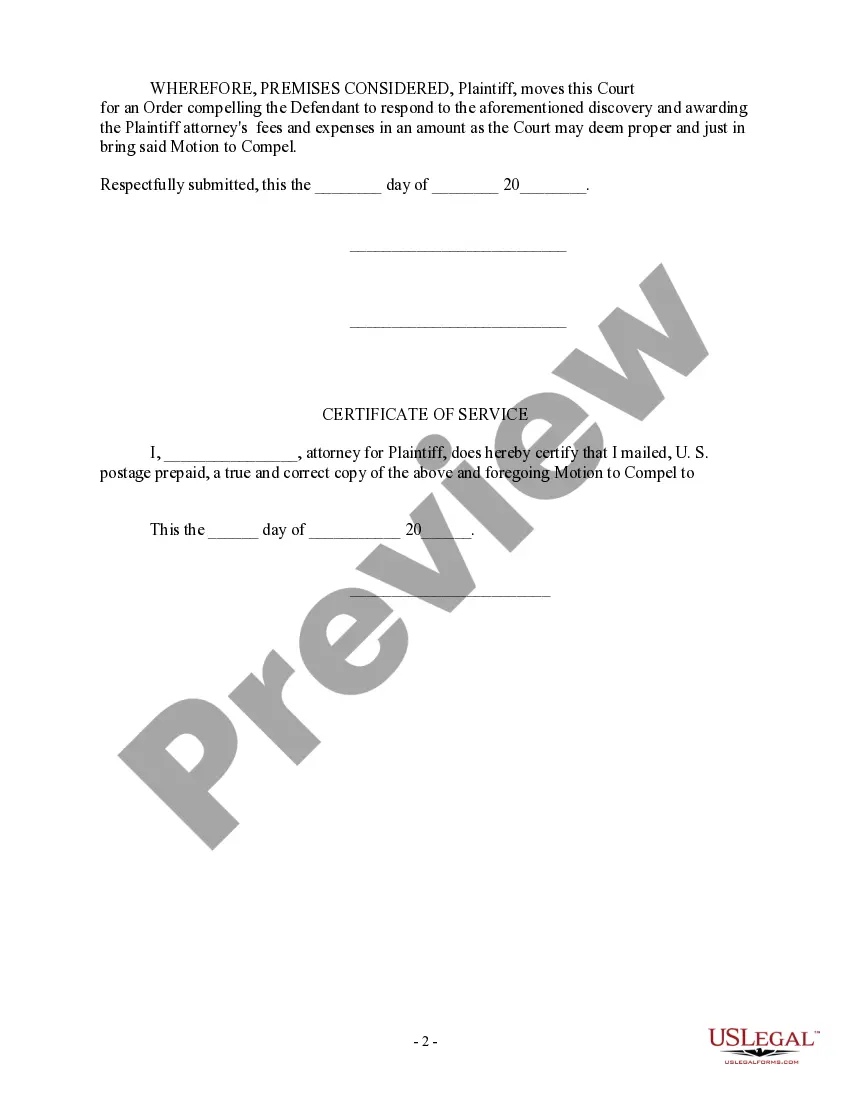

South Dakota Motion to Compel and For Attorney's Fees and Expenses

Description

How to fill out Motion To Compel And For Attorney's Fees And Expenses?

Choosing the best authorized document format could be a battle. Naturally, there are plenty of layouts available on the Internet, but how will you discover the authorized form you want? Make use of the US Legal Forms internet site. The support gives a large number of layouts, such as the South Dakota Motion to Compel and For Attorney's Fees and Expenses, which you can use for business and private requirements. Each of the forms are checked by specialists and meet up with state and federal needs.

Should you be currently listed, log in in your bank account and then click the Obtain option to find the South Dakota Motion to Compel and For Attorney's Fees and Expenses. Utilize your bank account to appear through the authorized forms you have purchased previously. Go to the My Forms tab of the bank account and get an additional version of your document you want.

Should you be a new user of US Legal Forms, listed below are basic recommendations so that you can follow:

- Initial, make sure you have selected the right form for the town/area. You may look over the form while using Preview option and read the form information to make sure it is the right one for you.

- In case the form fails to meet up with your needs, utilize the Seach discipline to find the correct form.

- When you are certain that the form is proper, click on the Get now option to find the form.

- Opt for the prices program you want and enter the required information. Create your bank account and pay for the transaction using your PayPal bank account or Visa or Mastercard.

- Select the submit format and obtain the authorized document format in your gadget.

- Full, edit and printing and indication the attained South Dakota Motion to Compel and For Attorney's Fees and Expenses.

US Legal Forms is definitely the largest catalogue of authorized forms where you will find different document layouts. Make use of the service to obtain professionally-made papers that follow state needs.

Form popularity

FAQ

Asset Protection Trusts South Dakota was the first state to enact a discretionary trust statute designed to protect trust assets from creditors. This statutory protection also applies to self-settled trusts, these being trusts settled by a transferor of which the transferor is a beneficiary. Guide to South Dakota Trusts Trident Trust ? media ? ttsd-gui... Trident Trust ? media ? ttsd-gui... PDF

What makes South Dakota special? South Dakota has no state income, capital gains, dividend/interest, or intangible tax. South Dakota also has no state inheritance or estate tax. As such, assets held in a South Dakota trust are taxed under South Dakota tax law and not subject to other state's high tax rates. The South Dakota Trust Advantage | Swier Law Firm, Prof. LLC swierlaw.com ? library ? the-south-dakota-tr... swierlaw.com ? library ? the-south-dakota-tr...

The primary drawbacks to establishing a South Dakota dynastic trust are the restrictions on your financial flexibility once the trust is established and the limited flexibility imposed on beneficiaries. Understanding South Dakota's Dynasty Trusts wealthadvisorstrust.com ? blog ? creating-y... wealthadvisorstrust.com ? blog ? creating-y...

South Dakota allows for a trust to exist in perpetuity, i.e., for an unlimited duration. South Dakota Dynasty Trust South Dakota Trust Company ? why-south-dakota ? dynasty-trust South Dakota Trust Company ? why-south-dakota ? dynasty-trust

South Dakota was the first state in the nation to abolish the Rule Against Perpetuities ? which prohibited unlimited-duration trusts ? in 1983, clearing the way for the creation of the Dynasty Trust.

In estate planning, a durable power of attorney is often chosen as a way to plan for those times when you are incapacitated. It is a written document that remains valid even if you should later become unable to make your own decisions.

Codified Law 15-6-12(a) | South Dakota Legislature. 15-6-12(a). Time for presenting defenses and objections. A defendant shall serve the answer within thirty days after the service of the complaint upon defendant, except when otherwise provided by statute or rule.