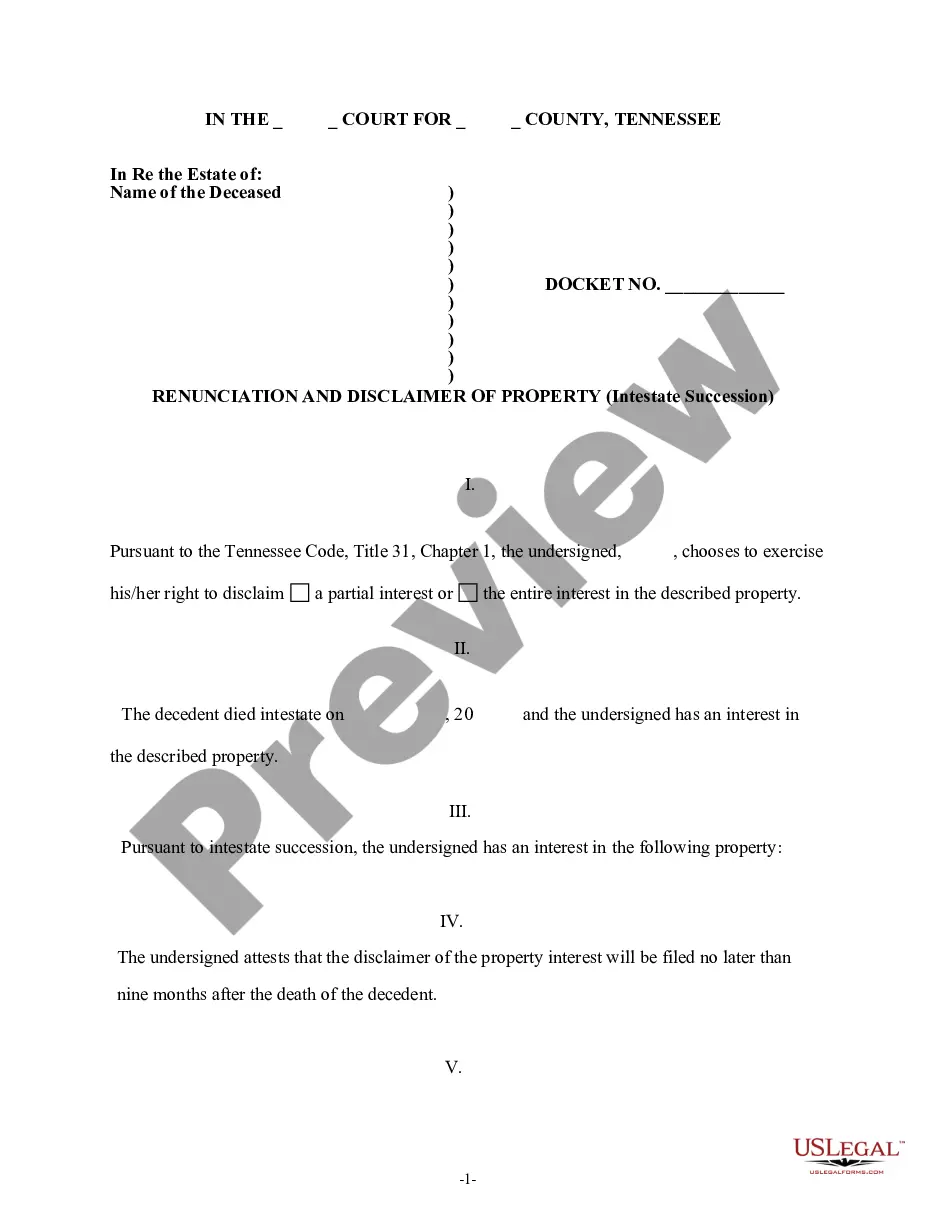

This is a Renunciation And Disclaimer of Property Received by Intestate Succession. An heir has the right to renounce any right he/he may have, in the deceased's estate. When an heir wishes to exercise that right, he/she must use this form in the State of Tennessee.

Tennessee Renunciation And Disclaimer of Property received by Intestate Succession

Description Tennessee Intestate Succession

How to fill out Tn Renunciation Intestate?

Get access to quality Tennessee Renunciation And Disclaimer of Property received by Intestate Succession samples online with US Legal Forms. Steer clear of days of misused time browsing the internet and dropped money on forms that aren’t updated. US Legal Forms offers you a solution to exactly that. Get around 85,000 state-specific legal and tax forms you can download and submit in clicks within the Forms library.

To find the sample, log in to your account and then click Download. The file will be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Check if the Tennessee Renunciation And Disclaimer of Property received by Intestate Succession you’re looking at is appropriate for your state.

- View the sample utilizing the Preview function and browse its description.

- Go to the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to finish making an account.

- Select a preferred file format to save the file (.pdf or .docx).

Now you can open the Tennessee Renunciation And Disclaimer of Property received by Intestate Succession template and fill it out online or print it out and do it by hand. Think about giving the file to your legal counsel to be certain everything is filled out properly. If you make a error, print out and fill sample again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and access far more samples.

Tn Property Intestate Form popularity

Tn Received Succession Other Form Names

Tn Intestate Succession FAQ

Who Inherits When There's No Will? Intestate succession laws determine how to distribute assets among them when no will is in place. This varies between states. Generally, a spouse receives most of the assets and property, followed by children, parents, grandparents, and other blood relatives of the deceased.

Bank accounts, cars or real estate jointly owned are considered non-probate assets, including joint tenants and tenants by the entirety with rights of survivorship. Assets with transferable on death or payable on death designations.

If a person dies intestate without any children, the spouse recovers the entire estate. If the person left a spouse and children, the surviving spouse will receive either one-third of the entire estate or a child's share of the estate, whichever is greater.

The term usually means your nearest blood relative. In the case of a married couple or a civil partnership it usually means their husband or wife. Next of kin is a title that can be given, by you, to anyone from your partner to blood relatives and even friends.

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Tennessee inheritance laws protect the inheritance rights of any children who were conceived prior to their parent's death, but were born following it. However, that child must have lived for at least 120 hours and been born in the 10-month window that comes after the parent's death.