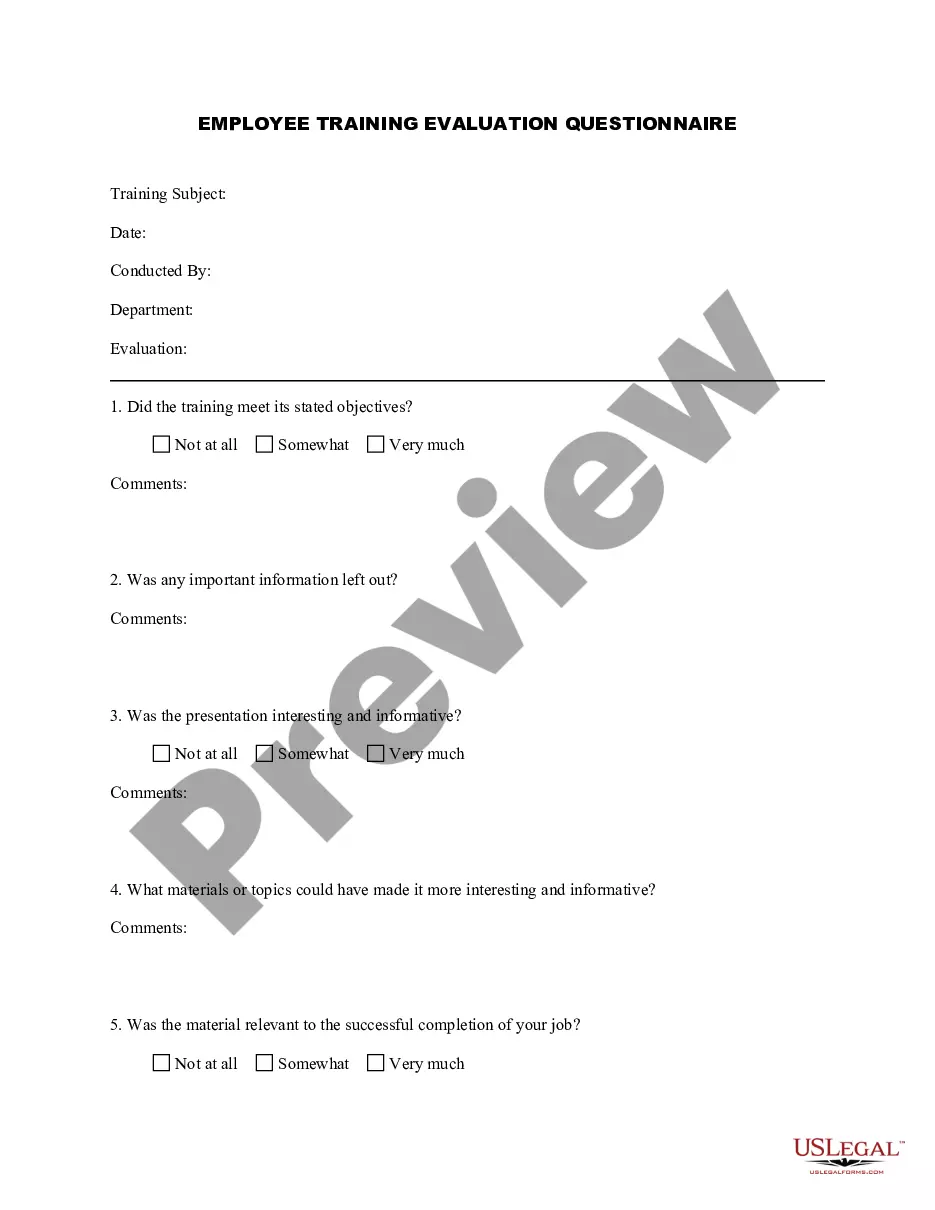

- First, ensure you have selected the appropriate type to your metropolis/state. You are able to examine the form while using Review button and study the form description to ensure it is the best for you.

- When the type is not going to fulfill your preferences, take advantage of the Seach industry to get the correct type.

- Once you are certain that the form is proper, select the Buy now button to obtain the type.

- Opt for the rates prepare you want and type in the essential details. Build your account and purchase an order making use of your PayPal account or credit card.

- Choose the submit format and download the legal papers design to your system.

- Comprehensive, revise and produce and sign the attained South Dakota Bookkeeping Agreement - Self-Employed Independent Contractor.

US Legal Forms is the most significant collection of legal kinds that you will find numerous papers templates. Utilize the service to download appropriately-made papers that adhere to condition requirements.

Form popularity

FAQ

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

1. PURPOSE. To establish a legal contract between the college and individuals who provide a service to the college and to determine whether an individual is an independent contractor or an employee based on Internal Revenue Service criteria.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

The independent contractor provision states that the relationship between the parties is that of an independent contractor, that the agreement does not create an employment relationship, and that under no circumstances is the independent contractor an agent of the company for which they provide services.

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.