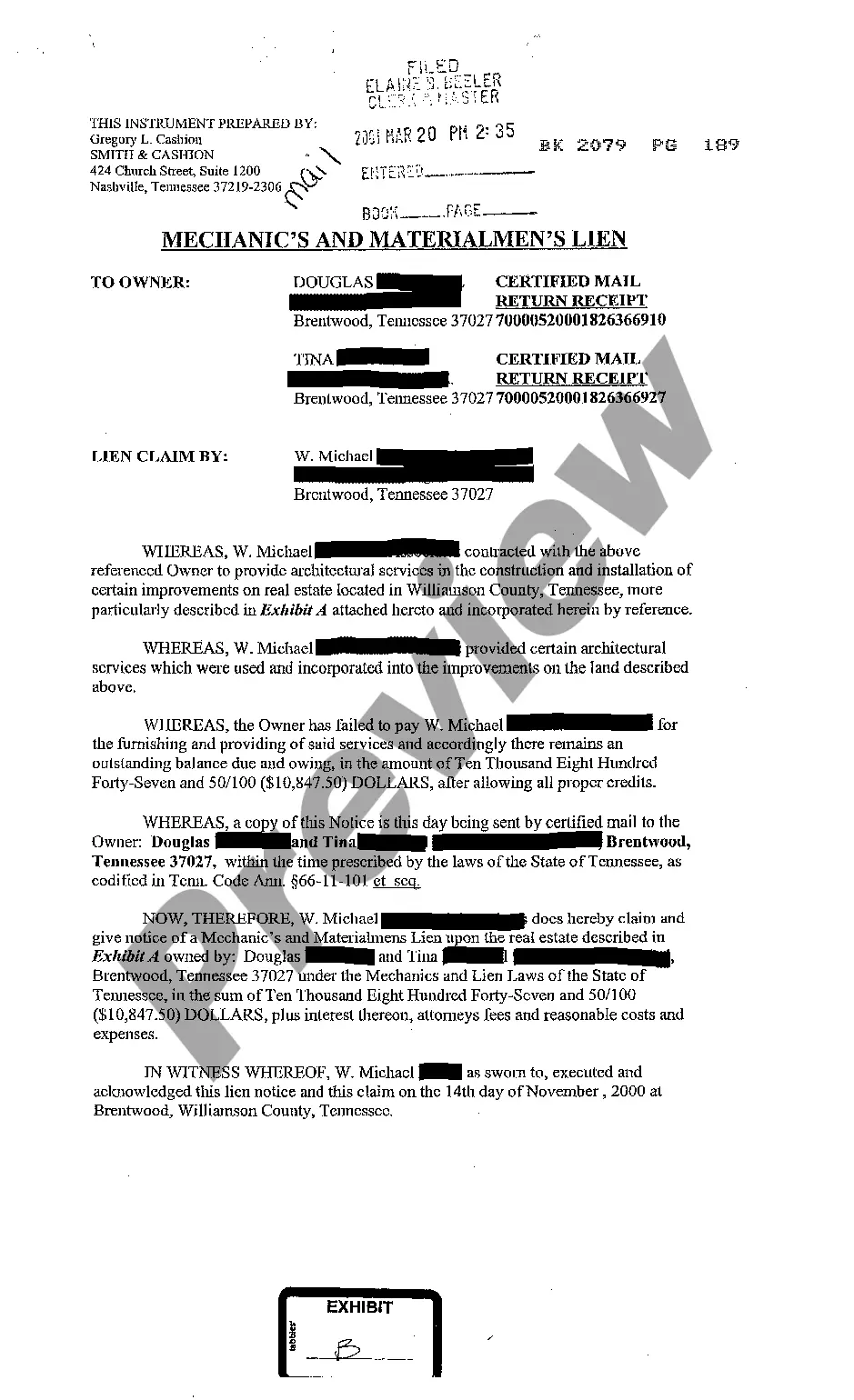

Tennessee Copy of Invoice for Services

Description

How to fill out Tennessee Copy Of Invoice For Services?

Get access to high quality Tennessee Copy of Invoice for Services forms online with US Legal Forms. Steer clear of hours of wasted time browsing the internet and dropped money on documents that aren’t updated. US Legal Forms offers you a solution to exactly that. Get around 85,000 state-specific authorized and tax forms that you could download and fill out in clicks within the Forms library.

To find the example, log in to your account and click Download. The file will be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- Check if the Tennessee Copy of Invoice for Services you’re looking at is suitable for your state.

- See the sample using the Preview option and browse its description.

- Check out the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay out by credit card or PayPal to complete making an account.

- Choose a preferred file format to download the file (.pdf or .docx).

You can now open up the Tennessee Copy of Invoice for Services example and fill it out online or print it out and do it yourself. Think about giving the file to your legal counsel to make certain everything is completed appropriately. If you make a error, print and fill application again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and access more templates.

Form popularity

FAQ

Tennessee requires businesses to collect sales tax on the sale of digital goods or services.

Business tax can be filed and paid online using the Tennessee Taxpayer Access Point (TNTAP). A TNTAP logon should be created to file this tax. Click here for help creating your logon.

Step 1Collect your records. Gather all business records. Step 2Find the right form. Determine the correct IRS tax form. Step 3Fill out your form. Fill out your Schedule C or Form 1120. Step 4Pay attention to deadlines. Be aware of different filing deadlines.

The State of Tennessee requires you to file an annual report for your LLC. You can mail in the report or complete it online at the Secretary of State website. You can download an annual report form already containing key information for your LLC from the SOS website.

Tennessee's excise tax, which effectively is an income tax, is a flat 6.5% tax on net earnings from doing business in the state.

Overview. Generally, if you conduct business within any county and/or incorporated municipality in Tennessee, then you should register for and remit business tax. Business tax consists of two separate taxes: the state business tax and the city business tax.

Tangible personal property, taxable services, amusements, and digital products specifically intended for resale are not subject to tax. Retail sales to the federal government or its agencies and the State of Tennessee or a county or municipality within Tennessee are not subject to tax.

What Businesses Are Subject to the Business Tax? The business tax is imposed generally on anyone delivering goods or services to Tennessee customers, but a number of activities and entities are specifically exempted. For example, taxpayers are exempt from the business tax if they generate less than $10,000 in sales.