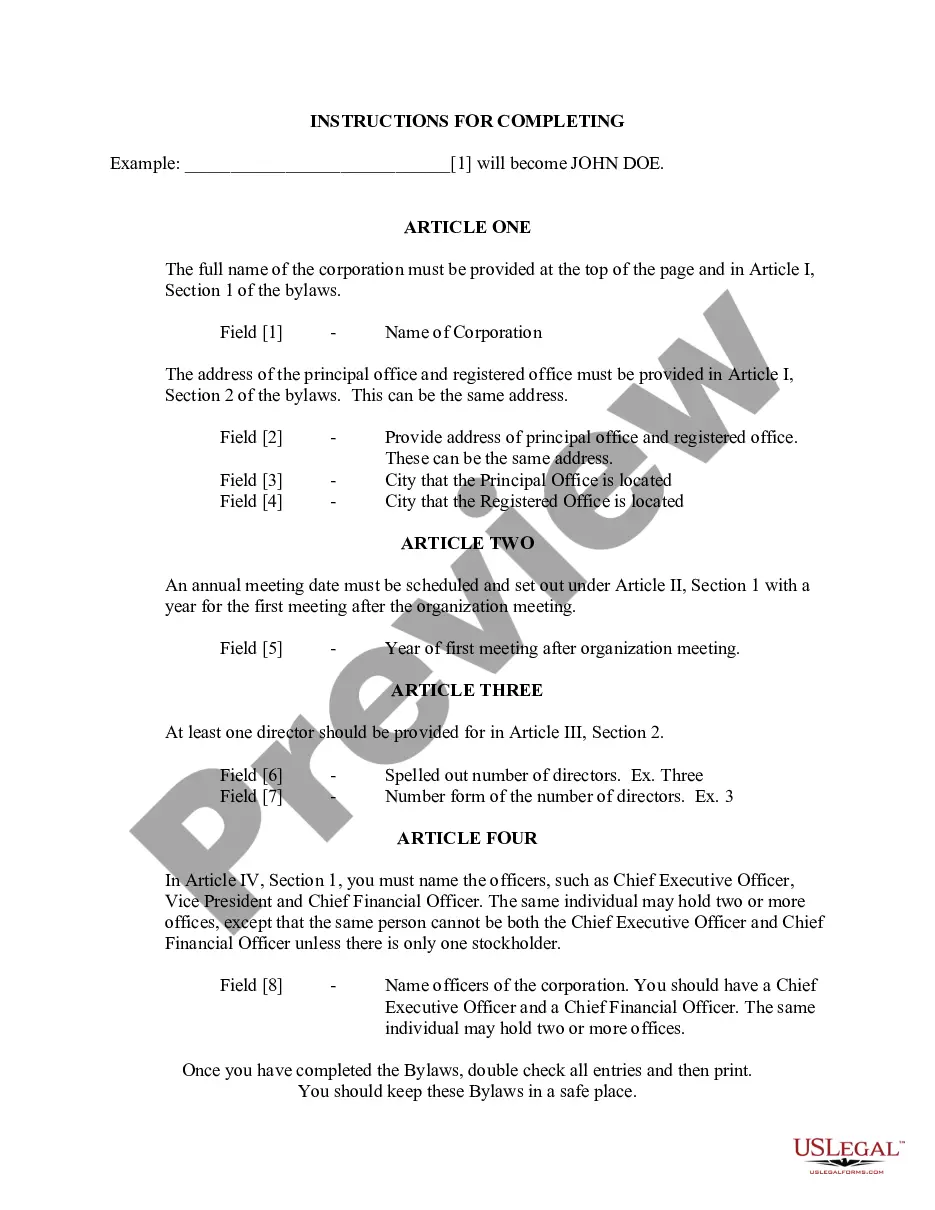

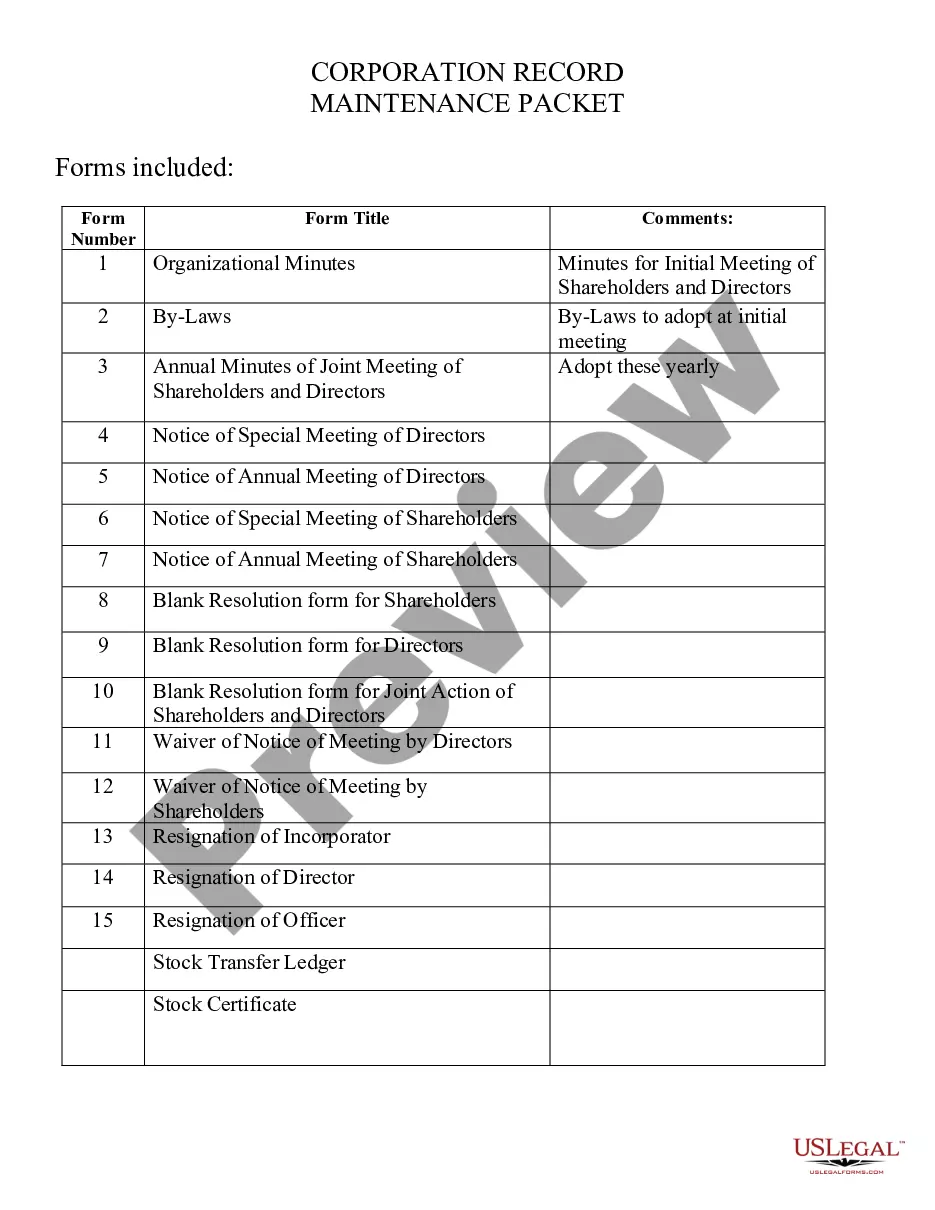

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Tennessee Business Incorporation Package to Incorporate Corporation

Description

How to fill out Tennessee Business Incorporation Package To Incorporate Corporation?

Access to high quality Tennessee Business Incorporation Package to Incorporate Corporation samples online with US Legal Forms. Prevent days of lost time seeking the internet and dropped money on documents that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Find above 85,000 state-specific legal and tax samples you can download and fill out in clicks within the Forms library.

To find the example, log in to your account and then click Download. The file will be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide listed below to make getting started simpler:

- Verify that the Tennessee Business Incorporation Package to Incorporate Corporation you’re looking at is appropriate for your state.

- View the sample making use of the Preview option and browse its description.

- Visit the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay by credit card or PayPal to complete making an account.

- Choose a preferred file format to save the document (.pdf or .docx).

Now you can open up the Tennessee Business Incorporation Package to Incorporate Corporation example and fill it out online or print it and do it by hand. Take into account giving the papers to your legal counsel to make sure things are filled out appropriately. If you make a mistake, print out and complete sample once again (once you’ve created an account every document you download is reusable). Make your US Legal Forms account now and get access to far more templates.

Form popularity

FAQ

State Business Tax By default, LLCs themselves do not pay federal income taxes, only their members do. Tennessee, however, imposes a franchise tax and an excise tax on most LLCs. You must register for this tax through the Department of Revenue (DOR).

How much does it cost to form a corporation in Tennessee? You can register your business name with the Tennessee Department of State for $20. To file your Corporate Charter, the Tennessee Department of State charges a $100 filing fee.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).

Tennessee charges a low $20 for corporations, and hits LLCs with a $300 filing fee for businesses with 1-6 members, and then tacks on an extra $50 per member. So if you have an 8 member LLC, you'll pay $400 per year to file your annual report, whereas a giant corporation pays $20.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)

Choose a Corporate Name. File a Corporate Charter. Appoint a Registered Agent. Prepare Corporate Bylaws. Appoint Initial Directors and Hold First Board Meeting. File Annual Report. Obtain an EIN.

How much does it cost to form an LLC in Tennessee? The Tennessee Secretary of State charges $50 per LLC member included in the filing, with a minimum total fee of $300. The filing fee cannot exceed $3,000 for the Articles of Organization. A convenience fee will also be charged when paying online by credit card.