It is not uncommon to encounter a situation where a mineral owner owns all the mineral estate in a tract of land, but the royalty interest in that tract has been divided and conveyed to a number of parties; i.e., the royalty ownership is not common in the entire tract. If a lease is granted by the mineral owner on the entire tract, and the lessee intends to develop the entire tract as a producing unit, the royalty owners may desire to enter into an agreement providing for all royalty owners in the tract to participate in production royalty, regardless of where the well is actually located on the tract. This form of agreement accomplishes this objective.

South Dakota Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common

Description

How to fill out Commingling And Entirety Agreement By Royalty Owners Where The Royalty Ownership Is Not Common?

US Legal Forms - one of many biggest libraries of authorized varieties in the USA - delivers an array of authorized file templates it is possible to down load or print. Making use of the web site, you may get thousands of varieties for company and individual reasons, categorized by categories, says, or keywords.You will find the most up-to-date versions of varieties like the South Dakota Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common within minutes.

If you have a monthly subscription, log in and down load South Dakota Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common in the US Legal Forms catalogue. The Acquire switch can look on every single form you view. You get access to all previously downloaded varieties within the My Forms tab of your accounts.

If you would like use US Legal Forms the very first time, here are easy instructions to obtain began:

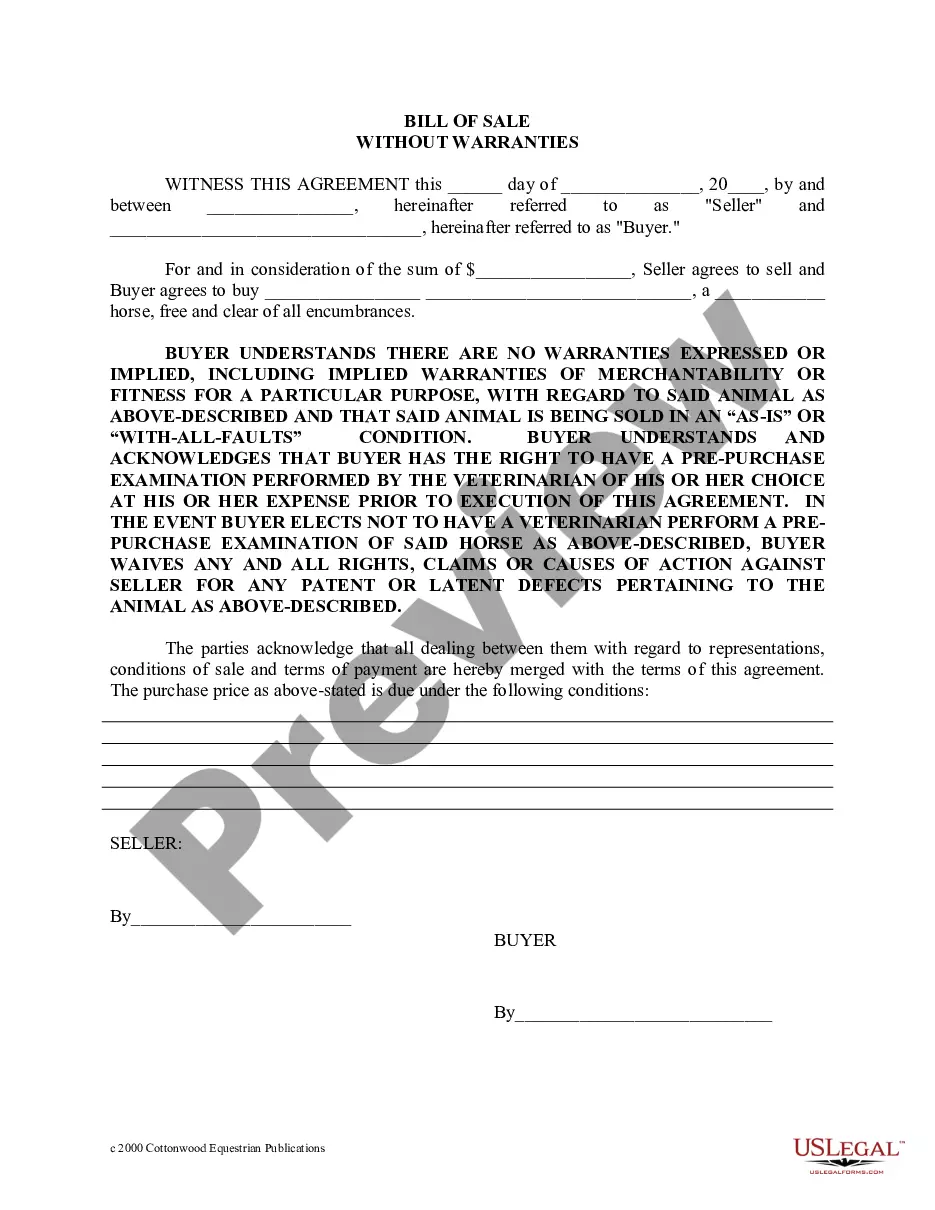

- Make sure you have chosen the proper form to your area/county. Click the Preview switch to examine the form`s content. Read the form description to ensure that you have selected the appropriate form.

- When the form doesn`t satisfy your demands, take advantage of the Lookup field at the top of the monitor to find the one which does.

- If you are pleased with the form, verify your choice by clicking on the Acquire now switch. Then, opt for the rates strategy you want and give your references to sign up for an accounts.

- Procedure the deal. Utilize your credit card or PayPal accounts to accomplish the deal.

- Pick the structure and down load the form on your product.

- Make modifications. Load, revise and print and indicator the downloaded South Dakota Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common.

Every design you included in your account does not have an expiry time and is also your own permanently. So, if you would like down load or print yet another backup, just visit the My Forms area and click on about the form you require.

Get access to the South Dakota Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common with US Legal Forms, the most substantial catalogue of authorized file templates. Use thousands of expert and express-distinct templates that fulfill your small business or individual demands and demands.