South Dakota Certificate of Limited Partnership of New Private Equity Fund

Description

How to fill out Certificate Of Limited Partnership Of New Private Equity Fund?

Choosing the best legitimate record web template could be a have difficulties. Naturally, there are plenty of templates available on the Internet, but how can you obtain the legitimate form you will need? Use the US Legal Forms web site. The assistance provides thousands of templates, including the South Dakota Certificate of Limited Partnership of New Private Equity Fund, which can be used for business and personal demands. All the varieties are examined by specialists and meet state and federal requirements.

Should you be previously signed up, log in in your accounts and click the Obtain button to have the South Dakota Certificate of Limited Partnership of New Private Equity Fund. Make use of your accounts to check from the legitimate varieties you have ordered previously. Check out the My Forms tab of your respective accounts and get another duplicate in the record you will need.

Should you be a fresh customer of US Legal Forms, allow me to share basic directions so that you can adhere to:

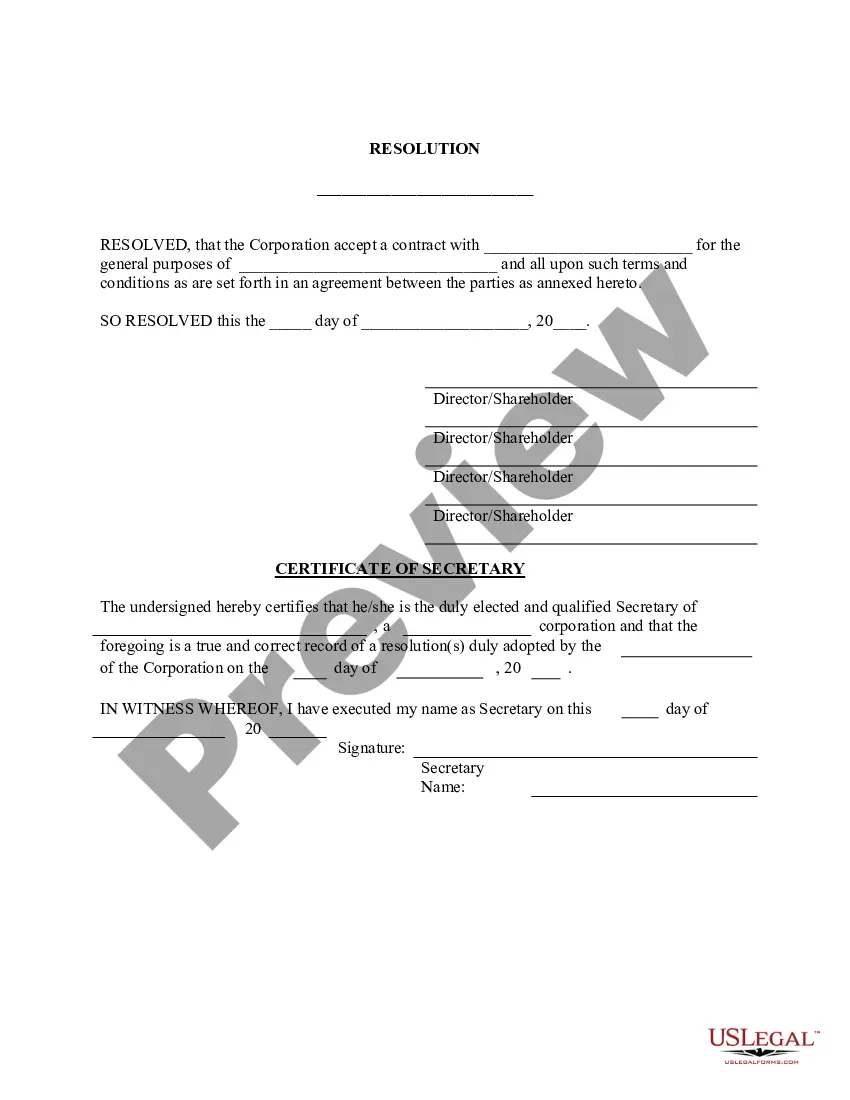

- Very first, be sure you have chosen the proper form to your area/county. It is possible to look through the shape utilizing the Preview button and study the shape explanation to ensure this is the right one for you.

- In the event the form is not going to meet your requirements, take advantage of the Seach industry to find the correct form.

- When you are certain the shape is suitable, select the Get now button to have the form.

- Select the pricing plan you want and enter in the needed information. Design your accounts and buy your order making use of your PayPal accounts or Visa or Mastercard.

- Pick the data file structure and down load the legitimate record web template in your device.

- Complete, modify and print and indicator the received South Dakota Certificate of Limited Partnership of New Private Equity Fund.

US Legal Forms may be the biggest catalogue of legitimate varieties that you can discover a variety of record templates. Use the service to down load appropriately-made paperwork that adhere to status requirements.

Form popularity

FAQ

The firm name of your limited liability partnership must contain the words ?limited liability partnership? or ?societe a responsabilite limitee? or the abbreviations ?LLP?, ?L.L.P.? or ?s.r.l.? as the last words or letters of the firm name.

In South Dakota partnerships are generally taxed as pass-through entities, meaning the profit and losses from the businesses pass directly into the partners' personal incomes.

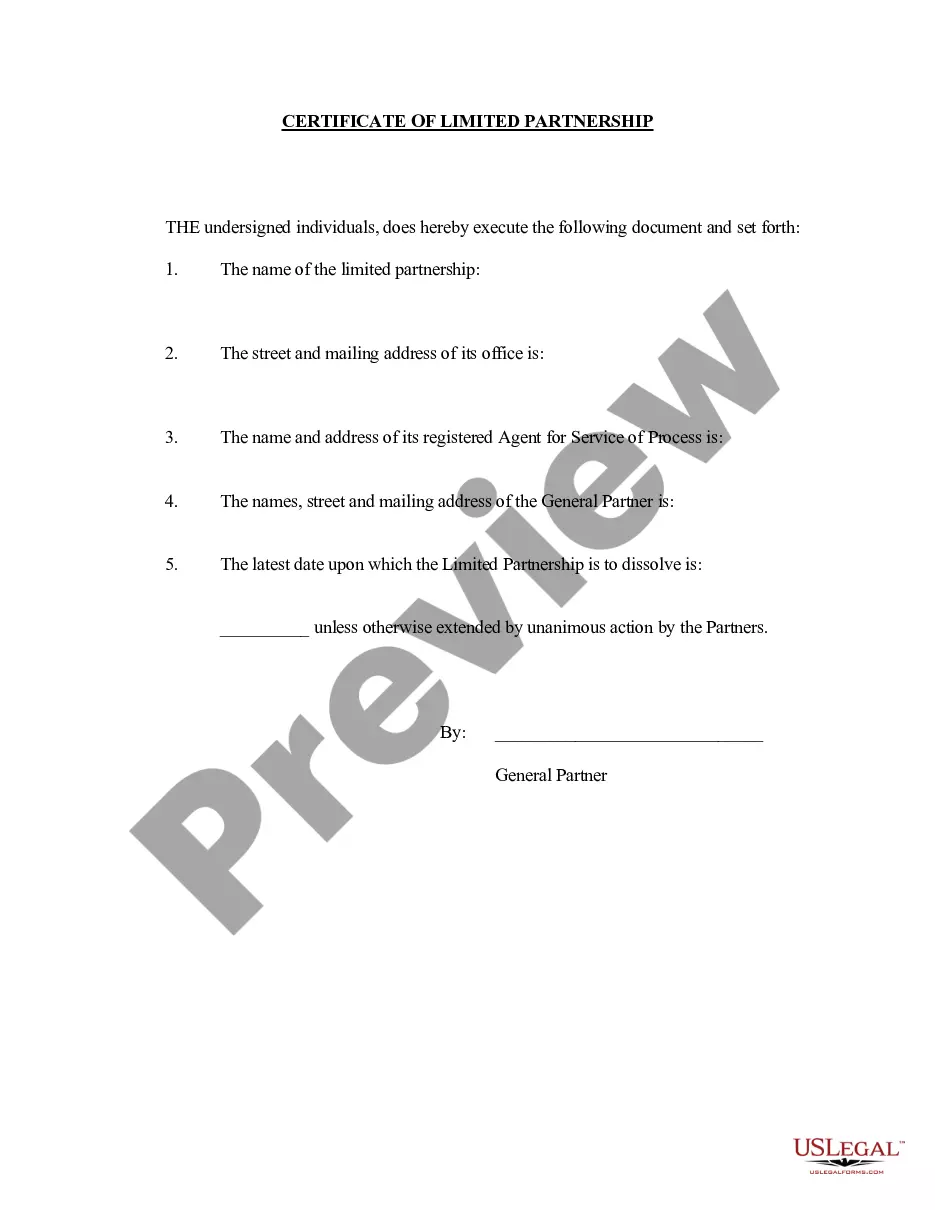

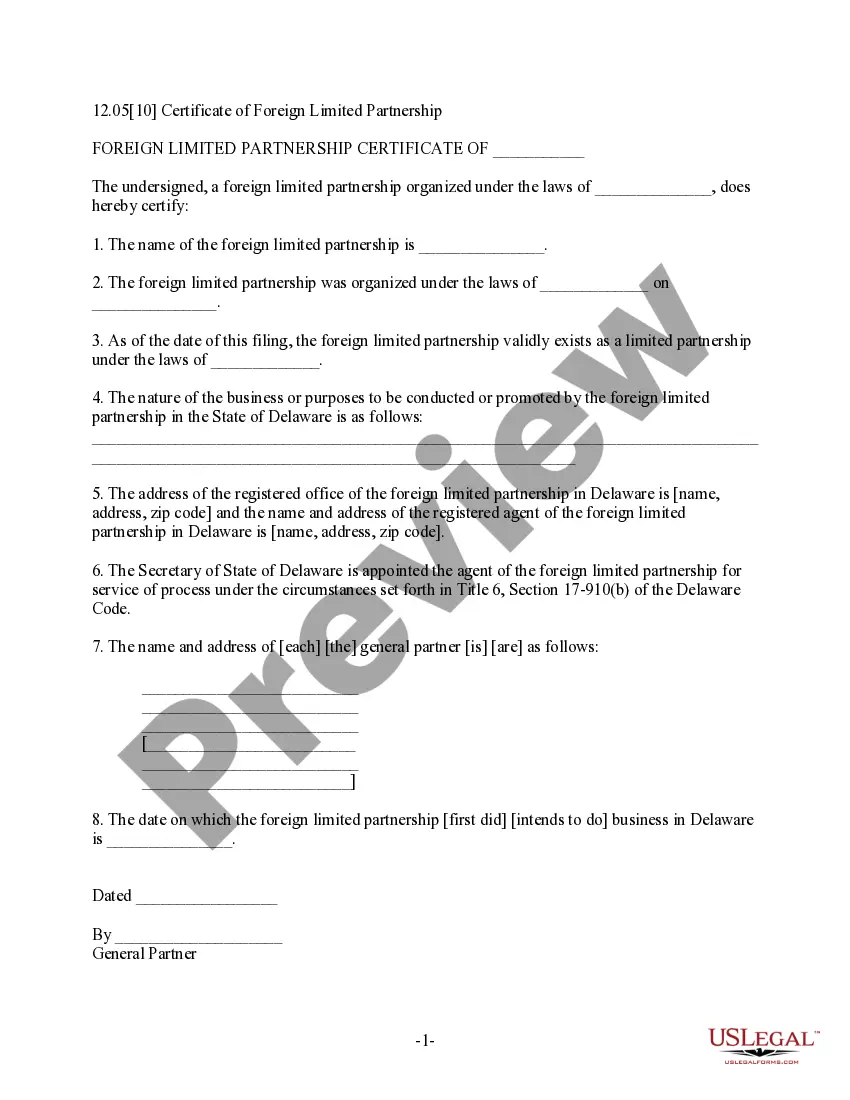

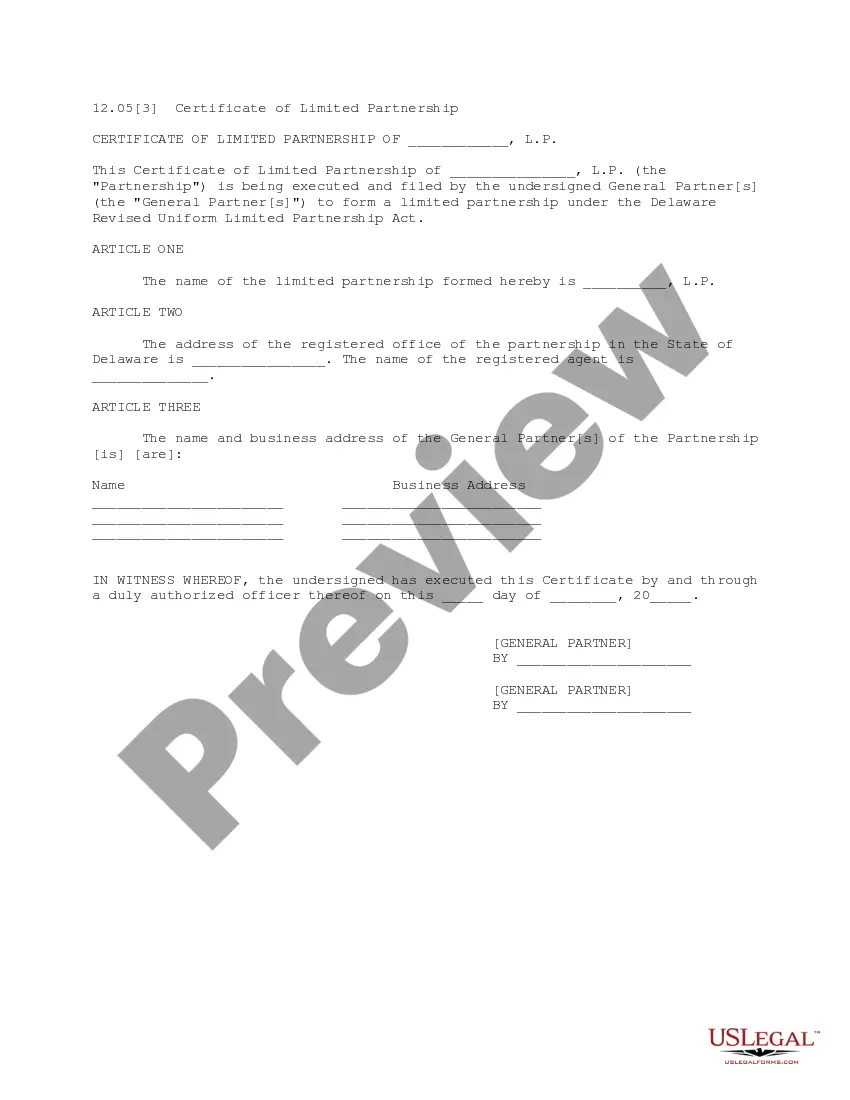

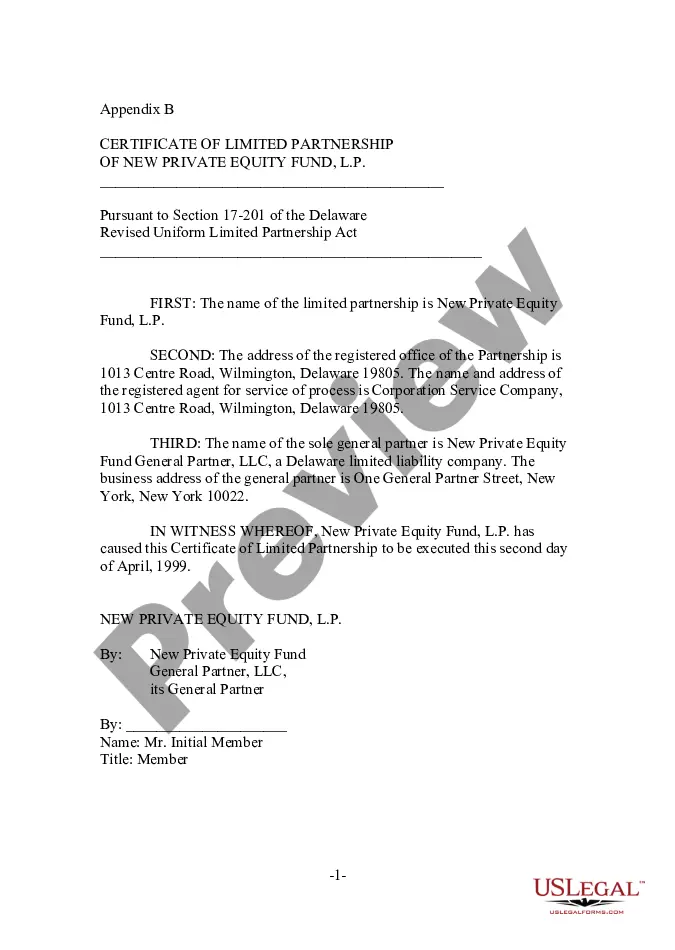

Some states only require that the certificate contains the name of the limited partnership, the name and address of the registered agent and registered office, and the names and addresses of all of the general partners.

Limited liability partnership (LLP) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. Partners will not be liable for the tortious damages of other partners but potentially for the contractual debts depending on the state.

A limited partnership has two types of partners: general partners and limited partners. It must have one or more of each type. All partner, limited and general, share the profits of the business. Each general partner has unlimited liability for the obligations of the business.

The certificate must state: (1) the name of the limited partnership, which must comply with Section 15901.08; (2) the address of the initial designated office; and (3) the name and address of the initial agent for service of process in ance with paragraph (1) of subdivision (d) of Section 15901.16.