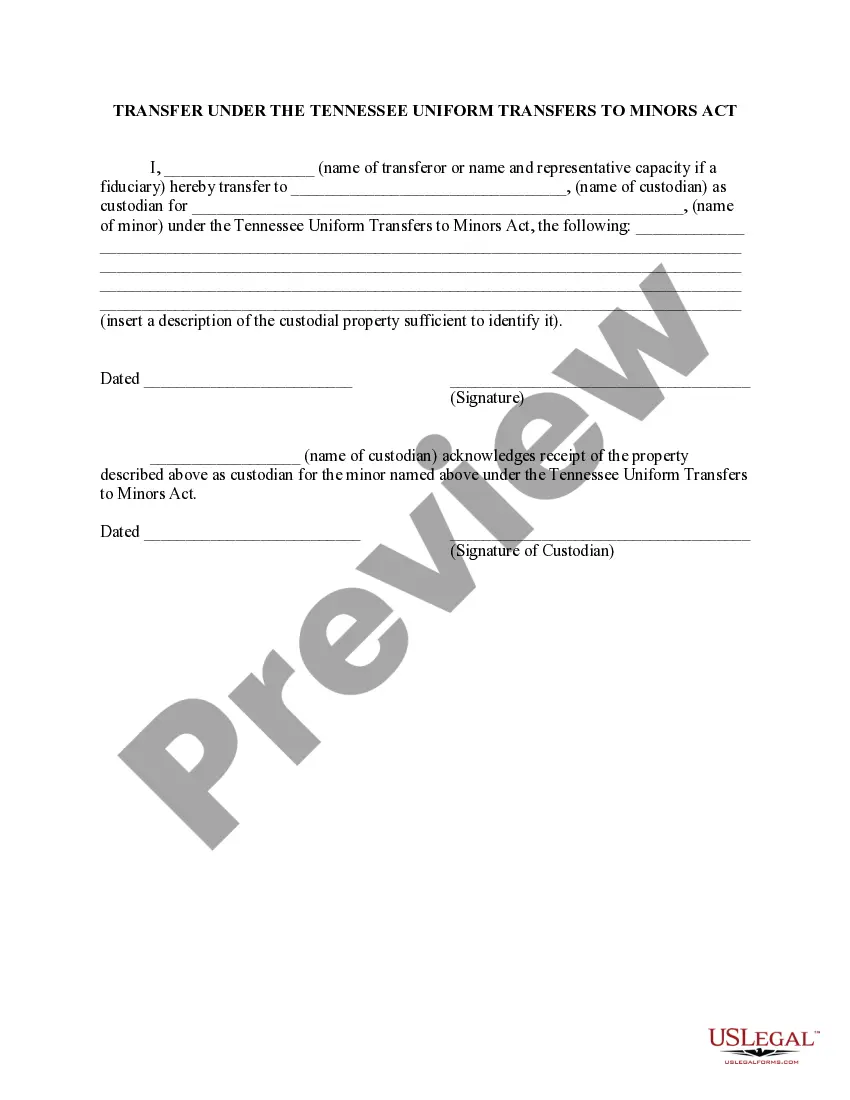

This is a sample form for use in Tennessee, a Transfer Under the Tennessee Uniform Transfers to Minors Act. Adapt to fit your circumstances. Available in standard formats.

Transfer Under the Tennessee Uniform Transfers to Minors Act

Description

How to fill out Transfer Under The Tennessee Uniform Transfers To Minors Act?

Access to quality Transfer Under the Tennessee Uniform Transfers to Minors Act samples online with US Legal Forms. Avoid days of misused time browsing the internet and lost money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get around 85,000 state-specific legal and tax templates you can download and fill out in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The document is going to be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- Check if the Transfer Under the Tennessee Uniform Transfers to Minors Act you’re considering is suitable for your state.

- View the form making use of the Preview function and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to sign up.

- Pay by card or PayPal to complete making an account.

- Choose a preferred format to save the document (.pdf or .docx).

Now you can open up the Transfer Under the Tennessee Uniform Transfers to Minors Act example and fill it out online or print it out and do it yourself. Think about giving the file to your legal counsel to make certain everything is filled out properly. If you make a error, print and fill sample once again (once you’ve registered an account every document you save is reusable). Make your US Legal Forms account now and access a lot more forms.

Form popularity

FAQ

The Uniform Transfers To Minors Act (UTMA) is a uniform act drafted and recommended by the National Conference of Commissioners on Uniform State Laws in 1986, and subsequently enacted by most U.S. States, which provides a mechanism under which gifts can be made to a minor without requiring the presence of an appointed

When children reach the age of majority, the account can be transferred into their name only with custodian consent. Otherwise, they can remove the custodian from the account at the age of termination.

Virtually all states have adopted some form of UTMA that allows you to make gifts to a minor to be held in the name of a custodian during the age of minority. On reaching the age of majority, usually 21 years, the minor is entitled to all assets held in the account.

UGMA and UTMA accounts allow parents to save money and invest, maintain full control until their child is an adult. UTMA stands for Uniform Transfers to Minors Act, and UGMA stands for Universal Gifts to Minors Act. Both accounts allow you to transfer financial assets to a minor without establishing a trust.

The main advantage of using an UTMA account is that the money contributed into the account is exempted from paying a gift tax, up to a maximum of $15,000 per year. Moreover, any income earned on the contributed funds is taxed at the tax rate of the minor who is being gifted the funds.

The Uniform Gifts to Minors Act (UGMA) provides a way to transfer financial assets to a minor without the time-consuming and expensive establishment of a formal trust. A UGMA account is managed by an adult custodian until the minor beneficiary comes of age, at which point he assumes control of the account.

An account created under the Uniform Transfers to Minors Act (UTMA) is one of the most commonly used forms of making gifts to children, grandchildren or other young family members.On reaching the age of majority, usually 21 years, the minor is entitled to all assets held in the account.

The biggest difference between UGMA and UTMA accounts is that UTMAs allow for more types of assets. While UGMA accounts are typically limited to things you find in most IRAs like stocks, bonds, and mutual funds, UTMAs can also hold things like real estate, art, patents, and even cars.

The Uniform Transfers to Minors Act (UTMA) allows a minor to receive gifts without the aid of a guardian or trustee.The donor can name a custodian who has the fiduciary duty to manage and invest the property on behalf of the minor until the minor becomes of legal age.