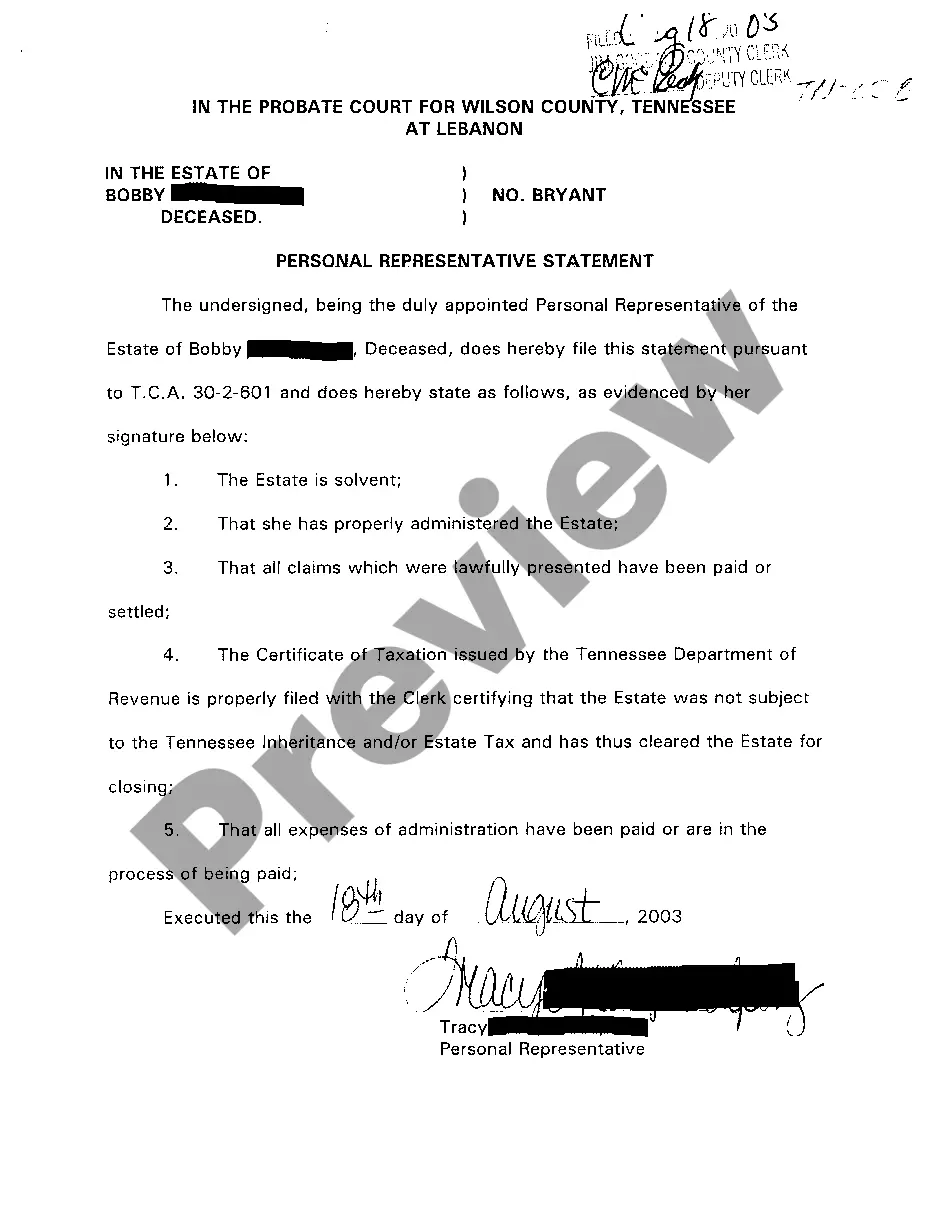

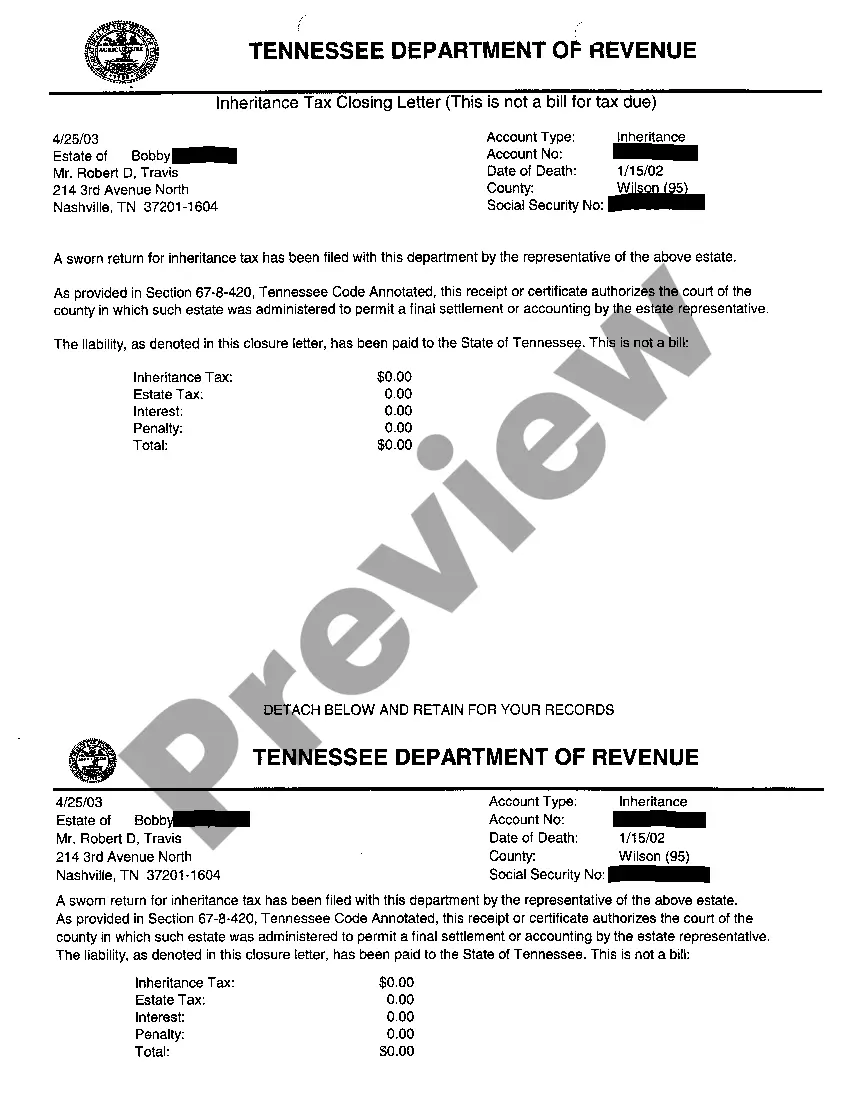

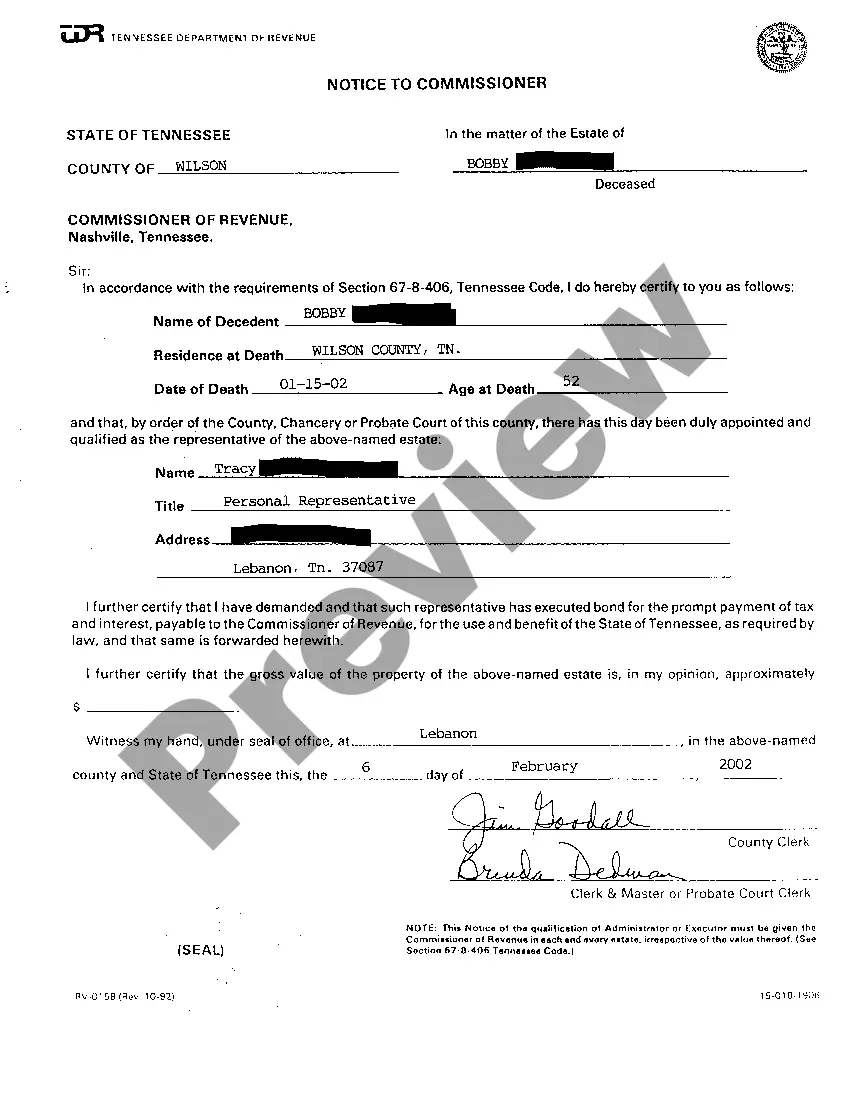

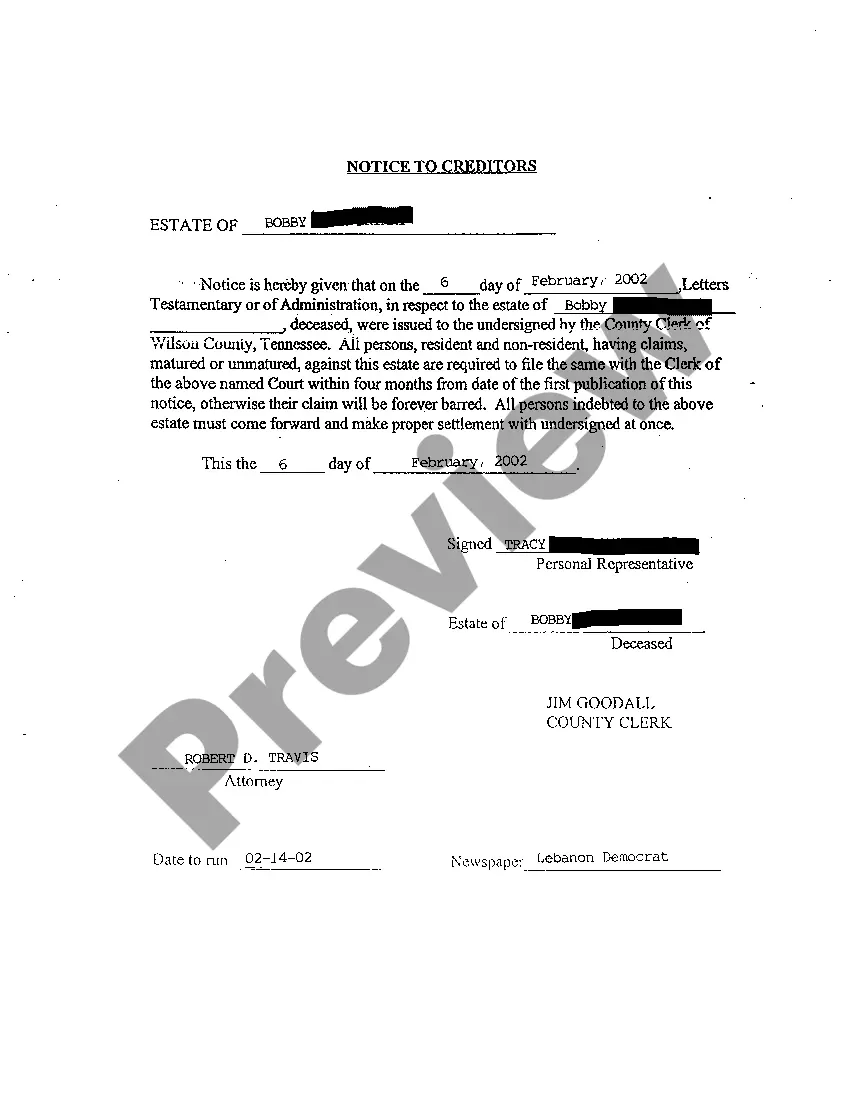

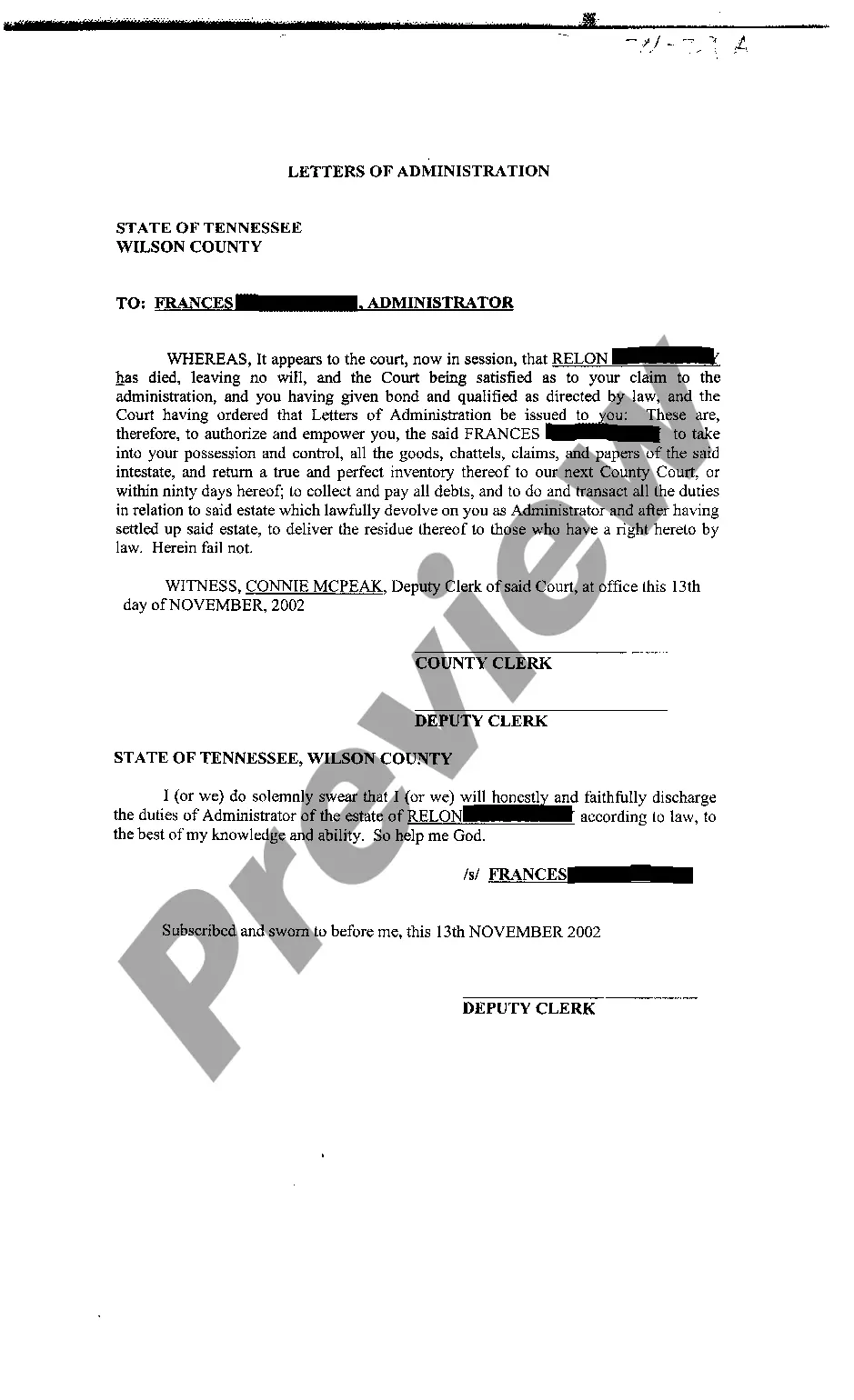

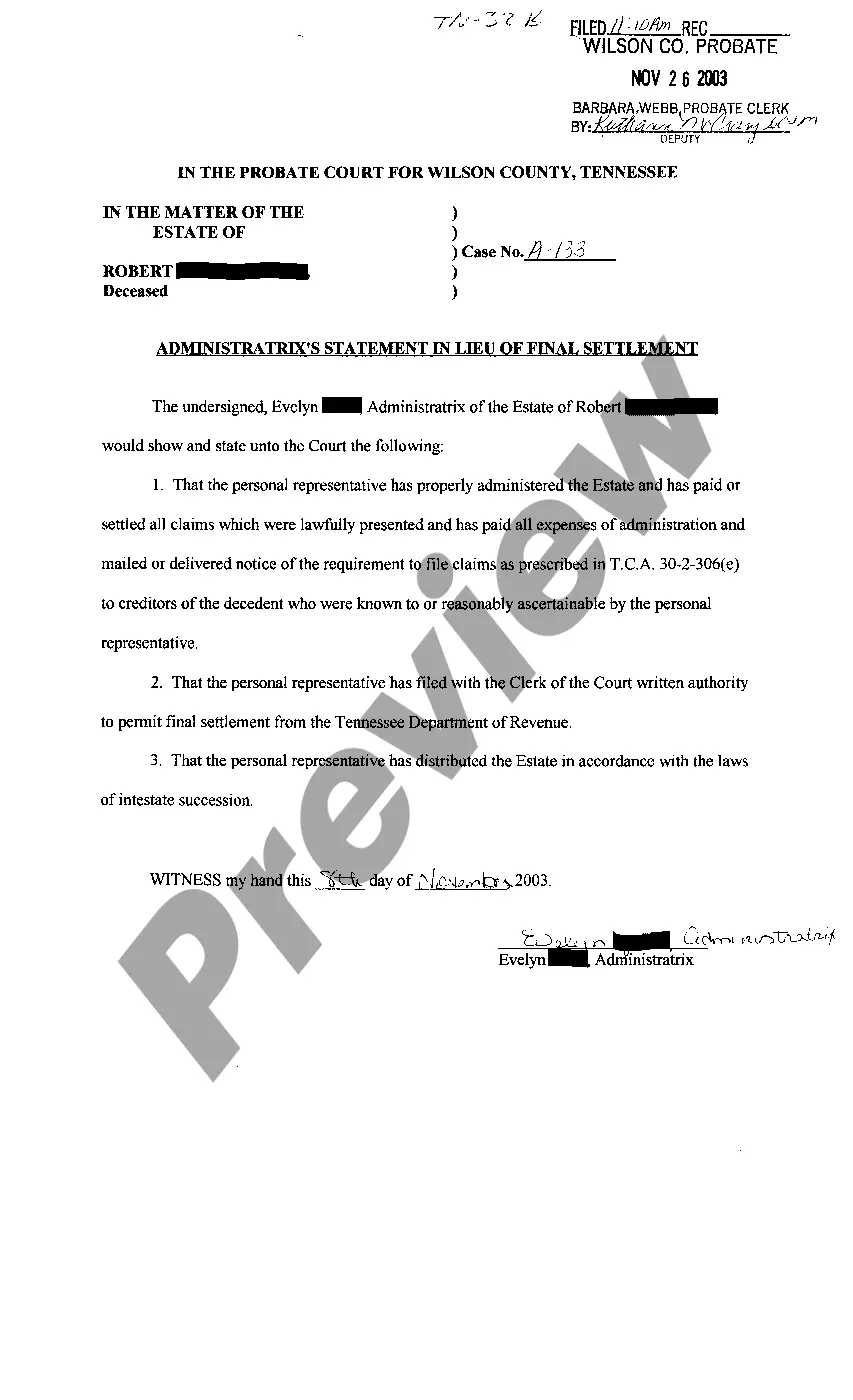

Tennessee Personal Representative Statement

Description

How to fill out Tennessee Personal Representative Statement?

Get access to top quality Tennessee Personal Representative Statement templates online with US Legal Forms. Avoid days of wasted time seeking the internet and lost money on files that aren’t updated. US Legal Forms provides you with a solution to exactly that. Find over 85,000 state-specific legal and tax forms that you could download and submit in clicks within the Forms library.

To find the example, log in to your account and click Download. The file will be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Verify that the Tennessee Personal Representative Statement you’re looking at is appropriate for your state.

- View the form using the Preview function and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to finish making an account.

- Choose a favored format to download the file (.pdf or .docx).

Now you can open up the Tennessee Personal Representative Statement sample and fill it out online or print it and do it by hand. Take into account giving the document to your legal counsel to make sure all things are filled in properly. If you make a mistake, print and fill sample once again (once you’ve registered an account every document you download is reusable). Make your US Legal Forms account now and get access to a lot more templates.

Form popularity

FAQ

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

5% on the first $20K. 4% on the next $80K. 3% on the next $150K. 2% on the next $500K.

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

This four-month period must pass before the estate can be closed. Even under the best of circumstances, a simple estate will usually take at least six months to close.

Executor's remuneration: 3.5% calculated on the gross value of assets as at death. income collection fee: 6% calculated on all post-death revenue.

Some probate specialists and solicitors charge an hourly rate while others charge a fee that is a percentage of the value of the estate. This fee is usually calculated as between 1% to 5% of the value of the estate, plus VAT. The table below is an example of how much you could end up paying for their service.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.