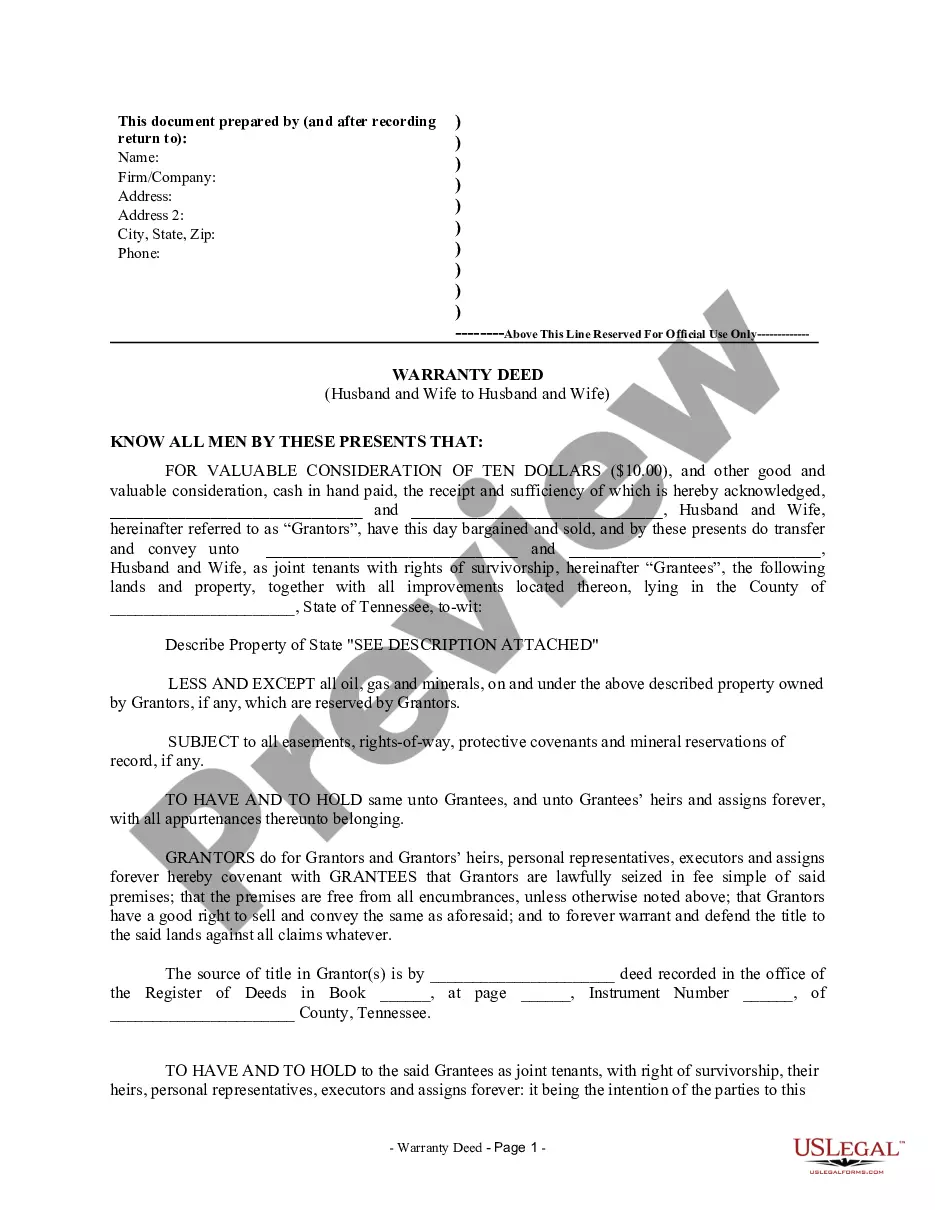

This form is a Warranty Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and warrant the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

Tennessee Warranty Deed from Husband and Wife to Husband and Wife

Description

How to fill out Tennessee Warranty Deed From Husband And Wife To Husband And Wife?

Get access to quality Tennessee Warranty Deed from Husband and Wife to Husband and Wife forms online with US Legal Forms. Prevent days of misused time looking the internet and lost money on documents that aren’t updated. US Legal Forms provides you with a solution to just that. Find over 85,000 state-specific legal and tax forms that you can save and submit in clicks in the Forms library.

To find the sample, log in to your account and click Download. The file will be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- See if the Tennessee Warranty Deed from Husband and Wife to Husband and Wife you’re looking at is suitable for your state.

- Look at the form using the Preview function and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Choose the subscription plan to keep on to sign up.

- Pay by card or PayPal to finish creating an account.

- Select a favored file format to save the document (.pdf or .docx).

You can now open the Tennessee Warranty Deed from Husband and Wife to Husband and Wife example and fill it out online or print it out and get it done yourself. Consider giving the document to your legal counsel to make certain things are filled out properly. If you make a mistake, print out and complete sample once again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and get access to far more forms.

Form popularity

FAQ

To add a co-owner, the bank would have to create a new home loan agreement, which must be registered after paying the due stamp duty and registration charges. The bank would also insist on making the co-owner a co-borrower in the home loan applicable.

A deed that conveys an interest in your real estate ownership (adds someone on) has the legal effect of giving that additional person the same bundle of rights to which you are entitled. Once the conveyance happens, it cannot be undone except with that other additional owner's consent.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances.If a mortgage exists, it's best to work with the lender to make sure everyone on the title is protected.

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.