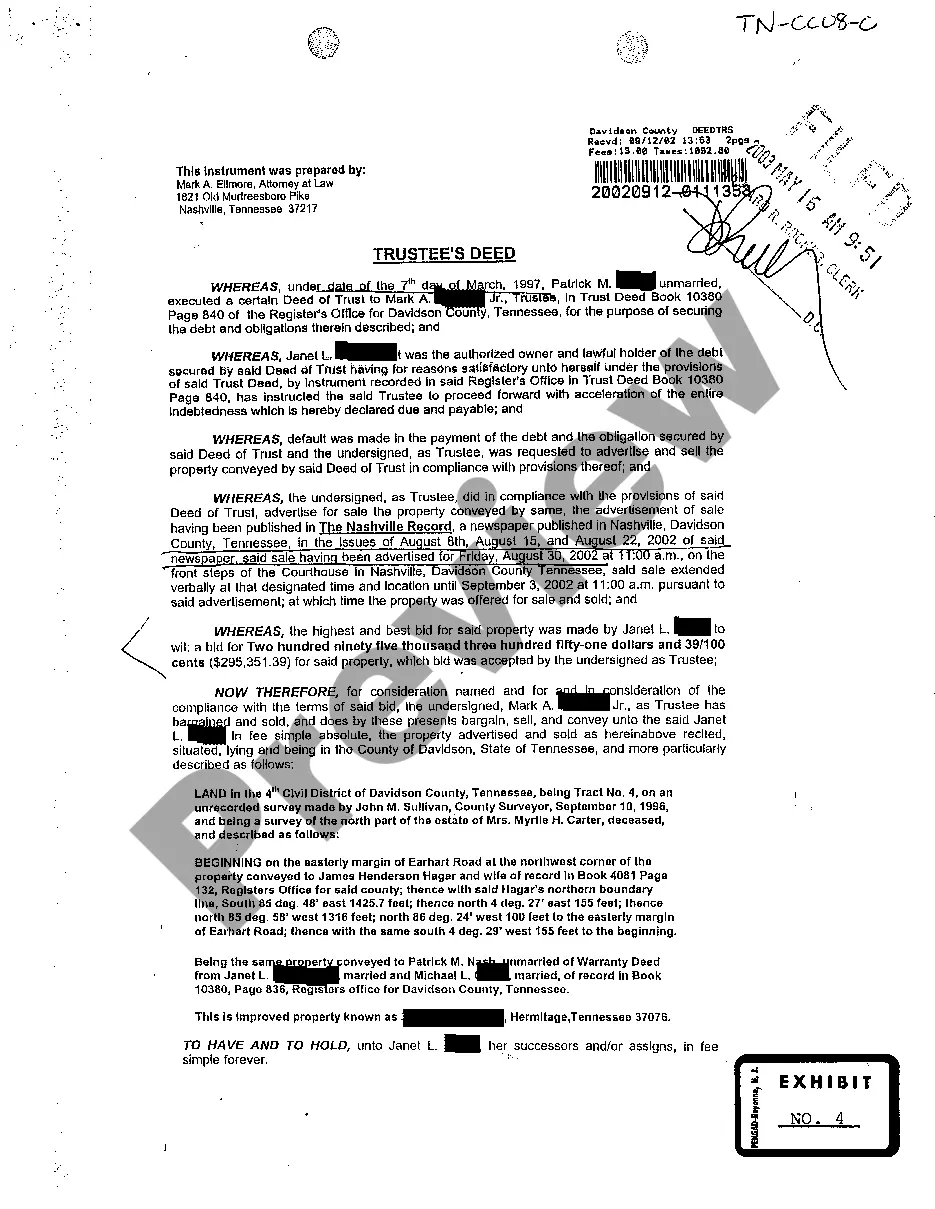

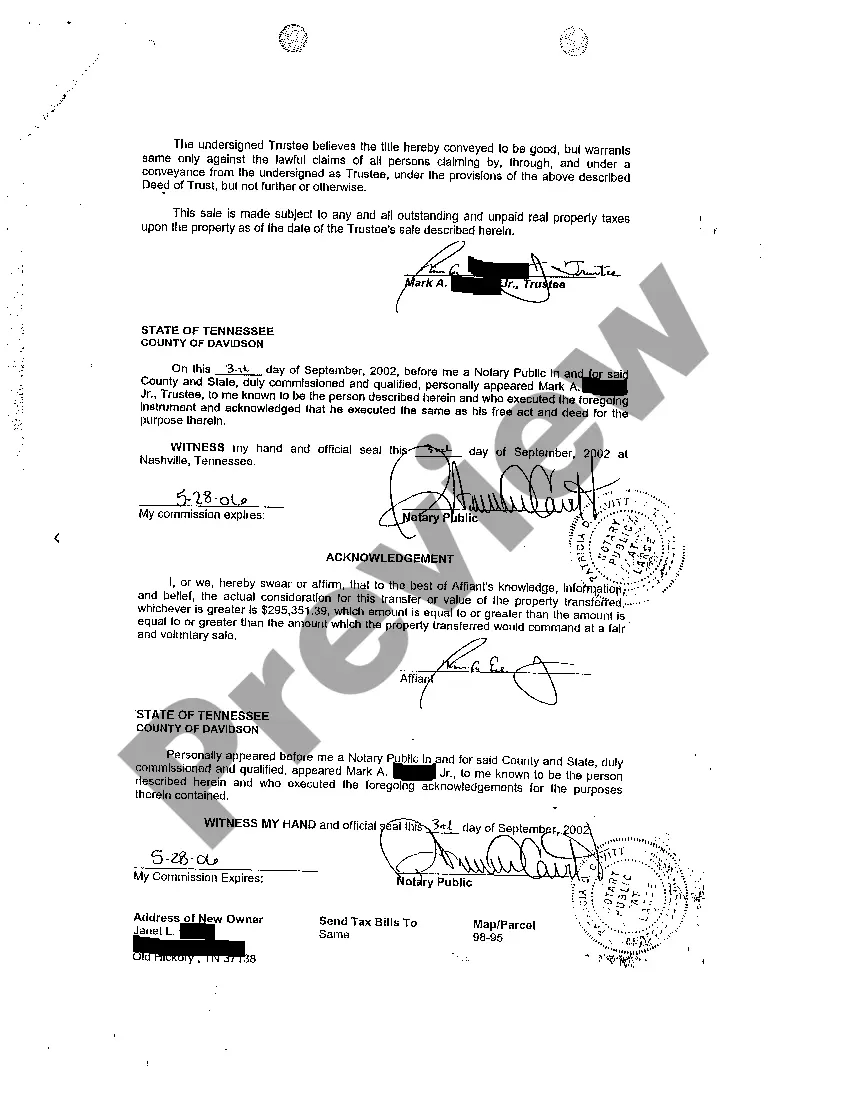

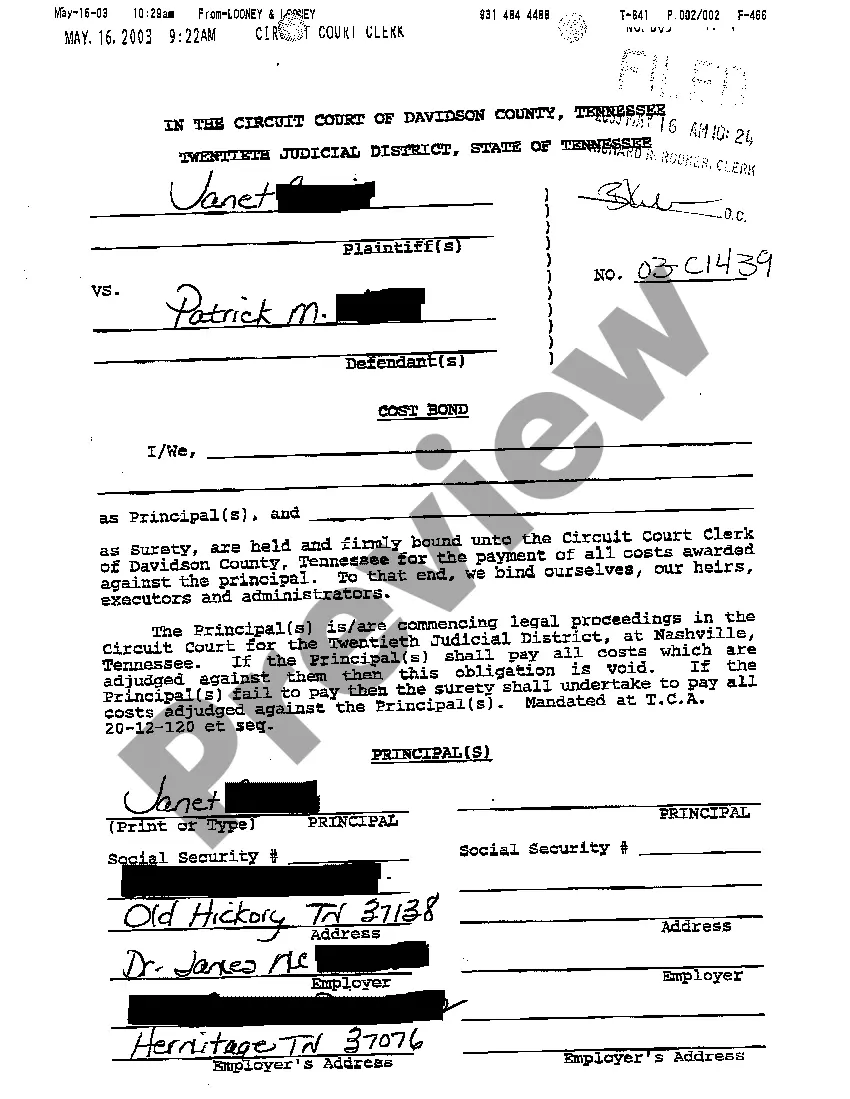

Tennessee Trustees Deed

Description

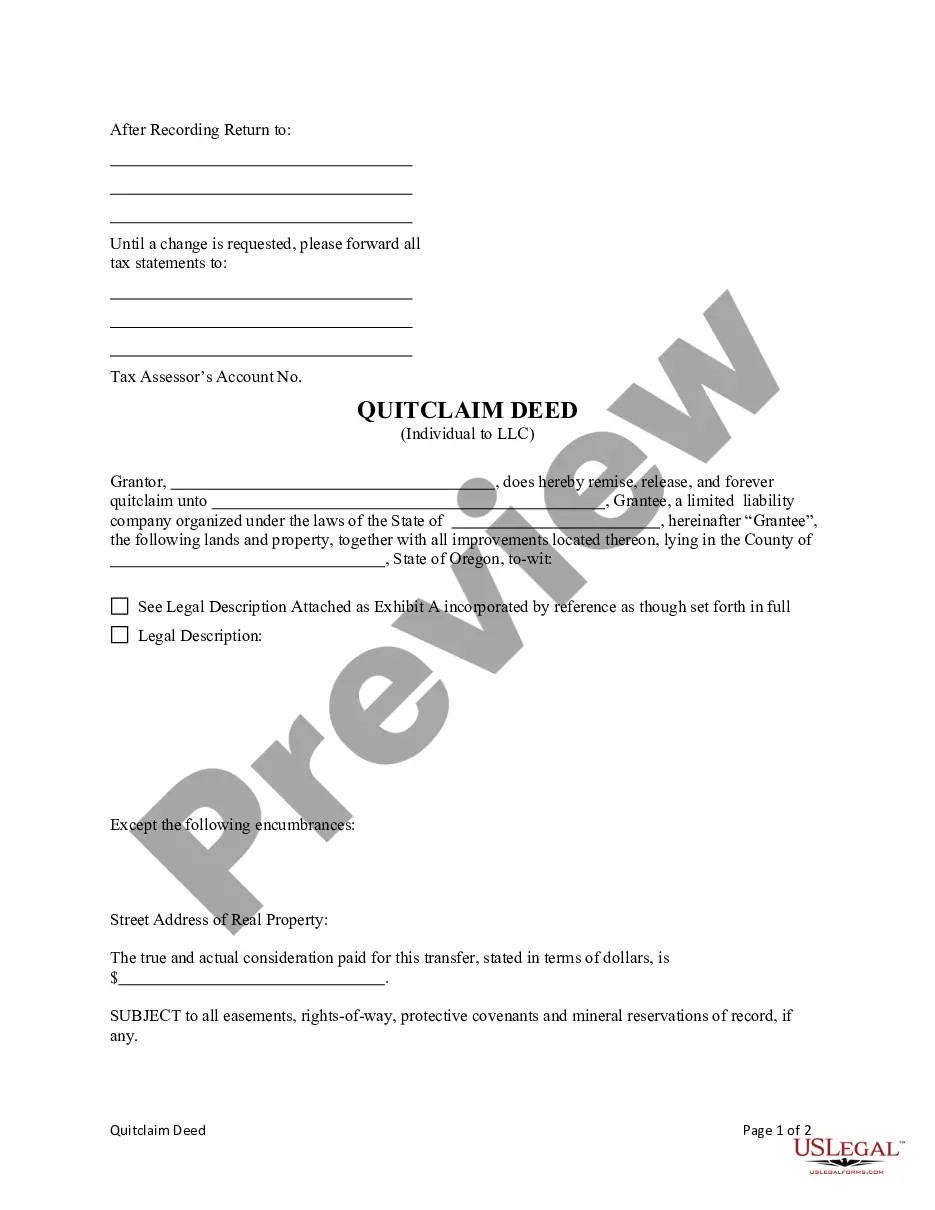

How to fill out Tennessee Trustees Deed?

Get access to top quality Tennessee Trustees Deed templates online with US Legal Forms. Prevent days of wasted time browsing the internet and dropped money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Find over 85,000 state-specific authorized and tax templates you can save and fill out in clicks in the Forms library.

To find the sample, log in to your account and click Download. The file will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

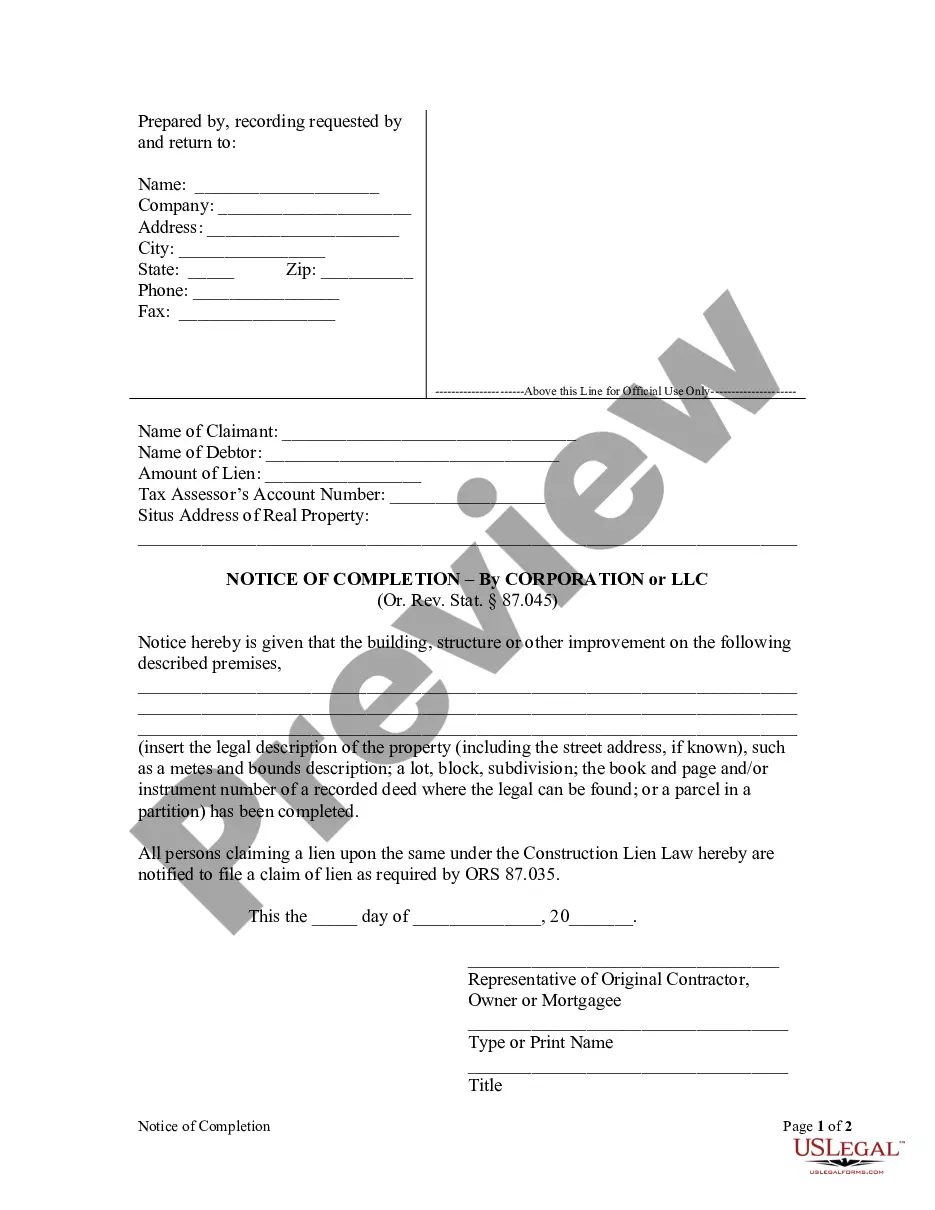

- Check if the Tennessee Trustees Deed you’re looking at is appropriate for your state.

- Look at the sample making use of the Preview option and browse its description.

- Visit the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay by credit card or PayPal to complete making an account.

- Select a preferred format to save the file (.pdf or .docx).

Now you can open up the Tennessee Trustees Deed example and fill it out online or print it out and do it yourself. Take into account mailing the file to your legal counsel to make sure things are filled in correctly. If you make a error, print out and complete sample once again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

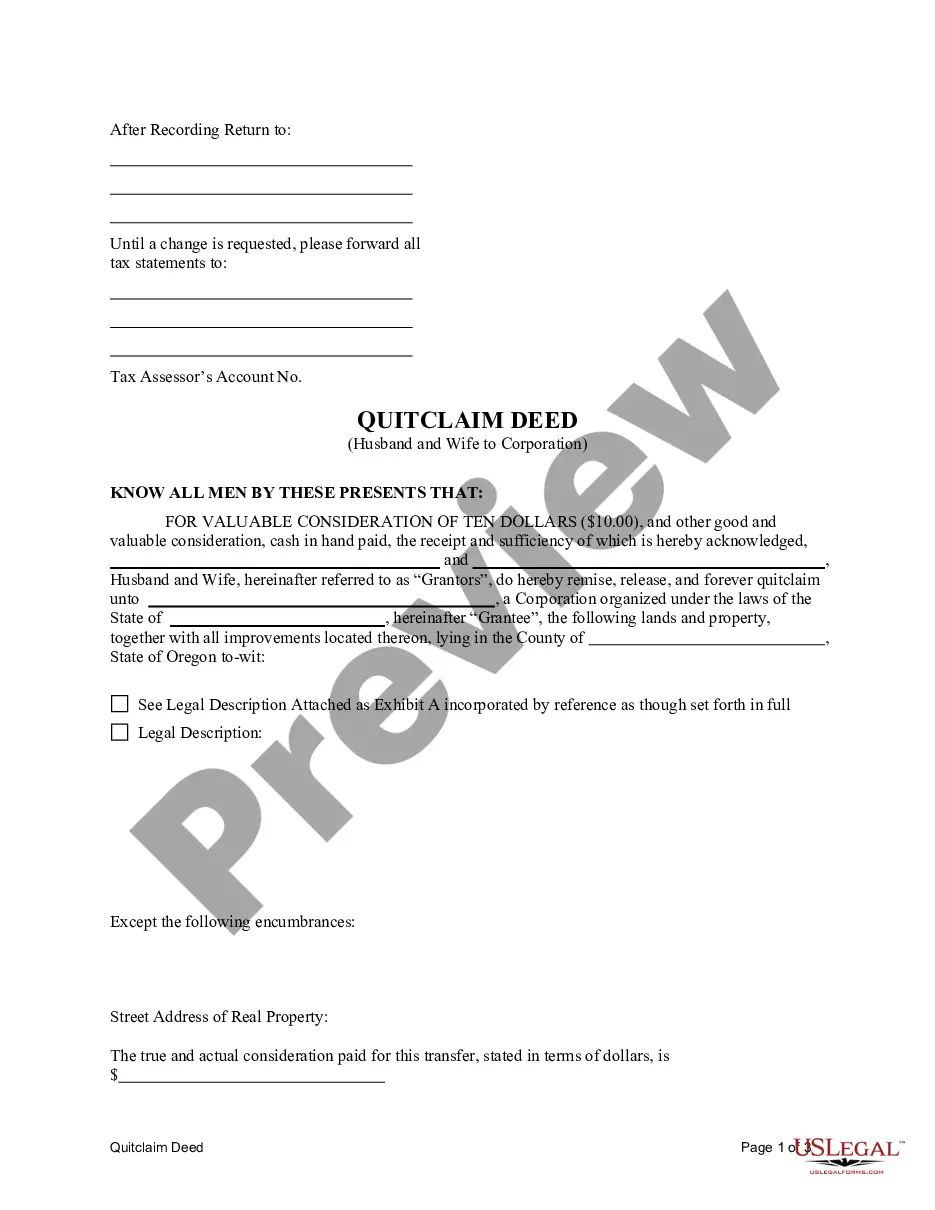

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

A trustee is any type of person or organization that holds the legal title of an asset or group of assets for another person, referred to as the beneficiary. A trustee is granted this type of legal title through a trust, which is an agreement between two consenting parties.

The trustee holds legal title to the property and the beneficiaries hold equitable title. Since the trustee holds legal title to the property, the property is always held in the trustee's name.Instead, it is simply a name denoting the legal relationship between a grantor and a trustee.

Some states have laws governing who may or may not serve as a trustee in a deed of trust. Generally, the trustee must be an attorney, title insurance company, trust company, bank, savings and loan, credit union, or other company specifically authorized by law to serve as a trustee.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Tennessee is a deed of trust state. However, a mortgage is enforceable. The trustee must be a resident of Tennessee or a corporation domiciled in Tennessee. There is a reciprocal agreement in which a trustee can serve in Tennessee if the trustee's home state allows a Tennessee trustee to serve.