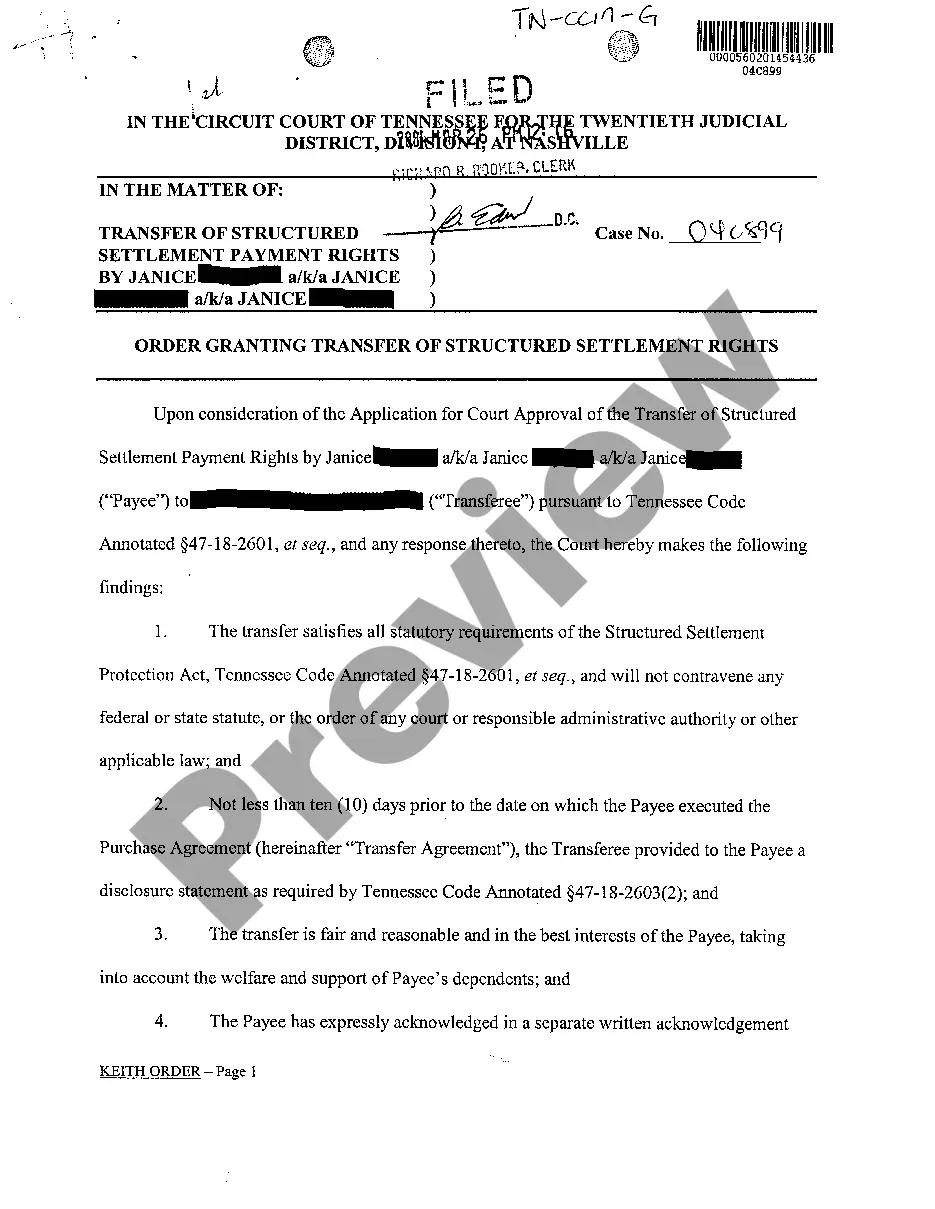

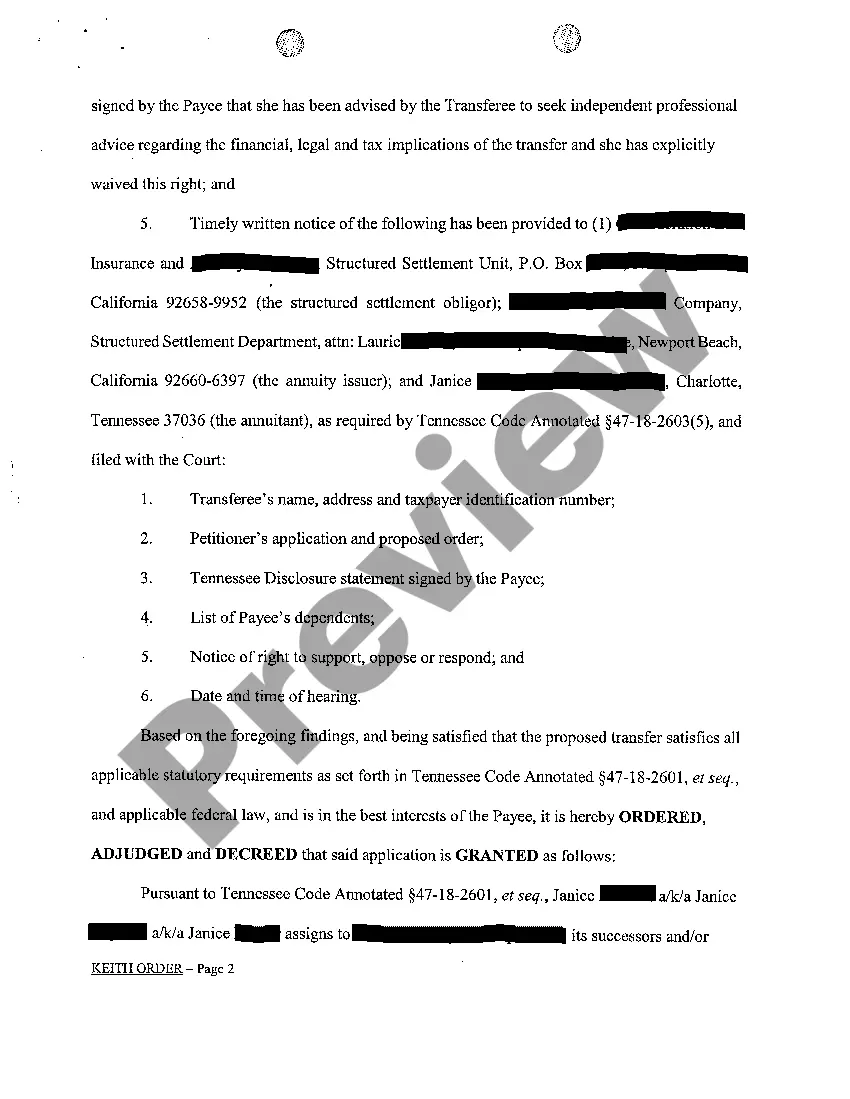

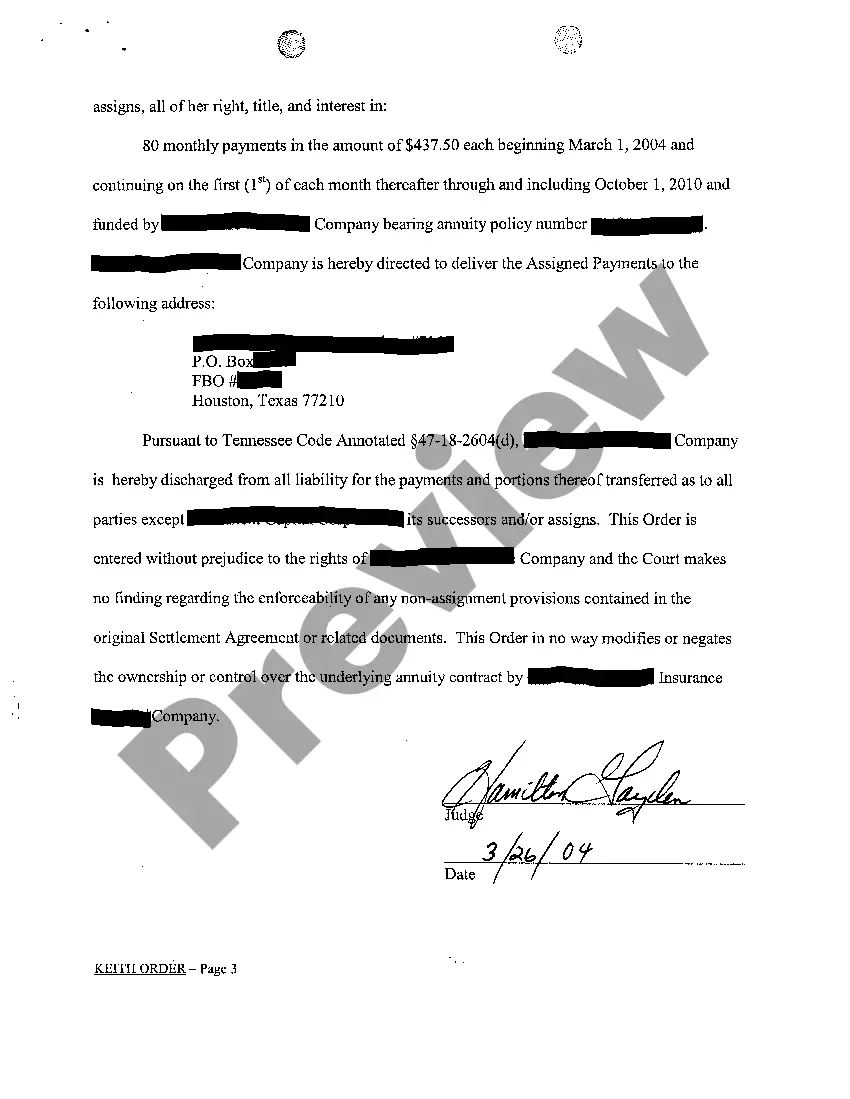

Tennessee Order Granting Transfer of Structure Settlement

Description

How to fill out Tennessee Order Granting Transfer Of Structure Settlement?

Get access to top quality Tennessee Order Granting Transfer of Structure Settlement forms online with US Legal Forms. Prevent days of wasted time seeking the internet and dropped money on documents that aren’t updated. US Legal Forms offers you a solution to just that. Find over 85,000 state-specific authorized and tax forms that you can download and fill out in clicks within the Forms library.

To receive the example, log in to your account and click Download. The document will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide listed below to make getting started easier:

- Verify that the Tennessee Order Granting Transfer of Structure Settlement you’re looking at is suitable for your state.

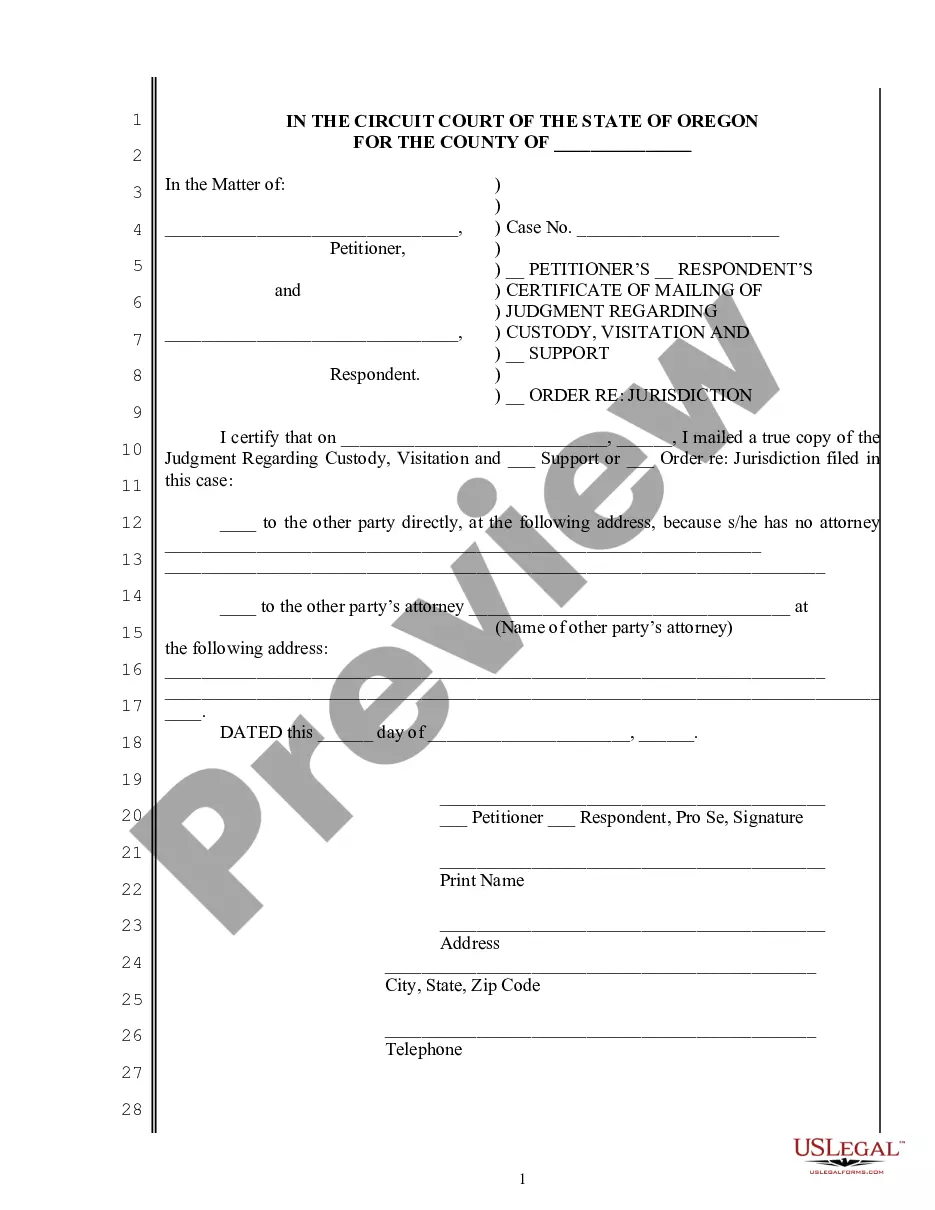

- Look at the sample making use of the Preview function and browse its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay out by card or PayPal to finish creating an account.

- Choose a preferred format to download the document (.pdf or .docx).

Now you can open up the Tennessee Order Granting Transfer of Structure Settlement sample and fill it out online or print it out and get it done yourself. Consider giving the papers to your legal counsel to make sure all things are filled out appropriately. If you make a error, print and fill application again (once you’ve made an account all documents you save is reusable). Make your US Legal Forms account now and get more samples.

Form popularity

FAQ

A structured settlement is when part or all of the settlement amount is paid to the plaintiff over a period of years. Part of the settlement will generally be paid to the plaintiff and his/her lawyer immediately after the settlement as a lump sum, and the rest will be structured over a period of years.

How Do Structured Settlement Purchasing Companies Make Money? Factoring companies generally take anywhere from 9 to 18 percent to cover their operating costs and turn a profit.

The bulk of the cost of selling your settlement will be the discount rate, which will vary greatly by company. Quotes can range from 7% to as high as 29%. Expect many companies to offer a high discount rate in their initial quotes. Do not accept the initial quote from any company.

How Is a Settlement Paid Out? Compensation for a personal injury can be paid out as a single lump sum or as a series of periodic payments in the form of a structured settlement. Structured settlement annuities can be tailored to meet individual needs, but once agreed upon, the terms cannot be changed.

The qualified assignment fee (ranging from $0 to $750) is commissionable with some companies. In other cases it is not. Insurance laws in effect in most states expressly prohibit reduction of commissions or rebating. There are different market based structured settlement options for both plaintiffs and attorney.

Selling your payments to help pull yourself out of debt and get back on track is a decision that will not only improve your financial health but also may improve your mental and physical health as the stress of debt is removed. Selling your structured settlement or annuity payments to pay off debt is 100% legit.

A structured settlement is when part or all of the settlement amount is paid to the plaintiff over a period of years. Part of the settlement will generally be paid to the plaintiff and his/her lawyer immediately after the settlement as a lump sum, and the rest will be structured over a period of years.

On average, it takes 30 45 days to sell structured settlement payments. Selling your structured settlement payments requires court approval which is usually the main cause for any unexpected delays in the transfer.