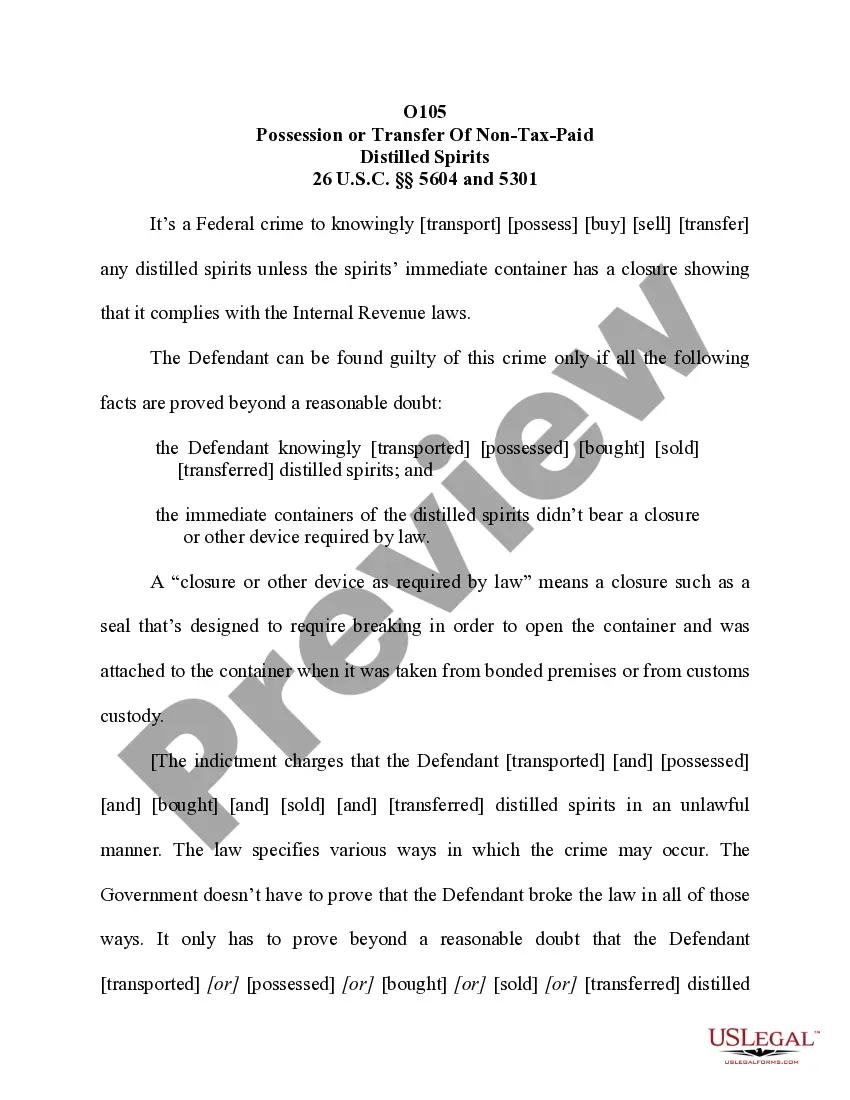

This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement with regards to taxes or insurance considerations.

South Dakota Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations

Description

How to fill out Indemnity Provisions - Dollar Exposure Of The Indemnity Regarding Tax And Insurance Considerations?

US Legal Forms - among the biggest libraries of lawful kinds in America - gives an array of lawful file themes you can down load or printing. Utilizing the site, you will get 1000s of kinds for company and individual purposes, categorized by categories, states, or search phrases.You will find the most recent models of kinds such as the South Dakota Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations in seconds.

If you have a subscription, log in and down load South Dakota Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations in the US Legal Forms catalogue. The Download option will show up on every type you view. You have accessibility to all previously downloaded kinds from the My Forms tab of your own account.

If you would like use US Legal Forms for the first time, listed here are easy recommendations to get you began:

- Make sure you have picked out the best type to your town/region. Select the Review option to check the form`s content. Browse the type information to actually have chosen the appropriate type.

- If the type doesn`t suit your demands, use the Research discipline towards the top of the display screen to get the one who does.

- In case you are satisfied with the shape, affirm your option by visiting the Buy now option. Then, pick the pricing program you prefer and offer your credentials to register to have an account.

- Method the financial transaction. Make use of charge card or PayPal account to perform the financial transaction.

- Pick the structure and down load the shape in your product.

- Make alterations. Load, change and printing and signal the downloaded South Dakota Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations.

Every web template you put into your account does not have an expiration time and is your own for a long time. So, if you want to down load or printing one more duplicate, just check out the My Forms section and click on around the type you need.

Gain access to the South Dakota Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations with US Legal Forms, one of the most considerable catalogue of lawful file themes. Use 1000s of skilled and state-certain themes that meet up with your company or individual needs and demands.