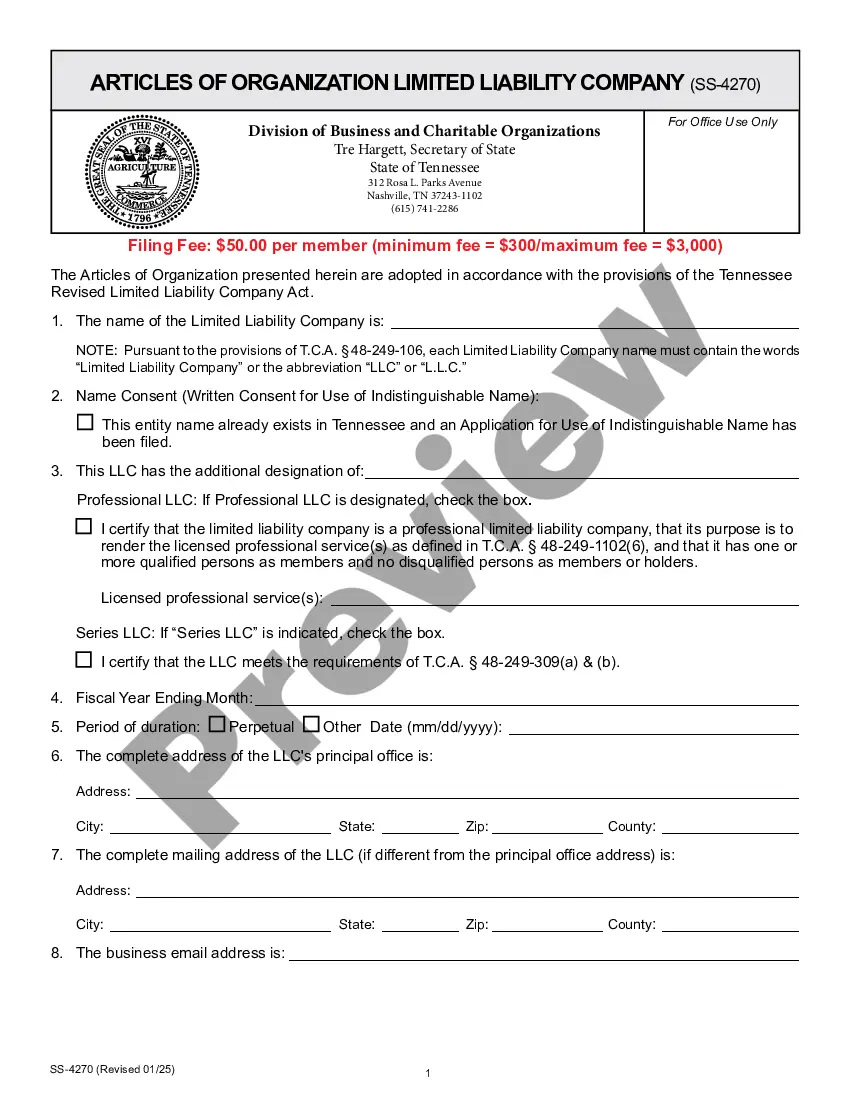

This Professional Limited Liability Company - PLLC Formation Package state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new Professional Limited Liability Company. The form contains basic information concerning the PLLC, normally including the PLLC's name, purpose and duration of the PLLC, the registered address, registered agent, and related information.

Tennessee Professional Limited Liability Company PLLC Formation Package

Description

How to fill out Tennessee Professional Limited Liability Company PLLC Formation Package?

Access to quality Tennessee Professional Limited Liability Company PLLC Formation Package templates online with US Legal Forms. Avoid hours of wasted time seeking the internet and lost money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get around 85,000 state-specific authorized and tax samples you can download and complete in clicks in the Forms library.

To find the sample, log in to your account and click on Download button. The document is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Check if the Tennessee Professional Limited Liability Company PLLC Formation Package you’re looking at is suitable for your state.

- View the form using the Preview function and browse its description.

- Visit the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay by card or PayPal to finish making an account.

- Pick a preferred file format to save the file (.pdf or .docx).

Now you can open up the Tennessee Professional Limited Liability Company PLLC Formation Package template and fill it out online or print it and do it yourself. Think about sending the file to your legal counsel to ensure things are filled in correctly. If you make a error, print out and complete sample once again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and get access to a lot more samples.

Form popularity

FAQ

Any person starting a business, or currently running a business as a sole proprietor, should consider forming an LLC. This is especially true if you're concerned with limiting your personal legal liability as much as possible. LLCs can be used to own and run almost any type of business.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

Professional LLCs The main difference between a LLC and a PLLC is that only professionals recognized in a state through licensing, such as architects, medical practitioners and lawyers, can form PLLCs. The articles of organization are similar to those for a standard LLC, but extra steps are necessary to file.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

Professional LLCs PLLCs offer the same benefits as LLCs. The main difference between a LLC and a PLLC is that only professionals recognized in a state through licensing, such as architects, medical practitioners and lawyers, can form PLLCs.

How much does it cost to form an LLC in Tennessee? The Tennessee Secretary of State charges $50 per LLC member included in the filing, with a minimum total fee of $300. The filing fee cannot exceed $3,000 for the Articles of Organization.

The PLLC files a standard Form 1120, Corporate Income Tax Return, and pays taxes at the regular corporate tax rate. It retains earnings as a corporation, however, and doesn't distribute them to members for personal taxation.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.