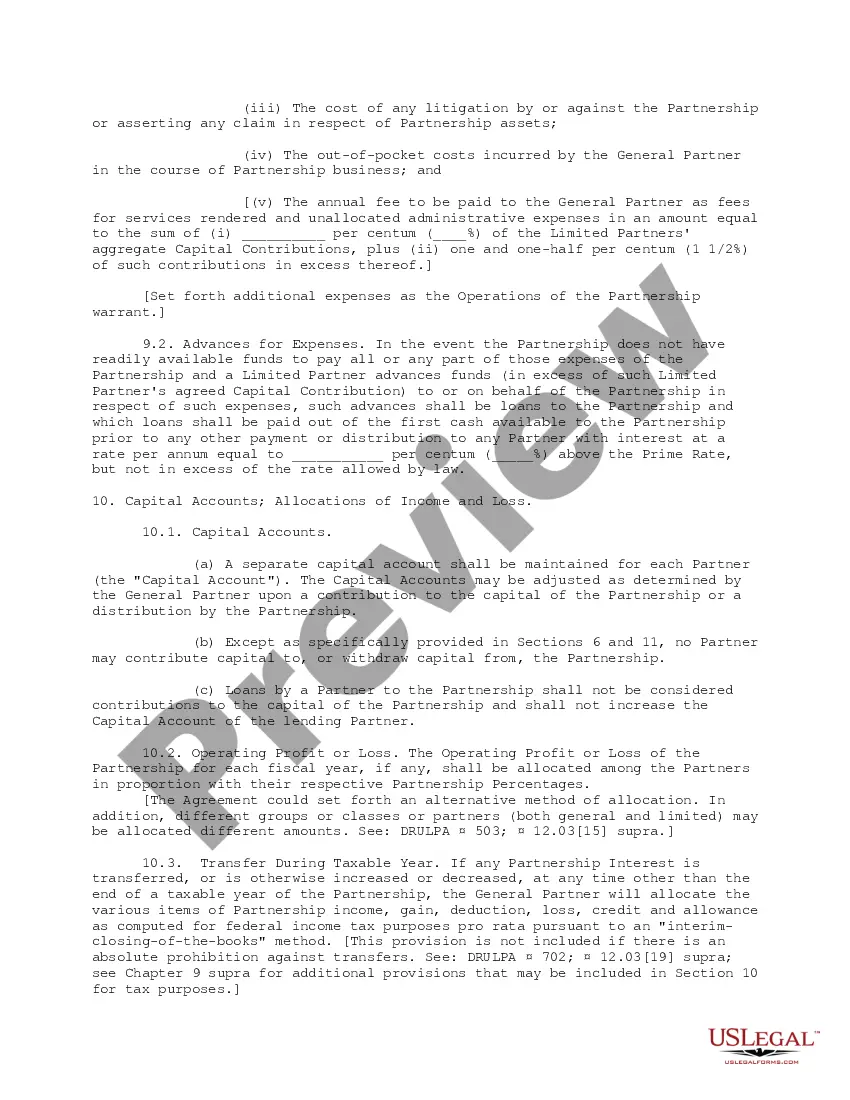

South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement — Comprehensive Guide for Partnerships in South Dakota Introduction: The South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement serves as a comprehensive guide for individuals or entities interested in forming a limited partnership in South Dakota. This agreement is specifically tailored to comply with the laws and regulations of both South Dakota and Delaware, ensuring a legally sound and binding partnership structure. This detailed description will provide an overview of the key elements covered in this agreement, making it easier for potential partners to understand its importance and relevance. Key Elements of the South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement: 1. Introduction and Recitals: This section outlines the purpose and intent of the partnership, identifying the roles and responsibilities of each partner involved. 2. Formation and Duration: Details the process of forming the partnership, including the official filing requirements and the duration of the partnership. 3. Contributions and Distributions: Explains the specific contributions made by each partner, such as capital, property, or services, and the manner in which profits and losses will be allocated among partners. 4. Management and Decision-making: Clarifies the decision-making authority and responsibilities of the general partner(s) and limited partner(s), highlighting the managerial structure of the partnership. 5. Meetings and Voting: Describes the procedures for partner meetings, including notice requirements and voting rights, ensuring transparency and consensus-building within the partnership. 6. Dissolution and Termination: Outlines the conditions under which the partnership can be dissolved or terminated, including provisions for withdrawal, retirement, or death of partners. 7. Indemnification and Liability: Addresses the indemnification of partners, limiting their personal liabilities and outlining the extent to which the partnership will provide legal and financial protection. 8. Taxation and Reporting: Discusses tax-related obligations, as well as reporting requirements of the partnership, ensuring compliance with both state and federal regulations. 9. Governing Law and Jurisdiction: States the governing law and jurisdiction preferences, providing clarity on any legal conflicts that may arise and determining the appropriate court for dispute resolution. Types of South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement: While there may not be distinct types of the South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement, it is essential to note that this agreement can be tailored to suit diverse partnership structures and specific business needs. The agreement can be adapted for partnerships in various industries, such as real estate, finance, or healthcare, accommodating the unique considerations and requirements of each partnership type. Conclusion: The South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement serves as a comprehensive and legally binding document for those looking to establish a limited partnership in South Dakota. By meticulously addressing each key element important to a partnership, this agreement safeguards the interests of all involved parties and ensures a clear understanding of roles, responsibilities, and decision-making processes.

South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement — Comprehensive Guide for Partnerships in South Dakota Introduction: The South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement serves as a comprehensive guide for individuals or entities interested in forming a limited partnership in South Dakota. This agreement is specifically tailored to comply with the laws and regulations of both South Dakota and Delaware, ensuring a legally sound and binding partnership structure. This detailed description will provide an overview of the key elements covered in this agreement, making it easier for potential partners to understand its importance and relevance. Key Elements of the South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement: 1. Introduction and Recitals: This section outlines the purpose and intent of the partnership, identifying the roles and responsibilities of each partner involved. 2. Formation and Duration: Details the process of forming the partnership, including the official filing requirements and the duration of the partnership. 3. Contributions and Distributions: Explains the specific contributions made by each partner, such as capital, property, or services, and the manner in which profits and losses will be allocated among partners. 4. Management and Decision-making: Clarifies the decision-making authority and responsibilities of the general partner(s) and limited partner(s), highlighting the managerial structure of the partnership. 5. Meetings and Voting: Describes the procedures for partner meetings, including notice requirements and voting rights, ensuring transparency and consensus-building within the partnership. 6. Dissolution and Termination: Outlines the conditions under which the partnership can be dissolved or terminated, including provisions for withdrawal, retirement, or death of partners. 7. Indemnification and Liability: Addresses the indemnification of partners, limiting their personal liabilities and outlining the extent to which the partnership will provide legal and financial protection. 8. Taxation and Reporting: Discusses tax-related obligations, as well as reporting requirements of the partnership, ensuring compliance with both state and federal regulations. 9. Governing Law and Jurisdiction: States the governing law and jurisdiction preferences, providing clarity on any legal conflicts that may arise and determining the appropriate court for dispute resolution. Types of South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement: While there may not be distinct types of the South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement, it is essential to note that this agreement can be tailored to suit diverse partnership structures and specific business needs. The agreement can be adapted for partnerships in various industries, such as real estate, finance, or healthcare, accommodating the unique considerations and requirements of each partnership type. Conclusion: The South Dakota Annotated Form of Basic Delaware Limited Partnership Agreement serves as a comprehensive and legally binding document for those looking to establish a limited partnership in South Dakota. By meticulously addressing each key element important to a partnership, this agreement safeguards the interests of all involved parties and ensures a clear understanding of roles, responsibilities, and decision-making processes.