South Dakota Surface Lease Agreement For Production Equipment and Facilities

Description

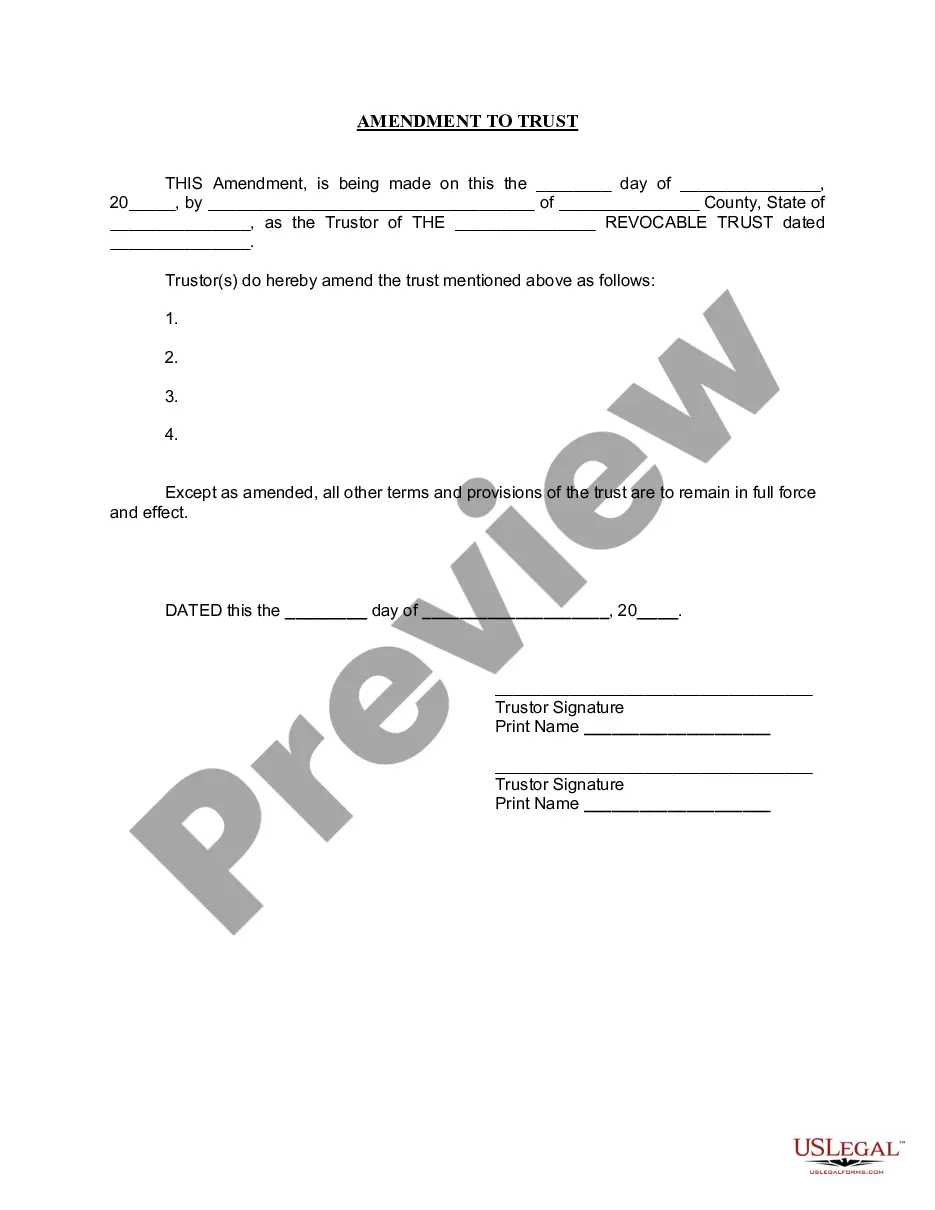

How to fill out Surface Lease Agreement For Production Equipment And Facilities?

It is possible to invest several hours on the web looking for the legitimate file design that fits the federal and state needs you will need. US Legal Forms gives a huge number of legitimate forms which can be reviewed by experts. It is simple to obtain or printing the South Dakota Surface Lease Agreement For Production Equipment and Facilities from your services.

If you currently have a US Legal Forms account, it is possible to log in and click the Obtain button. Afterward, it is possible to total, revise, printing, or indication the South Dakota Surface Lease Agreement For Production Equipment and Facilities. Every legitimate file design you get is your own property eternally. To have yet another version for any acquired form, check out the My Forms tab and click the related button.

If you are using the US Legal Forms web site the very first time, keep to the easy instructions beneath:

- Very first, be sure that you have selected the correct file design to the region/area of your liking. Browse the form explanation to make sure you have selected the correct form. If available, take advantage of the Preview button to check from the file design also.

- If you want to find yet another version of the form, take advantage of the Lookup area to get the design that meets your requirements and needs.

- Upon having found the design you would like, just click Purchase now to move forward.

- Pick the prices strategy you would like, key in your accreditations, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can utilize your bank card or PayPal account to pay for the legitimate form.

- Pick the structure of the file and obtain it in your device.

- Make changes in your file if needed. It is possible to total, revise and indication and printing South Dakota Surface Lease Agreement For Production Equipment and Facilities.

Obtain and printing a huge number of file themes while using US Legal Forms website, that offers the greatest assortment of legitimate forms. Use expert and status-specific themes to handle your small business or personal needs.

Form popularity

FAQ

The lease or rental of real property is exempt from sales tax. However, leased or rented tangible personal property installed into real property may be subject to contractor?s excise tax. Lease and Rental - South Dakota Department of Revenue sd.gov ? media ? 2016-06-lease-and-rental sd.gov ? media ? 2016-06-lease-and-rental

The Basics. Residential Tenancy Branch Policy Guideline 8 defines a material term as: a term that the parties both agree is so important that the most trivial breach of that term gives the other party the right to end the agreement.

North Dakota motor vehicle excise tax law requires payment of 5 percent motor vehicle excise tax on the purchase price by a leasing company or licensed motor vehicle dealer titling motor vehicles intended for rental service or for lease having a term of less than one year. Lease or Rental of Motor Vehicles Guideline nd.gov ? guidelines ? business ? sales-use nd.gov ? guidelines ? business ? sales-use

South Dakota charges a 4% excise sales tax rate on the purchase of all vehicles. In addition, for a car purchased in South Dakota, there are other applicable fees, including registration, title, and plate fees. How Much Is Excise Tax On A Car In South Dakota? DakotaPost ? blog ? how-much-is-sal... DakotaPost ? blog ? how-much-is-sal...

You may purchase motor vehicles to lease or rent without paying sales tax. Dealers are required to collect the state sales tax and any applicable municipal sales tax, motor vehicle gross receipts tax, and tourism tax on any vehicle, product, or service they sell that is subject to sales tax in South Dakota.

Some customers are exempt from paying sales tax under South Dakota law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction. South Dakota Sales & Use Tax Guide - Avalara avalara.com ? taxrates ? state-rates ? south-d... avalara.com ? taxrates ? state-rates ? south-d...