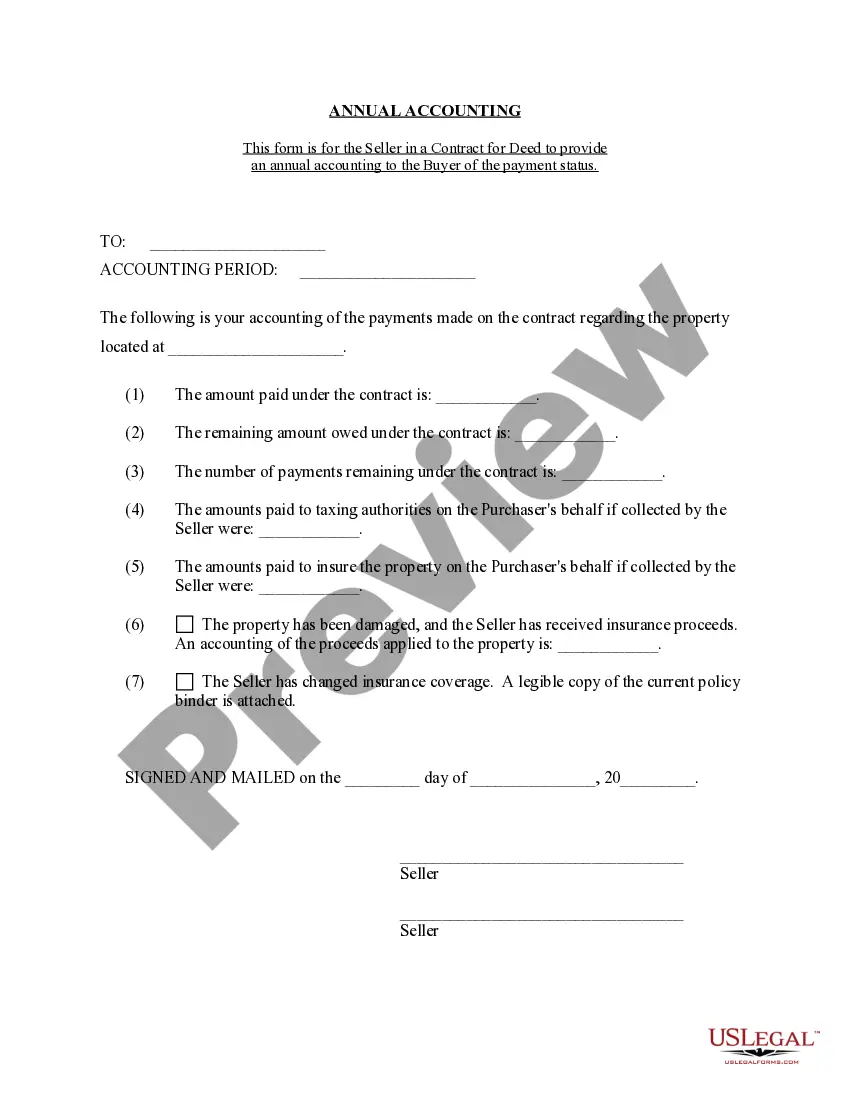

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Tennessee Contract for Deed Seller's Annual Accounting Statement

Description

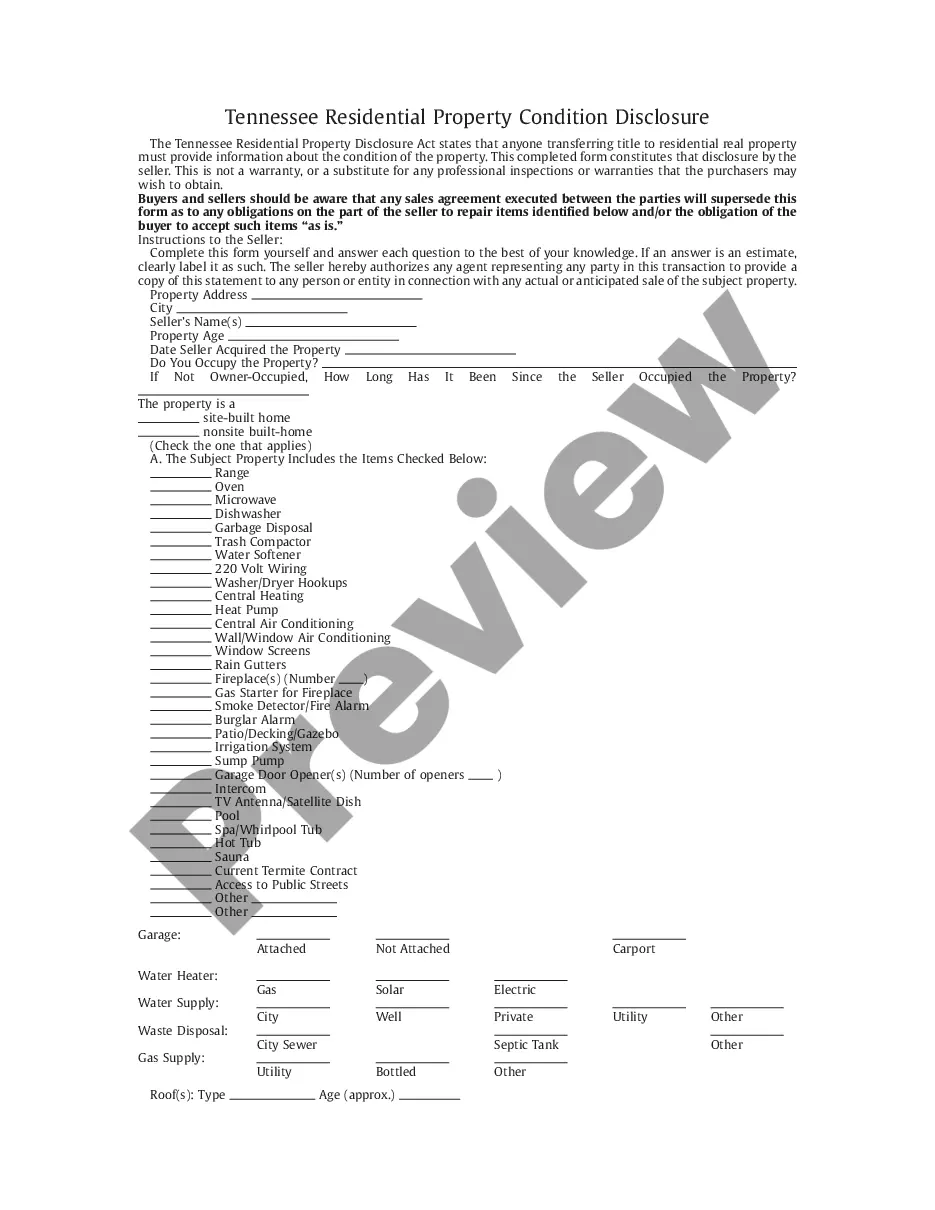

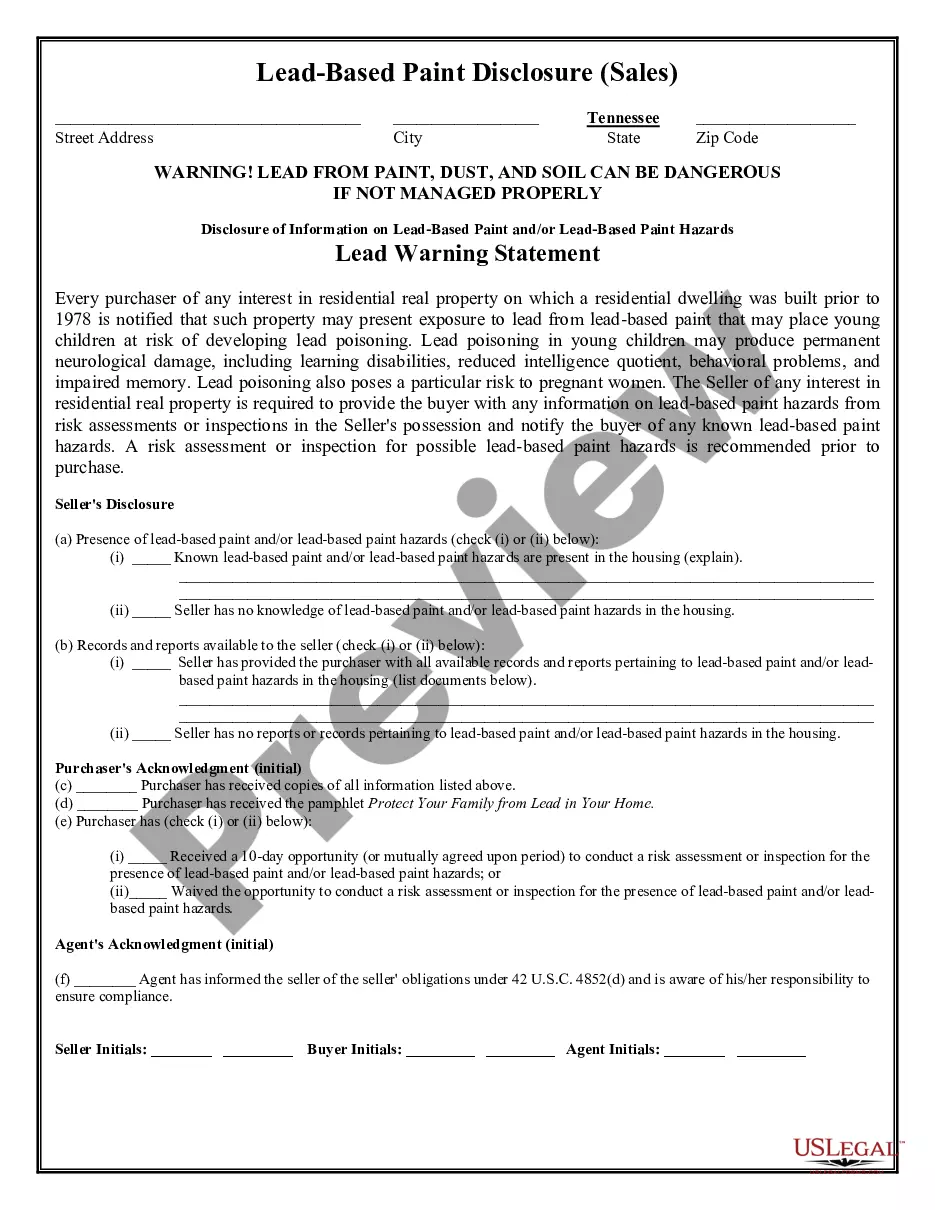

How to fill out Tennessee Contract For Deed Seller's Annual Accounting Statement?

Use US Legal Forms to obtain a printable Tennessee Contract for Deed Seller's Annual Accounting Statement. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms catalogue on the web and offers reasonably priced and accurate templates for customers and attorneys, and SMBs. The documents are categorized into state-based categories and some of them can be previewed prior to being downloaded.

To download templates, customers must have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to easily find and download Tennessee Contract for Deed Seller's Annual Accounting Statement:

- Check to ensure that you get the proper template with regards to the state it is needed in.

- Review the document by reading the description and using the Preview feature.

- Press Buy Now if it is the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Use the Search engine if you want to find another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Tennessee Contract for Deed Seller's Annual Accounting Statement. More than three million users have utilized our platform successfully. Choose your subscription plan and get high-quality forms in just a few clicks.

Form popularity

FAQ

After a certain amount of time past the due date, if the report still isn't filed, the jurisdiction will revoke your company's good standing or put it into a forfeited status.Most states require the past due annual report as well as an additional certificate of reinstatement and more fees.

Tennessee Secretary of State Control Number: A control number is assigned to each entity on record with the Tennessee Secretary of State Division of Business Services. To find entity information, including the Secretary of State control number, visit: https://tnbear.tn.gov/ECommerce/FilingSearch.aspx.

An annual report is a business's yearly report required by the states for which entities are registered to do business.Filing an annual report in a timely manner ensures your good standing with state government.

By default, LLCs themselves do not pay federal income taxes, only their members do. Tennessee, however, imposes a franchise tax and an excise tax on most LLCs. You must register for this tax through the Department of Revenue (DOR).Tennessee's franchise and excise taxes also apply to LLCs taxed as corporations.

Annual reports inform all interested parties about the financial success (or failure) of a public entity, private corporation, non-profit organization, or other business formation.Some types of businesses must prepare and file an annual report by law with the Secretary of State where the company operates.

What Is an Annual Report? In Tennessee, an annual report is a regular filing that your LLC must complete every year. The report is essentially updating your registered agent address and paying a $50 fee per member (with a minimum of $300 and a maximum of $3,000).

State Business Tax By default, LLCs themselves do not pay federal income taxes, only their members do. Tennessee, however, imposes a franchise tax and an excise tax on most LLCs. You must register for this tax through the Department of Revenue (DOR).

For assistance with your annual report submission, or if you do not want to submit online, please contact Business Services at (615) 741-2286 or TNSOS.CORPINFO@tn.gov.