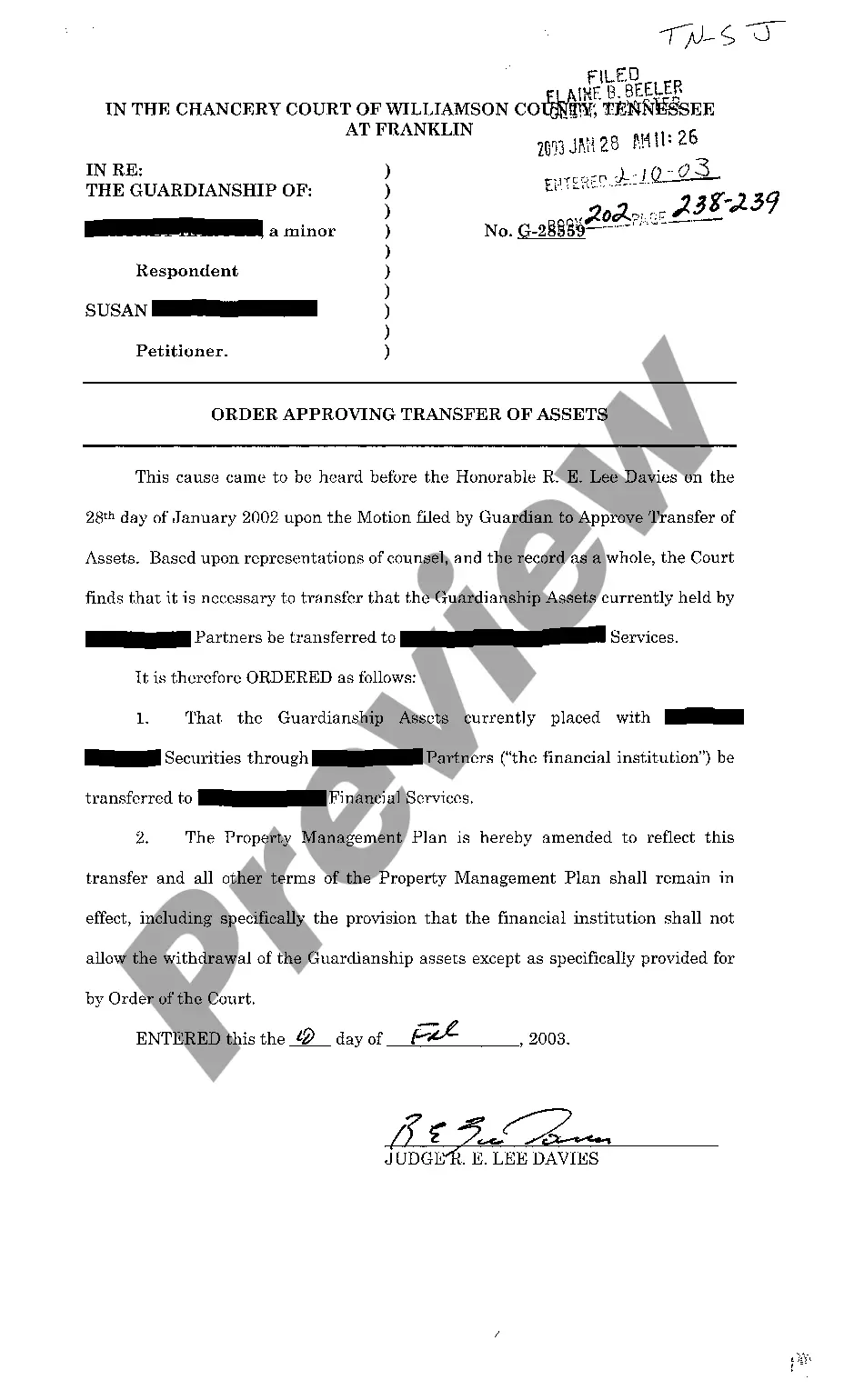

Tennessee Order Approving Transfer of Assets

Description Transfer On Death Deed Tennessee Form

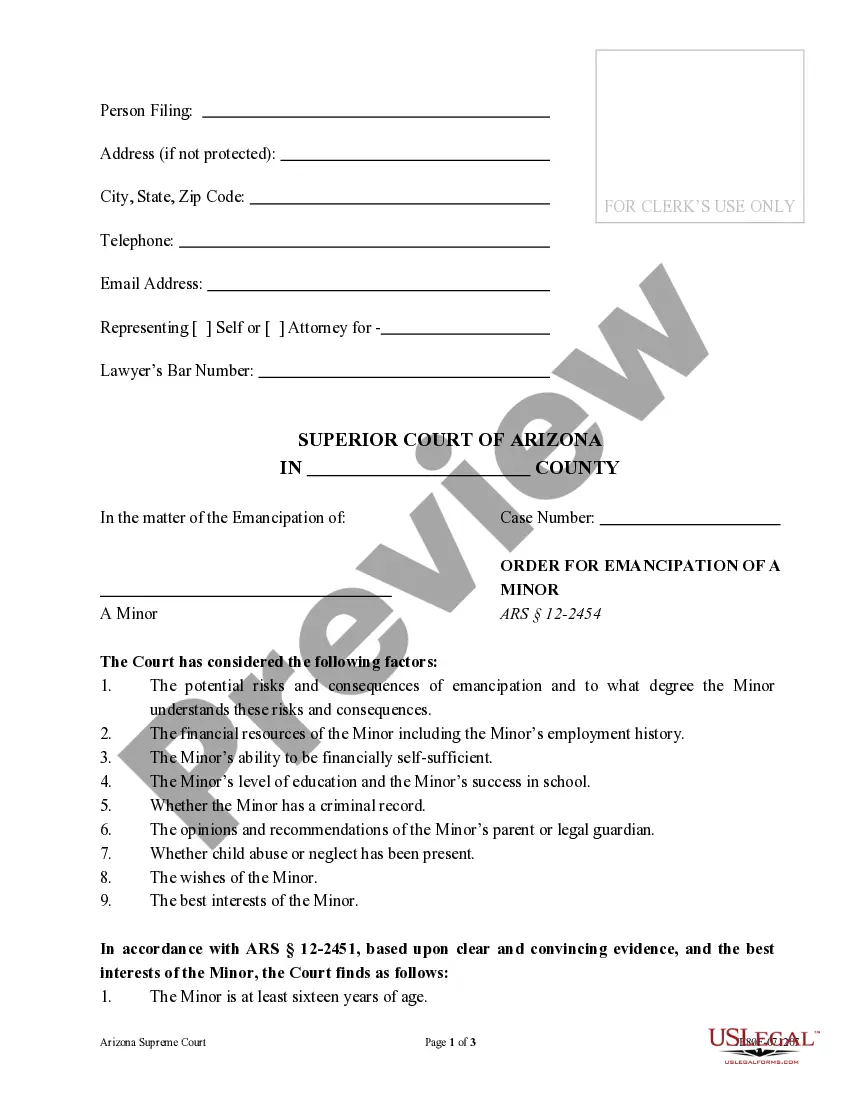

How to fill out Tennessee Order Approving Transfer Of Assets?

Get access to quality Tennessee Order Approving Transfer of Assets templates online with US Legal Forms. Steer clear of hours of misused time searching the internet and dropped money on files that aren’t updated. US Legal Forms provides you with a solution to exactly that. Find around 85,000 state-specific authorized and tax samples that you could save and complete in clicks in the Forms library.

To receive the sample, log in to your account and click Download. The document is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Verify that the Tennessee Order Approving Transfer of Assets you’re looking at is suitable for your state.

- View the form making use of the Preview option and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to go on to sign up.

- Pay out by card or PayPal to finish making an account.

- Choose a preferred format to save the document (.pdf or .docx).

You can now open the Tennessee Order Approving Transfer of Assets example and fill it out online or print it out and get it done by hand. Take into account mailing the papers to your legal counsel to make certain all things are filled out appropriately. If you make a mistake, print and complete sample once again (once you’ve registered an account all documents you download is reusable). Create your US Legal Forms account now and access more forms.

Form popularity

FAQ

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

After the Grant of Probate has been issued, our Probate Solicitors estimate that for a straightforward estate, it will take another 3 to 6 months before the funds can be distributed to the beneficiaries.

States that allow TOD deeds are Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, Washington, West Virginia,

Because transfer-on-death beneficiary deeds do not become effective until you pass away, someone can challenge the validity of the deed after you die. For example, someone can aruge that you lacked capacity to create a valid deed. Or, beneficiaries and family members can sue each other to take the property entirely.

Generally, in Tennessee, probate can take anywhere from six months to a year. However, the process can take longer if there is a dispute over the deceased person's will or any unusual assets or debts involved.

After someone dies, it can be a number of months before the assets are distributed to the beneficiaries. If a Grant of Probate is necessary, the Supreme Court needs to be informed of the current assets and liabilities of the deceased before probate can occur.

Benefits of a California TOD Deed Form Probate Avoidance A transfer-on-death deed allows homeowners to avoid probate at death.Saving Legal Fees Although the goals of a transfer-on-death deed could also be accomplished with a living trust, a transfer-on-death deed provides a less expensive alternative.

Tennessee does not allow real estate to be transferred with transfer-on-death deeds.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.