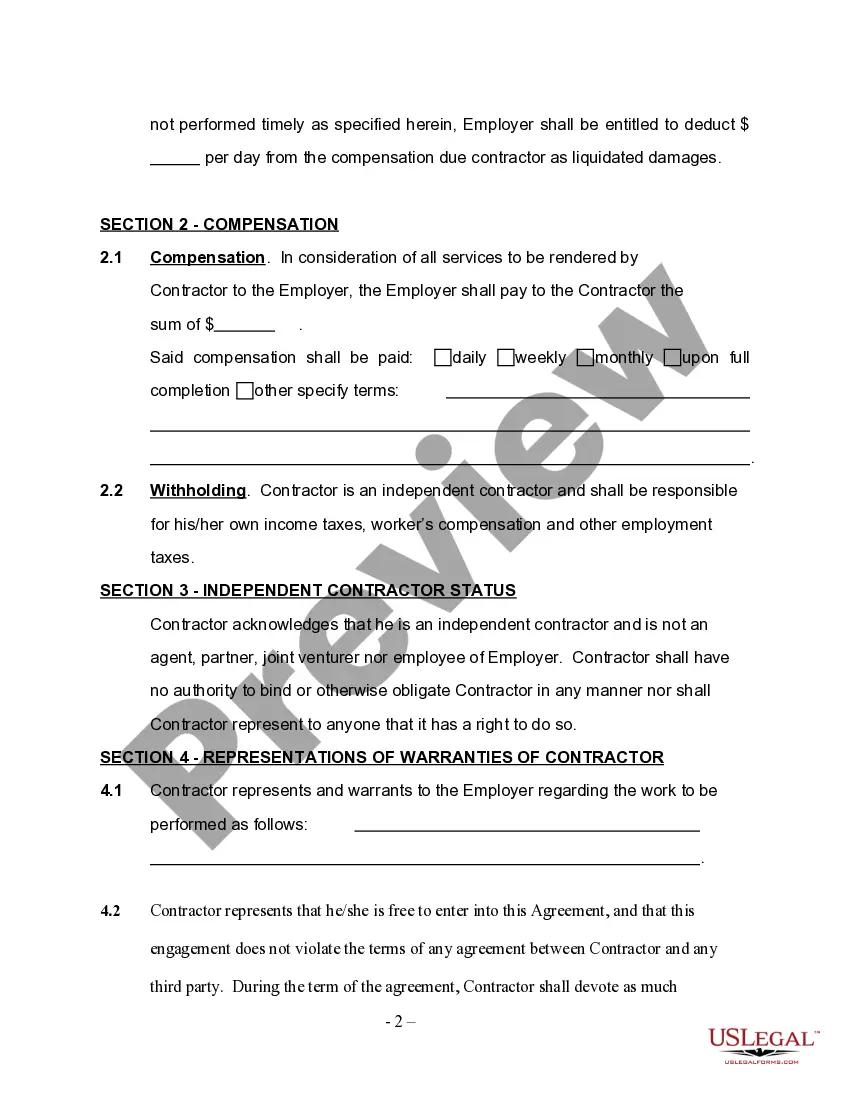

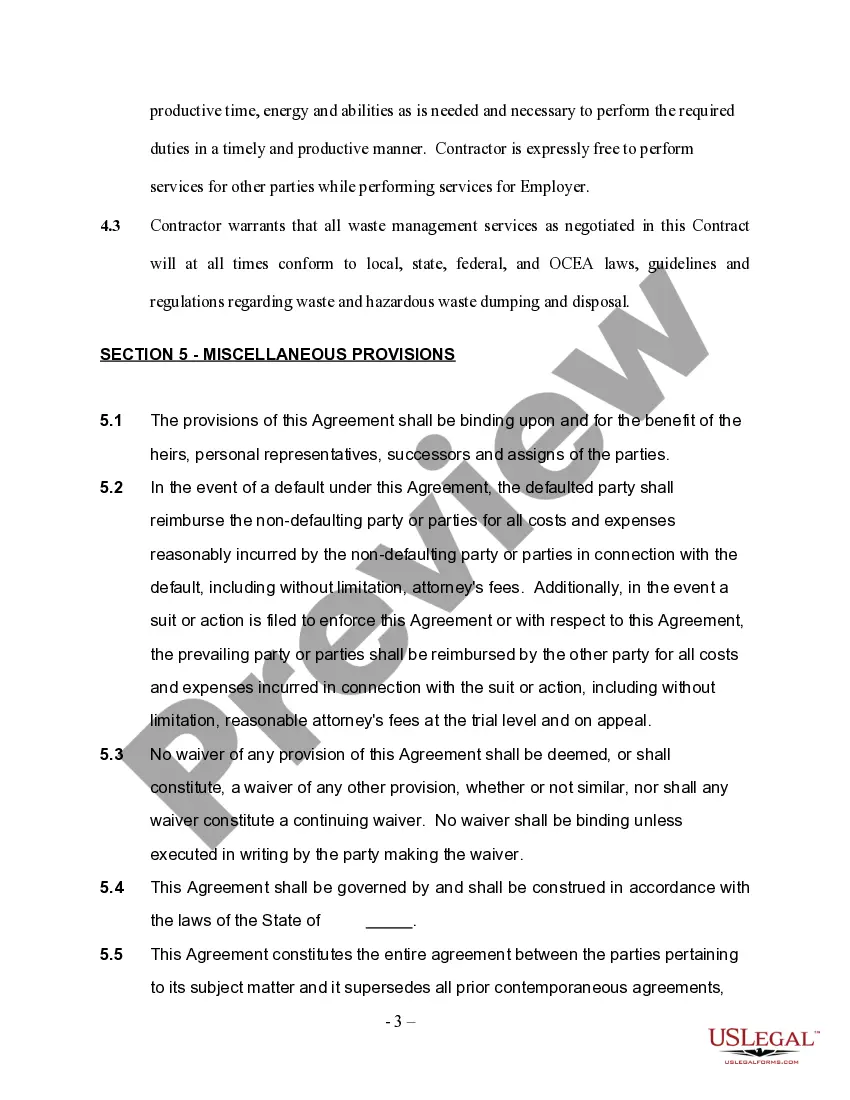

South Dakota Self-Employed Waste Services Contract for Private Company

Description

How to fill out South Dakota Self-Employed Waste Services Contract For Private Company?

Choosing the right legitimate papers format might be a have a problem. Of course, there are a variety of themes available on the net, but how do you obtain the legitimate type you need? Use the US Legal Forms internet site. The services gives thousands of themes, for example the South Dakota Self-Employed Waste Services Contract for Private Company, that you can use for business and personal requirements. Every one of the varieties are checked by specialists and meet federal and state specifications.

When you are already signed up, log in to the profile and click on the Down load switch to have the South Dakota Self-Employed Waste Services Contract for Private Company. Use your profile to look through the legitimate varieties you might have ordered in the past. Proceed to the My Forms tab of your respective profile and get yet another version from the papers you need.

When you are a fresh user of US Legal Forms, listed here are straightforward guidelines that you should comply with:

- Initially, make sure you have selected the correct type to your town/county. You are able to examine the form making use of the Preview switch and browse the form description to guarantee it is the right one for you.

- When the type does not meet your needs, take advantage of the Seach industry to obtain the right type.

- When you are certain that the form is proper, go through the Purchase now switch to have the type.

- Opt for the prices program you desire and type in the necessary information. Design your profile and purchase your order utilizing your PayPal profile or credit card.

- Opt for the submit formatting and acquire the legitimate papers format to the device.

- Complete, change and print and signal the acquired South Dakota Self-Employed Waste Services Contract for Private Company.

US Legal Forms will be the most significant collection of legitimate varieties where you will find a variety of papers themes. Use the service to acquire appropriately-made papers that comply with state specifications.

Form popularity

FAQ

Start a Corporation in South Dakota To file the Articles of Incorporation for a corporation in South Dakota, you must submit formation documents to the Secretary of State online for a $150 filing fee or by mail for a $165 filing fee.

You can register your business for a sales tax permit with the South Dakota Department of Revenue's e-services center. Once your application is approved, you will receive a license card. You must have a separate license for each business location you operate, but you may be eligible to apply for consolidated filing.

With few exceptions, the sale of products and services in South Dakota are subject to sales tax or use tax. Services such as auto repair, maintenance, body repair, oil changes, and customizing are subject to state and municipal sales tax. Sales tax applies to the full charge, including parts, labor, and delivery.

Certificate of Good Standing: You can obtain a South Dakota certificate of good standing by ordering through the Secretary of State and paying the $20 fee.

Yes. Retail sales tax applies to a service contract or warranty sold to a consumer (WAC 458-20-257).

Are services subject to sales tax in South Dakota? The state of South Dakota does in fact usually collect sales taxes on the vast majority of services performed. An example of services which are not taxed would be a professional service provider which is related to health.

Conclusion. While the sole proprietor is such a simple business classification that South Dakota doesn't even require a business registration process or any type of fees, depending on how you use your sole proprietorship and what industry you operate in, you still might have some important steps that need to be taken.

South Dakota is unique in the fact that almost all services are taxable. The only major service that is exempt from being taxed is construction.

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor service and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new personal property.

There is no general business license in South Dakota. However, before you begin to operate your business, you will need to obtain a State of South Dakota Tax License issued by the Department of Revenue and Regulations. There are also other specialty licensing, tax and permit requirements that may also be needed.