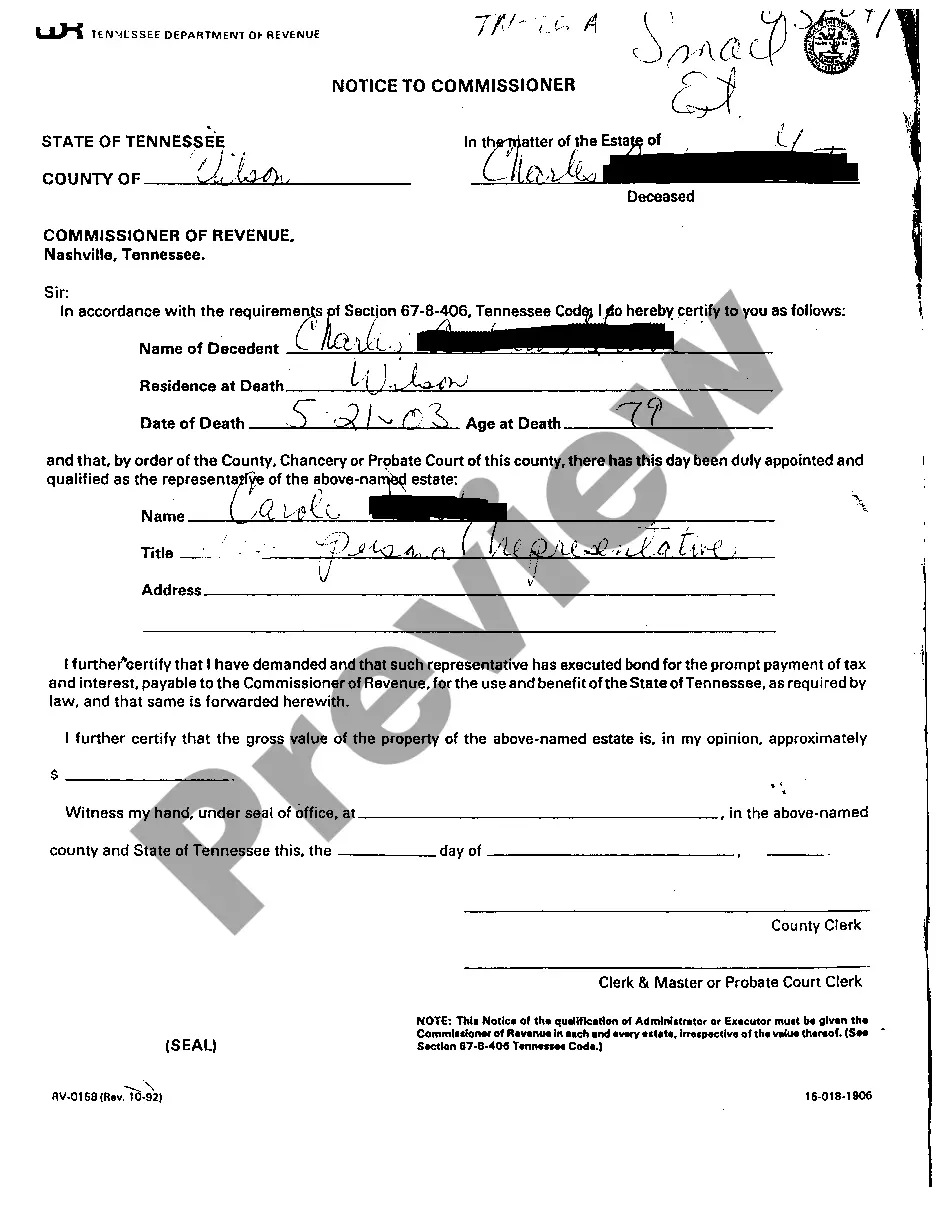

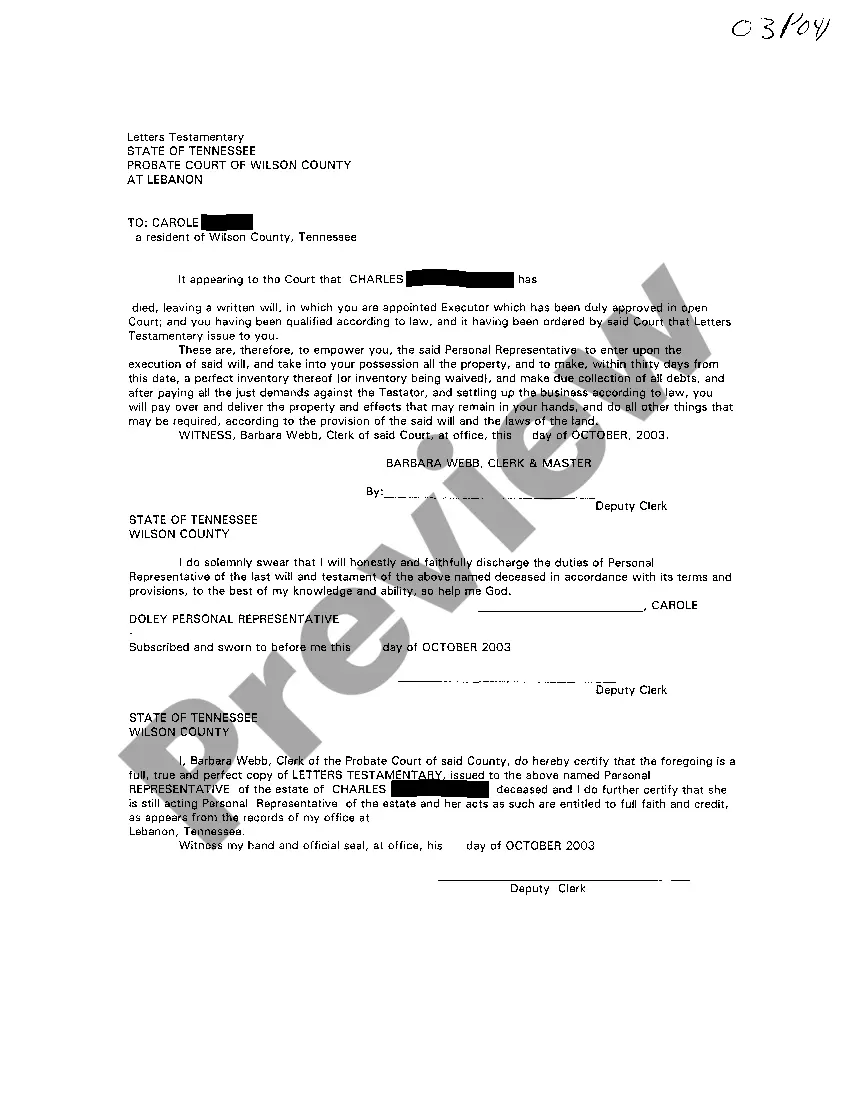

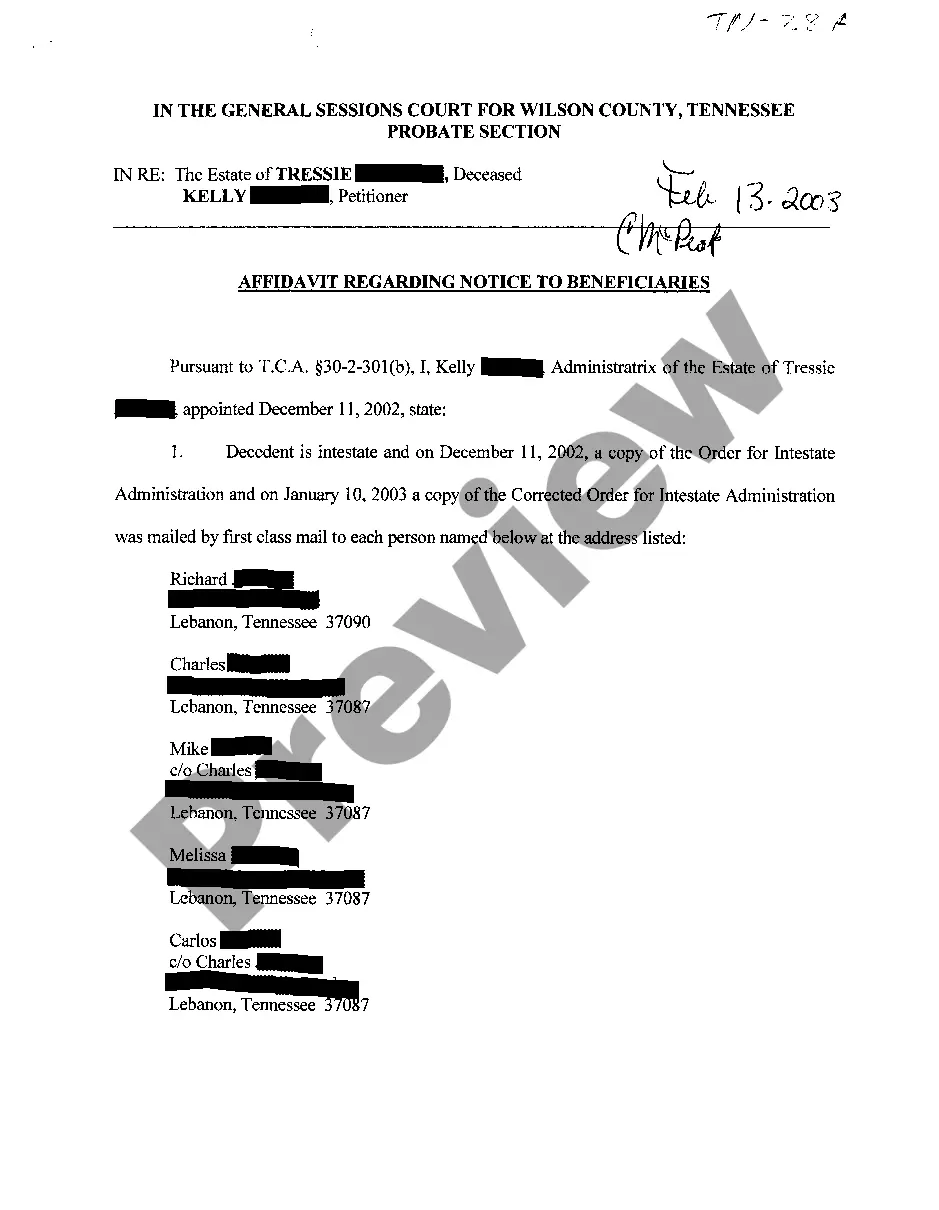

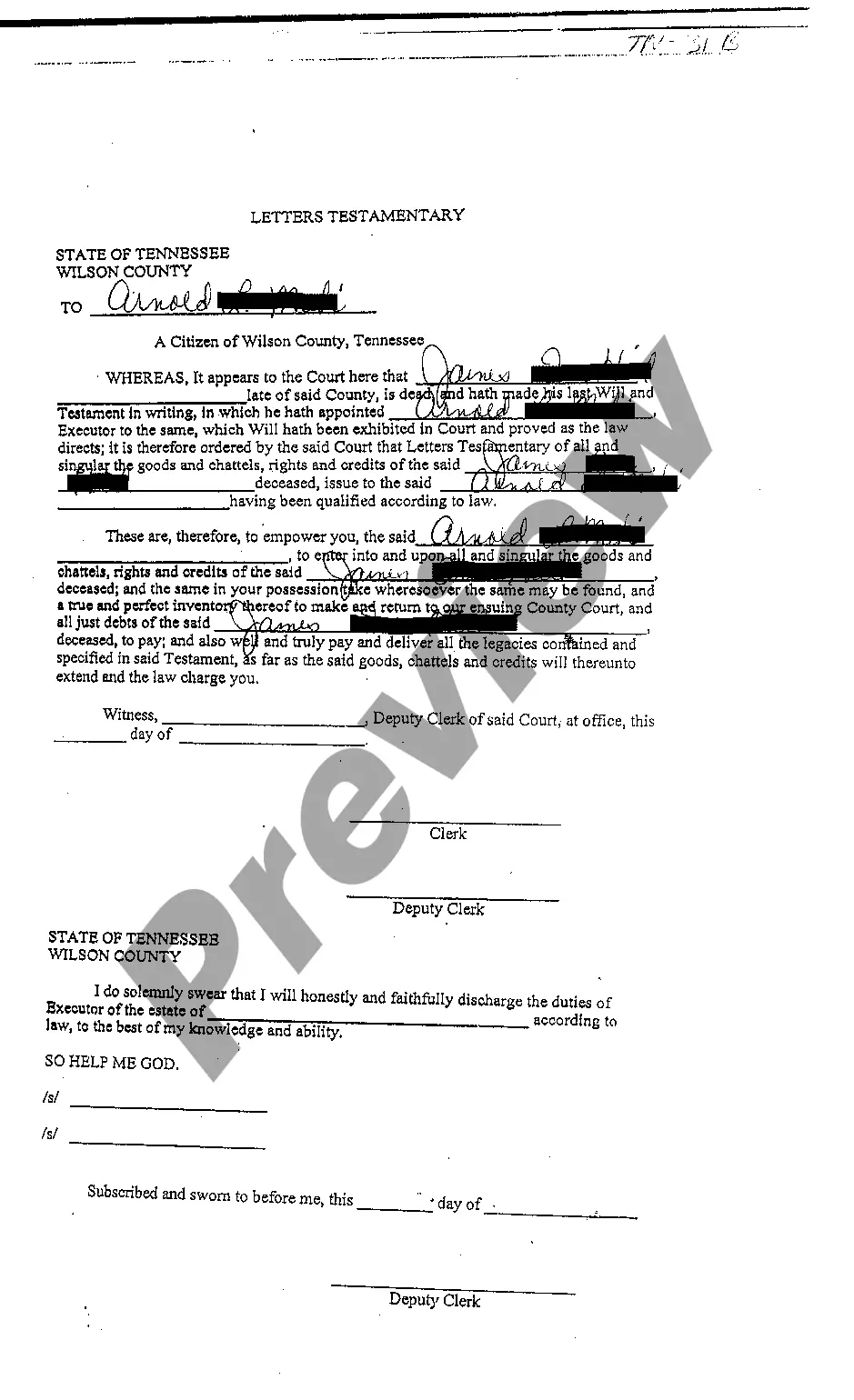

Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated

Description

How to fill out Tennessee Notice To Commissioner Of Revenue That Will Of Deceased Is Being Probated?

Access to top quality Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated forms online with US Legal Forms. Steer clear of days of misused time browsing the internet and dropped money on documents that aren’t updated. US Legal Forms offers you a solution to just that. Get over 85,000 state-specific authorized and tax forms that you can save and submit in clicks within the Forms library.

To get the sample, log in to your account and click on Download button. The file is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

- Verify that the Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated you’re looking at is appropriate for your state.

- Look at the form making use of the Preview function and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay out by card or PayPal to complete creating an account.

- Pick a favored file format to save the file (.pdf or .docx).

Now you can open up the Tennessee Notice To Commissioner of Revenue That Will of Deceased is Being Probated sample and fill it out online or print it and get it done yourself. Take into account giving the document to your legal counsel to be certain things are filled out correctly. If you make a mistake, print and fill application again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and get access to much more templates.

Form popularity

FAQ

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.

Only assets that the deceased person owned in his or her own name, alone, must go through probate. All other assets pass to new owners without oversight from the probate court. Assets that go through probate make up what's called the probate estate.

Routine and simple estates can cost as little as $2000 to $2500. The court costs (fees paid to the clerk) are presently $382.50. This is required to be paid when the estate is started (and can be reimbursed from the decedent's funds).

If an estate doesn't go through probate and it is a necessary process to transfer ownership of assets, the heirs could sue the executor for failing to do their job. The heirs may not receive what they are entitled to. They may be legally allowed to file a lawsuit to get what they are owed.

Tennessee, however, has no statutory time limit for when an executor must submit the will for probate. There is no penalty for not probating a will. That means if the will is never submitted to probate, the assets remain in the decedent's name so long as the estate continues to pay the required taxes.

If the court finds that fraud or undue influence were involved in the creation of your will, it will be deemed invalid. Common situations could include:A family member getting the testator to sign a will by pretending it is just a general legal document that needs a signature.

Probate is the only legal way to transfer the assets of someone who has died. Without probate, titled assets like homes and cars remain in the deceased's name indefinitely. You won't be able to sell them or keep registrations current because you won't have access to the individual's signature and consent.

Simply having a last will does not avoid probate; in fact, a will must go through probate. To probate a will, the document is filed with the court, and a personal representative is appointed to gather the decedent's assets and take care of any outstanding debts or taxes.

In Tennessee, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).