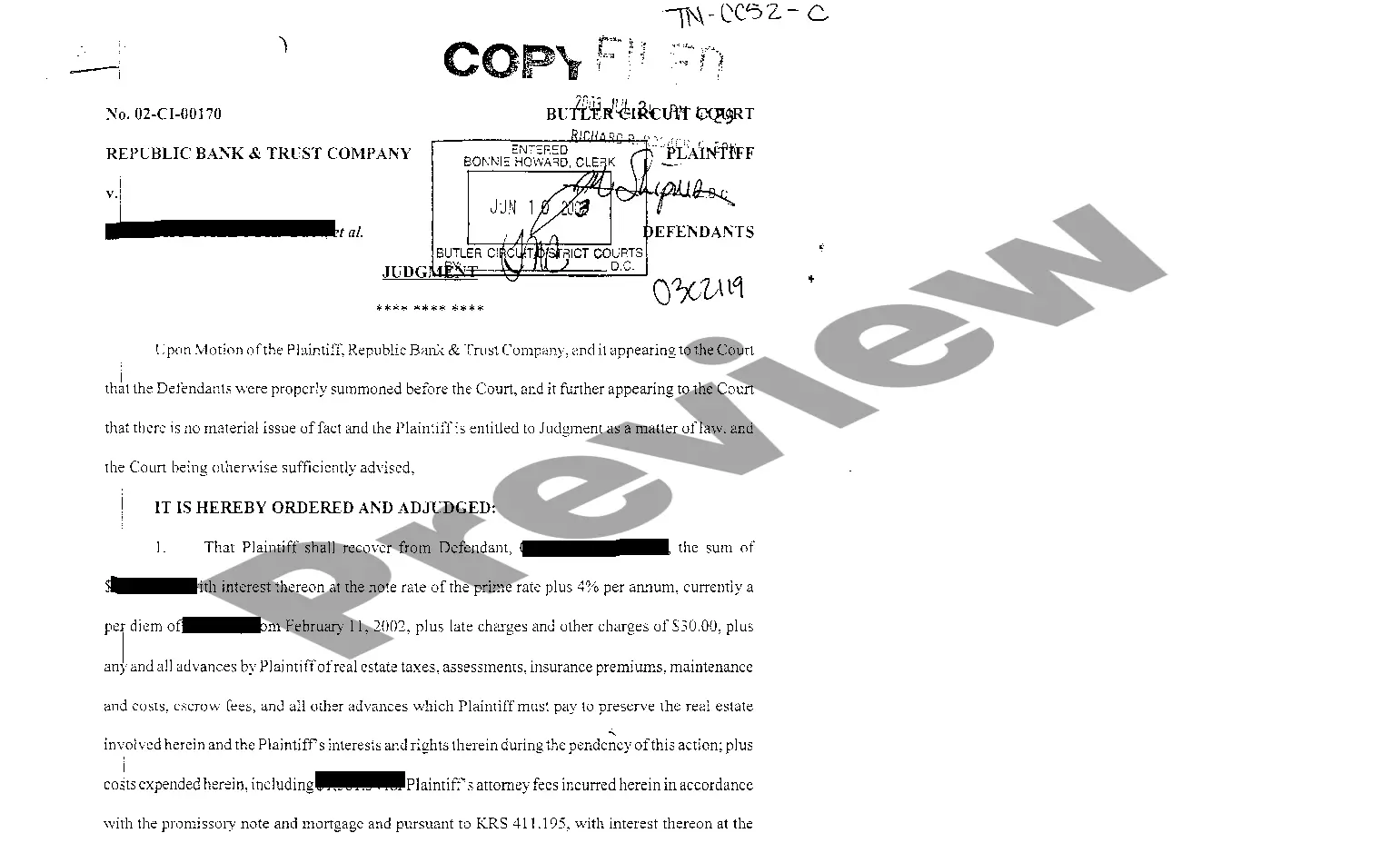

Tennessee Judgment for Money Award and Interest

Description

How to fill out Tennessee Judgment For Money Award And Interest?

Get access to high quality Tennessee Judgment for Money Award and Interest forms online with US Legal Forms. Prevent days of lost time seeking the internet and dropped money on files that aren’t updated. US Legal Forms offers you a solution to exactly that. Get above 85,000 state-specific legal and tax samples you can download and complete in clicks in the Forms library.

To receive the example, log in to your account and then click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- See if the Tennessee Judgment for Money Award and Interest you’re looking at is suitable for your state.

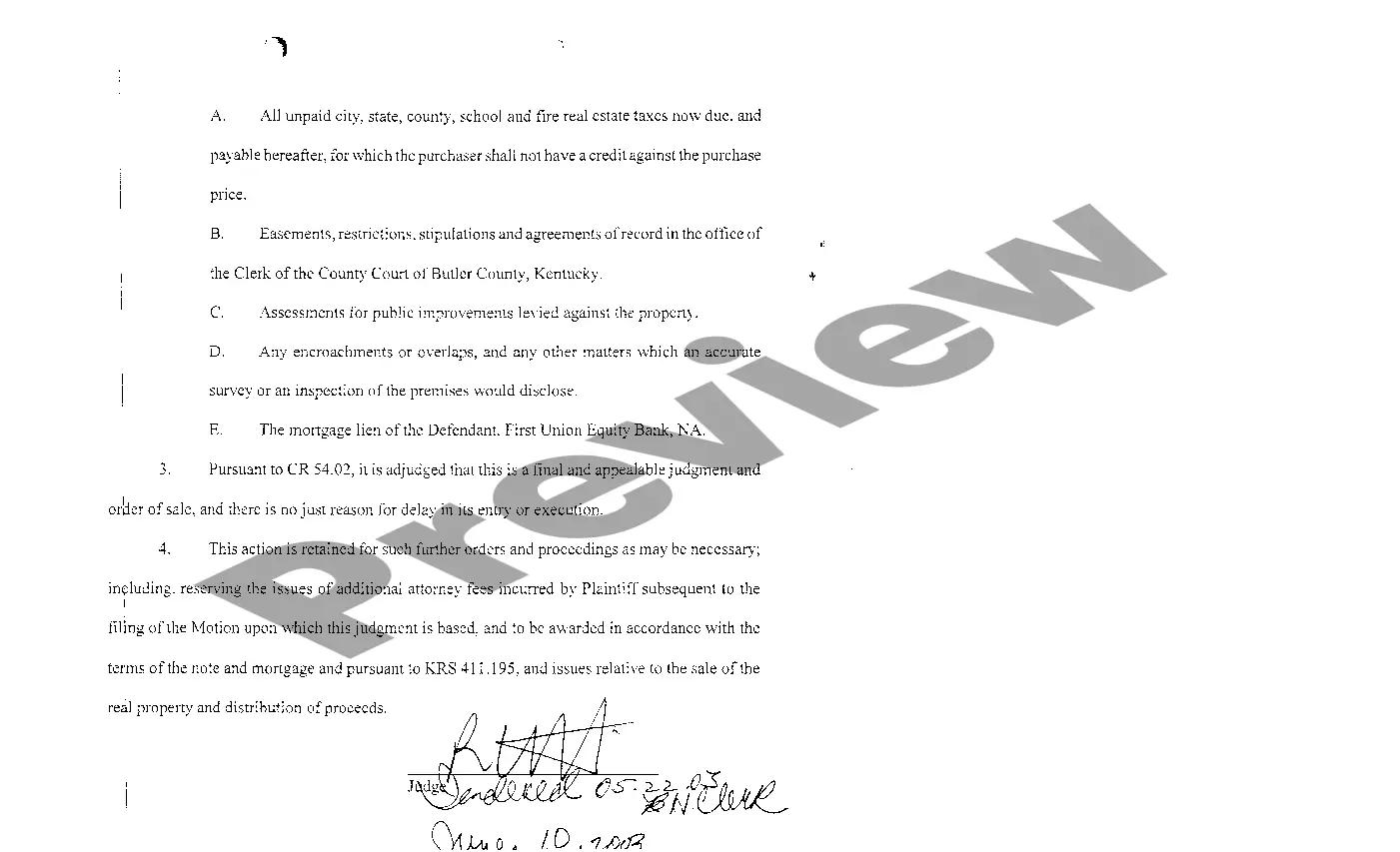

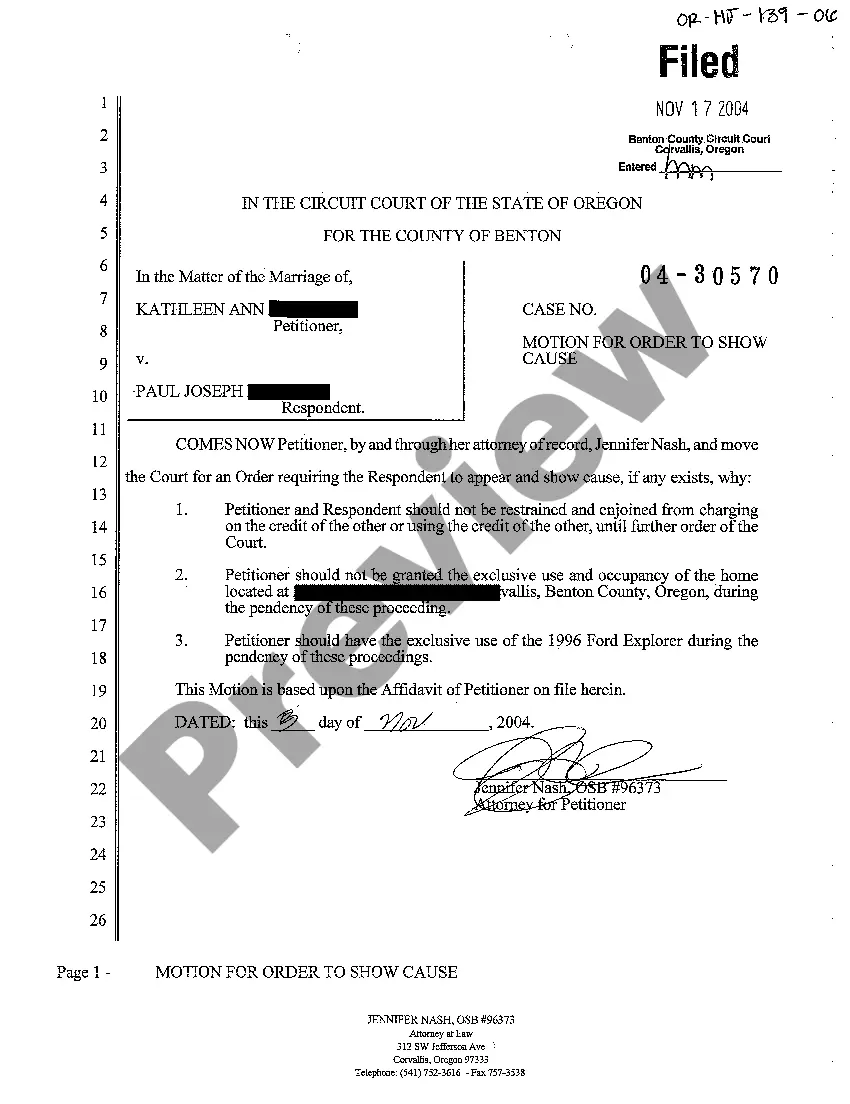

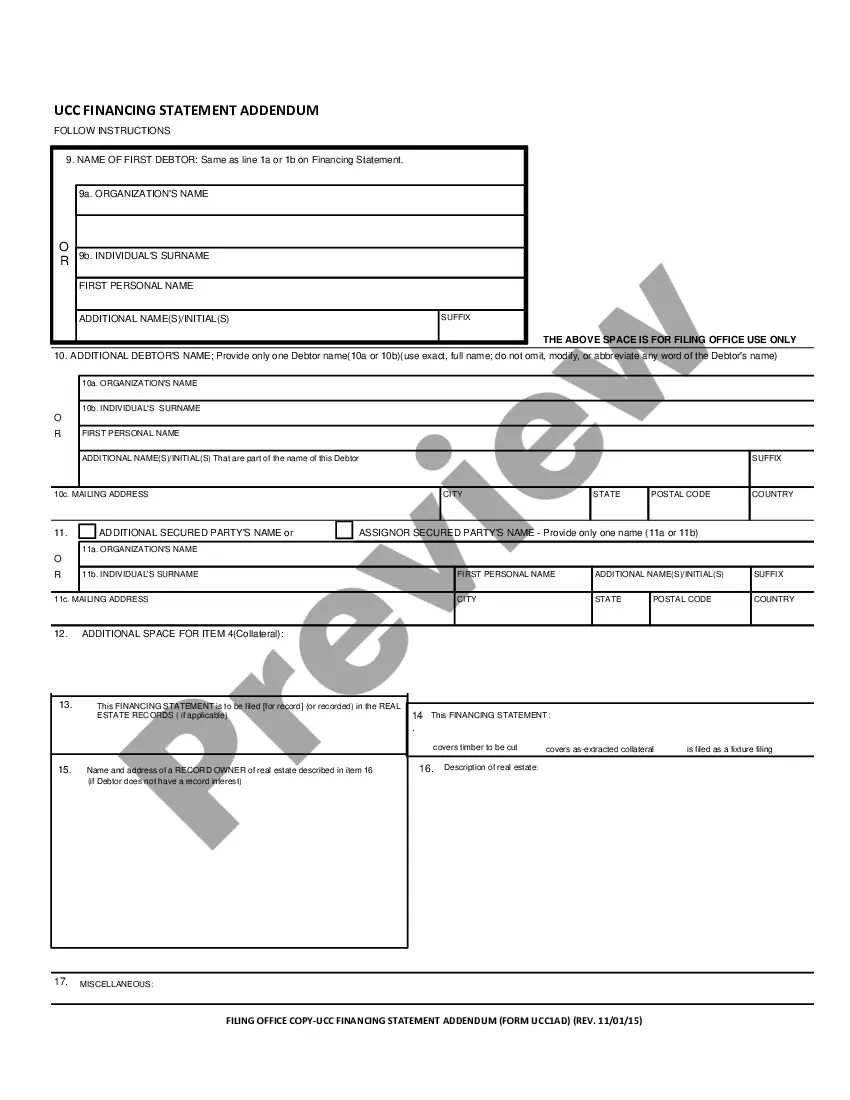

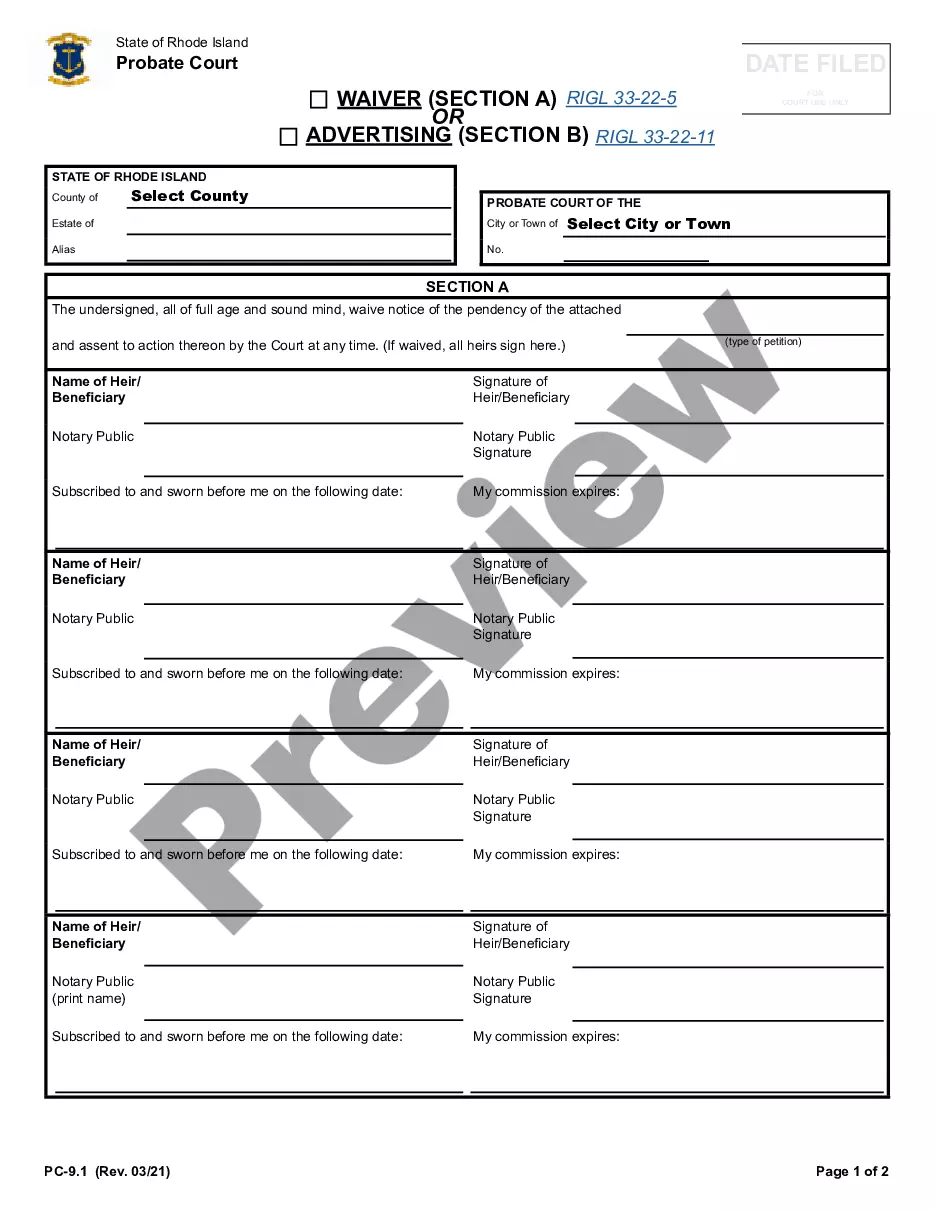

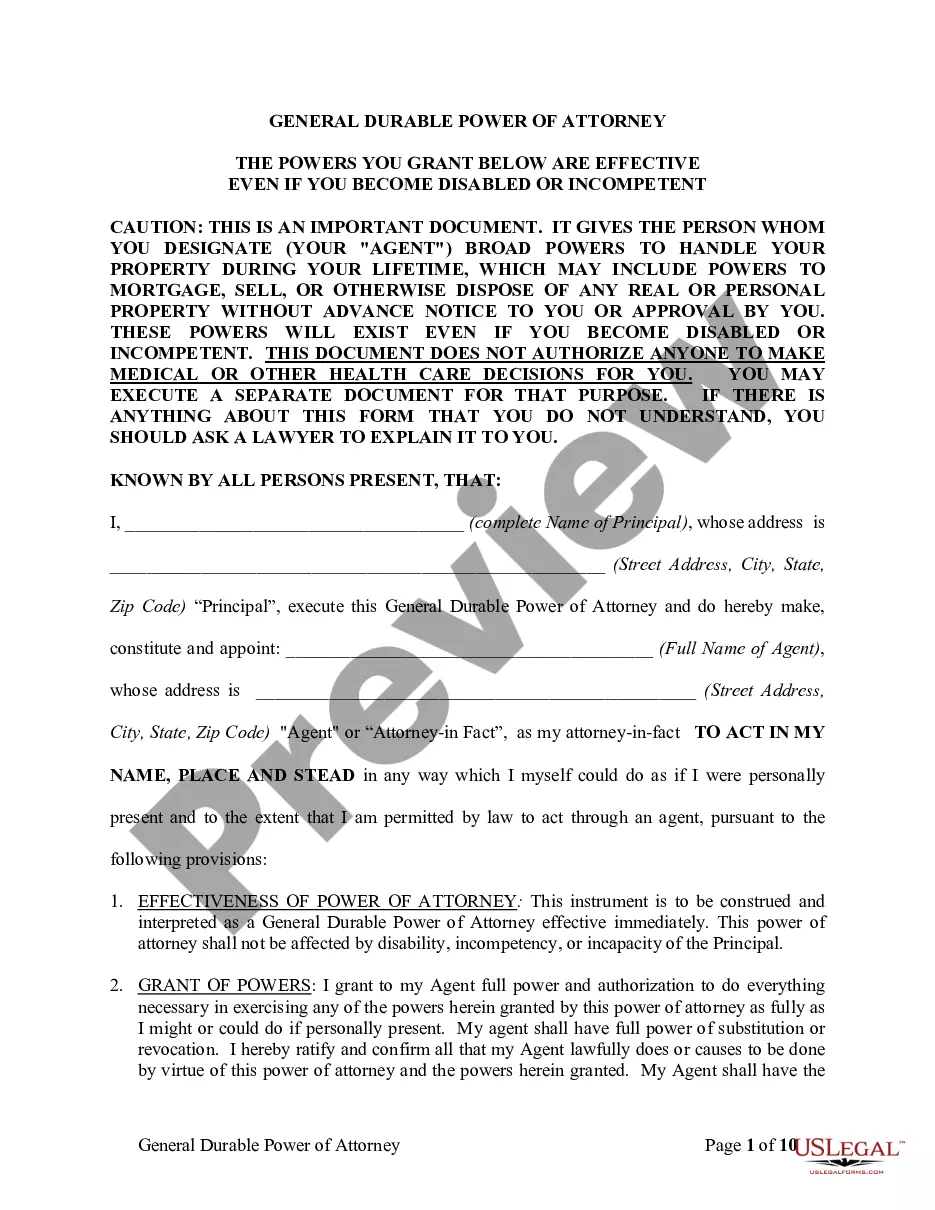

- View the sample using the Preview function and browse its description.

- Visit the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay by credit card or PayPal to complete making an account.

- Pick a favored format to download the file (.pdf or .docx).

Now you can open the Tennessee Judgment for Money Award and Interest template and fill it out online or print it and get it done by hand. Take into account giving the papers to your legal counsel to make certain things are filled out correctly. If you make a mistake, print and fill application again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and access more forms.

Form popularity

FAQ

The statute of limitations on debt in the state of Tennessee is six years. This means that if a debt has not been repaid in six years, the lender cannot sue to collect the debt.

Interest accrues on an unpaid judgment amount at the legal rate of 10% per year (7% if the judgment debtor is a state or local government entity) generally from the date of entry of the judgment.If the judgment is payable in installments, interest accrues from the date each installment is due.

How much interest can I add? The law allows you to add 10% interest per year to your judgment. To calculate this amount, multiply the unpaid judgment by 10%.

Formula: Total amount of judgment owed x 10% (or 0.10) = interest earned per year. Example: Judgment debtor owes the judgment creditor $5,000 (the judgment principal).

Small Claims Court, Limited Jurisdiction Superior Court, or. Unlimited Jurisdiction Superior Court.

In Tennessee, a judgment entered by a court is generally enforceable for a period of ten years.

Bad Debt. A type of contract case. Breach of Contract. Breach of Warranty. Failure to Return a Security Deposit. Libel or Slander (Defamation). Nuisance. Personal Injury. Product Liability.

You are entitled to ask for Interest on the amount you are claiming, this is currently 8% per year. If you want to claim interest you must put on your claim that you want your opponent to pay interest. You can claim the interest rate set out in the contract.

5. Interest under Tort Claims (negligence, fraud, breach of fiduciary duty, etc.) Like statutory obligations, prejudgment interest is also recoverable on tort damages under California Civil Code § 3287(a).