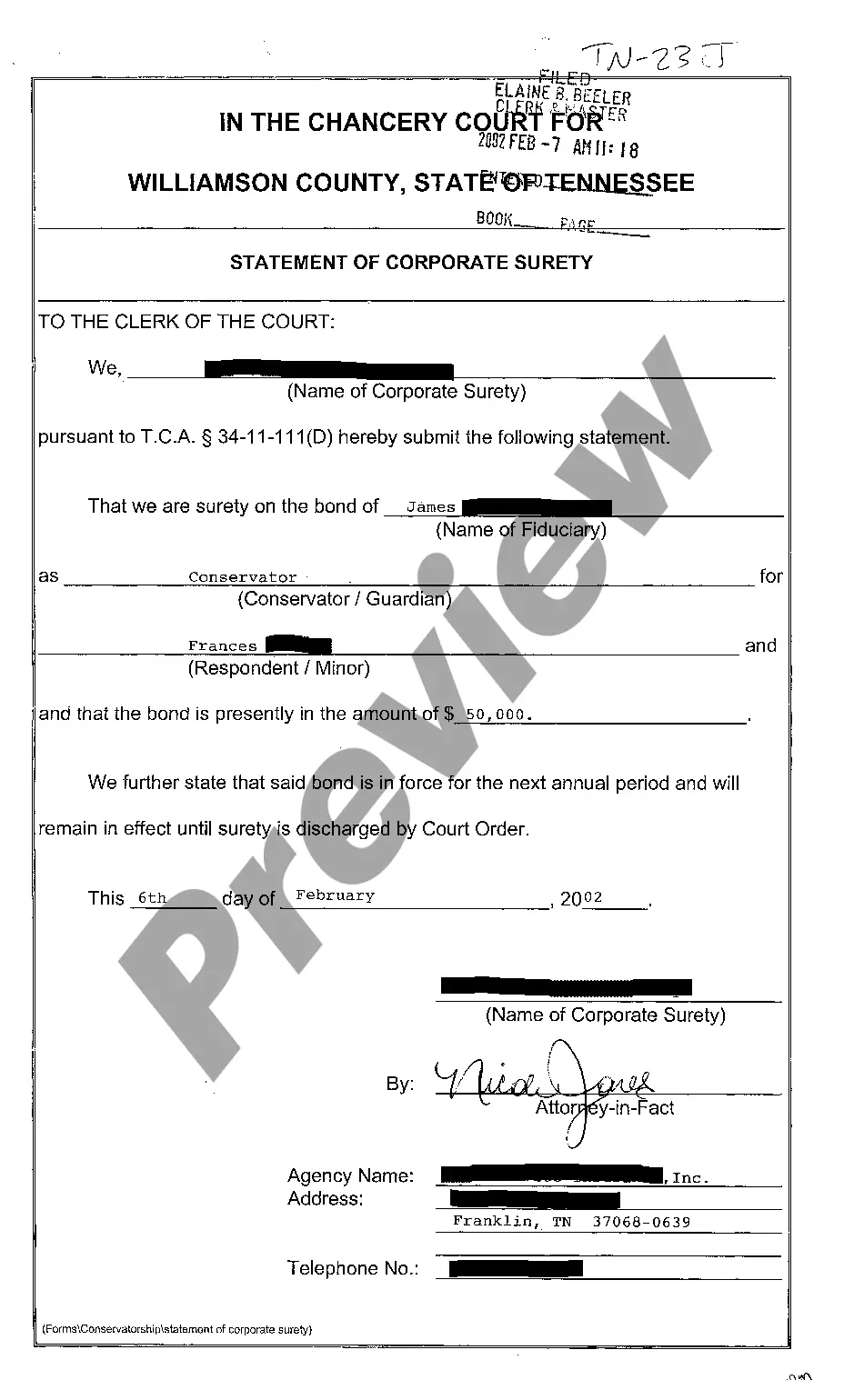

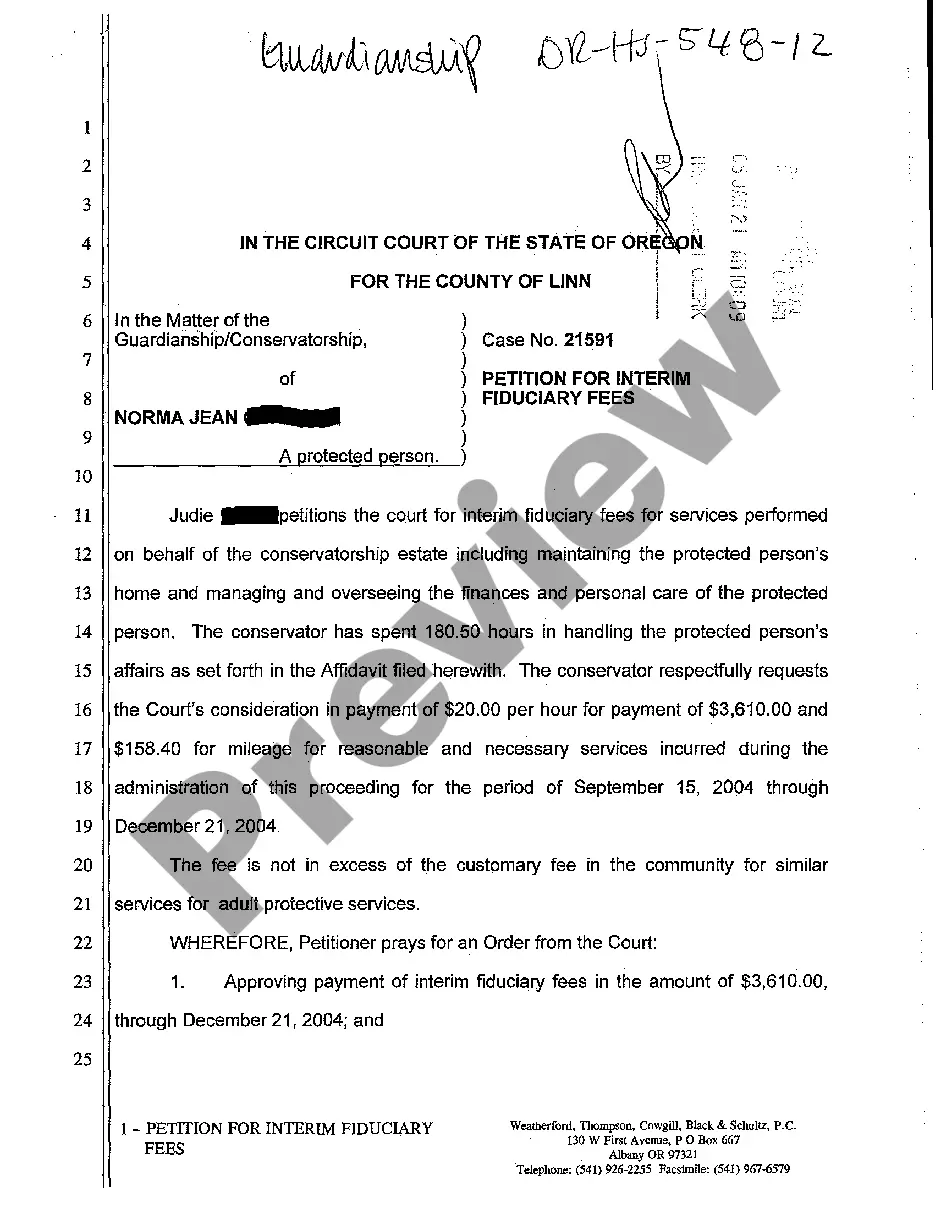

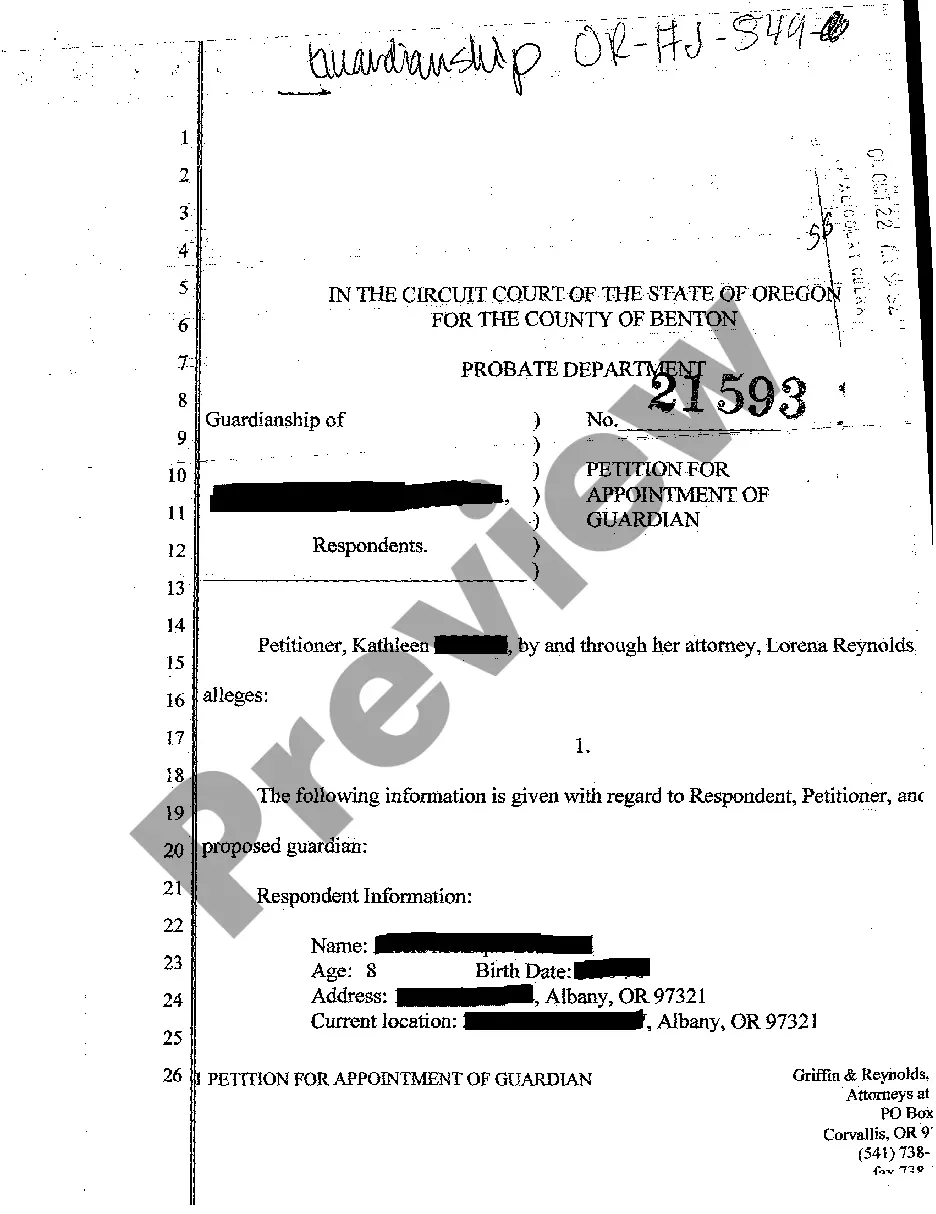

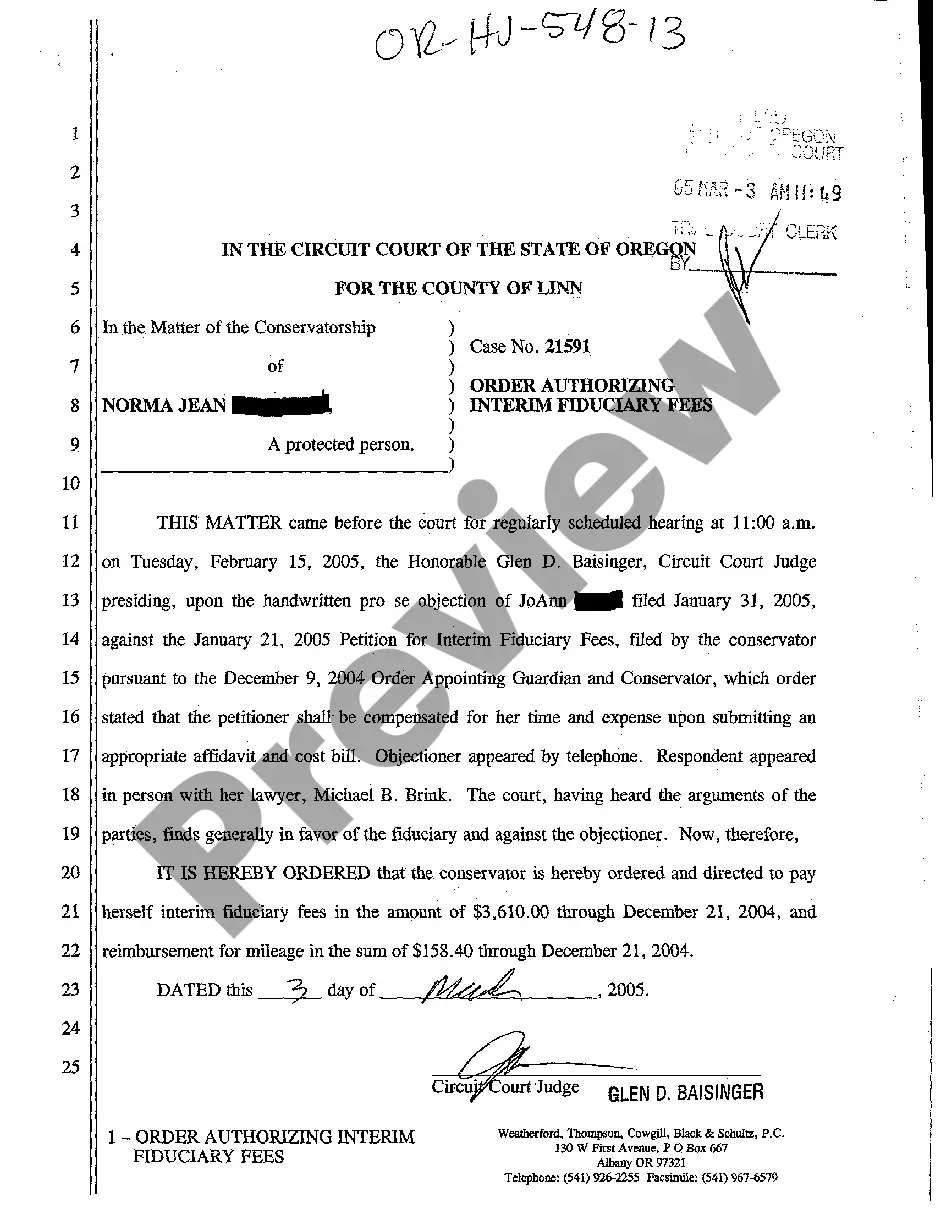

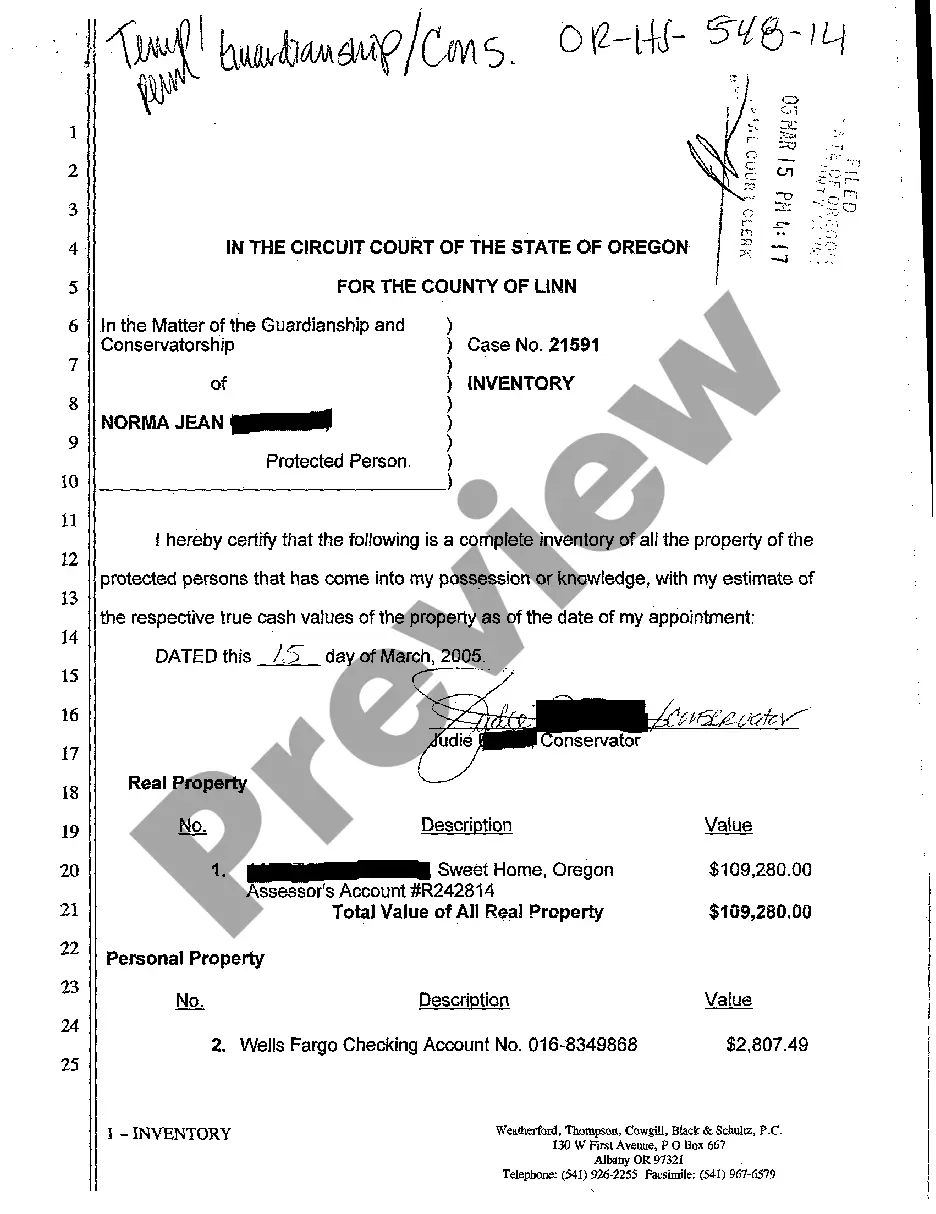

Tennessee Statement of Corporate Surety

Description

How to fill out Tennessee Statement Of Corporate Surety?

Access to quality Tennessee Statement of Corporate Surety forms online with US Legal Forms. Avoid days of wasted time seeking the internet and lost money on documents that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Find above 85,000 state-specific authorized and tax templates that you can download and complete in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The file will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- Check if the Tennessee Statement of Corporate Surety you’re considering is appropriate for your state.

- View the form using the Preview function and browse its description.

- Visit the subscription page by simply clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay by card or PayPal to complete creating an account.

- Choose a favored format to download the document (.pdf or .docx).

You can now open up the Tennessee Statement of Corporate Surety template and fill it out online or print it and do it by hand. Consider mailing the file to your legal counsel to make sure all things are filled in appropriately. If you make a mistake, print out and complete application again (once you’ve registered an account every document you save is reusable). Create your US Legal Forms account now and access much more samples.

Form popularity

FAQ

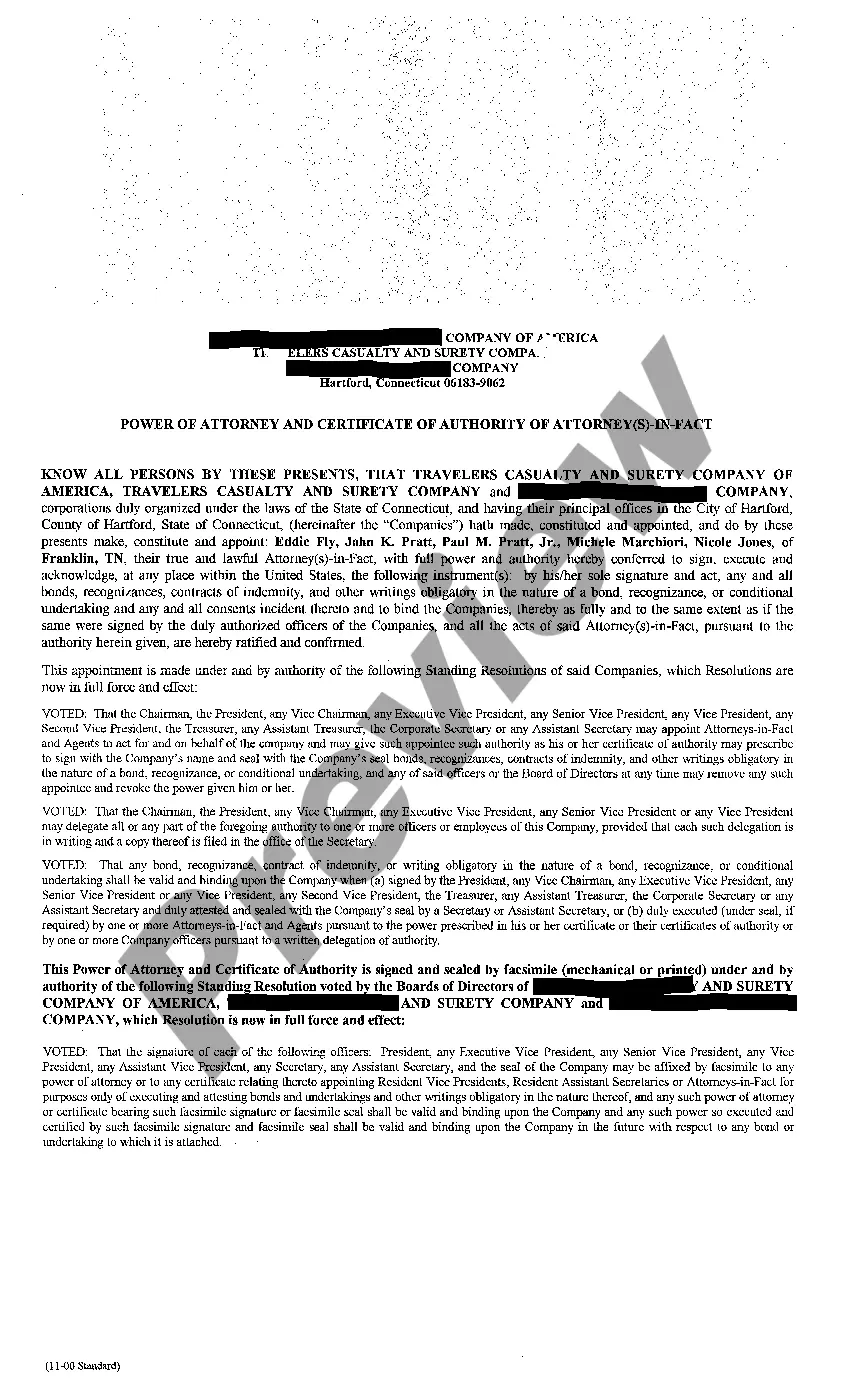

A firm called a "surety company" guarantees that a business corporation called a "principal" will carry out an obligation to a third party, called an "obligee." Two examples of such obligations include: A contractor constructing a site according to the contract specifications for the owner.

Tennessee is a growing state: many different industries require surety bonds to support the growth of an economy based on agriculture, textiles, and electricity generation. A surety bond is a contract that guarantees you will fulfill your obligations and follow the rules of your industry.

Corporate surety. Any domestic or foreign corporation, licensed as a surety in accordance with law and currently authorized to act as such, may provide bail by a bond subscribed jointly by the accused and an officer of the corporation duly authorized by its board of directors.

A surety is an organization or person that assumes the responsibility of paying the debt in case the debtor policy defaults or is unable to make the payments. The party that guarantees the debt is referred to as the surety, or as the guarantor.

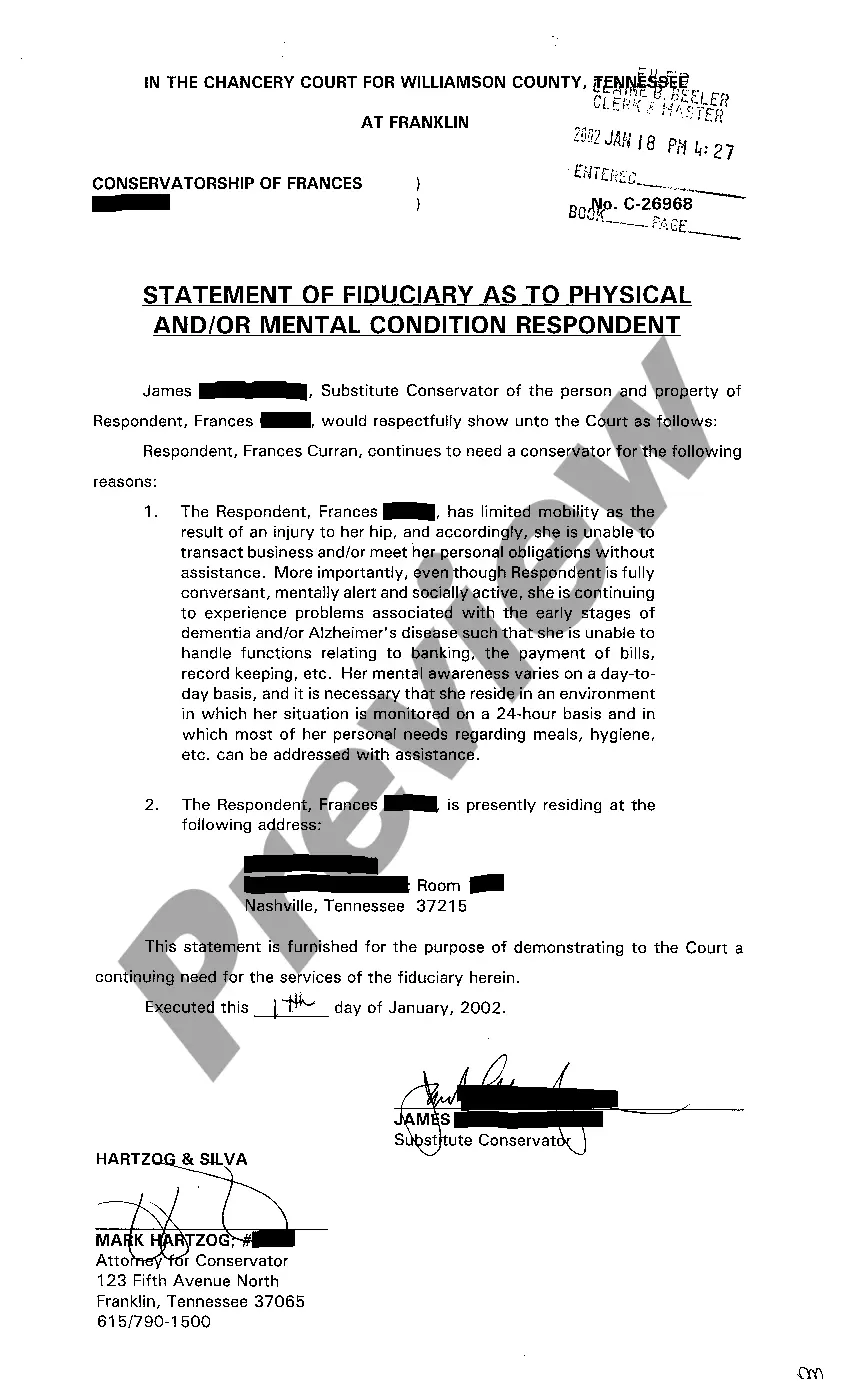

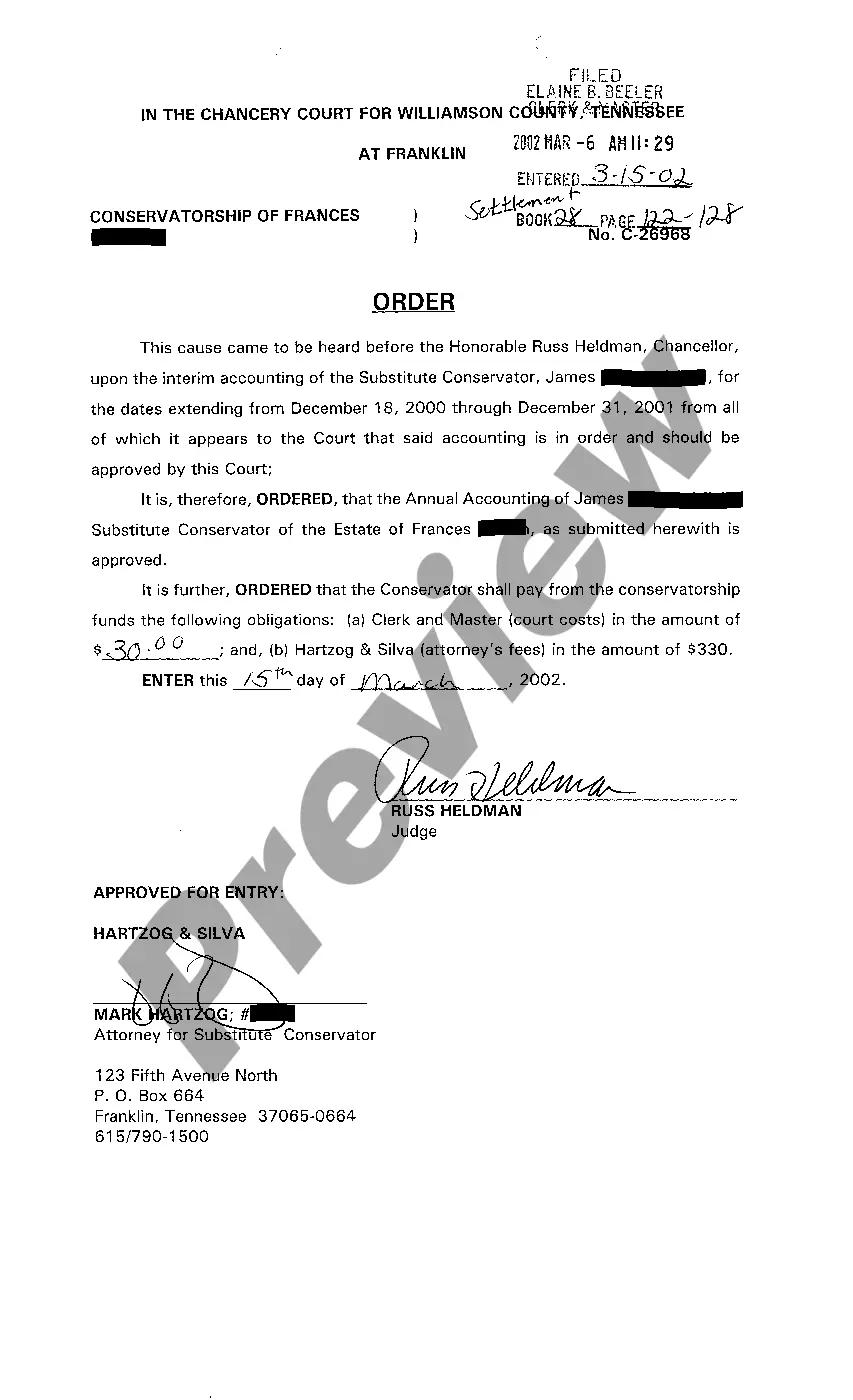

A surety bond protects executors and administrators of an estate if a claim of wrongdoing is made against them during the probate process. When a person dies, it becomes the designated executor or administrator's responsibility to navigate the estate through the probate process properly.

If your clients need reassurance that your business will follow through on its commitments, you might need a surety bond. A surety bond is an agreement that promises you will follow through with your commitments. If you fail to follow through on your commitments, the surety bond is there to protect your clients.

To verify the bond, you will need to contact the Surety and provide them with a scanned copy of the bond with your inquiry. If you do not have a copy, The Surety & Fidelity Association of America (SFAA) has provided a link to their Bond Authenticity Inquiry Form to supply the appropriate information.

Licensed. Ask if the business is licensed and, if so, with whom. Then contact the licensing agency to confirm. Insured. Ask the company to have its agent send a Certificate of Insurance directly to you. Bonded. Bonding is often a misunderstood and unique insurance product.

The bondability letter provides the owner with an assurance that the contractor has been underwritten and approved by a surety company for support of a specific project.The bondability letter is issued for no cost (it is regarded as a standard service provided by the bond agent).