This form package provides the forms necessary to form a professional corporation for the practice of a state-licensed profession in the State of Tennessee.

Professional Corporation Package for Tennessee

Description

How to fill out Professional Corporation Package For Tennessee?

Among countless free and paid examples that you find on the internet, you can't be certain about their accuracy. For example, who made them or if they’re competent enough to take care of the thing you need these people to. Keep relaxed and make use of US Legal Forms! Find Professional Corporation Package for Tennessee samples developed by skilled attorneys and get away from the high-priced and time-consuming procedure of looking for an lawyer or attorney and then paying them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you’re trying to find. You'll also be able to access all your earlier saved samples in the My Forms menu.

If you are making use of our website the very first time, follow the instructions below to get your Professional Corporation Package for Tennessee with ease:

- Make sure that the file you see is valid where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another example utilizing the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

Once you have signed up and bought your subscription, you may use your Professional Corporation Package for Tennessee as often as you need or for as long as it continues to be active in your state. Edit it with your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

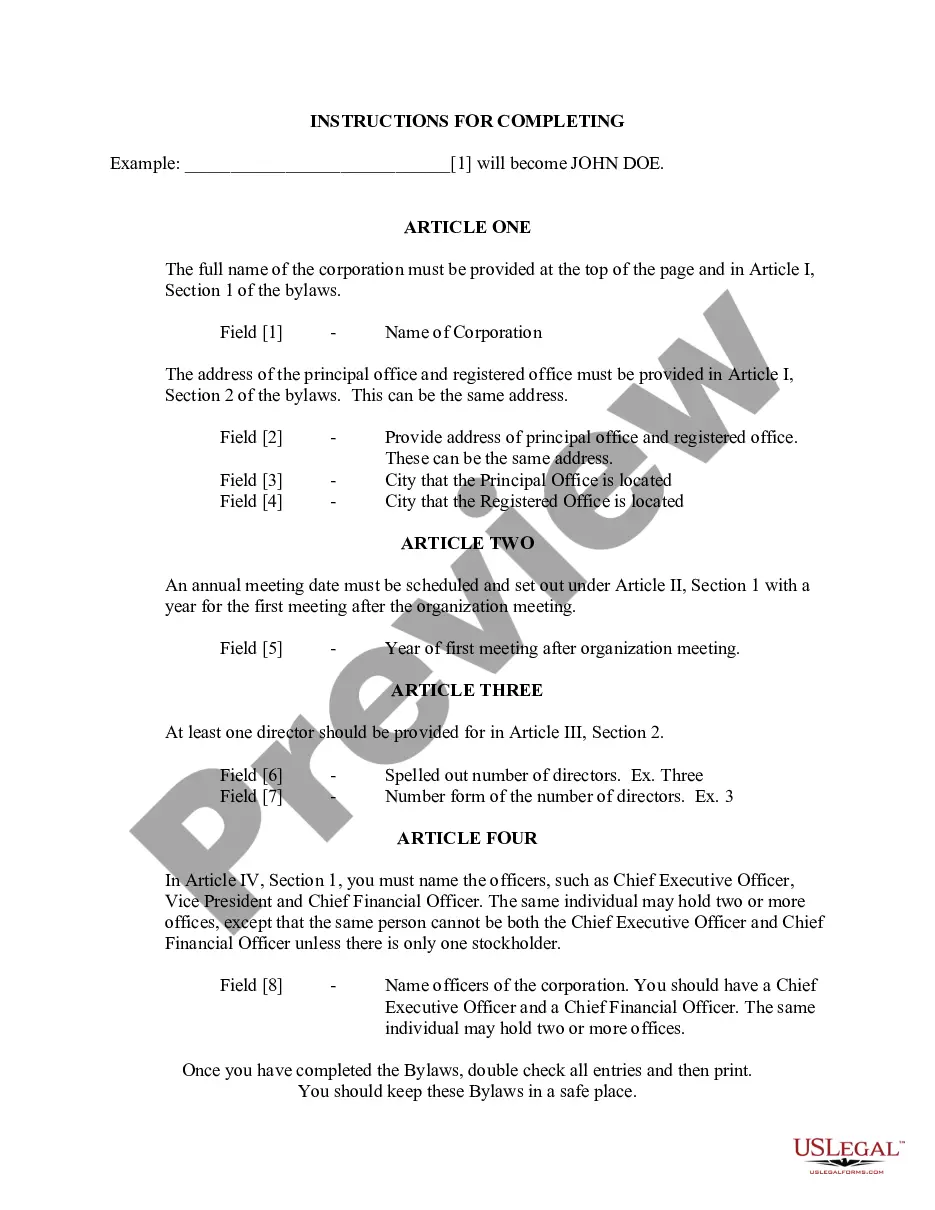

Choose a corporate name. File your Articles of Incorporation. Appoint a registered agent. Start a corporate records book. Prepare corporate bylaws. Appoint initial directors. Hold first Board of Directors meeting. Issue stock to shareholders.

Tennessee, however, is different: it does not recognize the federal S election, and instead treats S corporations like traditional corporations, including requiring them to pay the same taxes as traditional corporations.In addition, individual shareholders who receive dividends will owe tax to the state.

What Businesses Are Subject to the Business Tax? The business tax is imposed generally on anyone delivering goods or services to Tennessee customers, but a number of activities and entities are specifically exempted. For example, taxpayers are exempt from the business tax if they generate less than $10,000 in sales.

A Tennessee PLLC is a limited liability company (LLC) formed specifically by people who will provide Tennessee licensed professional services.Like other LLCs, PLLCs protect their individual members from people with claims for many (but not all) types of financial debts or personal injuries.

The Tennessee excise tax on S corp.The same income taxed at pass-through rates is 29.6 percent federal; 6.5 percent Tennessee excise; and three percent Tennessee Hall dividend tax - provided the owner takes a distribution equal to what would have been a bonus.

What Businesses Are Subject to the Business Tax? The business tax is imposed generally on anyone delivering goods or services to Tennessee customers, but a number of activities and entities are specifically exempted. For example, taxpayers are exempt from the business tax if they generate less than $10,000 in sales.

Some jurisdictionsthe District of Columbia, Louisiana, New Hampshire, New York City, Tennessee, and Texasdo not recognize the federal S corporation election and, for the most part, tax S corporations like other business corporations.

While each business is different, some states simply stand out as good choices for incorporation. Wyoming, Nevada, and Delaware are ideal choices for incorporating your business due to their business-friendly rules, enhanced privacy, and knowledgeable courts.

Tennessee charges a low $20 for corporations, and hits LLCs with a $300 filing fee for businesses with 1-6 members, and then tacks on an extra $50 per member. So if you have an 8 member LLC, you'll pay $400 per year to file your annual report, whereas a giant corporation pays $20.