South Dakota Clauses Relating to Termination and Liquidation of Venture

Description

How to fill out Clauses Relating To Termination And Liquidation Of Venture?

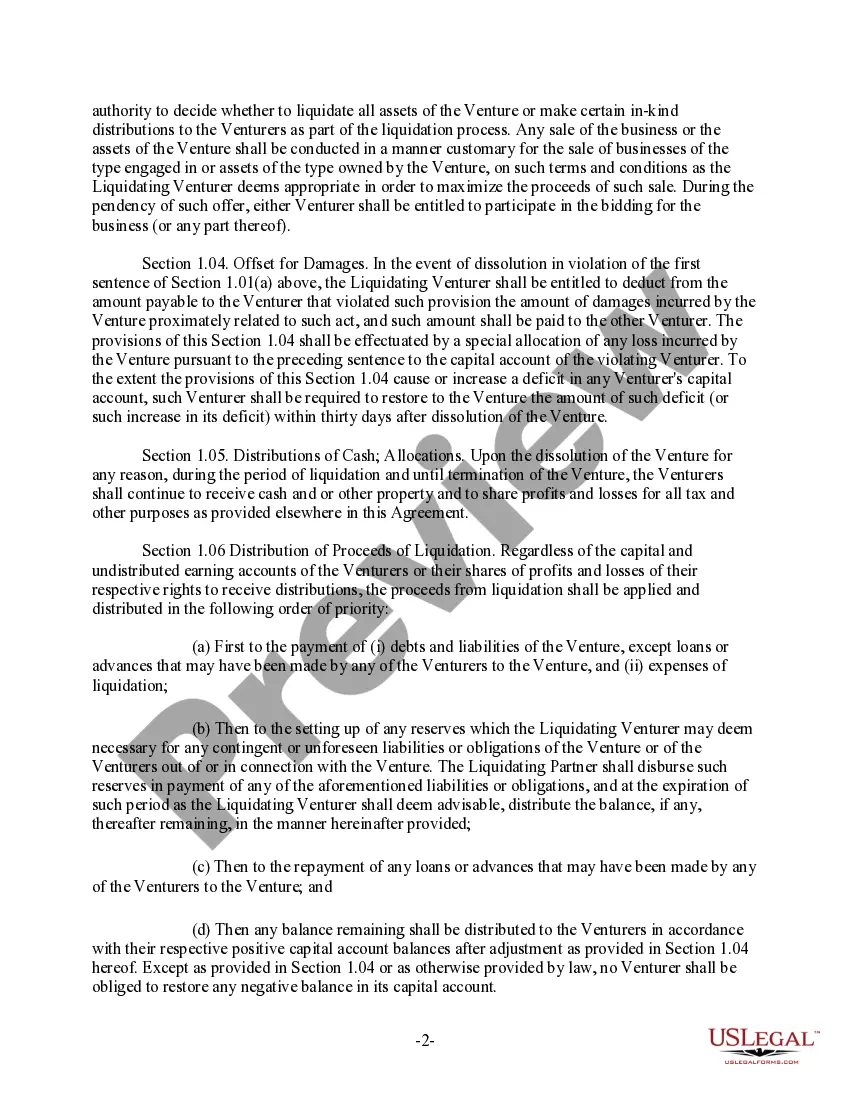

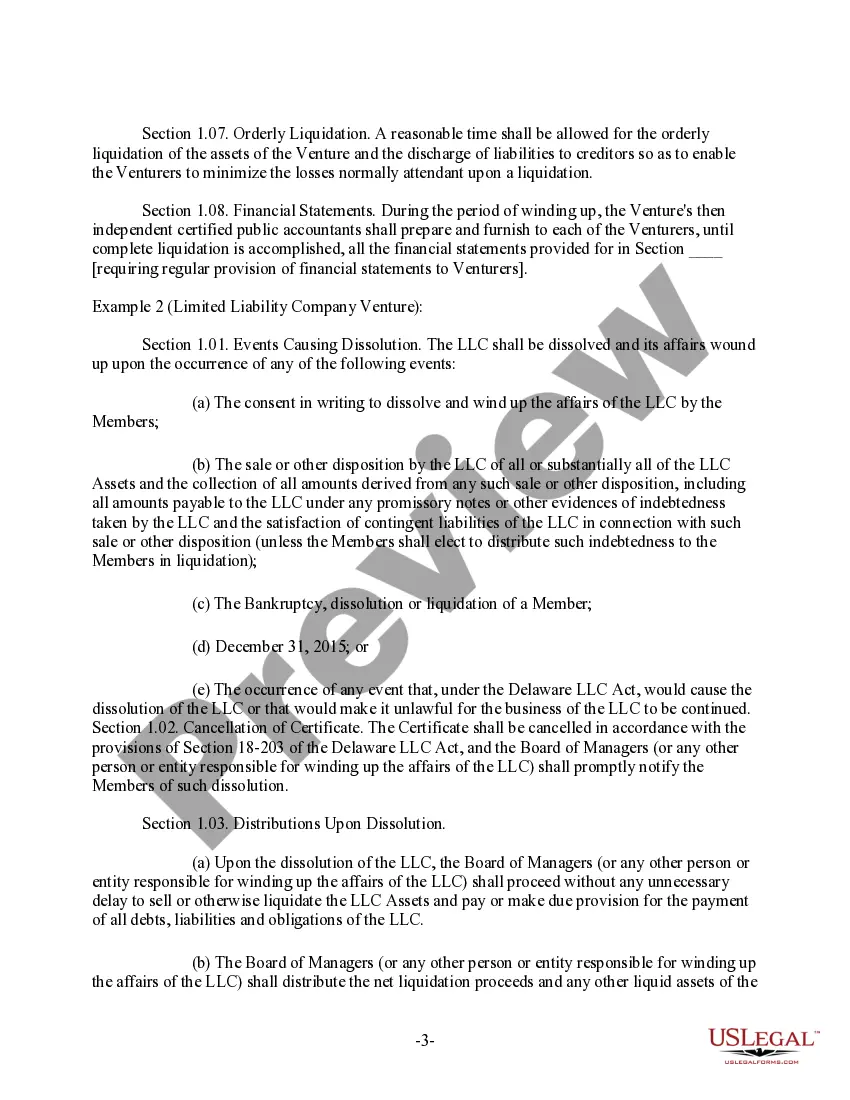

You can commit time on the Internet trying to find the authorized document format that suits the federal and state needs you require. US Legal Forms supplies thousands of authorized varieties that happen to be reviewed by professionals. You can actually download or print out the South Dakota Clauses Relating to Termination and Liquidation of Venture from the assistance.

If you already possess a US Legal Forms profile, you may log in and click on the Acquire option. Next, you may complete, change, print out, or signal the South Dakota Clauses Relating to Termination and Liquidation of Venture. Each authorized document format you purchase is your own property for a long time. To have one more backup associated with a purchased develop, go to the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms web site initially, adhere to the simple recommendations below:

- Initial, make sure that you have selected the proper document format for the county/metropolis of your choosing. Read the develop outline to make sure you have selected the proper develop. If accessible, take advantage of the Review option to appear throughout the document format as well.

- If you would like locate one more edition of your develop, take advantage of the Lookup industry to obtain the format that suits you and needs.

- Upon having found the format you desire, just click Get now to carry on.

- Select the costs strategy you desire, type your credentials, and register for a merchant account on US Legal Forms.

- Full the deal. You can use your Visa or Mastercard or PayPal profile to cover the authorized develop.

- Select the structure of your document and download it for your gadget.

- Make adjustments for your document if required. You can complete, change and signal and print out South Dakota Clauses Relating to Termination and Liquidation of Venture.

Acquire and print out thousands of document themes while using US Legal Forms website, that provides the most important assortment of authorized varieties. Use professional and state-distinct themes to deal with your business or specific requires.

Form popularity

FAQ

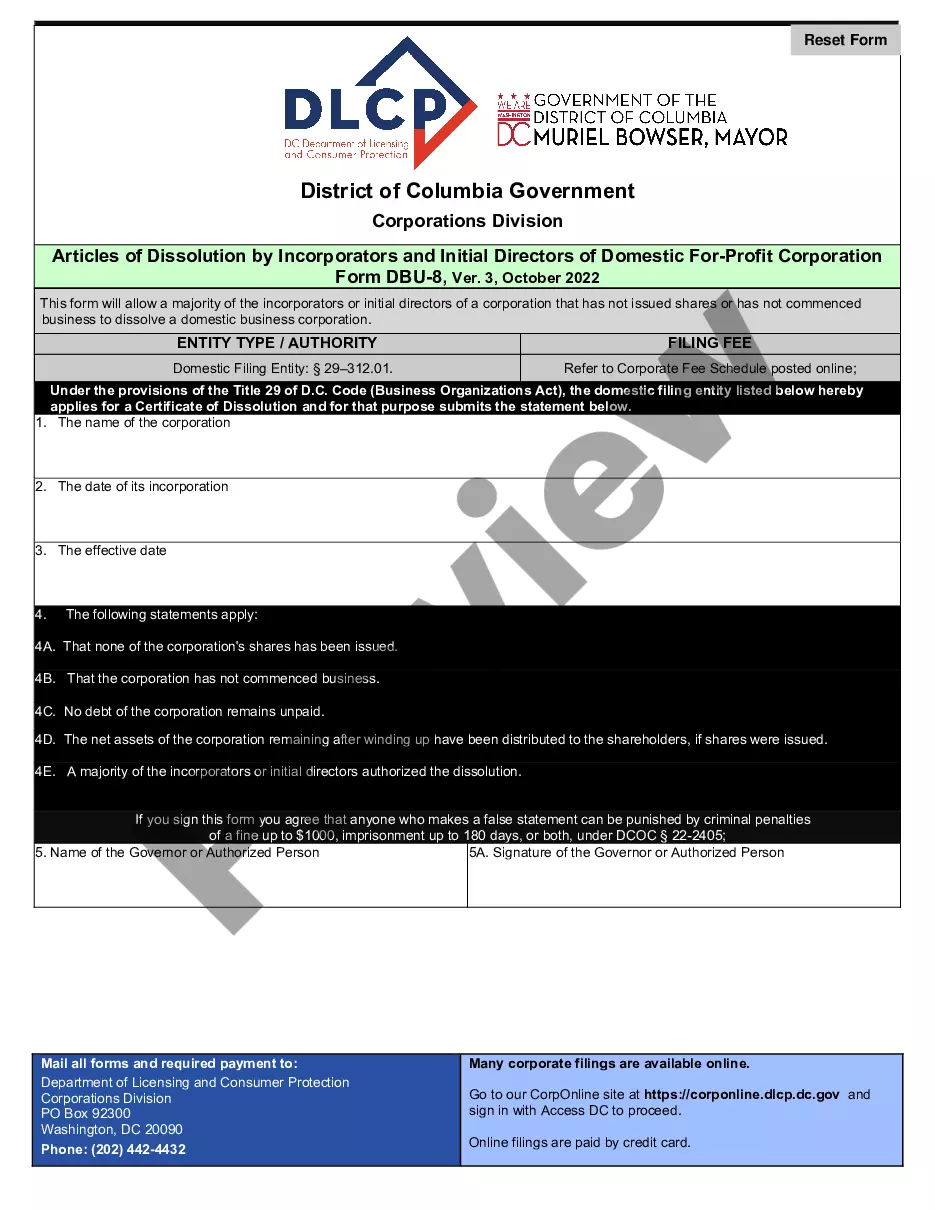

How do you dissolve/terminate a South Dakota Limited Liability Company? To dissolve/terminate your domestic LLC in South Dakota, you must submit the completed Articles of Termination form to the South Dakota Secretary of State by mail or in person and in duplicate along with the filing fee.

If the liability of one party to another has been determined by verdict or order or judgment, but the amount or extent of the liability remains to be determined by further proceedings, the party adjudged liable may make an offer of judgment, which shall have the same effect as an offer made before trial if it is served ...

Your operating agreement is an internal document, kept on file at your business location. You don't need to file it with the South Dakota Secretary of State, but it is still an essential document for your LLC.

Payment of accrued, unused vacation on termination is also not addressed by state statutes. Because South Dakota's Legislature and its courts have not provided any information about vacation leave, employers are free to create their own policies regarding vacation leave and PTO payout at termination.

Employment relationships in South Dakota may be 'terminated at will,' which means an employer does not need a specific reason to fire an employee. This is the same concept as an employee not needing a specific reason to quit a job. Generally, the only exceptions to this rule are when: A contract for employment exists.

One cannot be terminated because of his or her color, race, religious beliefs or ancestry. Employers also cannot terminate those who have existing contracts, those who refuse to commit crimes on the employer's behalf or those who are engaging in actions such as seeking worker's compensation from the employer.

Nonexempt Status - The Fair Labor Standards Act requires that all employees that are not exempt be entitled to overtime pay (compensatory time off - public employers) of at least one-and-one-half times (1 ½) his/her regular rate for hours worked in excess of 40 in any workweek.

Q: When an employee voluntarily terminates employment, when is the final paycheck due? A: The law requires that all wages be paid on the next regular payday after an employee quits. The law does allow an employer to withhold the final paycheck until the employee returns any property that belongs to the employer.