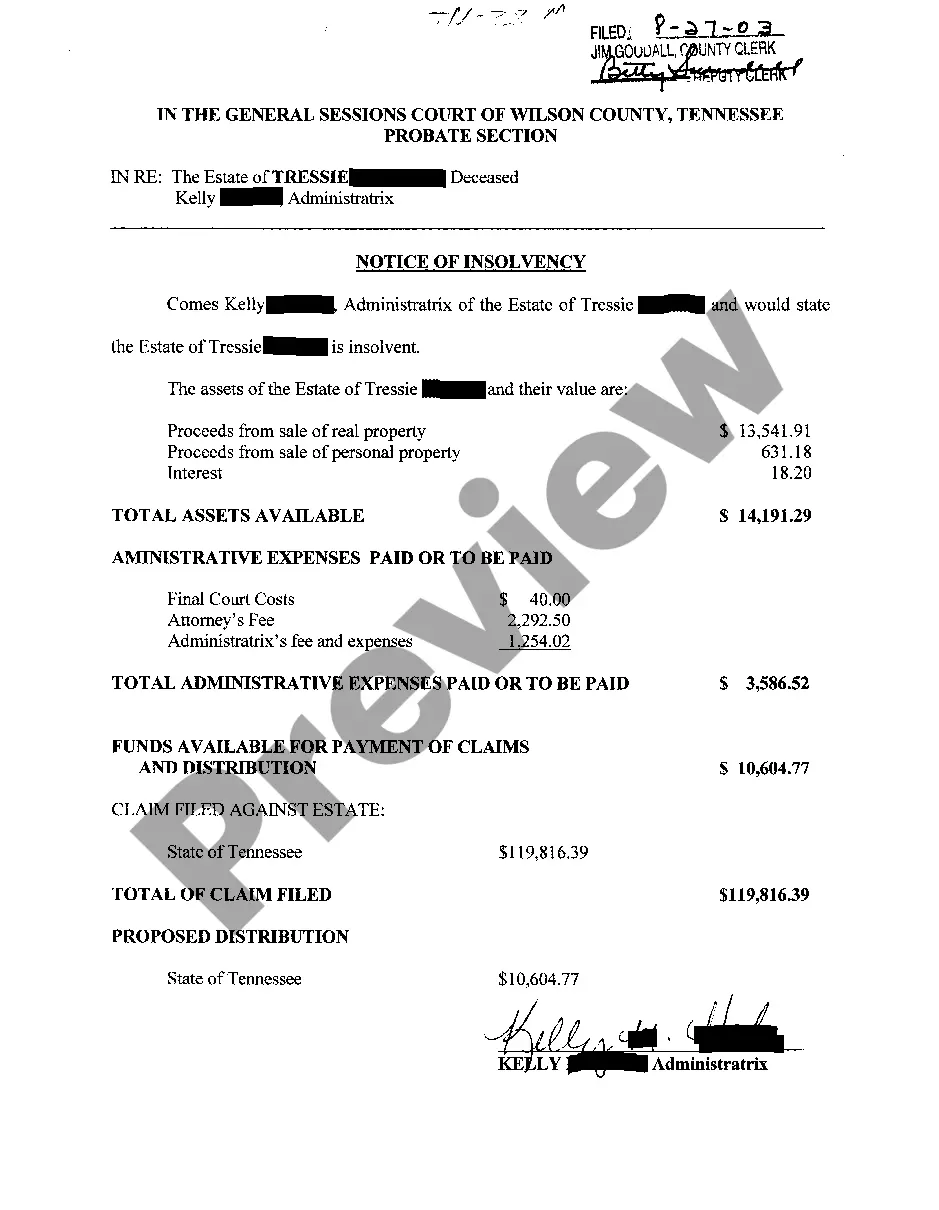

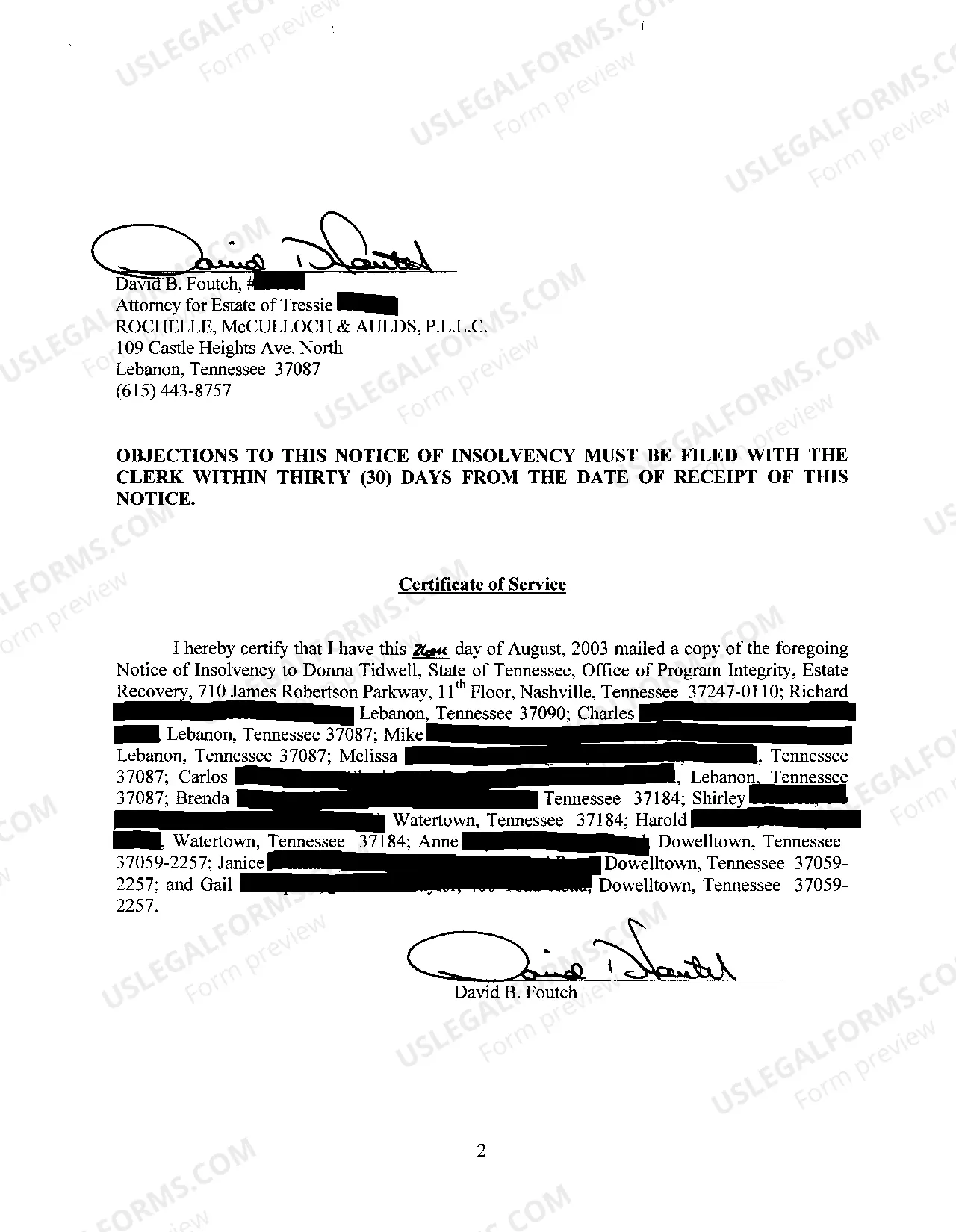

Tennessee Notice of Insolvency

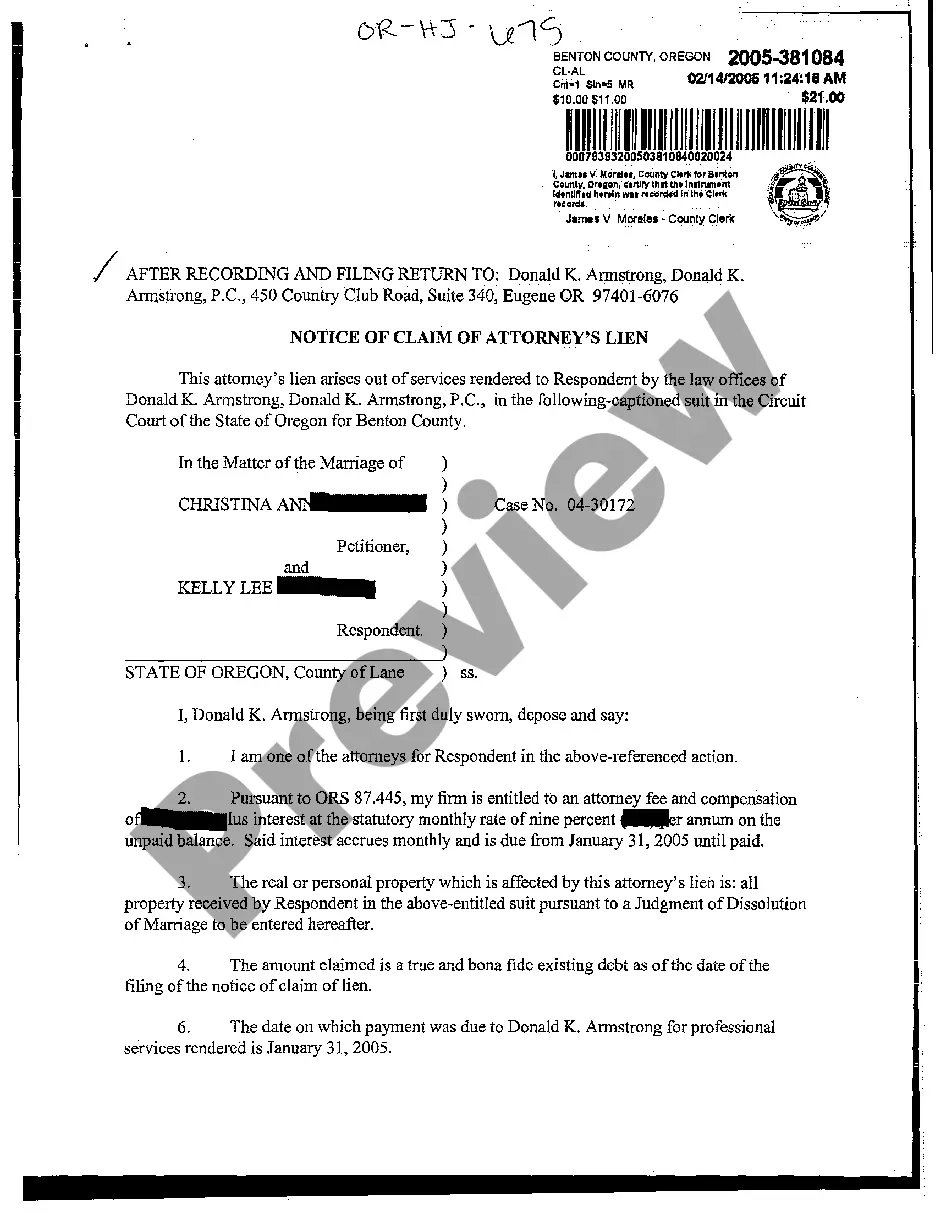

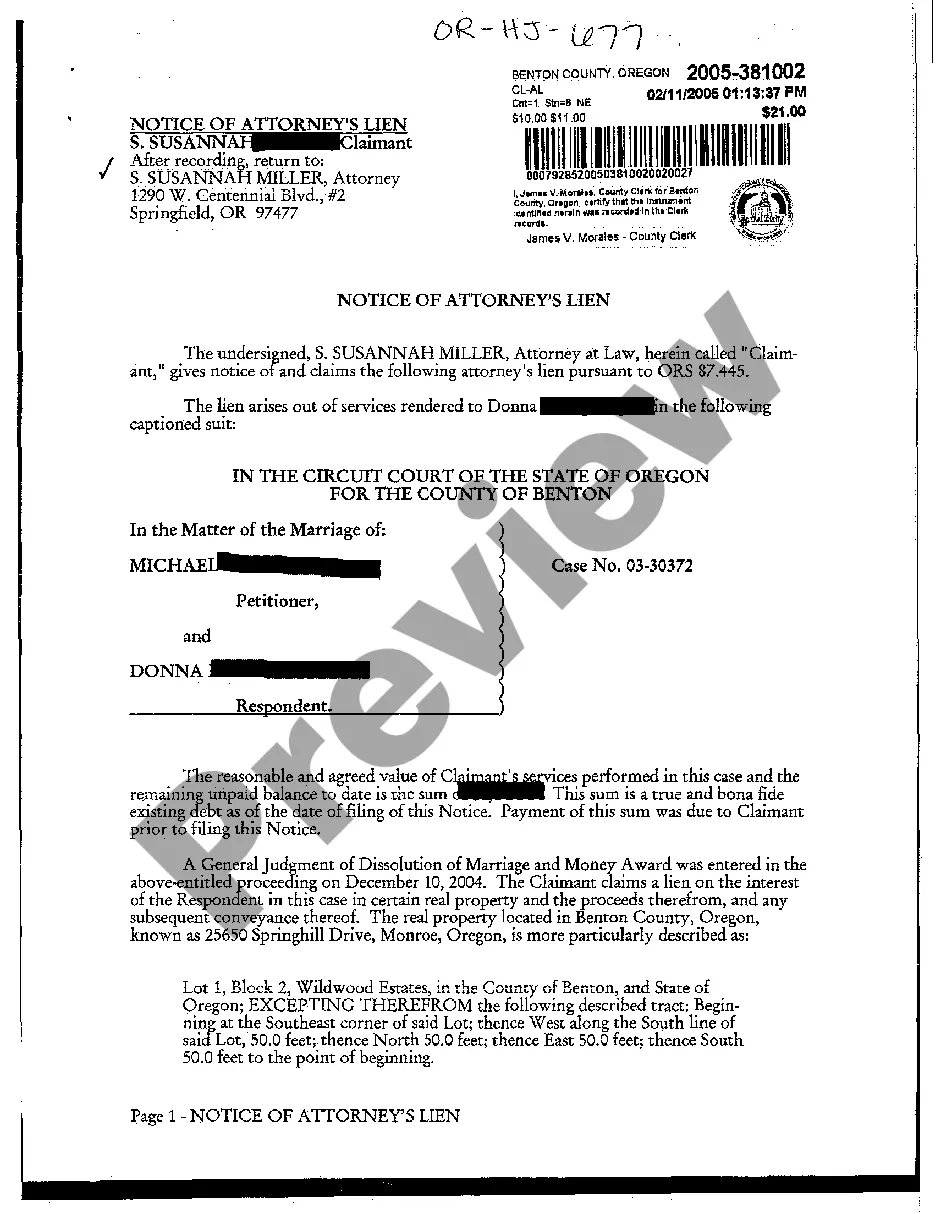

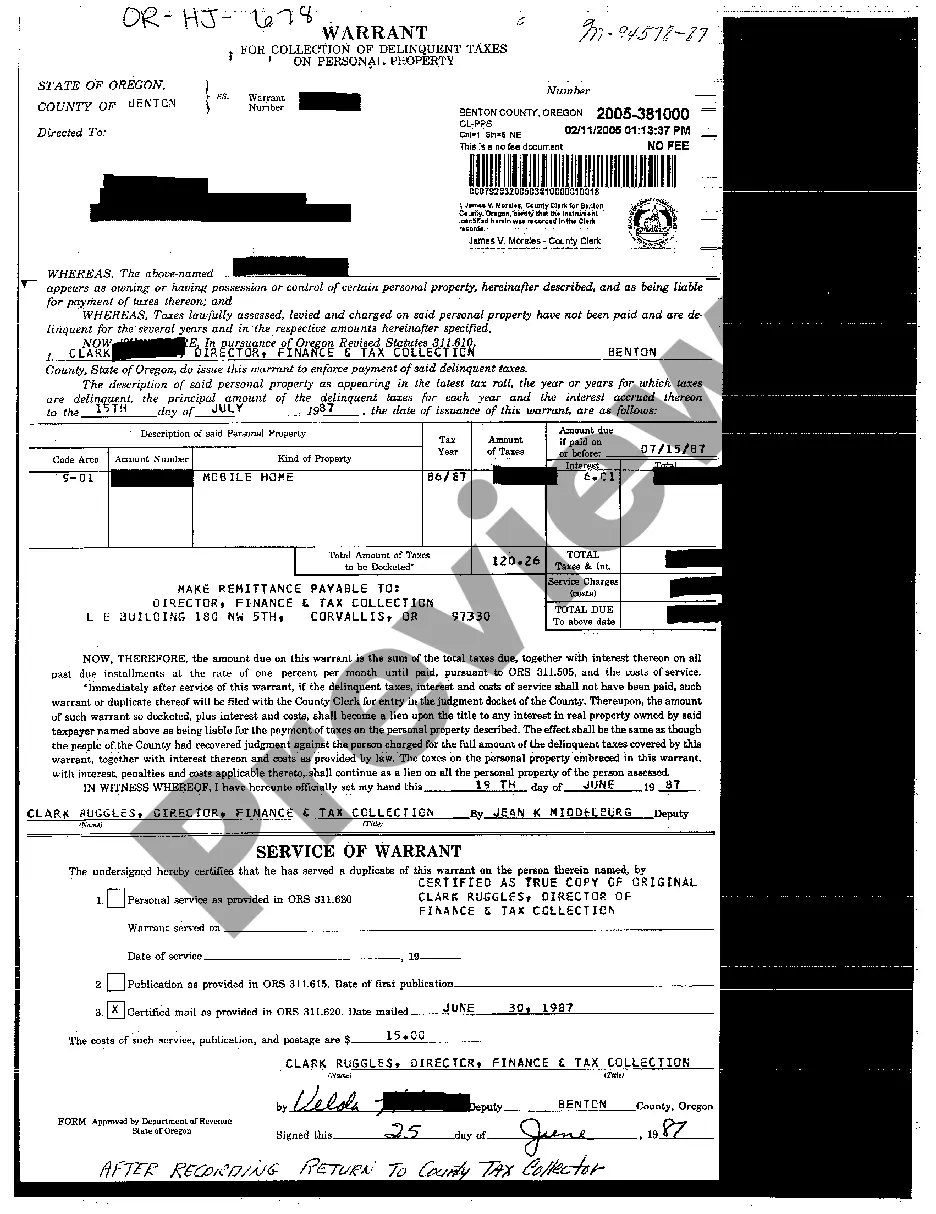

Description Insolvency Worksheet Example

How to fill out Tennessee Notice Of Insolvency?

Get access to high quality Tennessee Notice of Insolvency samples online with US Legal Forms. Prevent days of misused time looking the internet and lost money on documents that aren’t up-to-date. US Legal Forms gives you a solution to just that. Get over 85,000 state-specific authorized and tax templates you can save and fill out in clicks within the Forms library.

To get the example, log in to your account and then click Download. The document will be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- See if the Tennessee Notice of Insolvency you’re considering is appropriate for your state.

- Look at the sample making use of the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by card or PayPal to finish making an account.

- Pick a favored format to download the document (.pdf or .docx).

You can now open up the Tennessee Notice of Insolvency sample and fill it out online or print it and get it done by hand. Take into account giving the papers to your legal counsel to make certain all things are filled out appropriately. If you make a mistake, print and complete sample once again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and get far more forms.

Form popularity

FAQ

Insolvency is a type of financial distress, meaning the financial state in which a person or entity is no longer able to pay the bills or other obligations. The IRS states that a person is insolvent when the total liabilities exceed total assets.

Step 1: Obtain the form at the Department of treasury, Internal Revenue Service of the Federal Government. Step 3: First fill Part I- General Information. Step 4: Fill out Part II- Reduction of Task Attributes.

To claim insolvency, you'll need to fill out IRS Forms 1099-C and 982. These forms should be filed with your federal income tax return for any year in which a discharge of indebtedness was excluded from your income. Form 1099-C reports cancellation of debt (greater than $600) to the IRS.

You must file Form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Certain individuals may need to complete only a few lines on Form 982.

To claim insolvency, you'll need to fill out IRS Forms 1099-C and 982. These forms should be filed with your federal income tax return for any year in which a discharge of indebtedness was excluded from your income. Form 1099-C reports cancellation of debt (greater than $600) to the IRS.

Form 982 is used to determine, under certain circumstances described in section 108, the amount of discharged indebtedness that can be excluded from gross income.

Enter Form 1099-C. To enter your 1099-C: Create the Insolvency Worksheet. Check entries on the Canceled Debt Worksheet. Check Form 982.

In general, you must report any taxable amount of a canceled debt as ordinary income from the cancellation of debt on Form 1040, U.S. Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors or Form 1040-NR, U.S. Nonresident Alien Income Tax Return as "other income" if the debt is a nonbusiness debt, or

The IRS will consider you insolvent if your total liabilities exceed your total assets. In other words, liabilities assets = insolvency. You can figure out if insolvency applies to you by comparing the difference between your total assets and total liabilities at the time your debt was canceled.