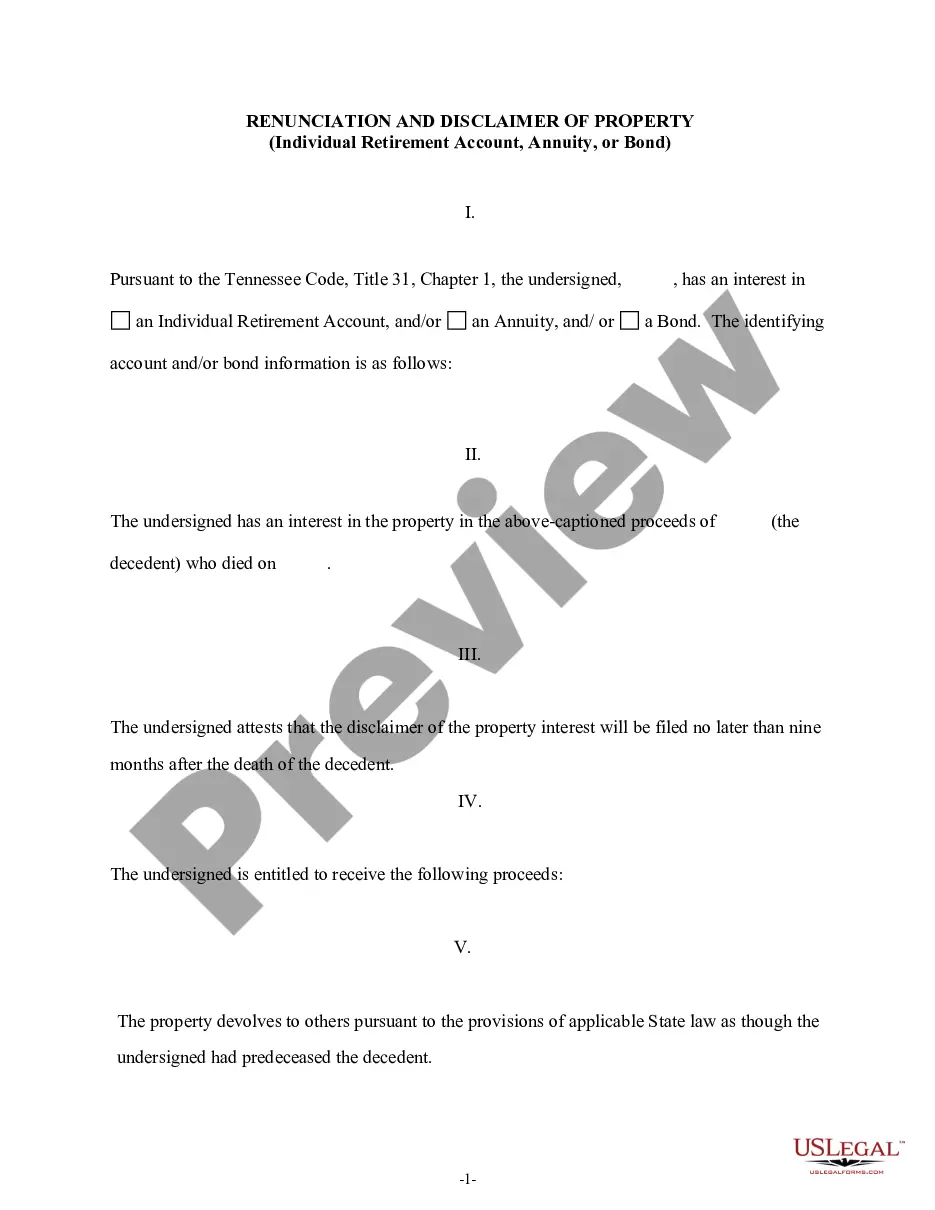

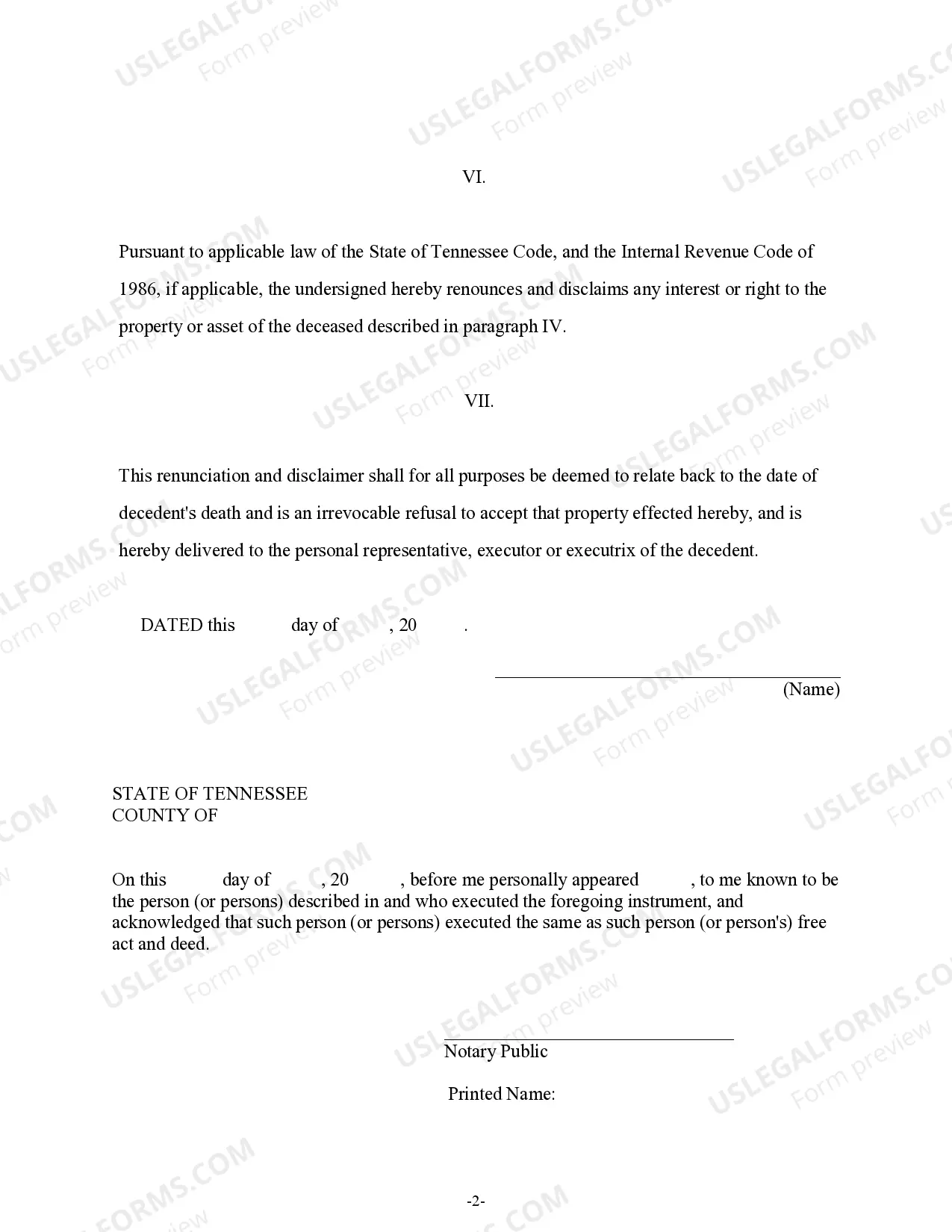

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond where the beneficiary gained an interest in the proceeds upon the death of the decedent, but, pursuant to the Tennessee Code, Title 31, Chapter 1, will renounce his/her interest in the proceeds. Therefore, the property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgement and a certificate to verify the delivery of the document.

Tennessee Renunciation And Disclaimer of Property - Individual Retirement Account, Annuity, Or Bond

Description

How to fill out Tennessee Renunciation And Disclaimer Of Property - Individual Retirement Account, Annuity, Or Bond?

Access to high quality Tennessee Renunciation And Disclaimer of Property - Individual Retirement Account, Annuity, Or Bond forms online with US Legal Forms. Prevent hours of wasted time browsing the internet and lost money on documents that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Get above 85,000 state-specific authorized and tax templates that you can save and complete in clicks in the Forms library.

To receive the example, log in to your account and click on Download button. The file is going to be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Find out if the Tennessee Renunciation And Disclaimer of Property - Individual Retirement Account, Annuity, Or Bond you’re looking at is appropriate for your state.

- Look at the sample making use of the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay by credit card or PayPal to finish making an account.

- Pick a favored format to download the file (.pdf or .docx).

You can now open up the Tennessee Renunciation And Disclaimer of Property - Individual Retirement Account, Annuity, Or Bond sample and fill it out online or print it out and get it done yourself. Take into account giving the document to your legal counsel to make sure things are filled in correctly. If you make a error, print out and fill application again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and get much more samples.

Form popularity

FAQ

Some states real estate laws make it mandatory for sellers and agents to disclose information on homes where a murder, suicide, crime, death or paranormal occurrences have taken place. In Tennessee it is not mandatory to disclose these things unless it affects the physical condition of the property.

It usually takes four to six weeks to complete the legal processes involved in the transfer of title.

Rights in property can be transferred only on execution and registration of a sale deed in favour of the buyer. A conveyance deed is executed to transfer title from one person to another. Generally, an owner can transfer his property unless there is a legal restriction barring such transfer.

Land can only be transferred from one individual to another in the legally prescribed manner. Historically speaking, a written deed is the instrument used to convey ownership of real property. A deed is labeled an instrument of conveyance.

Tennessee deed forms convey interest in property from one party (the Grantor) to another (the Grantee). The documents can be prepared by anyone as long as the required information is written in the deed as outlined in § 66-5-103.

In order to convey any real property or an interest in property in Tennessee, the deed must be in writing, acknowledged by the grantor, and registered in the county where the property is located. The Annotated Code of Tennessee allows for the transfer of real property through the usage of a variety of deeds.

No Tennessee State Income TaxTennessee is one of the seven states that does not impose an income tax. Taxpayers are not required to file a state return or pay tax on their wages and monetary bonuses. The only income subject to tax is investment dividends and interest.

What does Tennessee law say about disclosure? The Residential Property Disclosure Act in Tennessee Code Annotated § 66-5-201 to 210 requires most sellers of residential real estate to complete a disclosure statement. The disclosure statement lets the buyers know about the condition of the property.

You can always call the office first at 615-862-6790, and we will tell you the information that you need to include in your request. The cost is 50 cents per page (certified copies are $ 1.00 per page), and there is a $2.00 minimum charge for mailed copies. The charge to mail a copy of a subdivision plat is $5.00.