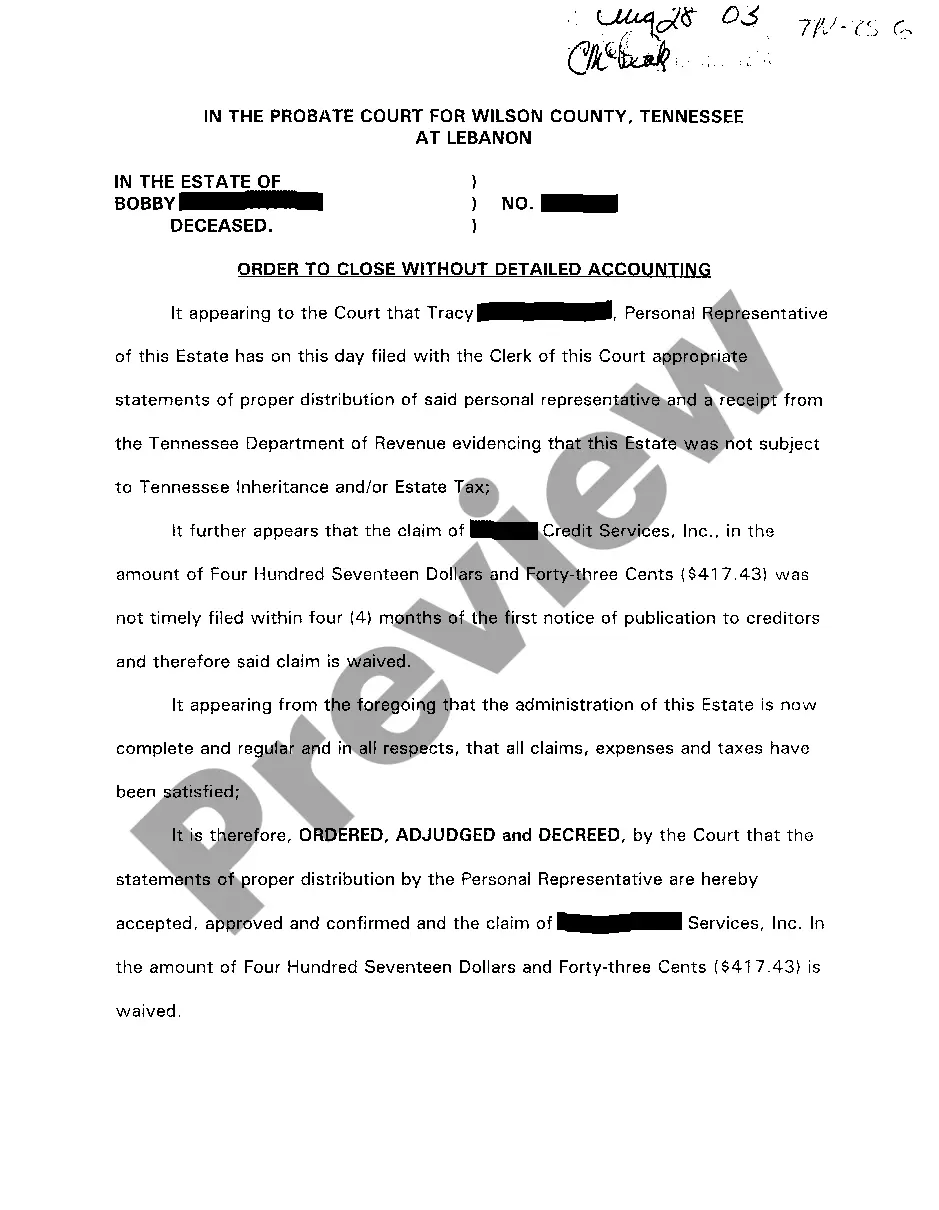

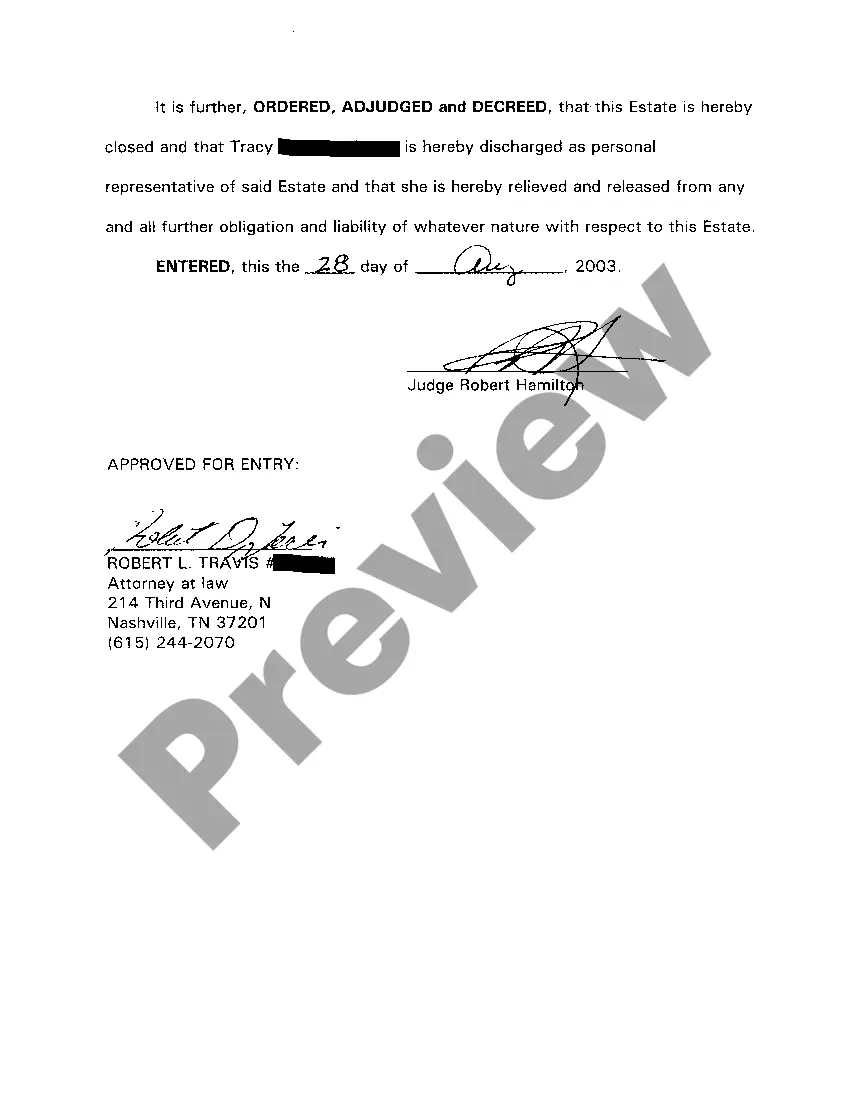

Tennessee Order To Close Without Detailed Accounting

Description

How to fill out Tennessee Order To Close Without Detailed Accounting?

Get access to high quality Tennessee Order To Close Without Detailed Accounting forms online with US Legal Forms. Avoid days of wasted time browsing the internet and lost money on documents that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Find above 85,000 state-specific authorized and tax samples that you can download and complete in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The file will be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide listed below to make getting started simpler:

- Find out if the Tennessee Order To Close Without Detailed Accounting you’re looking at is suitable for your state.

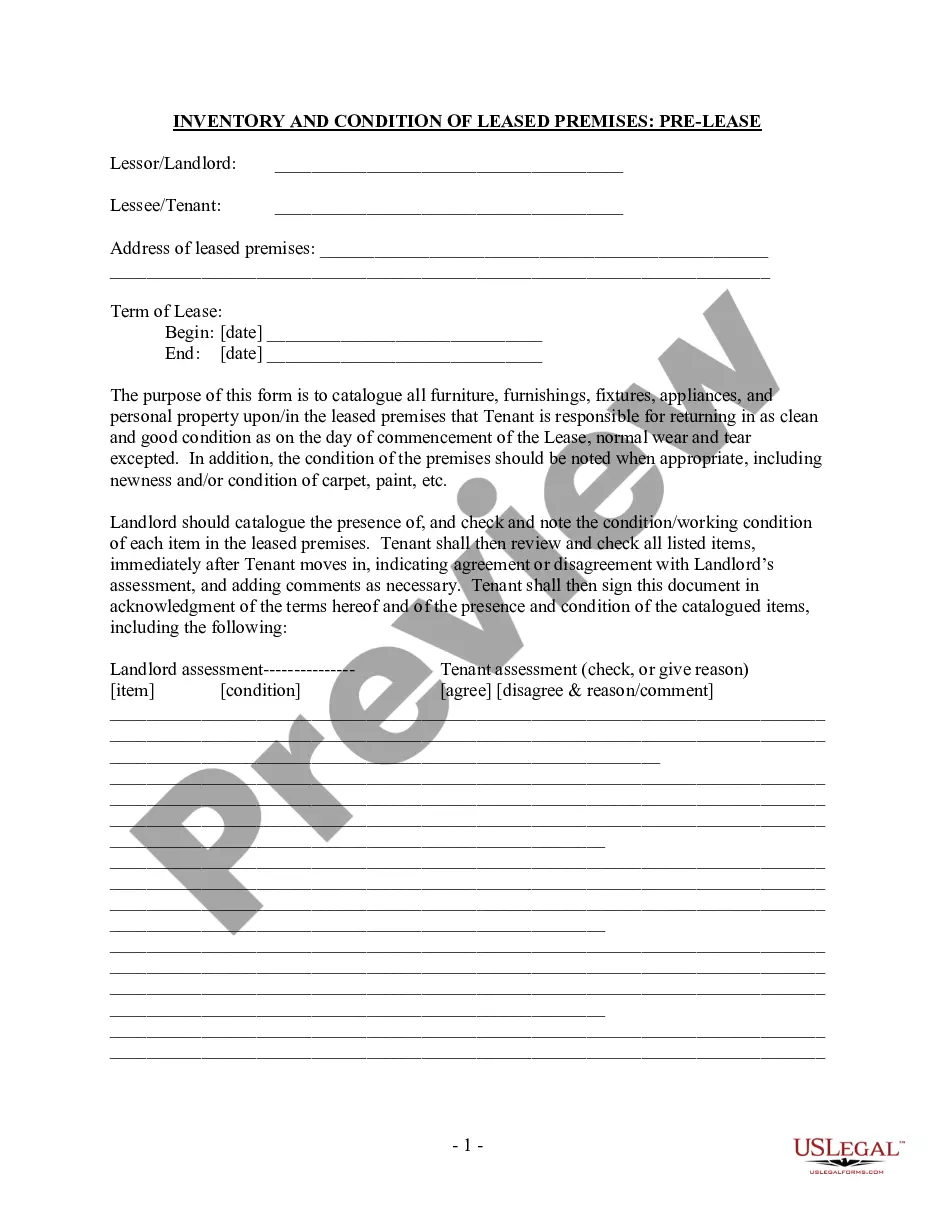

- View the sample making use of the Preview function and read its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to finish making an account.

- Choose a favored format to download the file (.pdf or .docx).

You can now open the Tennessee Order To Close Without Detailed Accounting template and fill it out online or print it out and get it done yourself. Take into account giving the file to your legal counsel to make certain all things are filled in correctly. If you make a error, print out and complete application again (once you’ve registered an account every document you save is reusable). Create your US Legal Forms account now and get access to far more templates.

Form popularity

FAQ

If the executor does anything that would constitute a breach of the fiduciary duty, then beneficiaries may petition the probate court to remove the executor. Sometimes a will outlines grounds for the executor's dismissal. If the will is silent, the probate court will make the decision.

The Will must be filed with the probate court in the county where the decedent lived. A Petition for Probate must be filed with the probate court as well. This requests the appointment of an executor.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

This four-month period must pass before the estate can be closed. Even under the best of circumstances, a simple estate will usually take at least six months to close.

Maximum $50,000. Laws Section 30-4-102. Step 1 Write in the name of the decedent. Step 2 Write in your name. Step 3 Write in the following information about the decedent: Step 4 List the creditor, address and amounts of any unpaid debts.

5% on the first $20K. 4% on the next $80K. 3% on the next $150K. 2% on the next $500K.

Real Estate: Muniment of Title is a legal action used to legally transfer clear title of one type of property (for assets such as real estate, a bank account, or a stock account) to a beneficiary. This procedure is appropriate only if the decedent executed a valid Will.