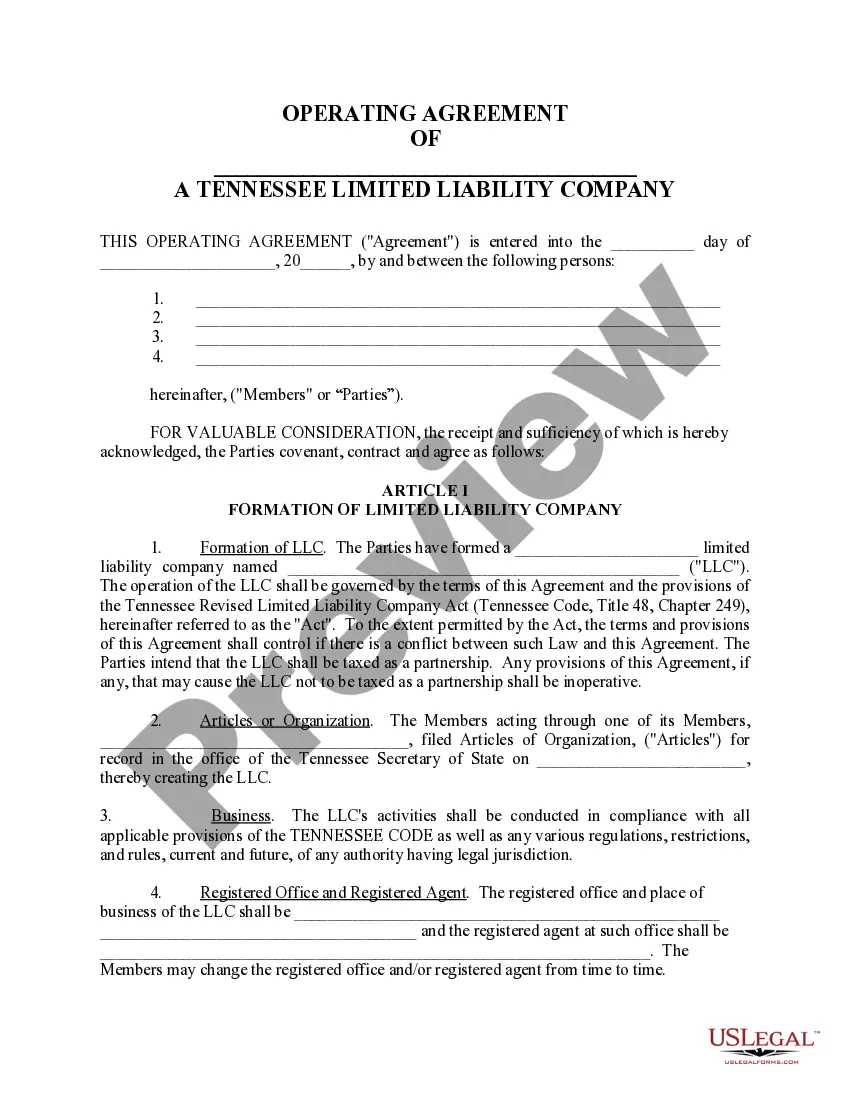

This Operating Agreement is used in the formation of any Limited Liability Company. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

Tennessee Limited Liability Company LLC Operating Agreement

Description Limited Llc Form

How to fill out Limited Company Operating?

Access to high quality Tennessee Limited Liability Company LLC Operating Agreement templates online with US Legal Forms. Prevent days of wasted time looking the internet and lost money on forms that aren’t updated. US Legal Forms gives you a solution to exactly that. Find over 85,000 state-specific legal and tax forms you can save and complete in clicks within the Forms library.

To find the sample, log in to your account and click on Download button. The document is going to be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- See if the Tennessee Limited Liability Company LLC Operating Agreement you’re considering is appropriate for your state.

- See the form utilizing the Preview option and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay out by card or PayPal to complete making an account.

- Pick a favored file format to save the document (.pdf or .docx).

You can now open up the Tennessee Limited Liability Company LLC Operating Agreement sample and fill it out online or print it and do it by hand. Think about giving the file to your legal counsel to be certain everything is filled in correctly. If you make a mistake, print and fill sample again (once you’ve registered an account all documents you download is reusable). Make your US Legal Forms account now and get access to more samples.

Tennessee Llc Operating Agreement Form popularity

Limited Liability Company Form Other Form Names

Limited Liability Company File FAQ

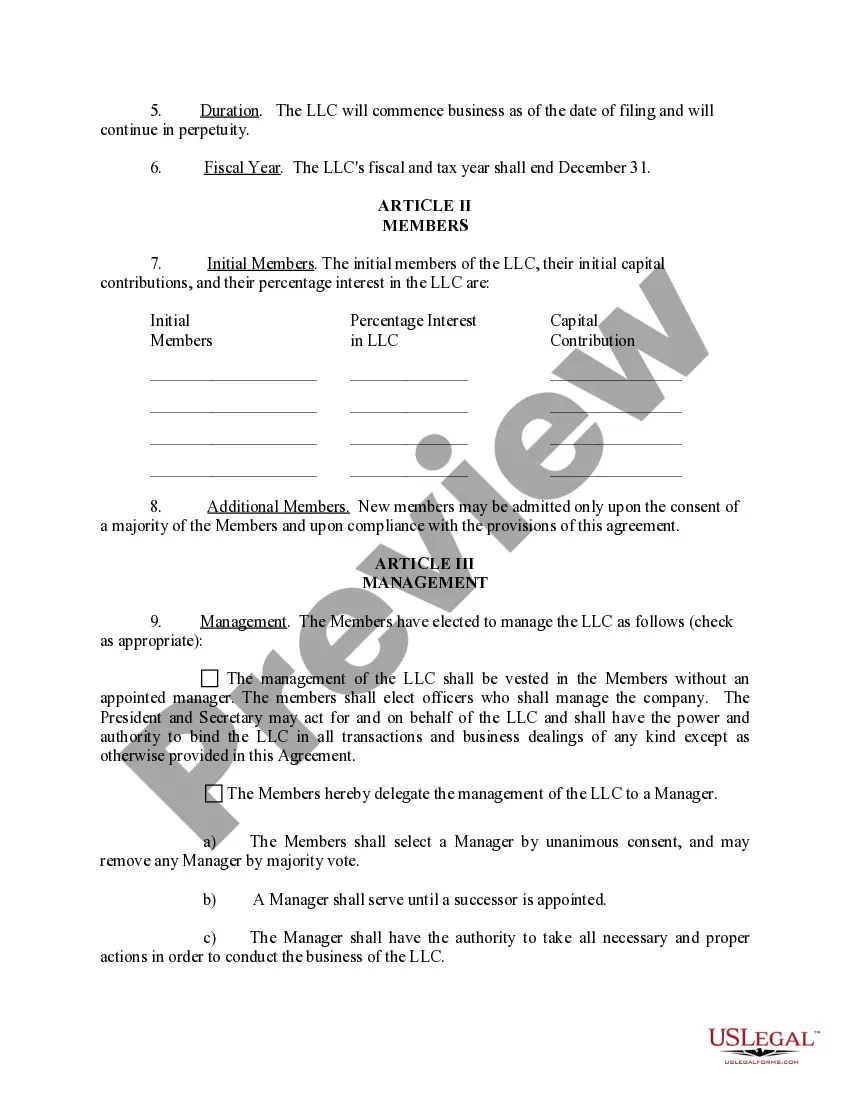

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

An LLC can be structured to be taxed in the same manner as a partnership however the owners or partners of a partnership are jointly and severally liable for the debts and obligations of the partnership.The operating agreement is a separate document and is an agreement between the owners of the LLC.

Call, write or visit the secretary of state's office in the state in which the LLC does business. Call, email, write or visit the owner of the company for which you want to see the LLC bylaws or operating agreement.

Pursuant to California Corporation's Code §17050, every California LLC is required to have an LLC Operating Agreement. Next to the Articles of Organization, the LLC Operating Agreement is the most important document in the LLC.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

Although an Operating Agreement is not required by TN statute, all LLCs should have one, especially multi-member LLCs. The Operating Agreement is a contract between/among the members of the LLC that lays out the rights and obligations of the members with respect to the LLC.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.