Residential Real Estate Sales Disclosure Statement

Tennessee Code: Title 66, Ch 5, Part 2: Residential Property Disclosures

66-5-201. General provisions.

The provisions of this part apply only with respect to transfers by

sale, exchange, installment land sales contract or lease with option to

buy residential real property consisting of not less than one (1) nor more

than four (4) dwelling units, including site-built and nonsite-built homes,

whether or not the transaction is consummated with the assistance of a

licensed real estate broker or salesperson. The disclosure statement referenced

in § 66-5-202 is not a warranty of any kind by a seller and is not

a substitute for inspections either by the individual purchasers or by

a professional home inspector. The disclosure required by this part

shall be provided to potential buyers for their exclusive use and may not

be relied upon by purchasers in subsequent transfers from the original

purchaser who received the property disclosure. The required disclosure

shall be given in good faith by the owner or owners of property that is

being transferred and shall be subject to the requirements of this part.

[Acts 1994, ch. 828, § 1; 2000, ch. 771, § 1.]

66-5-202. Required disclosures or disclaimers.

With regard to transfers described in § 66-5-201, the owner of

the residential property shall furnish to a purchaser one of the following:

(1) A residential property disclosure statement in the form provided

in this part regarding the condition of the property, including any material

defects known to the owner. Such disclosure form may be as included in

this part and must include all items listed on the disclosure form required

pursuant to this part. The disclosure form shall contain a notice to prospective

purchasers and owners that the prospective purchaser and the owner may

wish to obtain professional advice or inspections of the property. The

disclosure form shall also contain a notice to purchasers that the information

contained in the disclosure are the representations of the owner and are

not the representations of the real estate licensee or sales person, if

any. The owner shall not be required to undertake or provide any

independent investigation or inspection of the property in order to make

the disclosures required by this part; or

(2) A residential property disclaimer statement stating that the owner

makes no representations or warranties as to the condition of the real

property or any improvements thereon and that purchaser will be receiving

the real property "as is," that is, with all defects which may exist, if

any, except as otherwise provided in the real estate purchase contract.

A disclaimer statement may only be permitted where the purchaser waives

the required disclosure under subdivision (1). If the purchaser does

not waive the required disclosure under this part, the disclosure statement

described in subdivision (1) shall be provided in accordance with the requirements

of this part.

[Acts 1994, ch. 828, § 2.]

66-5-203. Delivery of disclosure or disclaimer statement.

(a) The owner of residential real property subject to this part

shall deliver to the purchaser the written disclosure or disclaimer statement,

if agreed upon by the purchaser required by this part prior to the acceptance

of a real estate purchase contract. For purposes of this part, a "real

estate purchase contract" means a contract for the sale, exchange or lease

with option to buy of real estate subject to this part, and "acceptance"

means the full execution of a real estate purchase contract by all parties.

The residential property disclaimer statement or residential property disclosure

statement may be included in the real estate purchase contract, in an addendum

thereto, or in a separate document.

(b) Failure to provide the disclosure or disclaimer statement

required by this part shall not permit a purchaser to terminate a real

estate purchase contract; however, a purchaser shall not be restricted

by this part from bringing such other actions at law or in equity that

are otherwise permitted.

[Acts 1994, ch. 828, § 3.]

66-5-204. Liability for errors or omissions - Experts' reports.

(a) The owner shall not be liable for any error, inaccuracy or

omission of any information delivered pursuant to this part if:

(1) The error, inaccuracy or omission was not within the actual knowledge

of the owner or was based upon information provided by public agencies

or by other persons providing information as specified in subsection (b)

that is required to be disclosed pursuant to this part, or the owner reasonably

believed the information to be correct; and

(2) The owner was not grossly negligent in obtaining the information

from a third party and transmitting it.

(b) The delivery by a public agency or other person, as described

in subsection (c), of any information required to be disclosed by this

part to a prospective purchaser shall be deemed to comply with the requirements

of this part, and shall relieve the owner of any further duty under this

part with respect to that item of information.

(c) The delivery by the owner of a report or opinion prepared

by a licensed engineer, land surveyor, geologist, wood destroying insect

control expert, contract or other home inspection expert, dealing with

matters within the scope of the professional license or expertise, shall

satisfy the requirements of subsection (a) if the information is provided

to the owner pursuant to request therefor, whether written or oral. In

responding to such a request, an expert may indicate, in writing, an understanding

that the information provided will be used in fulfilling the requirements

of this part and, if so, shall indicate the required disclosure or portions

thereof, to which the information being furnished is applicable.

Where such a statement is furnished, the expert shall not be responsible

for any items of information, or portions thereof, other than those expressly

set forth in this statement.

[Acts 1994, ch. 828, § 4.]

66-5-205. Liability for changed circumstances.If information disclosed in accordance with this part is subsequently

rendered or discovered to be inaccurate as a result of any act, occurrence,

information received, circumstance or agreement subsequent to the delivery

of the required disclosures, the inaccuracy resulting therefrom does not

constitute a violation of this part. However, at or before closing, the

owner shall be required to disclose any material change in the physical

condition of the property or certify to the purchaser at closing that the

condition of the property is substantially the same as it was when the

disclosure form was provided. If, at the time the disclosures are required

to be made, an item of information required to be disclosed is unknown

or not available to the owner, the owner may state that the information

is unknown or may use an approximation of the information; provided, that

the approximation is clearly identified as such, is reasonable, is based

on the actual knowledge of the owner and is not used for the purpose of

circumventing or evading this part.

[Acts 1994, ch. 828, § 5.]

66-5-206. Duties of real estate licensees.

A real estate licensee representing an owner of residential real property

as the listing broker has a duty to inform each such owner represented

by that licensee of the owner's rights and obligations under this part.

A real estate licensee representing a purchaser of residential real property

or, if the purchaser is not represented by a licensee, the real estate

licensee representing an owner of residential real estate and dealing with

the purchaser has a duty to inform each such purchaser of the purchaser's

rights and obligations under this part. If a real estate licensee performs

those duties, the licensee shall have no further duties to the parties

to a residential real estate transaction under this part, and shall not

be liable to any party to a residential real estate transaction for a violation

of this part or for any failure to disclose any information regarding any

real property subject to this part. However, a cause of action for damages

or equitable remedies may be brought against a real estate licensee for

intentionally misrepresenting or defrauding a purchaser. A real estate

licensee will further be subject to a cause of action for damages or equitable

relief for failing to disclose adverse facts of which the licensee has

actual knowledge or notice. "Adverse facts" means conditions or occurrences

generally recognized by competent licensees that significantly reduce the

structural integrity of improvements to real property, or present a significant

health risk to occupants of the property.

[Acts 1994, ch. 828, § 6.]

66-5-207. Liability for nondisclosure of communicable diseases

or criminal acts on property.

Notwithstanding any of the provisions of this part, or any other statute

or regulation, no cause of action shall arise against an owner or a real

estate licensee for failure to disclose that an occupant of the subject

real property, whether or not such real property is subject to this part,

was afflicted with human immunodeficiency virus (HIV) or other disease

which has been determined by medical evidence to be highly unlikely to

be transmitted through the occupancy of a dwelling place, or that the real

property was the site of:

(1) An act or occurrence which had no effect on the physical structure

of the real property, its physical environment or the improvements located

thereon; or

(2) A homicide, felony or suicide.

[Acts 1994, ch. 828, § 7.]

66-5-208. Remedies for misrepresentation or nondisclosure.

(a) The purchaser's remedies hereunder for an owner's misrepresentation

on a residential property disclosure statement shall be either:

(1) An action for actual damages suffered as a result of defects existing

in the property as of the date of execution of the real estate purchase

contract; provided, that the owner has actually presented to a purchaser

the disclosure statement required by this part, and of which the purchaser

was not aware at the earlier of closing or occupancy by the purchaser,

in the event of a sale, or occupancy in the event of a lease with the option

to purchase. Any action brought under this subsection shall be commenced

within one (1) year from the date the purchaser received the disclosure

statement or the date of closing (or occupancy if a lease situation), whichever

occurs first;

(2) In the event of a misrepresentation in any residential property

disclosure statement required by this part, termination of the contract

prior to closing, subject to the provisions of § 66-5-204; or

(3) Such other remedies at law or equity otherwise available against

an owner in the event of an owner's intentional or willful misrepresentation

of the condition of the subject property.

(b) No cause of action may be instituted against an owner of residential

real property subject to this part for the owner's failure to provide the

disclosure or disclaimer statement required by this part. However,

such owner would be subject to any other cause of action available in law

or equity against an owner for misrepresentation or failure to disclose

material facts regarding the subject property that exists on July 1, 1994.

(c) No cause of action may be instituted against a closing agent

or closing attorney for the failure of an owner to provide the disclaimer

or disclosure required by this part or for any misrepresentations made

by a seller on the disclosure form supplied to the purchaser pursuant to

this part.

(d) The failure of an owner to provide a purchaser the disclosure

or disclaimer required by this part shall not have any effect on title

to property subject to this part and the presence or absence of such disclosure

or disclaimer is not a cloud on title and has no effect on title to such

property.

[Acts 1994, ch. 828, § 8.]

66-5-209. Exempt property transfers.

The following are specifically excluded from the provisions of this

part:

(1) Transfers pursuant to court order including, but not limited to,

transfers ordered by a court in the administration of an estate, transfers

pursuant to a writ of execution, transfers by foreclosure sale, transfers

by a trustee in bankruptcy, transfers by eminent domain and transfers resulting

from a decree of specific performance;

(2) Transfers to a beneficiary of a deed of trust by a trustor or successor

in interest who is in default; transfers by a trustee under a deed of trust

pursuant to a foreclosure sale, or transfers by a beneficiary under a deed

of trust who has acquired the real property at a sale conducted pursuant

to a foreclosure sale under a deed of trust or has acquired the real property

by a deed in lieu of foreclosure;

(3) Transfers by a fiduciary in the course of the administration of

a decedent's estate, guardianship, conservatorship or trust;

(4) Transfers from one (1) or more co-owners solely to one (1) or more

co-owners. This provision is intended to apply and only does apply

in situations where ownership is by a tenancy by the entirety, a joint

tenancy or a tenancy in common and the transfer will be made from one (1)

or more of the owners to another owner or co-owners holding property either

as a joint tenancy, tenancy in common or tenancy by the entirety;

(5) Transfers made solely to any combination of a spouse or a person

or persons in the lineal line of consanguinity of one (1) or more of the

transferors;

(6) Transfers between spouses resulting from a decree of divorce or

a property settlement stipulation;

(7) Transfers made by virtue of the record owner's failure to pay any

federal, state or local taxes;

(8) Transfers to or from any governmental entity of public or quasi-public

housing authority or agency;

(9) Transfers involving the first sale of a dwelling provided that the

builder offers a written warranty;

(10) Any property sold at public auction;

(11) Any transfer of property where the owner has not resided on the

property at any time within three (3) years prior to the date of transfer;

and

(12) Any transfer from a debtor in a chapter 7 or a chapter 13 bankruptcy

to a creditor or third party by a deed in lieu of foreclosure or by a quitclaim

deed.

[Acts 1994, ch. 828, § 9; 2000, ch. 771, §§ 2-4.]

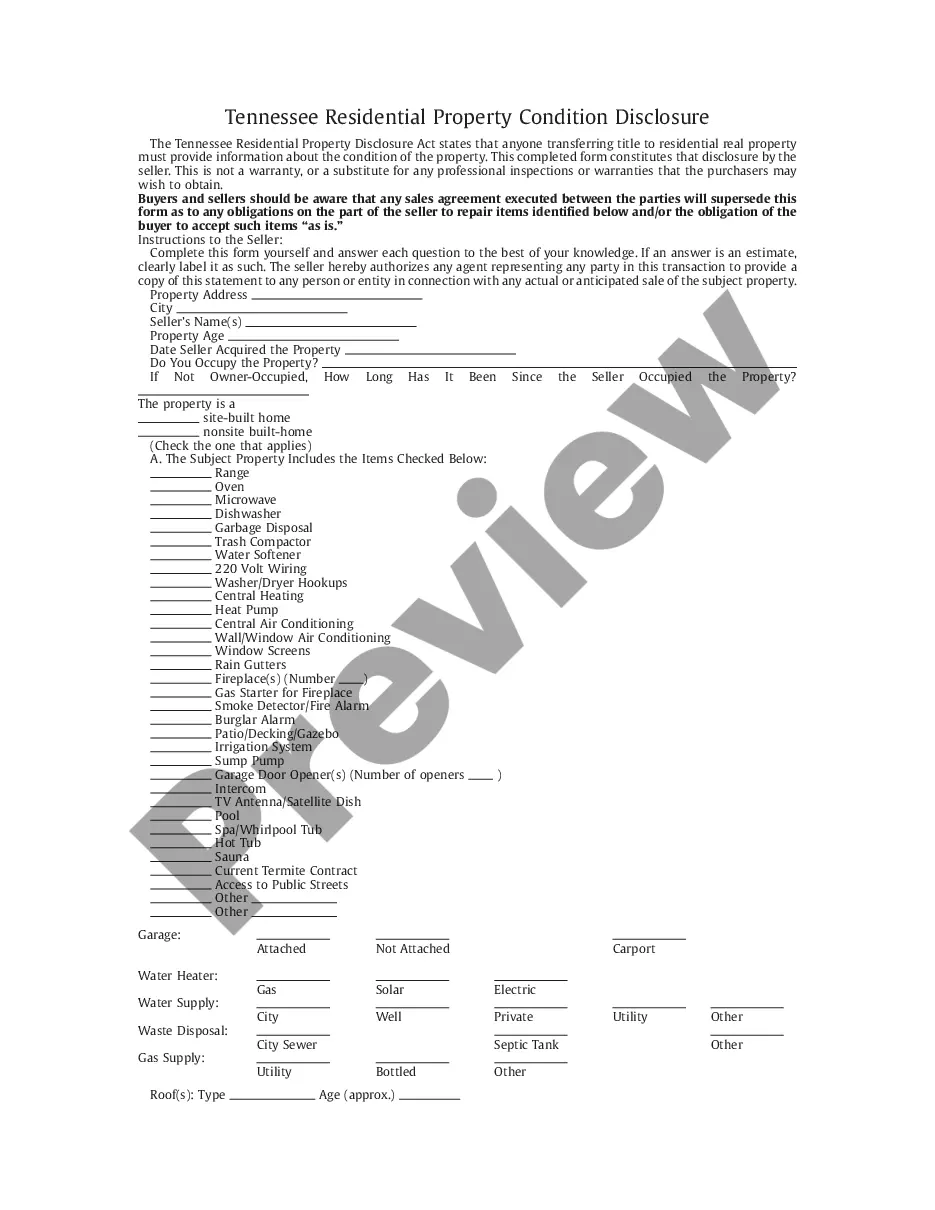

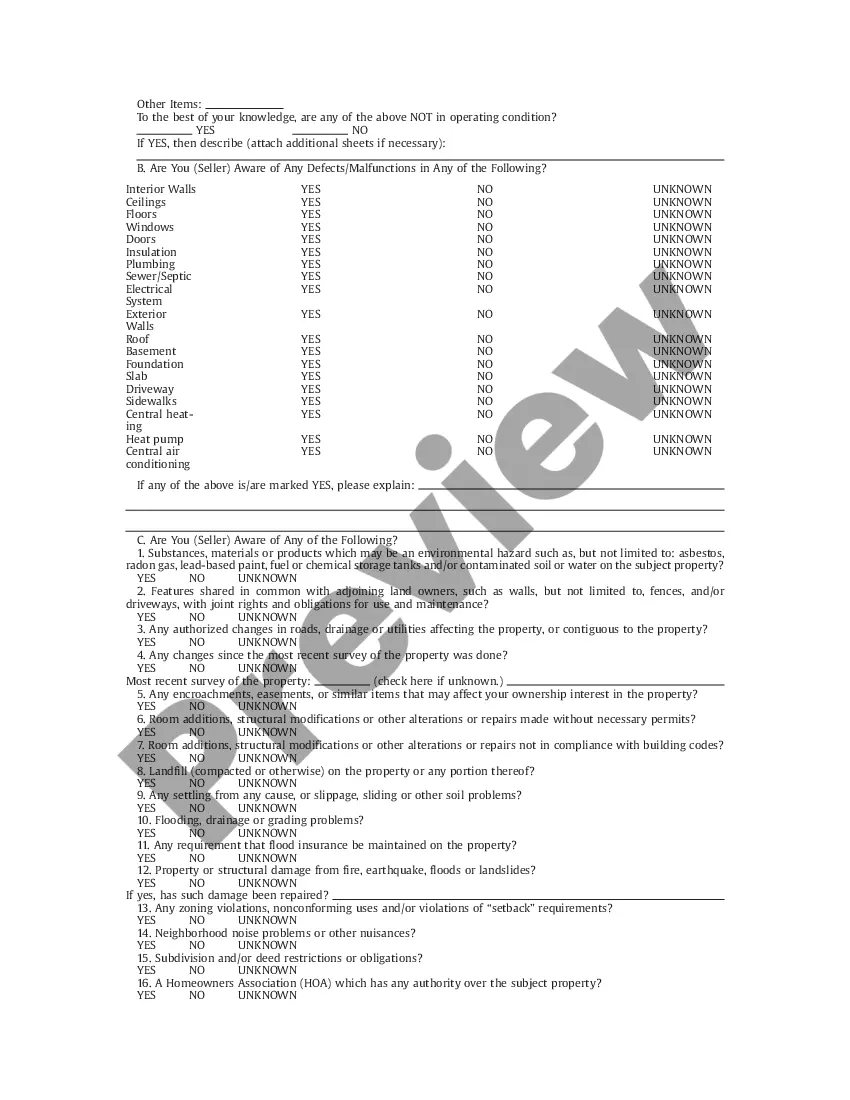

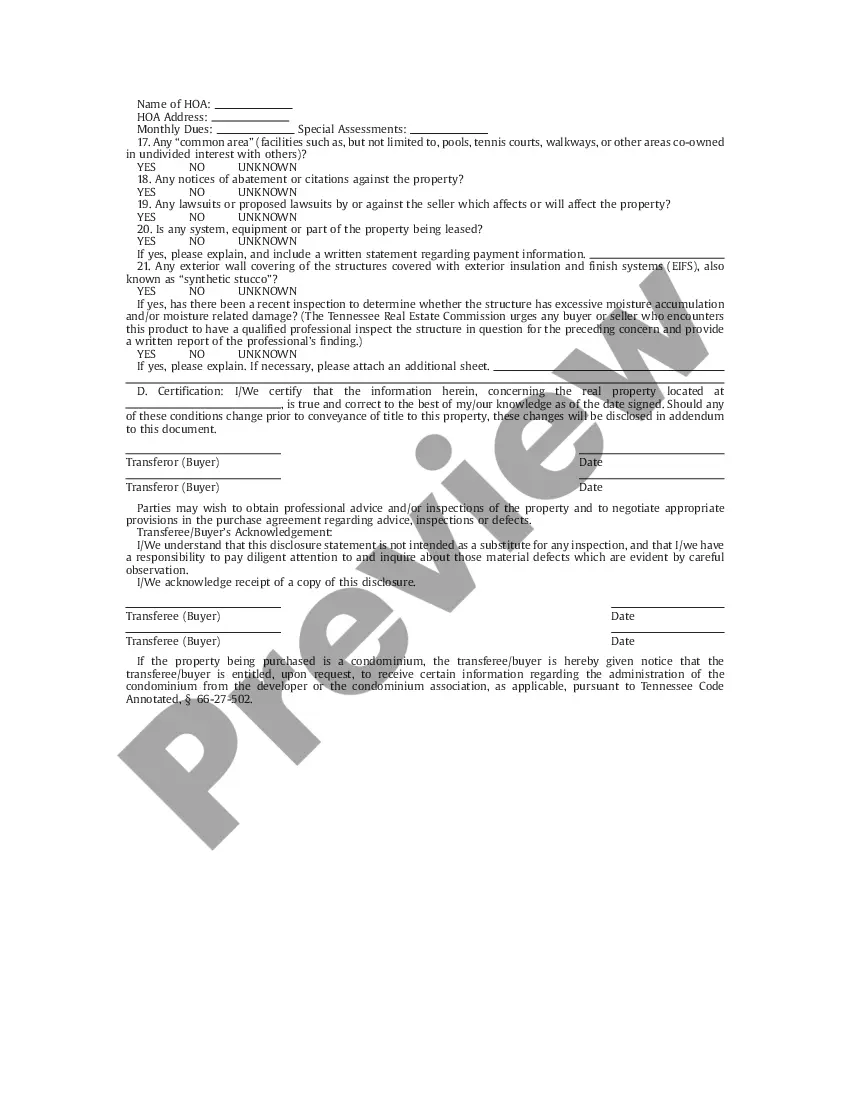

66-5-210. Disclosure form.

Following is the form prescribed by the general assembly which is necessary

to comply with the provisions of this part. The form used does not have

to be the one included in this section, but it is the intent of the general

assembly that any such form includes all items contained in the form below

with all acknowledgement provisions of such form:

[See USLF Form TN-37014]

[Acts 1994, ch. 828, § 10; 1998, ch. 727, § 1; 2000, ch.

771, § 5.]