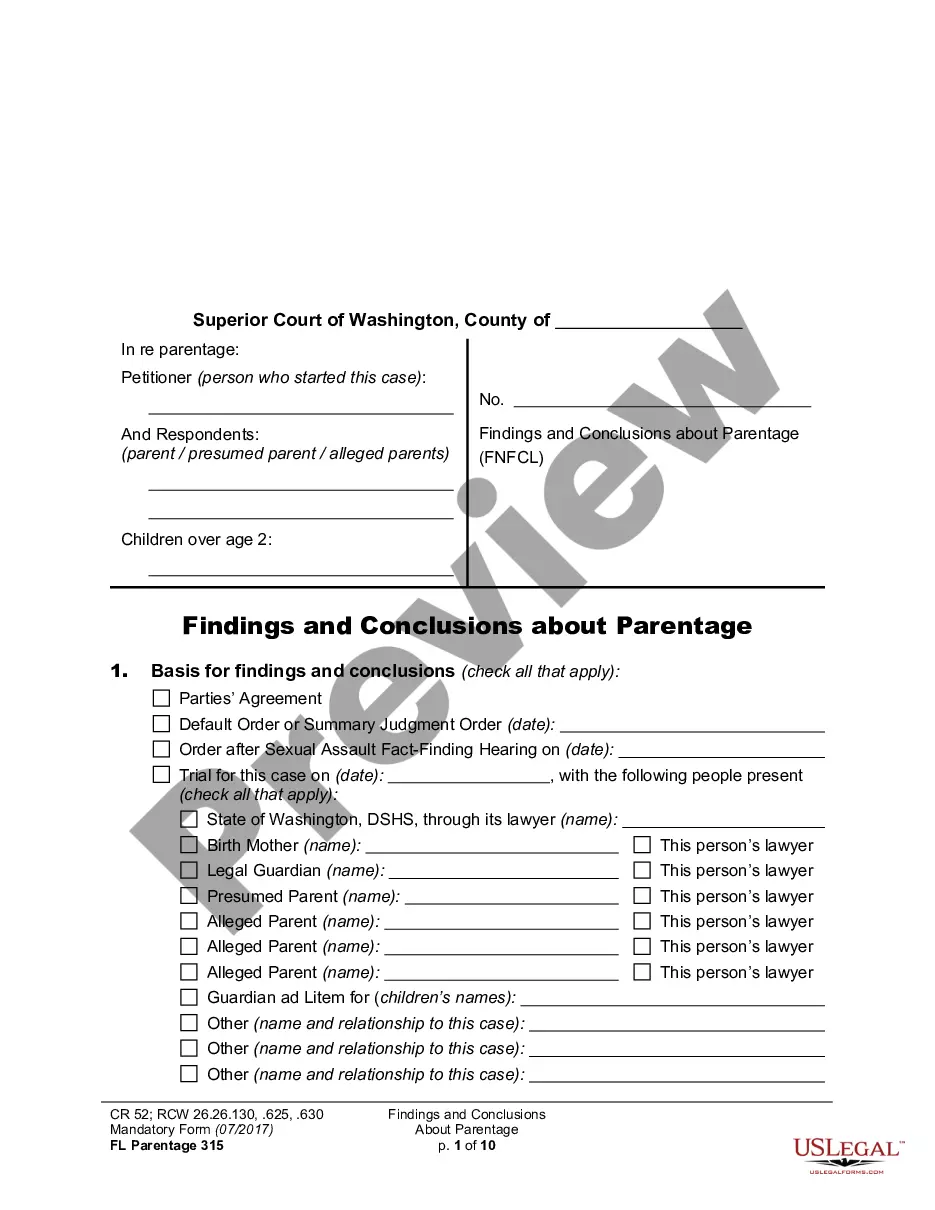

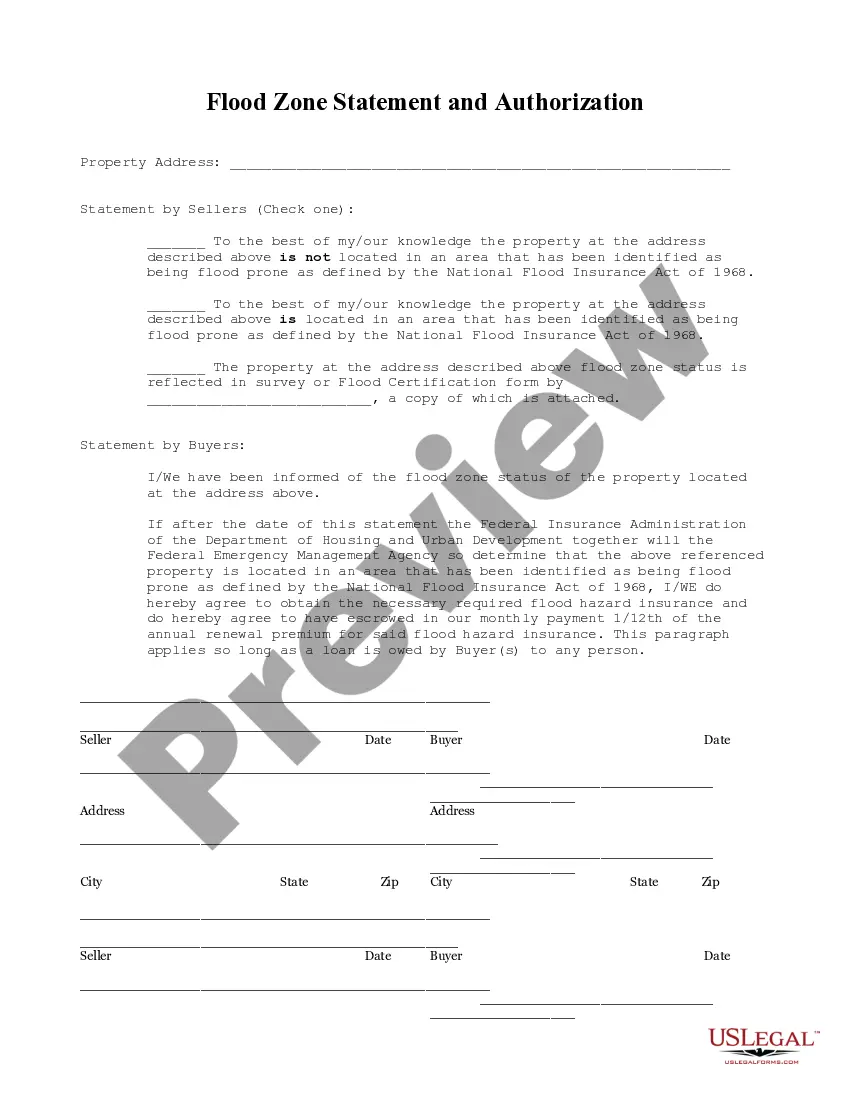

This Flood Zone Statement and Authorization form is for seller(s) to sign, stating the flood zone status of the property and for the buyers to acknowledge the same and state that should the property ever be determined to be in a flood zone, that they will obtain flood insurance.

Tennessee Flood Zone Statement and Authorization

Description

How to fill out Tennessee Flood Zone Statement And Authorization?

Get access to quality Tennessee Flood Zone Statement and Authorization forms online with US Legal Forms. Avoid days of misused time searching the internet and lost money on forms that aren’t up-to-date. US Legal Forms offers you a solution to just that. Get above 85,000 state-specific legal and tax forms that you could save and complete in clicks in the Forms library.

To receive the example, log in to your account and then click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- See if the Tennessee Flood Zone Statement and Authorization you’re considering is appropriate for your state.

- Look at the form utilizing the Preview option and read its description.

- Go to the subscription page by clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to complete making an account.

- Pick a preferred file format to save the file (.pdf or .docx).

Now you can open up the Tennessee Flood Zone Statement and Authorization template and fill it out online or print it and get it done yourself. Consider mailing the file to your legal counsel to be certain everything is filled out correctly. If you make a error, print and fill application again (once you’ve registered an account all documents you download is reusable). Create your US Legal Forms account now and access far more templates.

Form popularity

FAQ

According to FEMA and the National Flood Insurance Program, any building located in an A or V zone is considered to be in a Special Flood Hazard Area, and is lower than the Base Flood Elevation.Flood insurance is mandatory in V zone areas.

Flood Zone A. Areas subject to inundation by the 1-percent-annual-chance flood event generally determined using approximate methodologies. Flood Zone AE, A1-30. Flood Zone AH. Flood Zone AO. Flood Zone AR. Flood Zone A99. Flood Zone V. Flood Zone VE, V1-30.

Summary: Proximity to a flood zone lowers property values. The findings indicate that the price of a residential property located within a floodplain is significantly lower than an otherwise similar house located outside the flood zone.

Evidence of flood insurance Completed and executed NFIP Flood Insurance Application PLUS a copy of the Borrower's premium check or agent's paid receipt.

Petersburg, Florida-headquartered Wright National Flood Insurance Company, says buying a home in a non-SFHA flood zone can be worth it, too, provided you have flood coverage intact, even if it's not required. Everyone should have flood coverage, says Templeton-Jones.

1Your local floodplain manager: Your local floodplain manager may already have a certificate on file.2The seller of your property: If you're buying a property, the sellers may already have the certificate, and you can ask them for it before purchasing.What Is An Elevation Certificate for Flood Insurance? - ValuePenguin\nwww.valuepenguin.com > elevation-certificate-flood-insurance

Zone A. Zone A is the flood insurance rate zone that corresponds to the I-percent annual chance floodplains that are determined in the Flood Insurance Study by approximate methods of analysis.

After a house is flooded, there's a sudden loss of real estate liquidity and then a subsequent, gradual accumulation of liquidity. In other words, the decrease in home value is impermanent. It's more broadly impacted by the location of the home itself and its proximity to or within a floodplain.

Compared to selling other types of properties, selling a property in a flood zone is always more difficult. These properties are located in areas that FEMA considers high risk due to their risk of flooding and low elevation.