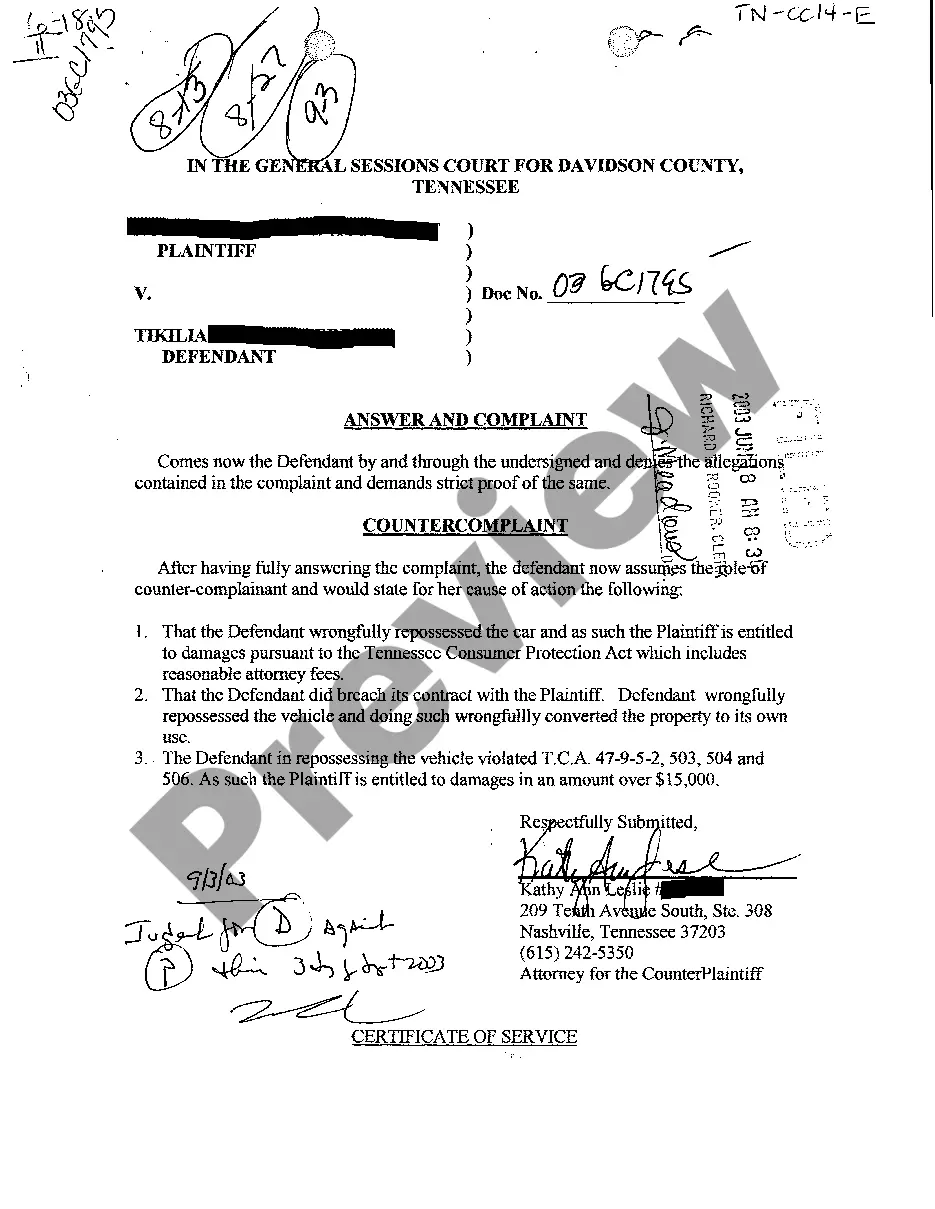

Tennessee Answer To Complaint for Debt Collection and Countercomplaint for Wrongful Repossession of Automobile

Description

How to fill out Tennessee Answer To Complaint For Debt Collection And Countercomplaint For Wrongful Repossession Of Automobile?

Access to top quality Tennessee Answer To Complaint for Debt Collection and Countercomplaint for Wrongful Repossession of Automobile templates online with US Legal Forms. Steer clear of days of lost time seeking the internet and lost money on files that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Get over 85,000 state-specific authorized and tax forms that you can download and submit in clicks in the Forms library.

To get the sample, log in to your account and click Download. The document is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide listed below to make getting started easier:

- Check if the Tennessee Answer To Complaint for Debt Collection and Countercomplaint for Wrongful Repossession of Automobile you’re considering is appropriate for your state.

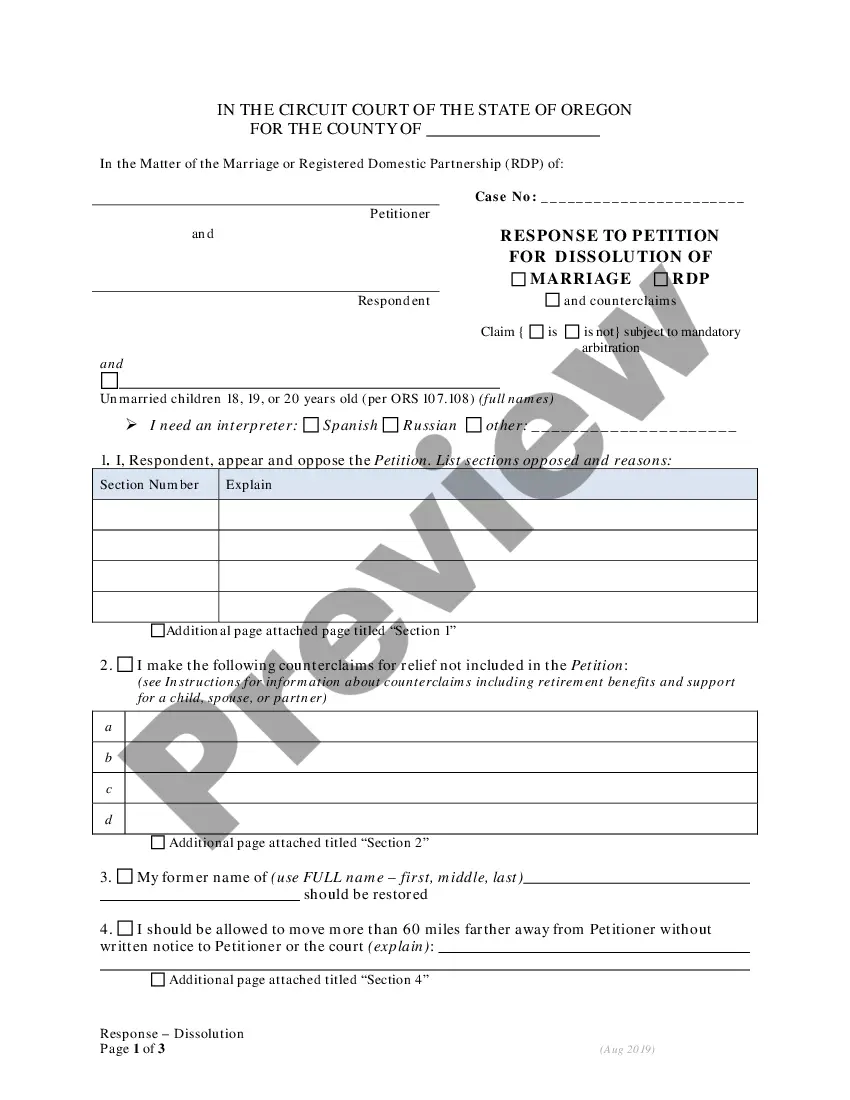

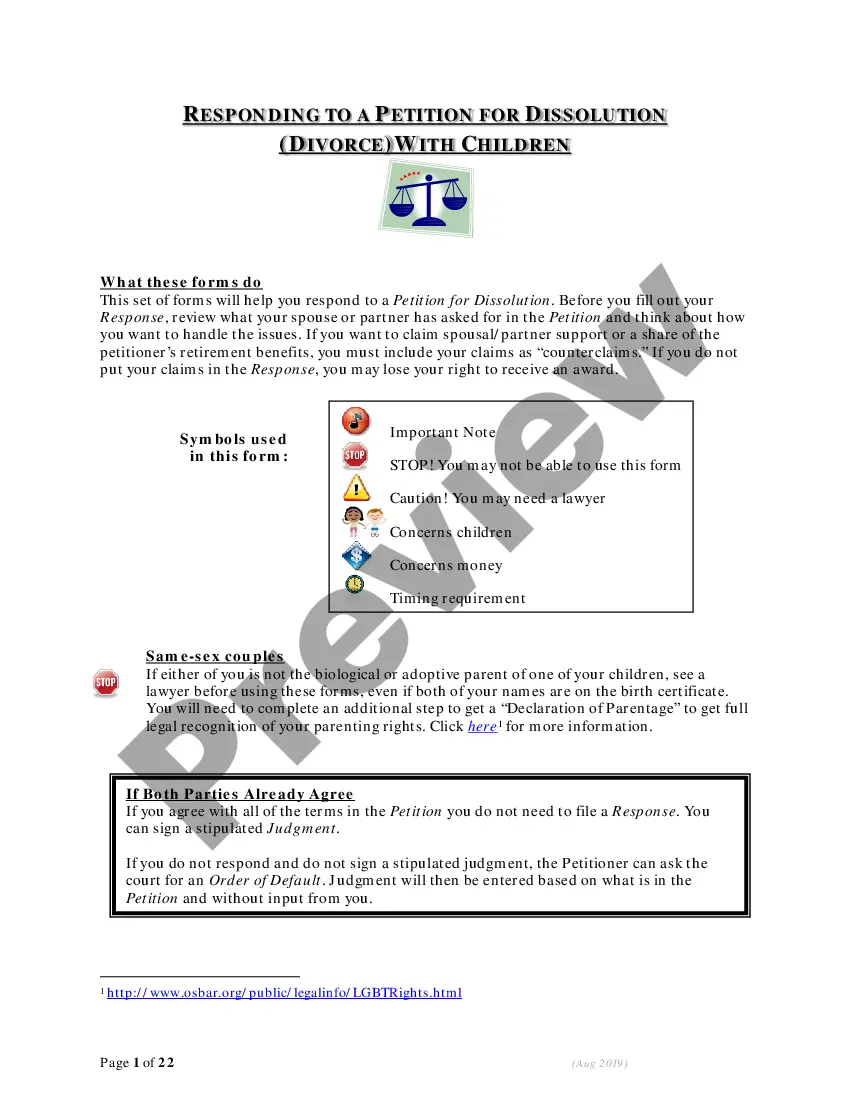

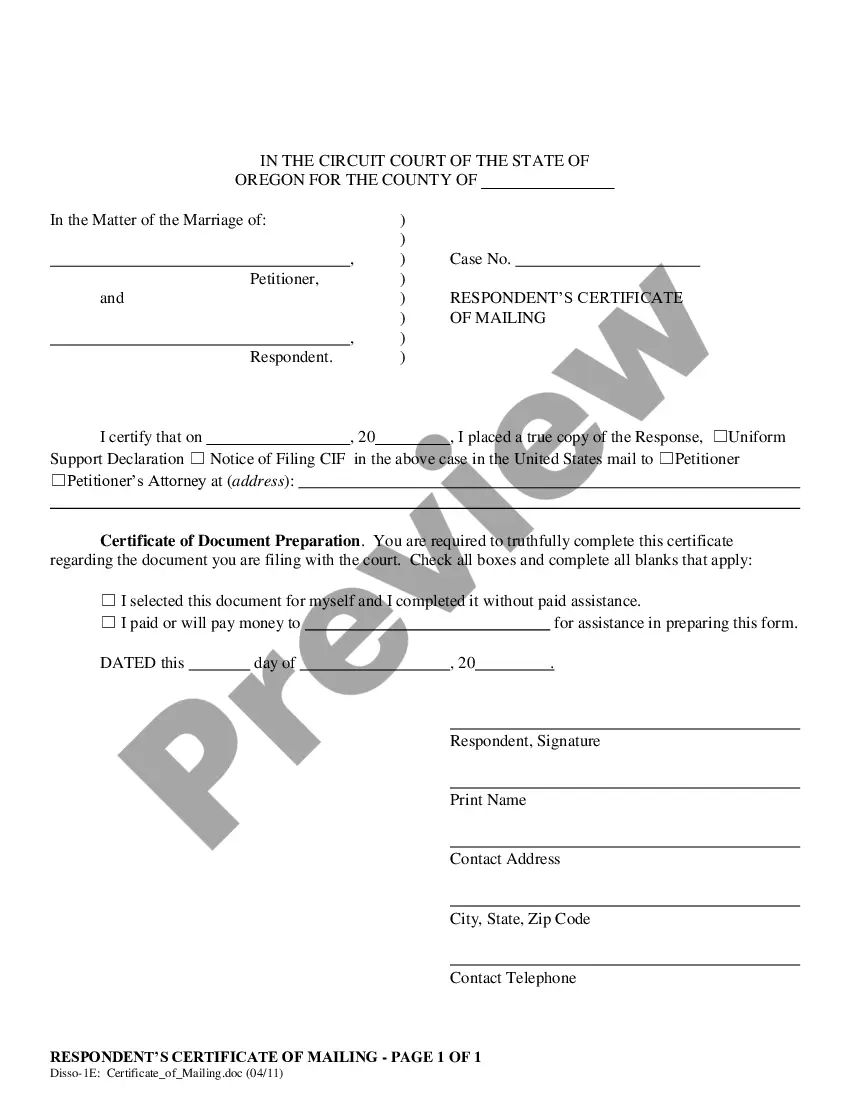

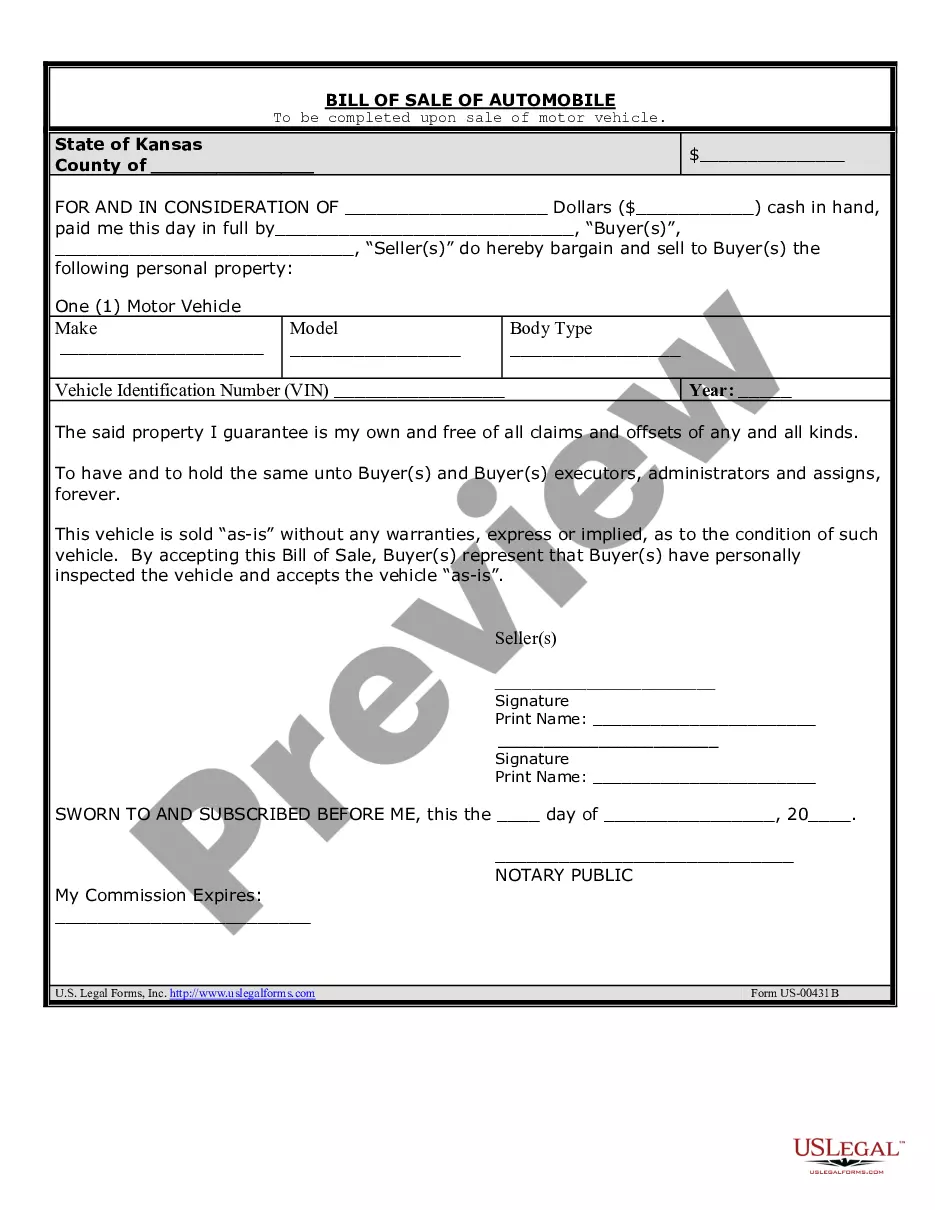

- Look at the sample using the Preview function and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Choose the subscription plan to go on to register.

- Pay by card or PayPal to complete creating an account.

- Select a favored file format to save the document (.pdf or .docx).

Now you can open the Tennessee Answer To Complaint for Debt Collection and Countercomplaint for Wrongful Repossession of Automobile example and fill it out online or print it and do it by hand. Think about giving the document to your legal counsel to make sure things are filled out correctly. If you make a mistake, print and fill sample again (once you’ve created an account every document you download is reusable). Create your US Legal Forms account now and access far more forms.

Form popularity

FAQ

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

Make sure you respond to the Complaint and your response is timely filed. Review potential affirmative defenses that could apply to your case. Make the debt collector prove that they have the legal right to sue you.

Keep Calm and Respond Promptly. It's important to remember that the unpaid debt has passed through the original creditor to a debt collection attorney. Write It Down. Dispute Discrepancies. Be Upfront and Honest. Follow Up Immediately to a Court Summons.

Don't admit liability for the debt; force the creditor to prove the debt and your responsibility for it. File the Answer with the Clerk of Court. Ask for a stamped copy of the Answer from the Clerk of Court. Send the stamped copy certified mail to the plaintiff.

Try settling or negotiating. After you've received your letter and can verify that the debt is yours, see if the debt collector will settle for a portion of the cost if you pay upfront. If they still want the full amount due, ask if you can set up a payment plan.

Contact the clerk's office of the court where the lawsuit was filed. You'll find a phone number and address for the clerk's office on your summons. The clerk will be able to tell you exactly what documents you should file with your answer and whether any filing fee is required.

Filing an An answer is a formal statement, in writing, of your defense to the lawsuit. You can say that what the plaintiff claims is not true. Or you can say it is true but give more information and reasons to defend your actions or explain the situation.

The dollar amount of the debt. Original creditor's name and information. Statements about the validity and timeline of your debt repayment. Clear points of contact. Your right to dispute the collection, as well as instructions and required timeline.

Don't admit liability for the debt; force the creditor to prove the debt and your responsibility for it. File the Answer with the Clerk of Court. Ask for a stamped copy of the Answer from the Clerk of Court. Send the stamped copy certified mail to the plaintiff.