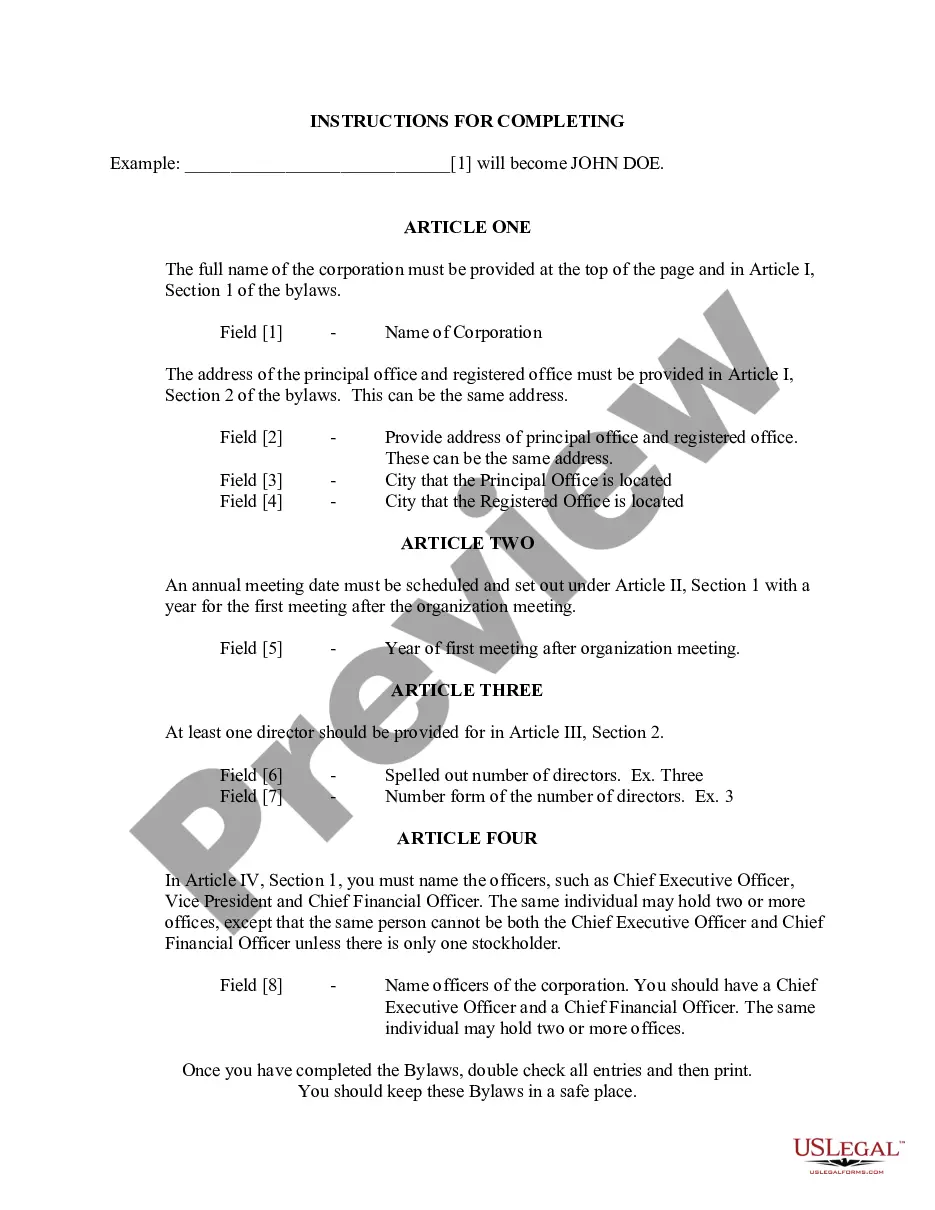

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Tennessee Charter of Incorporation for Domestic For-Profit Corporation

Description

How to fill out Tennessee Charter Of Incorporation For Domestic For-Profit Corporation?

Access to high quality Tennessee Charter of Incorporation for Domestic For-Profit Corporation templates online with US Legal Forms. Steer clear of days of lost time seeking the internet and lost money on forms that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Find over 85,000 state-specific legal and tax forms that you can download and submit in clicks in the Forms library.

To find the example, log in to your account and then click Download. The document will be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- See if the Tennessee Charter of Incorporation for Domestic For-Profit Corporation you’re considering is suitable for your state.

- Look at the sample utilizing the Preview function and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Choose the subscription plan to go on to register.

- Pay out by credit card or PayPal to finish creating an account.

- Select a preferred file format to download the document (.pdf or .docx).

You can now open the Tennessee Charter of Incorporation for Domestic For-Profit Corporation template and fill it out online or print it out and do it yourself. Consider mailing the papers to your legal counsel to be certain things are filled in properly. If you make a error, print and fill sample again (once you’ve registered an account all documents you download is reusable). Make your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

Visit Tennessee's Secretary of State website. Select Corporations from the drop-down menu of the Business Services tab.

Tennessee charges a low $20 for corporations, and hits LLCs with a $300 filing fee for businesses with 1-6 members, and then tacks on an extra $50 per member. So if you have an 8 member LLC, you'll pay $400 per year to file your annual report, whereas a giant corporation pays $20.

Do I need to incorporate my small business? Whether your team is composed of two people or 10, all businesses can benefit from incorporating. Advantages of forming a corporation or limited liability company (LLC) include: Personal asset protection.

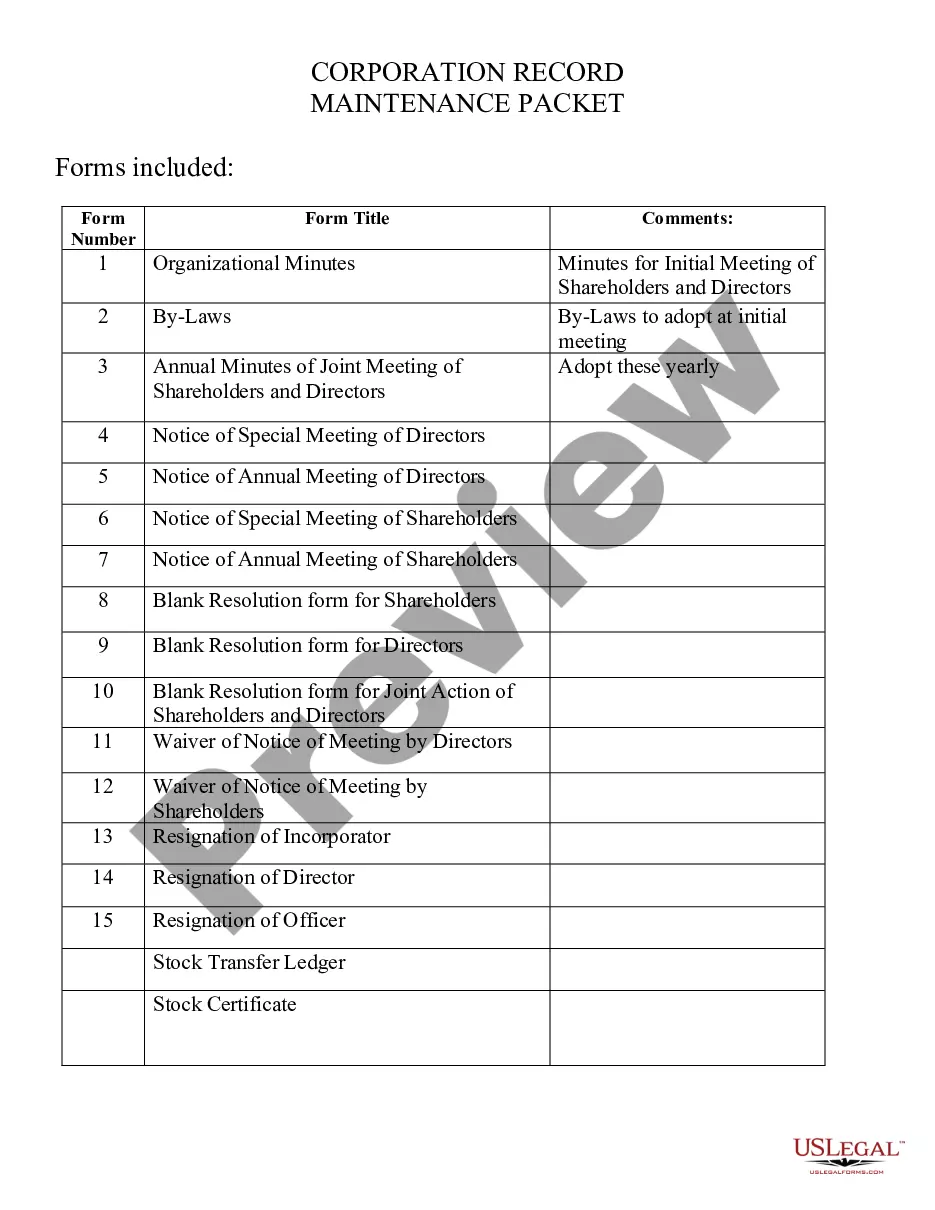

Choose a corporate name. File your Articles of Incorporation. Appoint a registered agent. Start a corporate records book. Prepare corporate bylaws. Appoint initial directors. Hold first Board of Directors meeting. Issue stock to shareholders.

Decide on the state where you want to incorporate. Choose a name for your business. File the articles of incorporation, which includes information about your business, stock shares you plan to issue, location, purpose of the company, and other pertinent details.

Choose a Corporate Structure. Incorporating means starting a corporation. Check Name Availability. Appoint a Registered Agent. File Tennessee Articles of Incorporation. Establish Bylaws & Corporate Records. Appoint Initial Directors. Hold Organizational Meeting. Issue Stock Certificates.

How much does it cost to form an LLC in Tennessee? The Tennessee Secretary of State charges $50 per LLC member included in the filing, with a minimum total fee of $300. The filing fee cannot exceed $3,000 for the Articles of Organization.

Tennessee, however, is different: it does not recognize the federal S election, and instead treats S corporations like traditional corporations, including requiring them to pay the same taxes as traditional corporations.In addition, individual shareholders who receive dividends will owe tax to the state.

Tennessee law has no provisions for entity domestication. If you plan to move your company to Tennessee your can choose between qualifying your existing company as Tennessee Foreign Entity, or dissolving it in the original state of registration and forming a new company in Tennessee.