South Dakota Due Diligence Information Request

Description

How to fill out Due Diligence Information Request?

Are you currently inside a situation where you need to have documents for possibly business or personal purposes nearly every day time? There are a lot of legitimate document web templates accessible on the Internet, but finding ones you can depend on is not simple. US Legal Forms provides a huge number of develop web templates, just like the South Dakota Due Diligence Information Request, which can be written in order to meet state and federal demands.

If you are already familiar with US Legal Forms site and also have a free account, simply log in. Following that, it is possible to obtain the South Dakota Due Diligence Information Request format.

If you do not have an account and want to begin to use US Legal Forms, adopt these measures:

- Find the develop you want and make sure it is for the correct area/area.

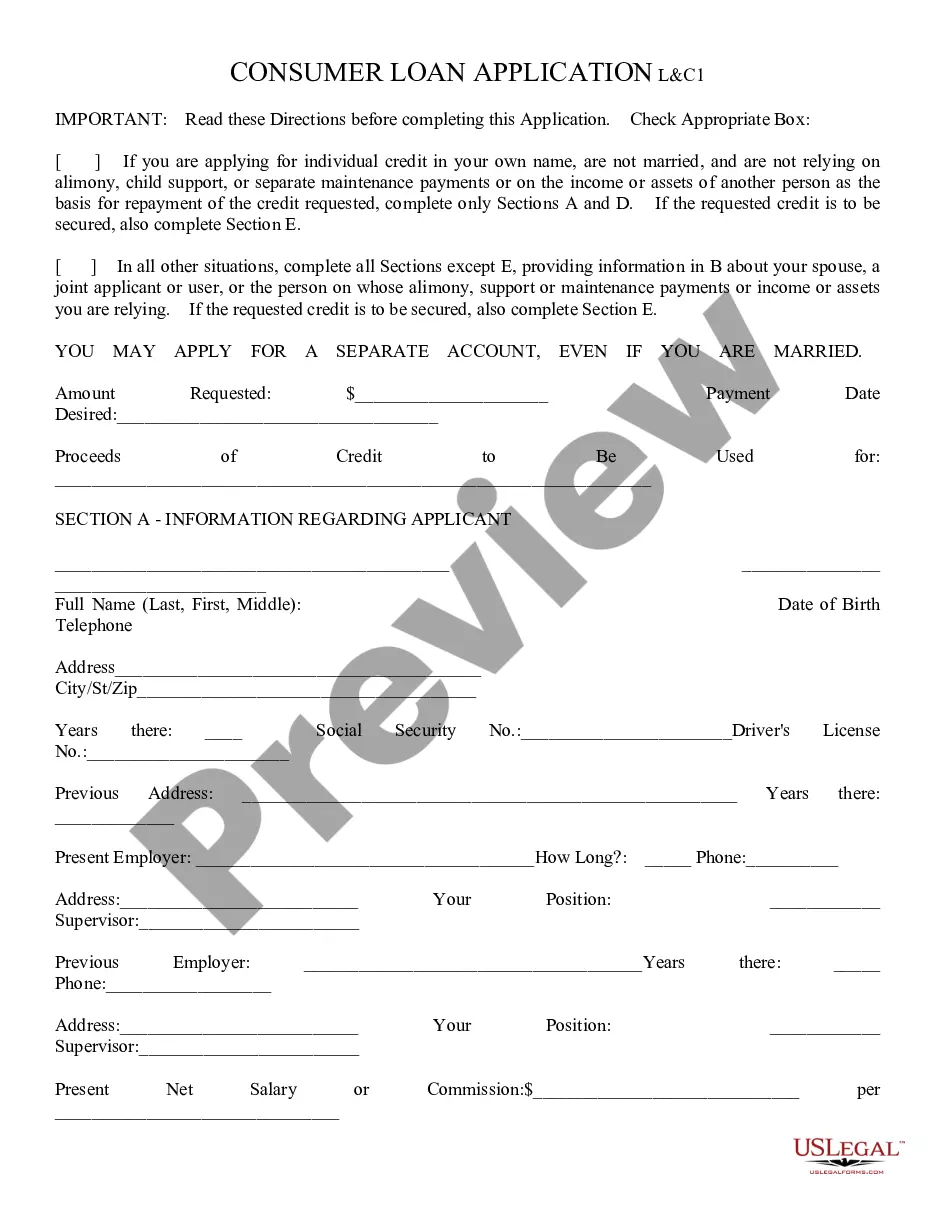

- Take advantage of the Review key to check the shape.

- Read the description to actually have chosen the correct develop.

- In the event the develop is not what you`re trying to find, take advantage of the Lookup area to discover the develop that suits you and demands.

- When you find the correct develop, click on Buy now.

- Select the pricing plan you would like, complete the necessary information to make your bank account, and purchase an order with your PayPal or Visa or Mastercard.

- Choose a practical paper file format and obtain your copy.

Find all the document web templates you might have bought in the My Forms menus. You can get a additional copy of South Dakota Due Diligence Information Request any time, if required. Just click the necessary develop to obtain or print out the document format.

Use US Legal Forms, the most extensive variety of legitimate forms, in order to save some time and prevent mistakes. The support provides expertly manufactured legitimate document web templates which can be used for a range of purposes. Make a free account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

Applications for coverage which require a disability determination to be made will be processed within 90 days. All other applications will be processed within 45 days. The South Dakota Medicaid Identification Card is issued by the Department of Social Services on behalf of eligible South Dakota Medicaid recipients. Recipient Eligibility | SD DSS sd.gov ? providers ? billingmanuals ? General sd.gov ? providers ? billingmanuals ? General

South Dakota is a pure no income/capital gains tax state for trusts. However, if income is distributed from the trust to a beneficiary, the distributed income is generally taxed at the beneficiary's personal rates in his/her tax residence jurisdiction.

The most significant tax advantage offered by South Dakota is that it does not collect income tax. This fact, combined with all the other trust laws, is what makes South Dakota such an attractive jurisdiction to establish trusts originating from other states.

The cost of creating a will in South Dakota can range from roughly $250 to $1,000. A South Dakota trust typically costs anywhere between $900 and $3,450. At Snug, any member can create a Power of Attorney and Health Care Directive for free. A Will costs $195 and a Trust costs $500. Understanding the Costs of Estate Planning in South Dakota | Snug getsnug.com ? post ? understanding-the-cost... getsnug.com ? post ? understanding-the-cost...

A settlor who wishes to establish a trust of longer duration under South Dakota law will need to appoint a South Dakota trustee and require that the trust be sitused and administered in South Dakota. There is no requirement that the settlor be resident or domiciled in South Dakota to take advantage of this law.

SIOUX FALLS, S.D. (KELO) ? South Dakota had 114 trust companies registered in 2022. Trust companies operating in SD in 2022 - KELOLAND.com keloland.com ? news ? capitol-news-bureau keloland.com ? news ? capitol-news-bureau

How much does a Trust cost in South Dakota? The cost of setting up a trust in South Dakota varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000.

To make a living trust in South Dakota, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document. Make a Living Trust in South Dakota | Nolo nolo.com ? legal-encyclopedia ? south-dako... nolo.com ? legal-encyclopedia ? south-dako...