South Dakota Lessor's Notice of Election to Take Royalty in Kind

Description

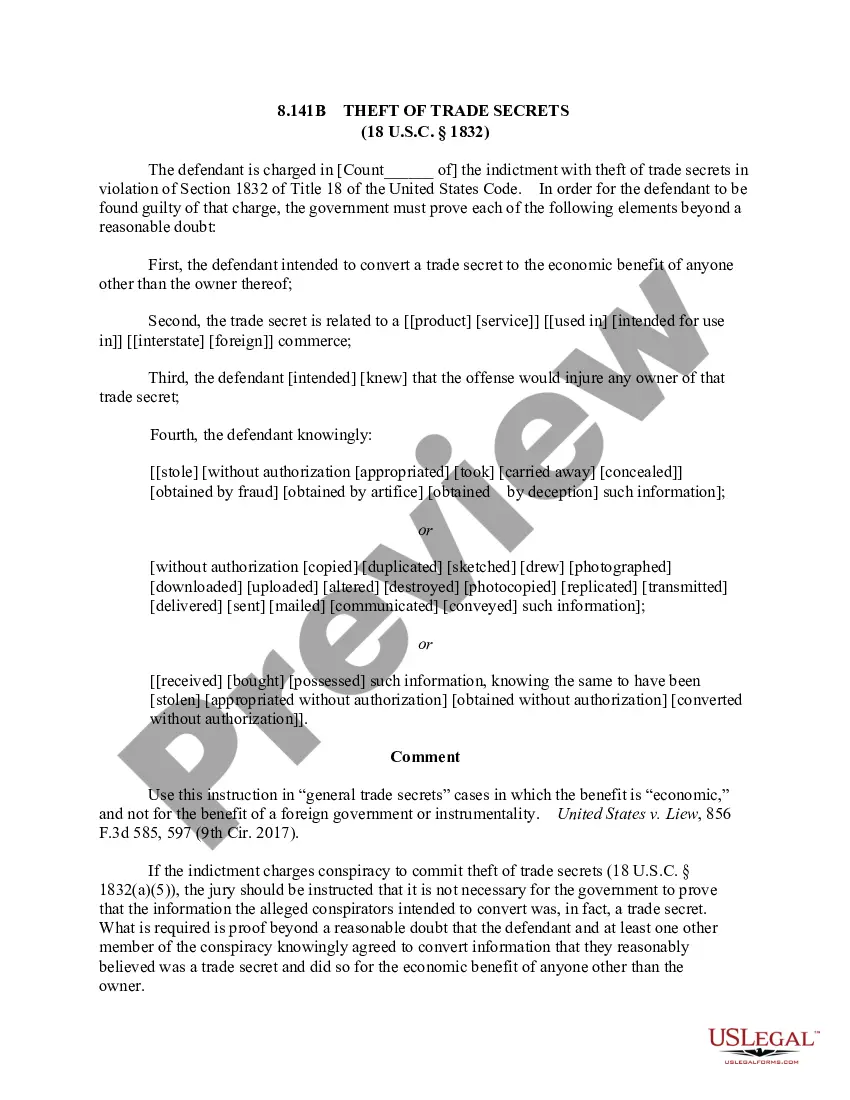

How to fill out Lessor's Notice Of Election To Take Royalty In Kind?

US Legal Forms - one of the most significant libraries of lawful types in America - delivers a wide array of lawful papers layouts you are able to acquire or print out. While using site, you may get a large number of types for company and specific functions, categorized by categories, says, or search phrases.You can get the newest types of types such as the South Dakota Lessor's Notice of Election to Take Royalty in Kind in seconds.

If you already have a membership, log in and acquire South Dakota Lessor's Notice of Election to Take Royalty in Kind from the US Legal Forms catalogue. The Down load switch will show up on every single type you perspective. You have accessibility to all previously acquired types within the My Forms tab of your respective profile.

If you would like use US Legal Forms the very first time, listed here are simple recommendations to get you started out:

- Make sure you have picked the right type to your town/region. Select the Preview switch to review the form`s information. See the type outline to actually have selected the correct type.

- When the type does not fit your needs, make use of the Lookup area on top of the screen to find the the one that does.

- Should you be content with the form, confirm your choice by clicking the Purchase now switch. Then, select the pricing strategy you favor and offer your credentials to sign up for the profile.

- Method the transaction. Use your credit card or PayPal profile to accomplish the transaction.

- Select the structure and acquire the form on your system.

- Make adjustments. Fill out, change and print out and indication the acquired South Dakota Lessor's Notice of Election to Take Royalty in Kind.

Each template you included with your bank account does not have an expiration day which is yours forever. So, if you want to acquire or print out another backup, just proceed to the My Forms portion and then click on the type you require.

Gain access to the South Dakota Lessor's Notice of Election to Take Royalty in Kind with US Legal Forms, the most considerable catalogue of lawful papers layouts. Use a large number of expert and condition-distinct layouts that satisfy your business or specific requires and needs.

Form popularity

FAQ

The South Dakota Condominium Law regulates condominium associations in the state. These condominium associations must explicitly choose to be governed by this Act by recording a declaration or master deed in the county register of deeds where the condominium is situated.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

South Dakota was the first state in the nation to abolish the Rule Against Perpetuities ? which prohibited unlimited-duration trusts ? in 1983, clearing the way for the creation of the Dynasty Trust.

An ?unless? clause provides that the lease terminates unless the lessee has either made the required payments or commenced drilling operations. Lessees can therefore be terminated from the lease by failure to pay the proper amount, by the due date, in the proper form, to the proper party.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

The right of governments to levy royalties from oil and gas companies derives from their ownership of natural resources. Through royalty payments, governments are compensated by oil and gas companies for the extraction of public natural resources.

Royalty Clause: The Lessor's only right to receive payments in addition to the Bonus Payment is through Royalties. Royalties are calculated as a percentage of the value of all minerals produced, typically 25%.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.