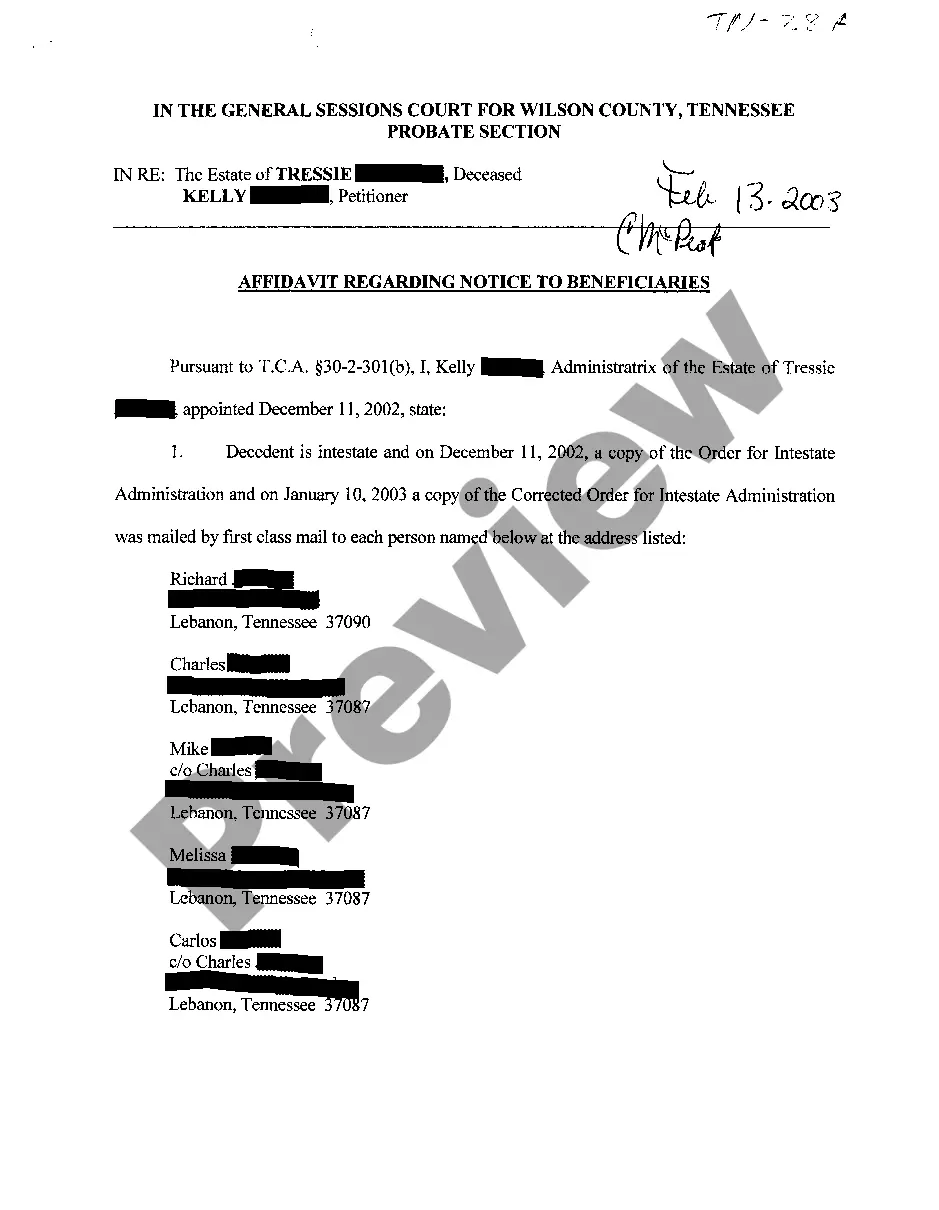

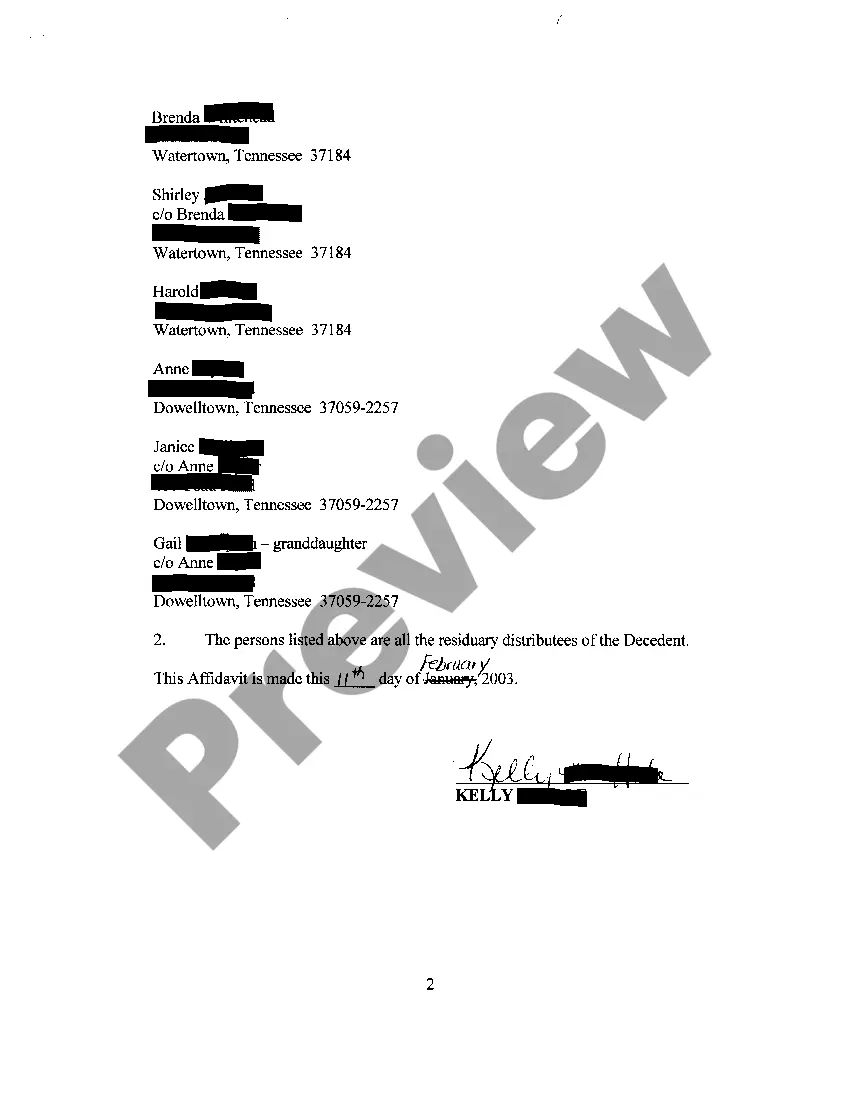

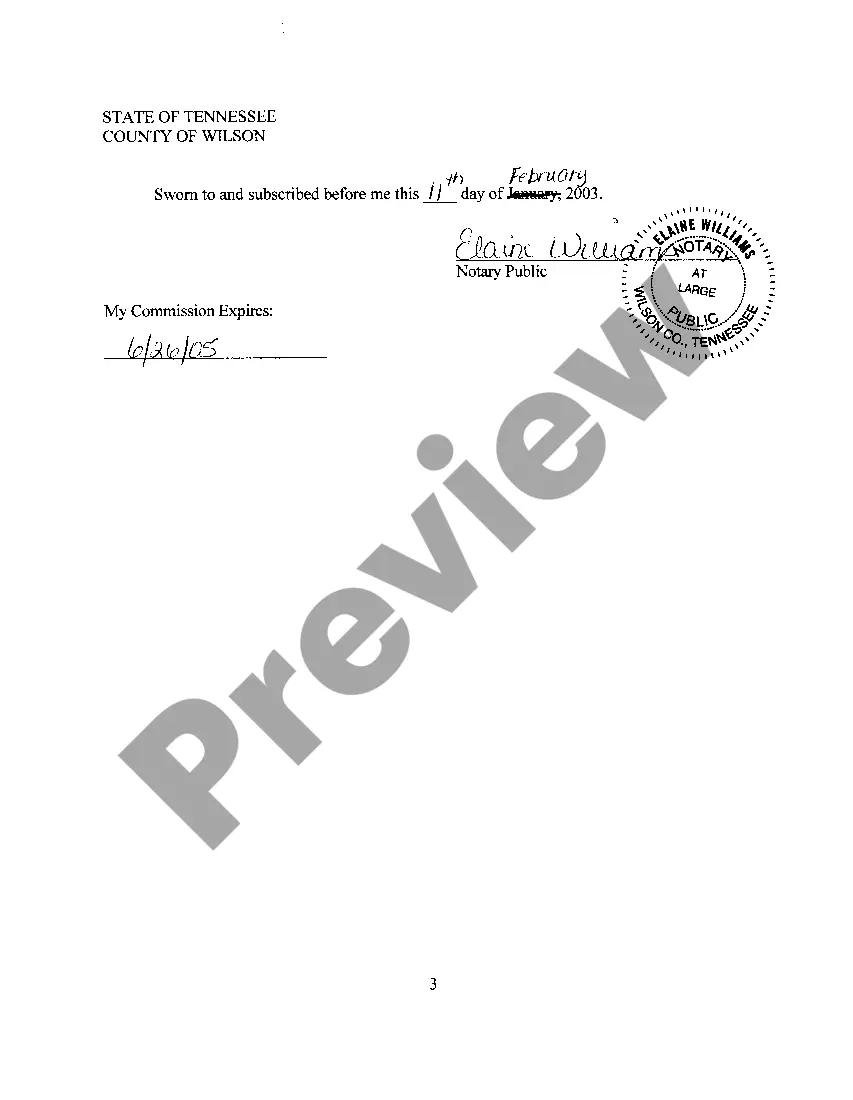

Tennessee Affidavit Regarding Notice To Beneficiaries of Decedent's Estate

Description

How to fill out Tennessee Affidavit Regarding Notice To Beneficiaries Of Decedent's Estate?

Access to high quality Tennessee Affidavit Regarding Notice To Beneficiaries of Decedent's Estate templates online with US Legal Forms. Steer clear of hours of misused time seeking the internet and dropped money on forms that aren’t updated. US Legal Forms gives you a solution to just that. Find above 85,000 state-specific legal and tax samples that you could download and submit in clicks within the Forms library.

To find the sample, log in to your account and then click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

- Check if the Tennessee Affidavit Regarding Notice To Beneficiaries of Decedent's Estate you’re considering is suitable for your state.

- See the form making use of the Preview function and read its description.

- Go to the subscription page by clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Select a favored format to download the file (.pdf or .docx).

Now you can open up the Tennessee Affidavit Regarding Notice To Beneficiaries of Decedent's Estate template and fill it out online or print it out and do it yourself. Think about sending the papers to your legal counsel to make certain things are filled out correctly. If you make a mistake, print and fill application again (once you’ve registered an account every document you download is reusable). Make your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

While an executor is obligated to notify beneficiaries and then move things along at a reasonable pace, he or she isn't required to distribute inheritances at the time of notification. In fact, beneficiaries might not receive anything until several months after they've been notified of their place in the will.

For a beneficiary to effectively monitor the administration of estate property it goes without saying the beneficiary needs information regarding the performance of the executor's duties and powers. To this end the law has imposed on executors and trustees a duty to account beneficiaries.

A will remains a private document until probate is granted. Once the probate court declares the will as valid, beneficiaries must be notified within three months, though ideally, notification will much sooner.

As an executor, you have a fiduciary duty to the beneficiaries of the estate. That means you must manage the estate as if it were your own, taking care with the assets. So you cannot do anything that intentionally harms the interests of the beneficiaries.

Beneficiaries who receive a share of the balance of the estate (known as the residue) are entitled to a full accounting of the estate including details of all funds received and expended by the estate. A beneficiary can bring court proceedings against an executor who fails to provide adequate information.

While an executor is obligated to notify beneficiaries and then move things along at a reasonable pace, he or she isn't required to distribute inheritances at the time of notification. In fact, beneficiaries might not receive anything until several months after they've been notified of their place in the will.

Where a person is a Residuary Beneficiary, they are entitled to receive a full account of the Estate assets and how they have been distributed in order to see how their share has been calculated. The Estate Accounts do not have to be provided until the Estate administration has been finalised.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.