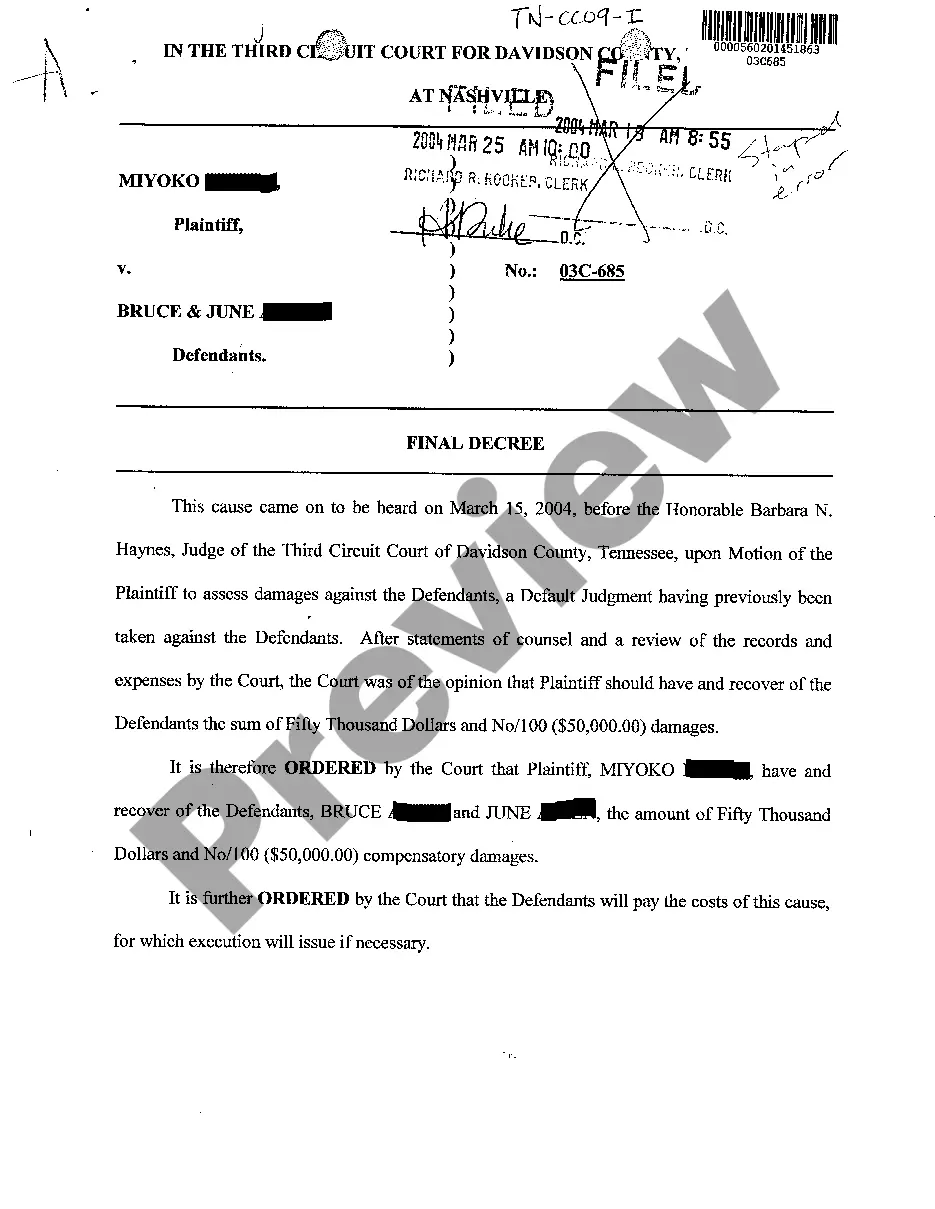

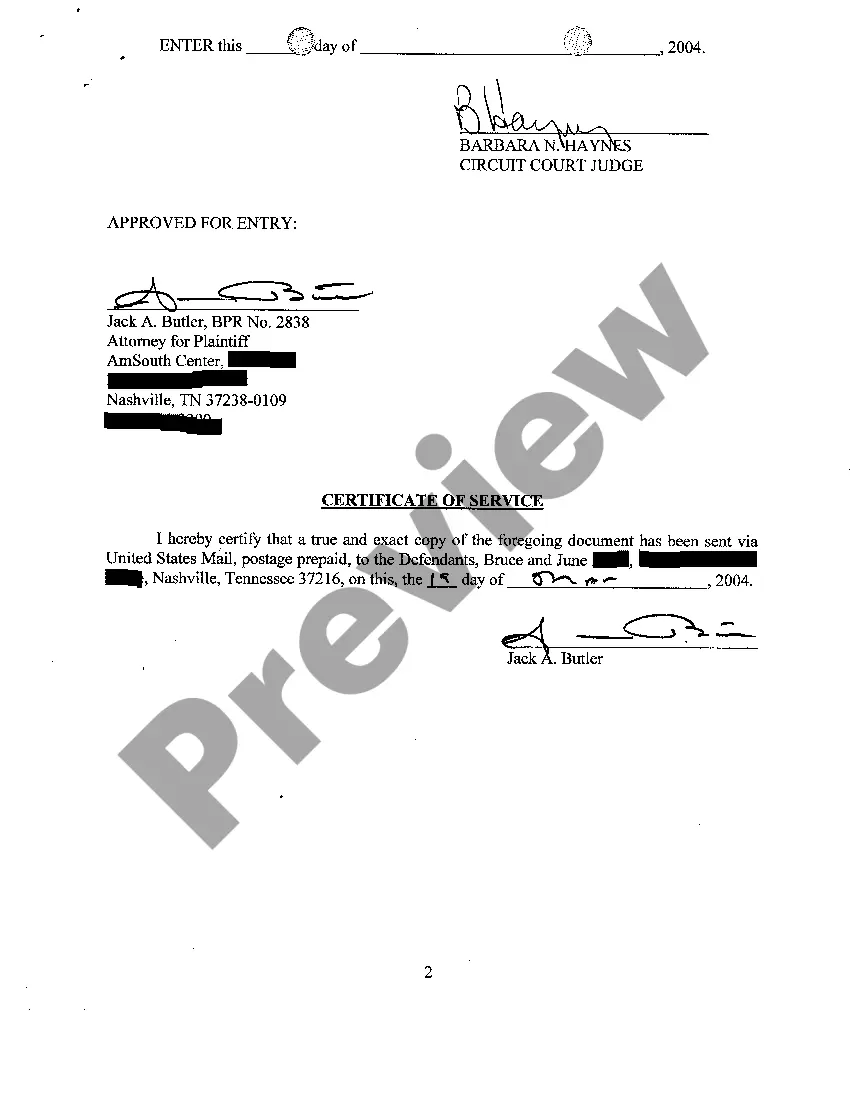

Tennessee Final Decree Granting Plaintiff to Obtain Default Judgment

Description

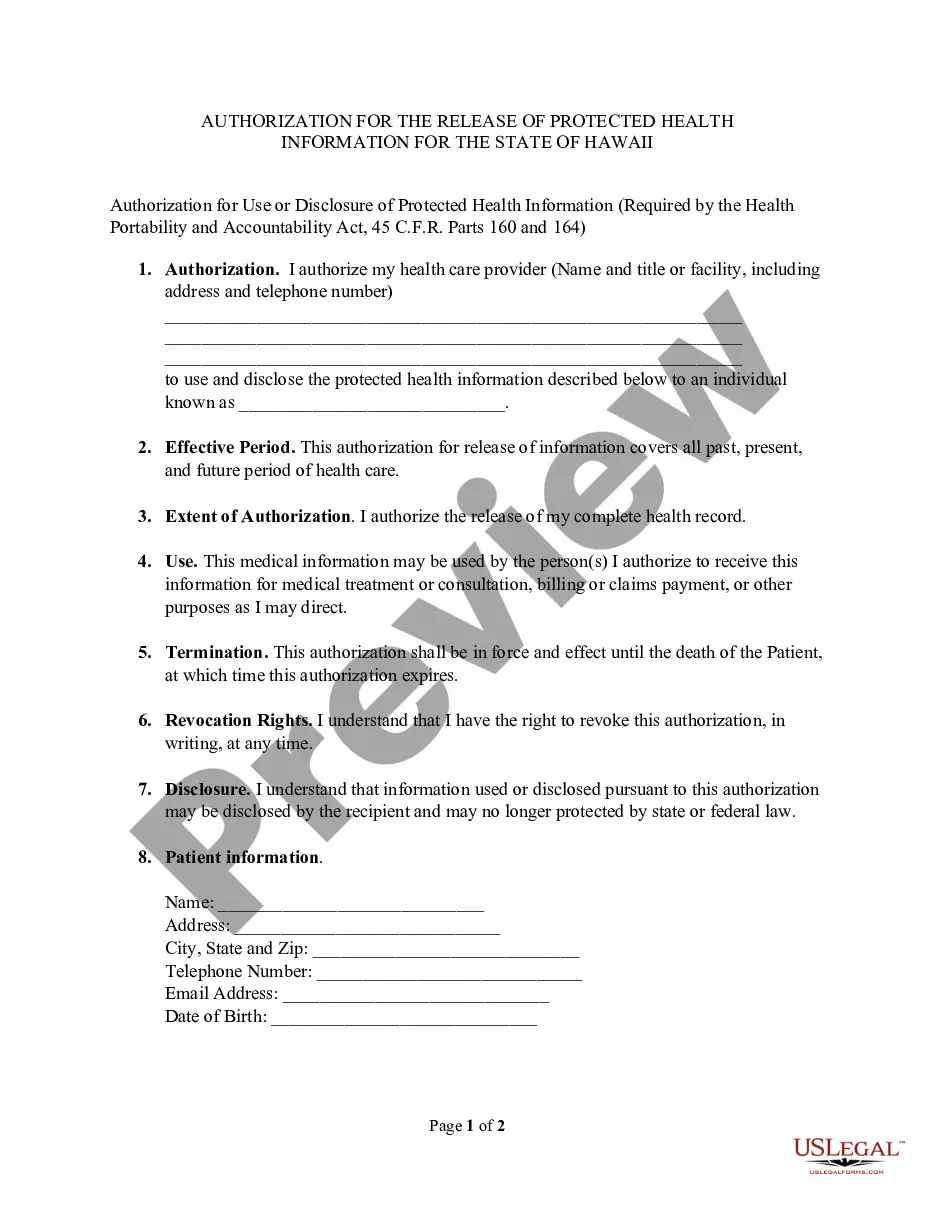

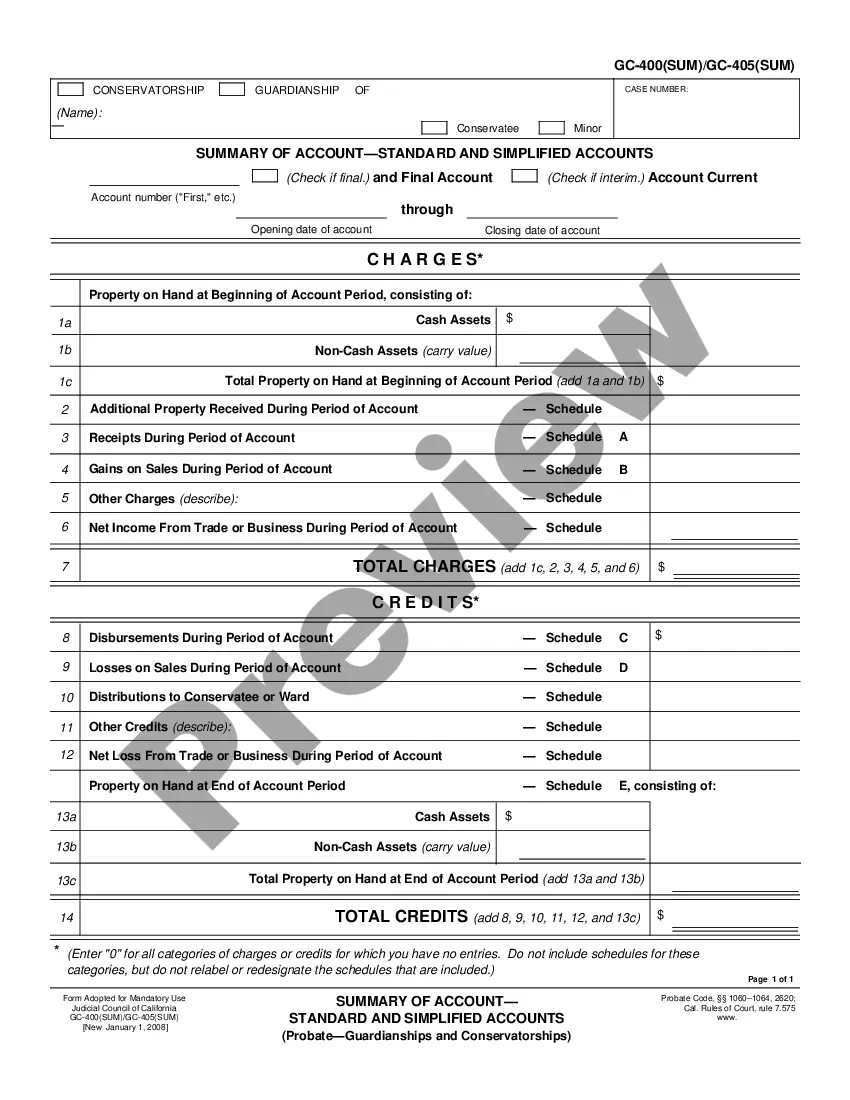

How to fill out Tennessee Final Decree Granting Plaintiff To Obtain Default Judgment?

Access to high quality Tennessee Final Decree Granting Plaintiff to Obtain Default Judgment forms online with US Legal Forms. Avoid days of lost time searching the internet and lost money on documents that aren’t updated. US Legal Forms provides you with a solution to just that. Get more than 85,000 state-specific authorized and tax samples you can download and complete in clicks in the Forms library.

To receive the sample, log in to your account and click on Download button. The file is going to be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

- See if the Tennessee Final Decree Granting Plaintiff to Obtain Default Judgment you’re looking at is suitable for your state.

- View the sample making use of the Preview option and browse its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to finish making an account.

- Pick a favored format to save the document (.pdf or .docx).

You can now open the Tennessee Final Decree Granting Plaintiff to Obtain Default Judgment template and fill it out online or print it and do it yourself. Take into account giving the document to your legal counsel to make certain things are filled out correctly. If you make a error, print and complete sample again (once you’ve created an account every document you download is reusable). Create your US Legal Forms account now and get far more templates.

Form popularity

FAQ

Generally, if a defendant fails to respond to a complaint you can get a default judgment after 45 days. However, the court system is very slow these days and it can take several months to get the court to issue the default judgment.

A default judgment is a ruling granted by a court or judge.For example, when a defendant is summoned to appear before the court in a case brought by a plaintiff, but fails to respond to the court's legal order, the judge can rule for default judgment and thereby decide the case in the plaintiff's favor.

Typically, a court's rules governing enforcement of default judgments include procedures for wage garnishments, attachment of bank accounts and seizure of assets. The plaintiff can usually pursue more than one of these enforcement mechanisms simultaneously.

Default judgments happen when you don't respond to a lawsuit often from a debt collector and a judge resolves the case without hearing your side.Next up could be wage garnishment or a bank account levy, which allows a creditor to remove money from your bank accounts to repay the debt.

Most often, it is a judgment in favor of a plaintiff when the defendant has not responded to a summons or has failed to appear before a court of law.A party can have a default judgment vacated, or set aside, by filing a motion, after the judgment is entered, by showing of a proper excuse.

First, you can ask the court to set aside the default judgment and give you an opportunity to contest it. Next, you can settle the debt with the debt buyer for an amount less than what the default judgment is for. And finally you can eliminate the default judgment completely by filing for bankruptcy.

A default judgment is a judgment that is taken against someone that's been sued when the person sued (defendant) is served with a lawsuit but ignores the lawsuit, fails to file the proper documents (an Answer) or otherwise make him or herself known to the court.

A default judgment means that the court has decided that you owe money. This a result of the person suing you in small claims court and you failed to appear at the hearing.

In effect, you're found guilty because you never entered a defense. Default judgments are sometimes called automatic judgments because of how fast they can happen. Next up could be wage garnishment or a bank account levy, which allows a creditor to remove money from your bank accounts to repay the debt.