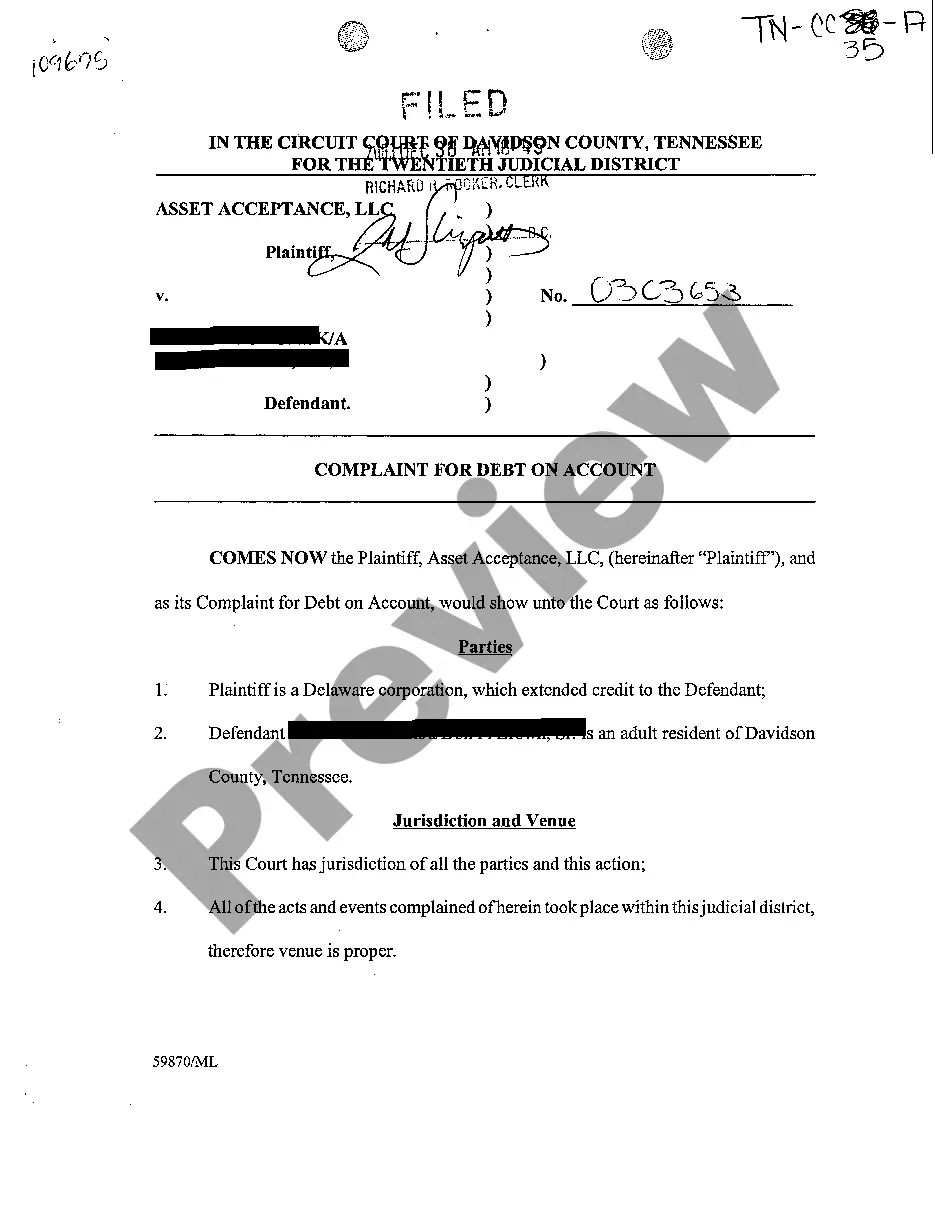

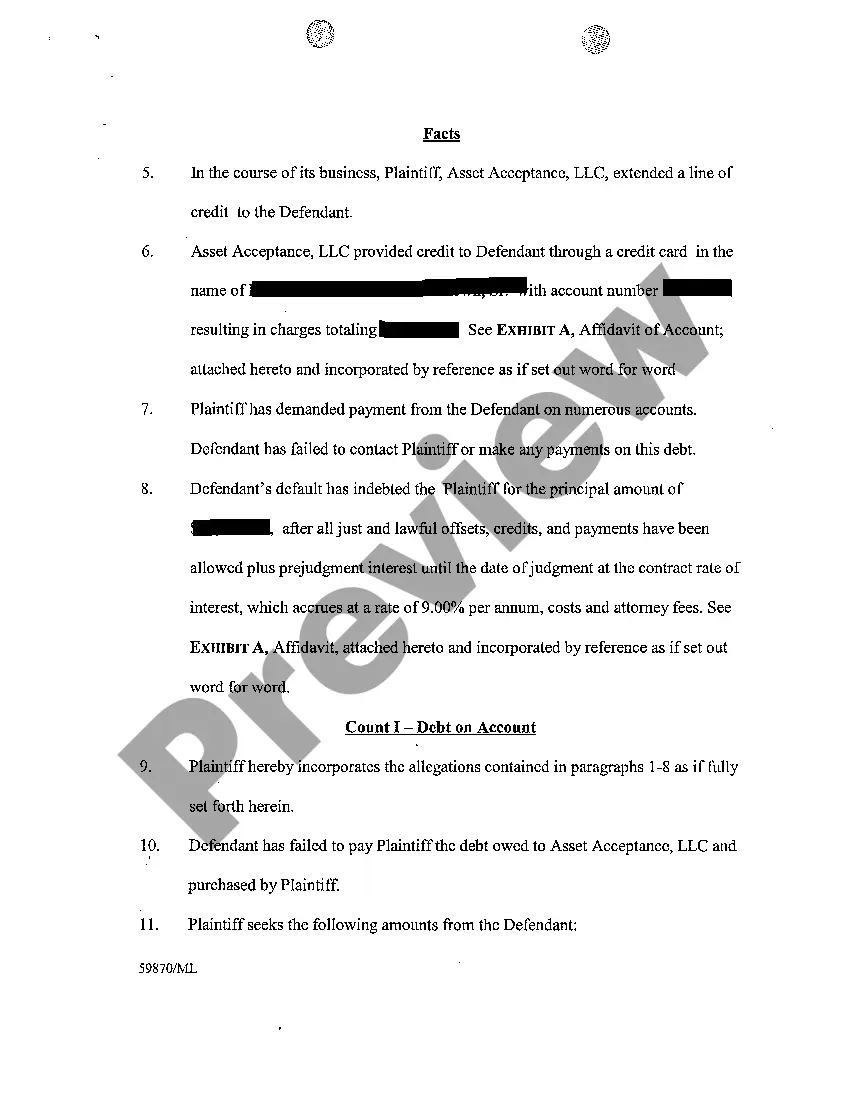

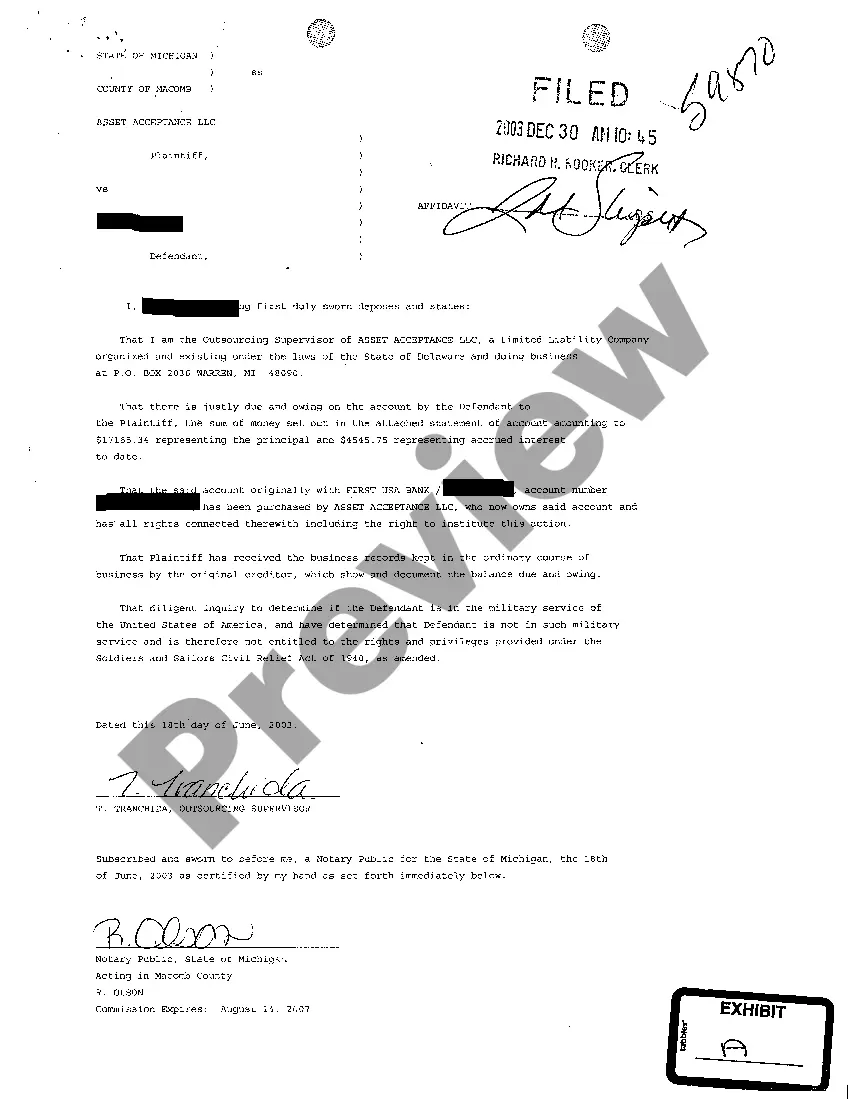

Tennessee Complaint For Debt On Account

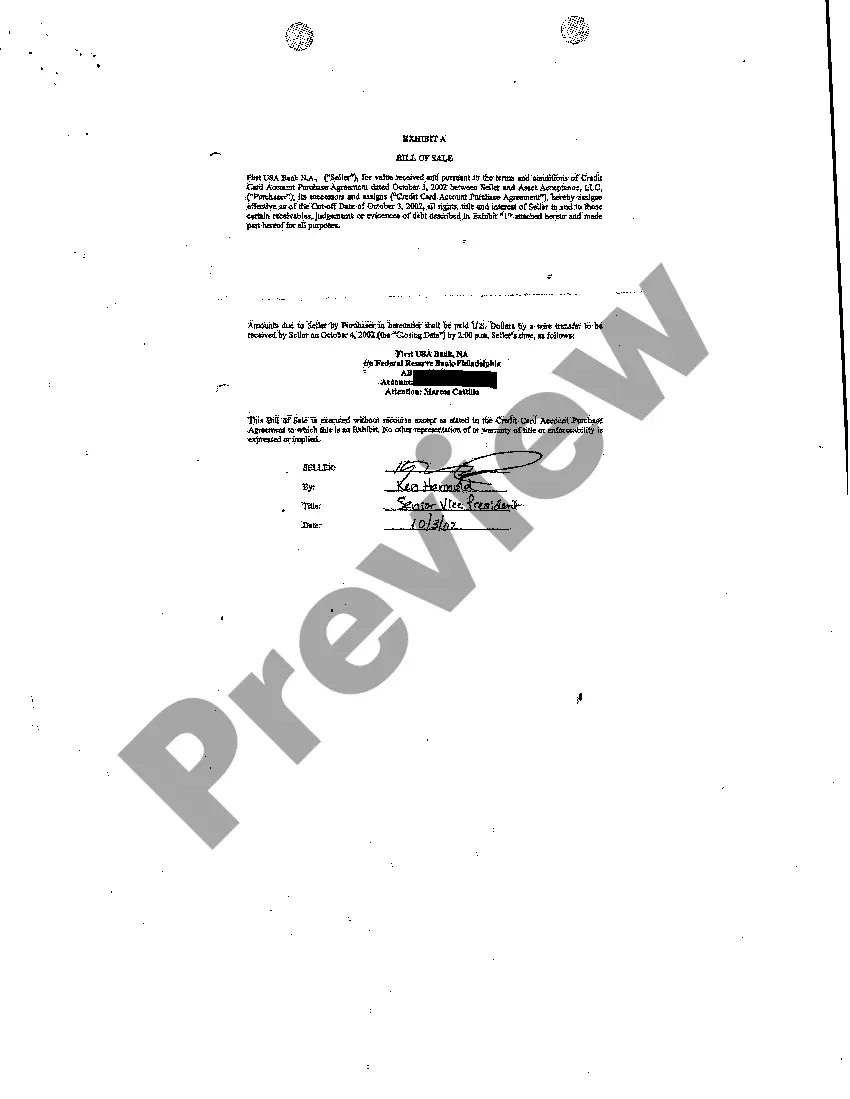

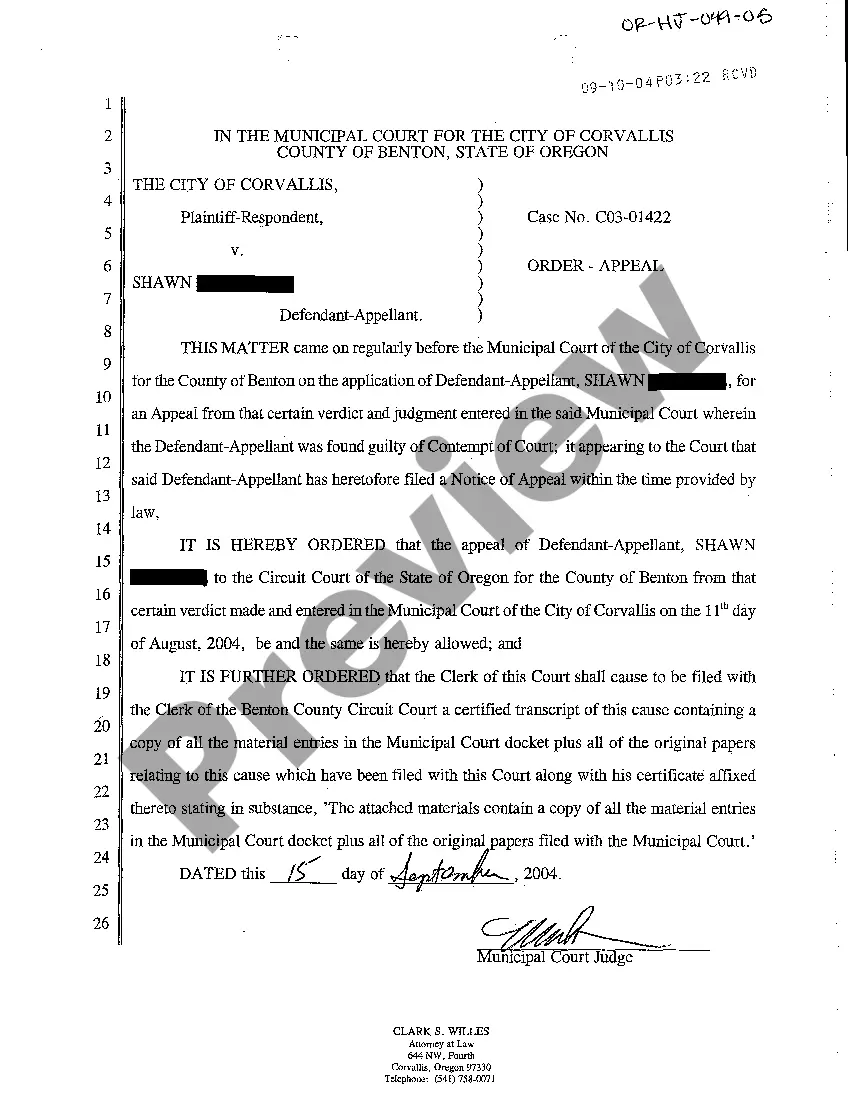

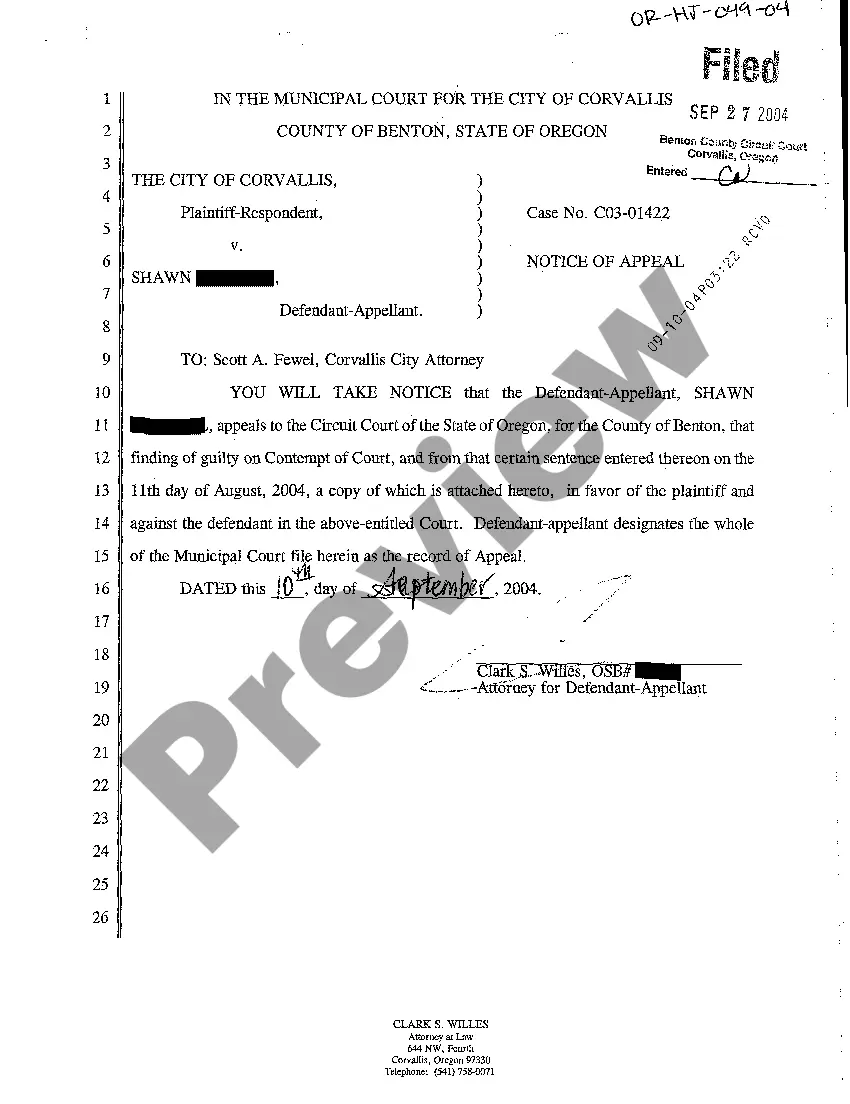

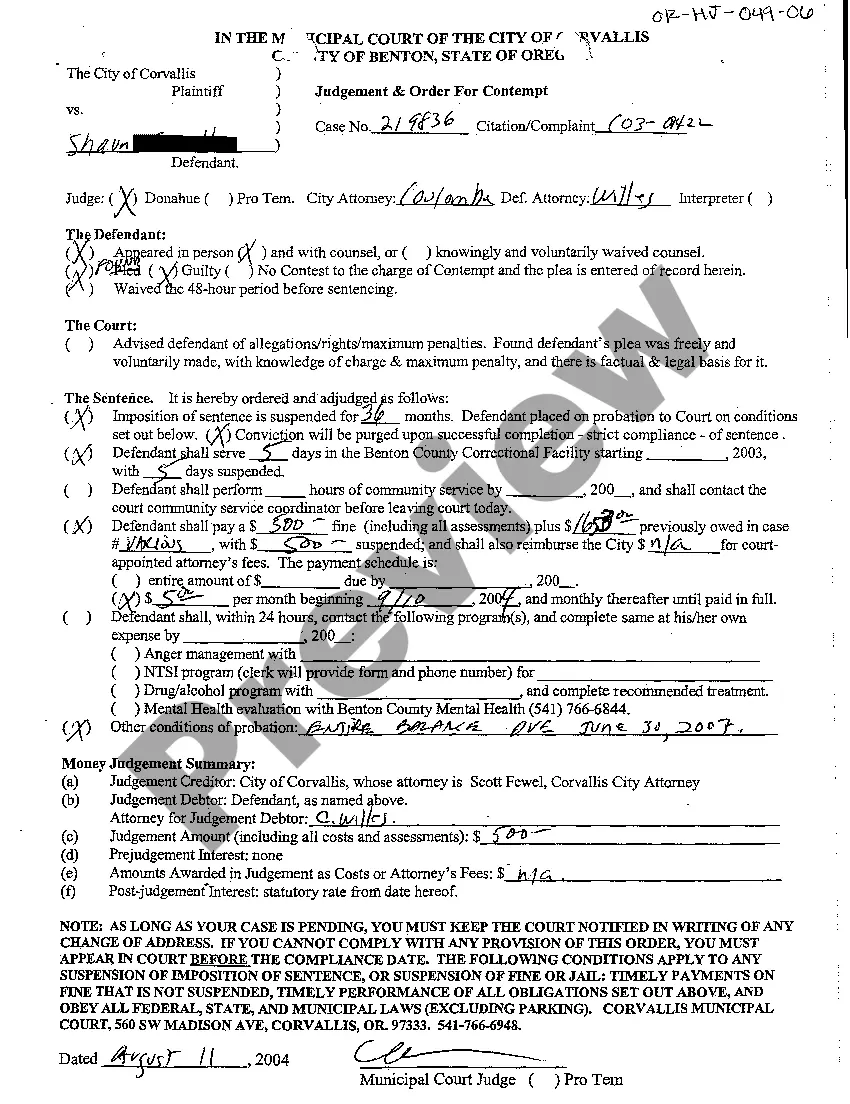

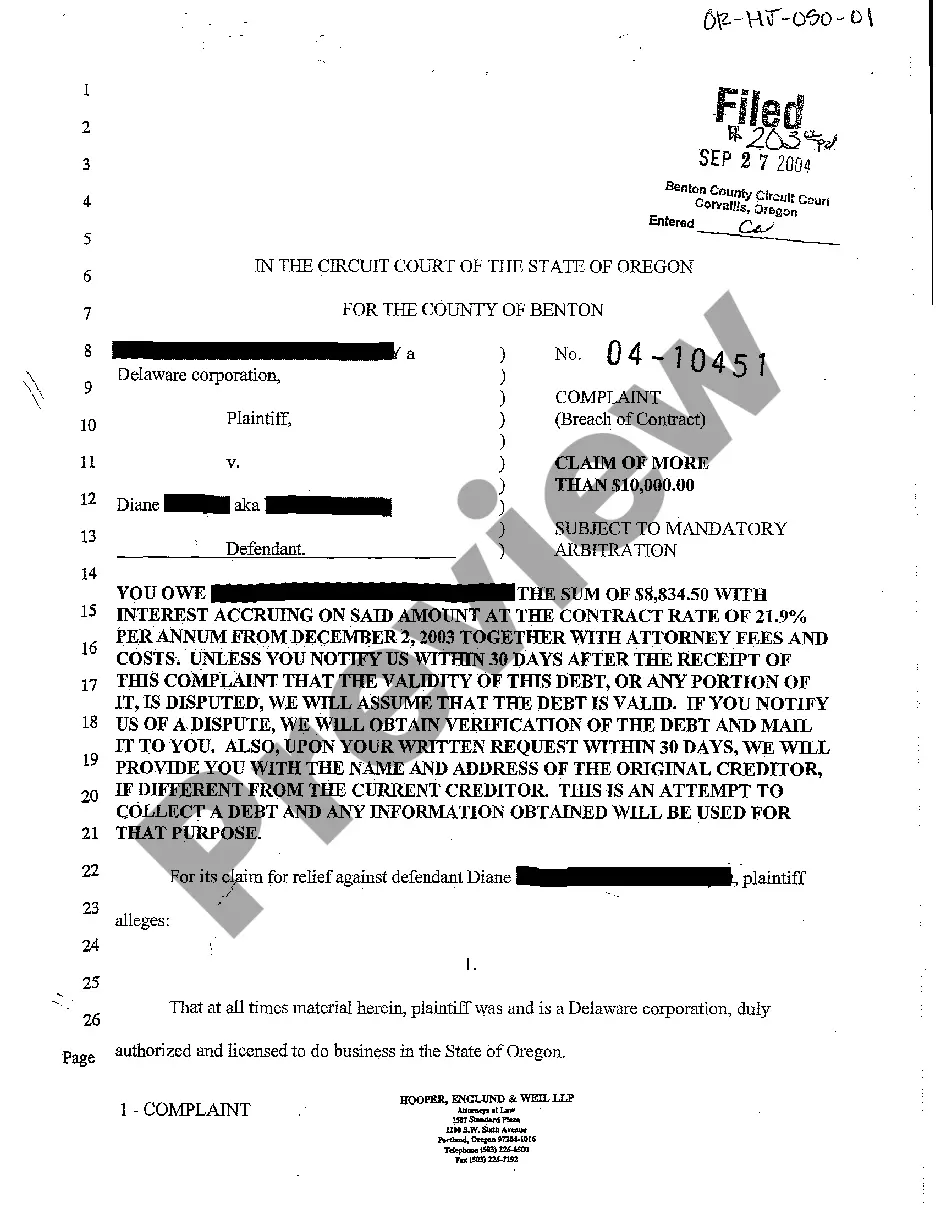

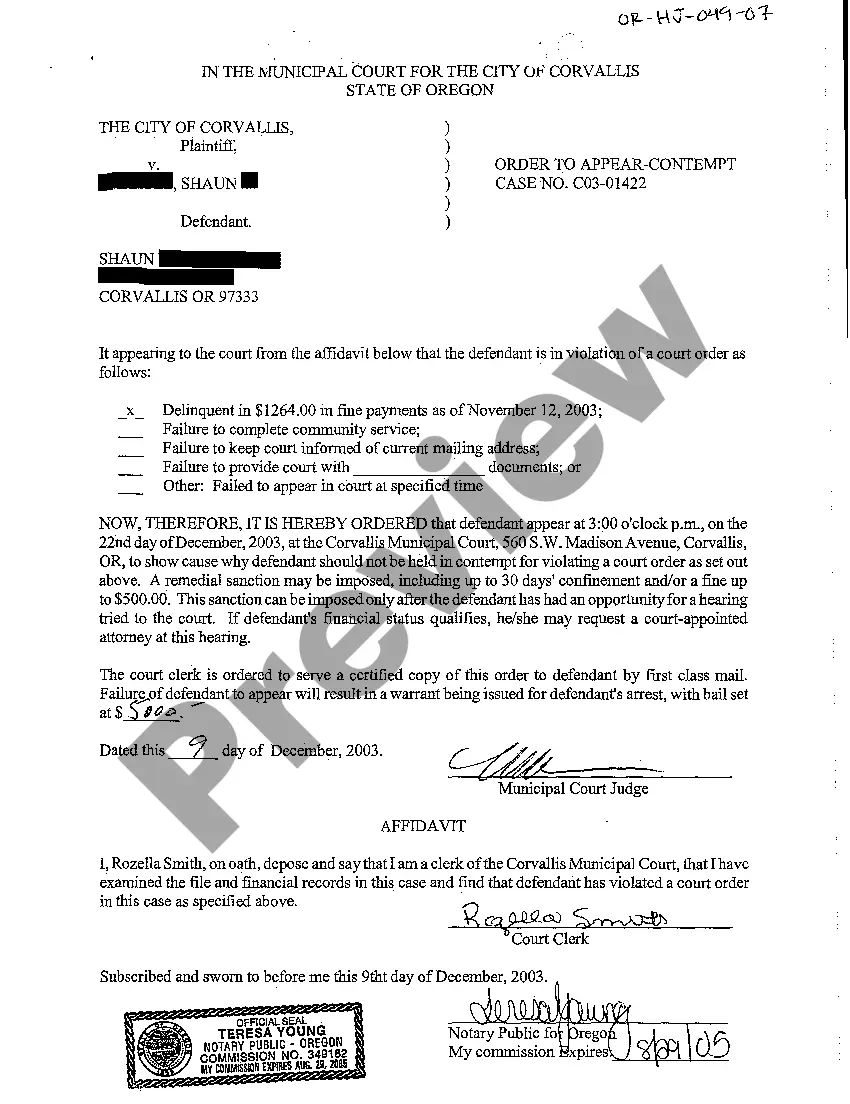

Description

How to fill out Tennessee Complaint For Debt On Account?

Access to high quality Tennessee Complaint For Debt On Account forms online with US Legal Forms. Steer clear of hours of lost time browsing the internet and dropped money on forms that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find around 85,000 state-specific authorized and tax samples that you can save and fill out in clicks within the Forms library.

To receive the example, log in to your account and then click Download. The file will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- Check if the Tennessee Complaint For Debt On Account you’re considering is appropriate for your state.

- View the sample making use of the Preview function and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to register.

- Pay by card or PayPal to complete making an account.

- Choose a preferred format to download the file (.pdf or .docx).

You can now open the Tennessee Complaint For Debt On Account template and fill it out online or print it and do it yourself. Think about sending the document to your legal counsel to make sure everything is filled in properly. If you make a error, print out and fill application again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and get much more samples.

Form popularity

FAQ

If you dispute the debt, the debt collector cannot report it to a credit reporting agency unless and until it verifies the debt. If the debt collector has already reported the debt (before it received your dispute letter), it must notify the credit reporting agencies that the debt is disputed.

Step 1: Keep detailed records of what the debt collector is doing. Step 2: Take action write to the debt collector, complain to an External Dispute Resolution scheme (Ombudsman Service) or VCAT. Step 3: Complain to a Regulator.

Your creditor also has to report your complaint to the Financial Conduct Authority (FCA), even if they respond within 3 business days. If you need help with this, you can phone our debt helpline on 0300 330 1313. We can usually help between 9am and 8pm, Monday to Friday.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

If the collector completely fails to respond to the validation letter, again they have 30 days to do so, then legally they must cease collection efforts, and remove negative items placed by them on your credit report.

Reach out to the company the collector says is the original creditor. They might help you figure out if the debt is legitimate and if this collector has the right to collect the debt. Also, get your free, annual credit report online or at 877-322-8228 and see if the debt shows up there. Dispute the debt in writing.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

That if you dispute the debt in writing within 30 days the debt collector will provide verification of the debt. That if you request the name and address of the original creditor within 30 days, if different from the current creditor, the debt collector will provide you that information.

The statute of limitations on debt in the state of Tennessee is six years. This means that if a debt has not been repaid in six years, the lender cannot sue to collect the debt.