South Dakota Exhibit to Operating Agreement Escrow Agreement

Description

How to fill out Exhibit To Operating Agreement Escrow Agreement?

Are you presently in the place where you will need papers for both business or specific uses nearly every day? There are a variety of authorized file web templates available on the Internet, but locating types you can rely isn`t easy. US Legal Forms offers a large number of type web templates, much like the South Dakota Exhibit to Operating Agreement Escrow Agreement, that happen to be composed to meet state and federal requirements.

When you are presently familiar with US Legal Forms web site and possess an account, just log in. Next, you can acquire the South Dakota Exhibit to Operating Agreement Escrow Agreement format.

Should you not provide an account and want to start using US Legal Forms, follow these steps:

- Find the type you want and make sure it is to the proper area/state.

- Take advantage of the Review switch to analyze the shape.

- Look at the outline to actually have chosen the appropriate type.

- In case the type isn`t what you are seeking, take advantage of the Look for discipline to discover the type that fits your needs and requirements.

- If you discover the proper type, click on Get now.

- Choose the rates program you desire, complete the specified details to produce your bank account, and pay money for the order with your PayPal or credit card.

- Choose a convenient paper structure and acquire your version.

Locate every one of the file web templates you have bought in the My Forms menu. You can obtain a extra version of South Dakota Exhibit to Operating Agreement Escrow Agreement anytime, if necessary. Just go through the needed type to acquire or produce the file format.

Use US Legal Forms, the most considerable assortment of authorized varieties, in order to save efforts and avoid errors. The service offers skillfully created authorized file web templates that you can use for a selection of uses. Produce an account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

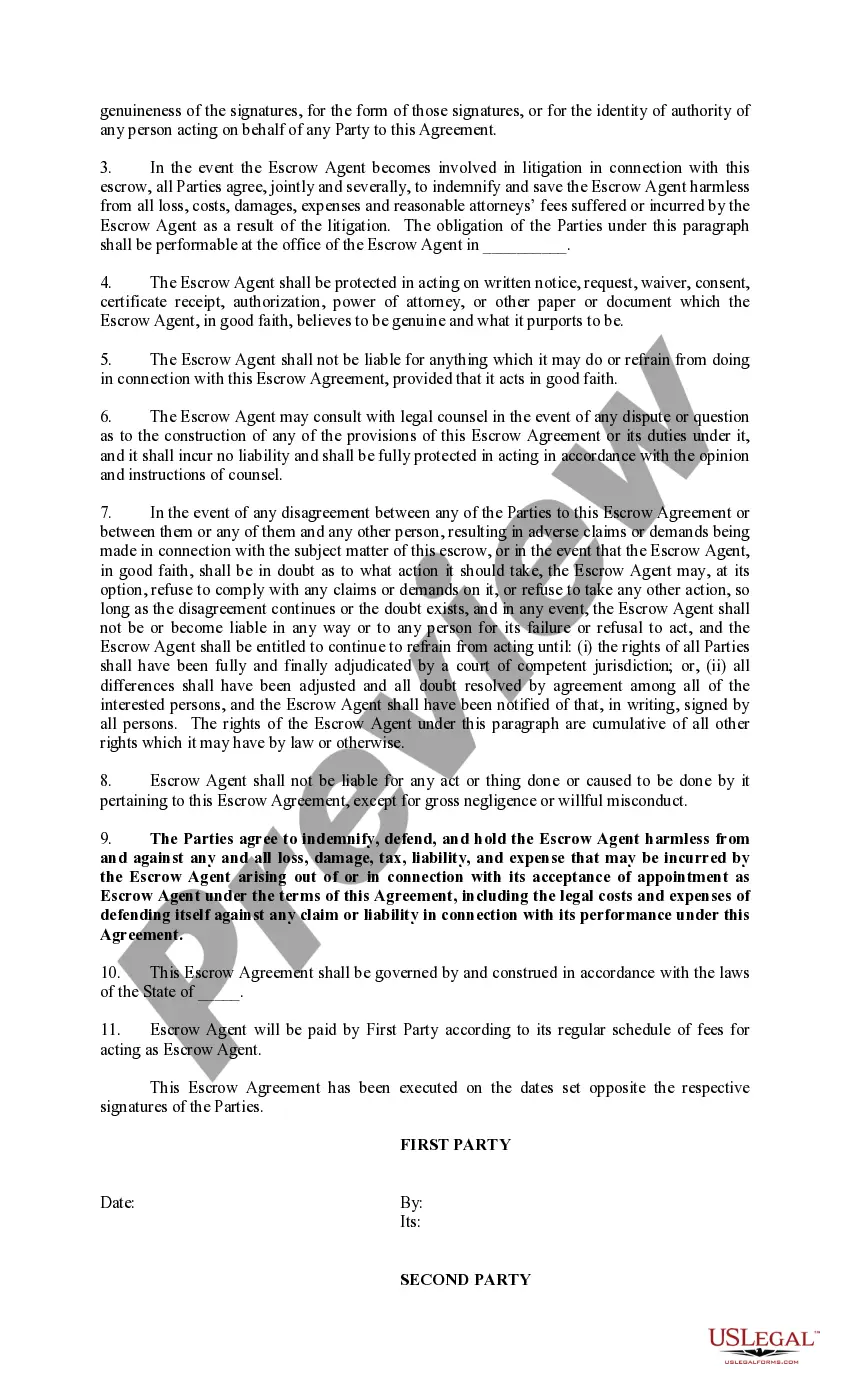

Escrow agreements are provided by independent escrow services whose trustworthiness must be assessed carefully. The agent is to be trusted with the holding and releasing of funds, which is a large responsibility and a noteworthy risk to both buyers and sellers.

Typically, the role of the escrow agent will be played by representatives from a title company, mortgage lender, or an attorney, but it can depend on the laws and customs in your state.

Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met. However, they should fully outline the conditions for all parties involved.

Release Conditions: Details the specific circumstances under which the escrow agent may release the deposited materials to the beneficiary, such as bankruptcy, failure to meet support obligations, or a predetermined trigger event.

Definition of Principals to the Escrow In a real estate sale escrow, the principals include the buyer and the seller and, if applicable, the lender(s) making the ?purchase money? loan. While principals are parties to the escrow, not all parties involved are principals.

An escrow holdback agreement addendum is used to ?hold back? part of the sale price at closing until certain conditions are met by the seller. The document details the release conditions, the amount of money in escrow, and the third party who will be entrusted with the escrowed funds.

In an escrow agreement, one party?usually a depositor?deposits funds or an asset with the escrow agent until the time that the contract is fulfilled. Once the contractual conditions are met, the escrow agent will deliver the funds or other assets to the beneficiary.

The escrow holder is the agent and depositary (as an impartial/neutral third party) having and holding possession of money, written instruments, documents, personal property, or other things of value to be held until the happening of specified events or the performance of described conditions.