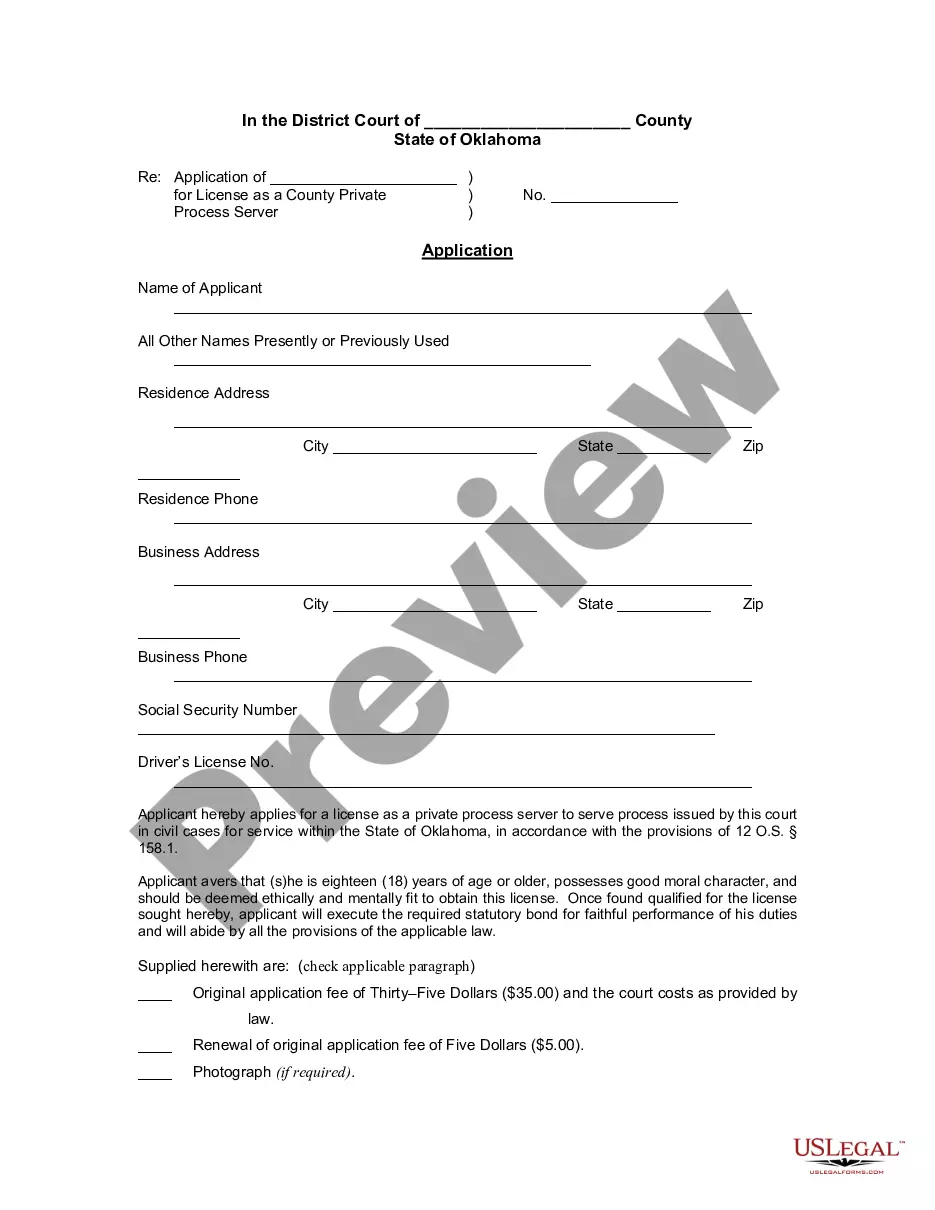

UCC1 - Financing Statement - South Dakota - For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

South Dakota UCC1 Financing Statement

Description

How to fill out South Dakota UCC1 Financing Statement?

Get access to quality South Dakota UCC1 Financing Statement samples online with US Legal Forms. Avoid hours of misused time searching the internet and dropped money on documents that aren’t updated. US Legal Forms offers you a solution to exactly that. Get above 85,000 state-specific authorized and tax samples that you can save and complete in clicks within the Forms library.

To get the example, log in to your account and then click Download. The file will be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Verify that the South Dakota UCC1 Financing Statement you’re considering is appropriate for your state.

- Look at the sample utilizing the Preview function and browse its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay by credit card or PayPal to complete making an account.

- Pick a favored file format to download the file (.pdf or .docx).

You can now open up the South Dakota UCC1 Financing Statement sample and fill it out online or print it out and get it done yourself. Take into account mailing the papers to your legal counsel to be certain everything is filled in properly. If you make a mistake, print and complete application once again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and access far more templates.

Form popularity

FAQ

Searching Secretary of State Records Online. Locate the correct secretary of state's website. UCC financing statement forms must be filed in the state where the borrower is located. Most states have online directories of UCC filings available on the secretary of state's website.

The UCC-1 Financing Statement is filed to protect a lender's or creditor's security interest by giving public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt with a certain debtor.

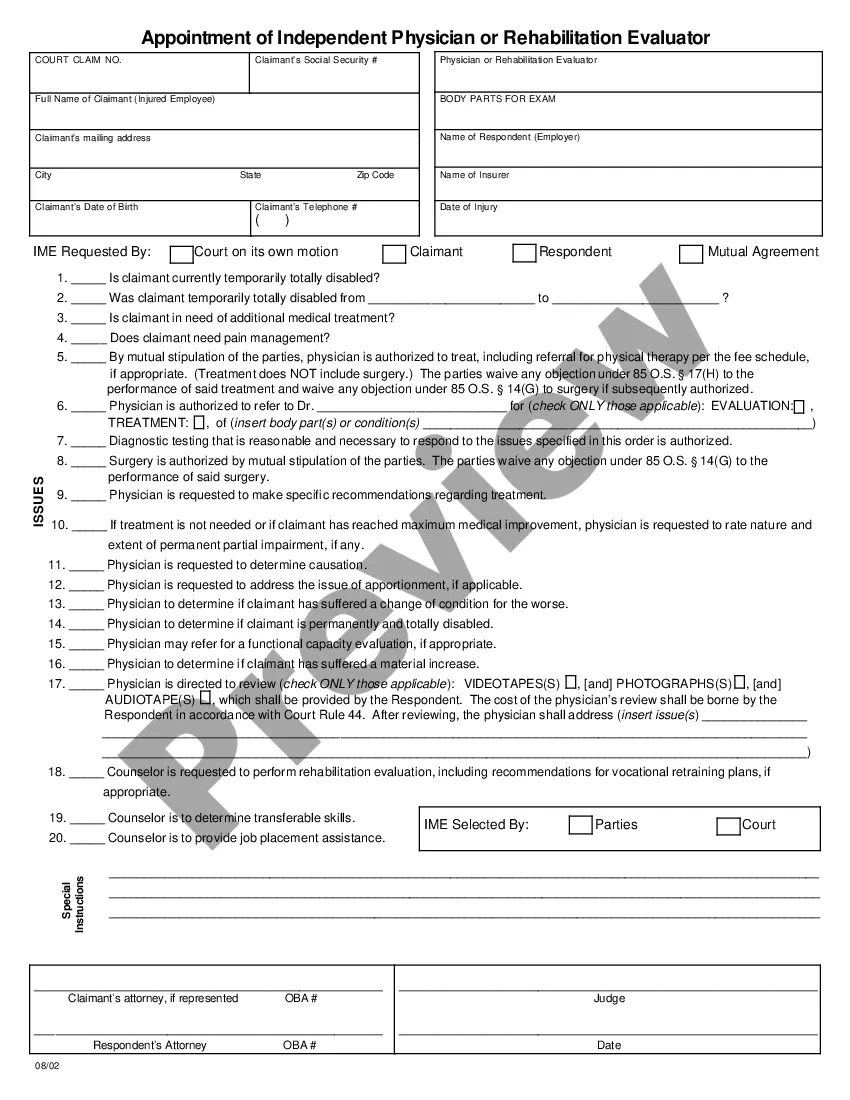

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

When is a UCC-1 Filed? UCC-1 filings typically happen when a loan is first originated. If the borrower has loans from more than one lender, the first lender to file the UCC-1 is first in line for the borrower's assets. This motivates lenders to file a UCC-1 as soon as a loan is made.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

Section 9-503 of the UCC provides various, more specific rules regarding the sufficiency of a debtor's name on a financing statement.However, unlike with a security agreement, on a financing statement it is acceptable to use a supergeneric description of collateral.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.