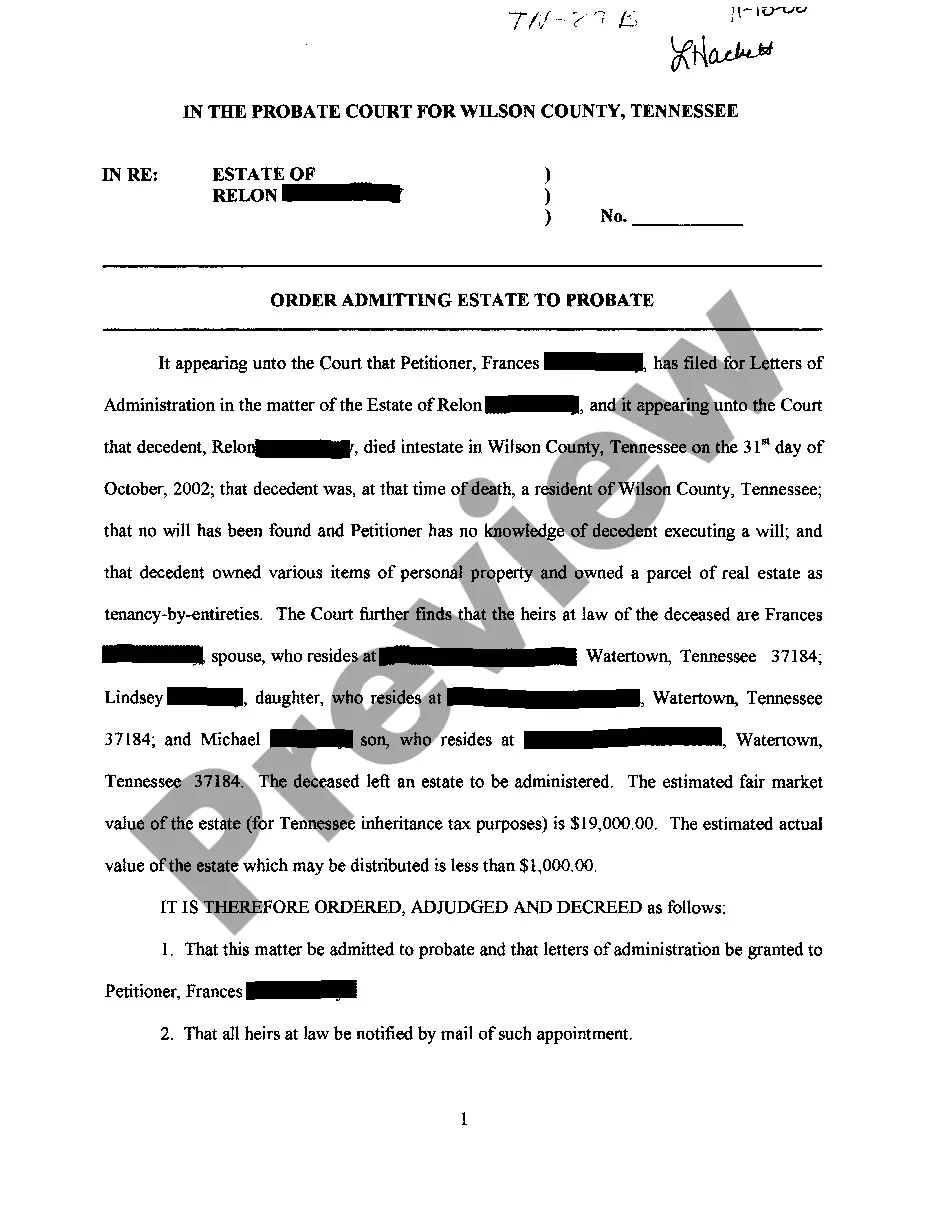

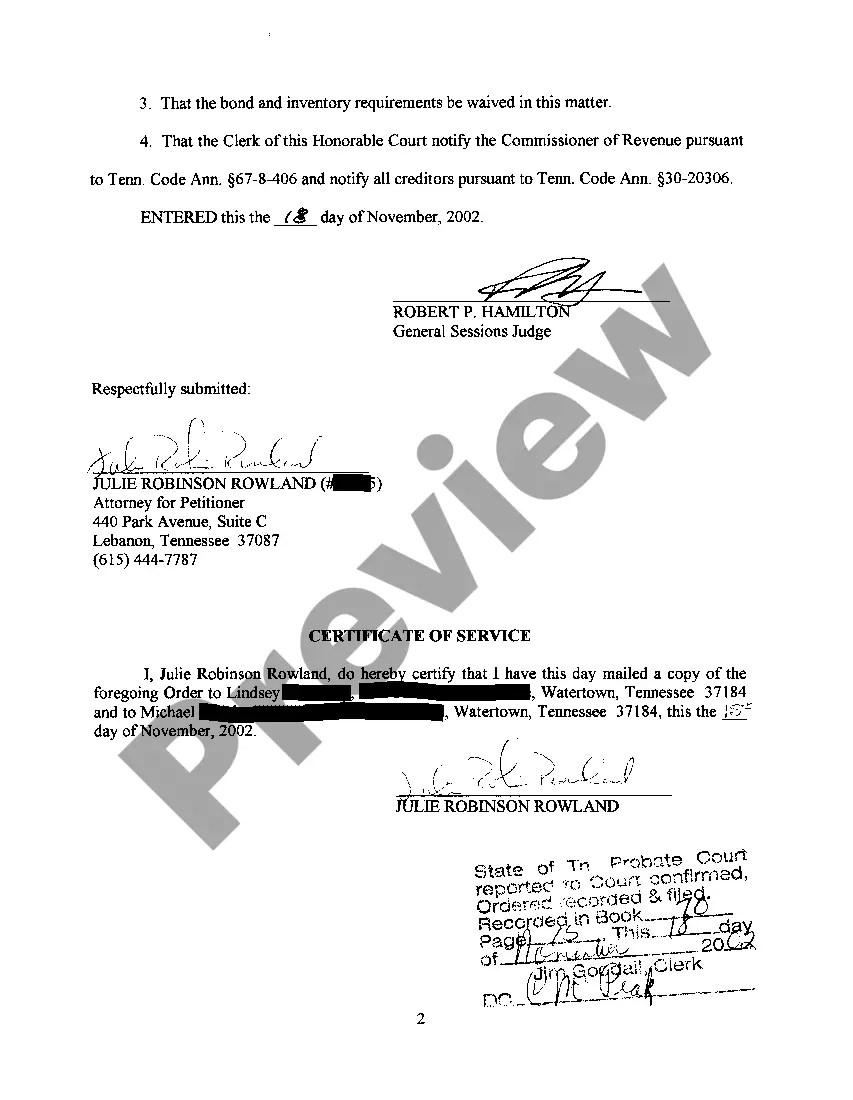

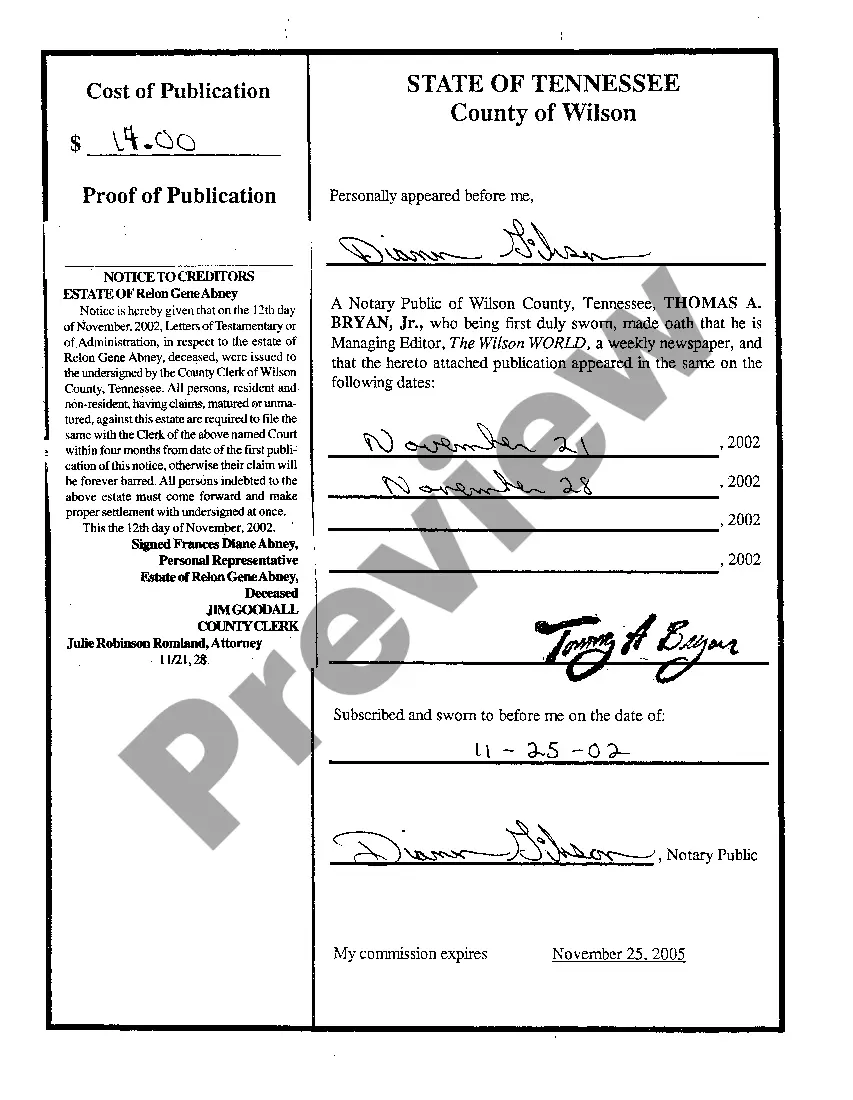

Tennessee Order Admitting Estate To Probate

Description Probate Forms

How to fill out Tennessee Order Admitting Estate To Probate?

Get access to top quality Tennessee Order Admitting Estate To Probate templates online with US Legal Forms. Steer clear of days of wasted time looking the internet and lost money on documents that aren’t up-to-date. US Legal Forms gives you a solution to just that. Get around 85,000 state-specific authorized and tax templates that you could save and complete in clicks in the Forms library.

To get the example, log in to your account and click on Download button. The file is going to be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- See if the Tennessee Order Admitting Estate To Probate you’re considering is suitable for your state.

- See the form making use of the Preview function and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay by card or PayPal to finish making an account.

- Select a favored format to save the file (.pdf or .docx).

Now you can open up the Tennessee Order Admitting Estate To Probate template and fill it out online or print it and get it done yourself. Think about sending the document to your legal counsel to make sure everything is completed correctly. If you make a mistake, print and fill application again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and access more samples.

Probate Order Form popularity

Probate Office Order Form Other Form Names

FAQ

Probate assets include bank accounts that are not joint and do not have any pay on death or transfer on death designations. Other probate assets include real estate when there is no joint, right of survivorship, co-owner.

Probate assets include: Real estate, vehicles, and other titled assets owned solely by the deceased person or as a tenant in common with someone else.

Tennessee state law does not require all of the decedent's assets to go through the probate process.These types of assets pass directly to their new owners without oversight from the probate court. The only types of assets that are required to pass through probate are the decedent's individually owned property.

Before being granted probate, you'll need to sign a declaration of truth - the probate registry will tell you how they want you to do this.the original will (if there is one) and three copies. the death certificate. the inheritance tax forms.

Bank accounts, cars or real estate jointly owned are considered non-probate assets, including joint tenants and tenants by the entirety with rights of survivorship. Assets with transferable on death or payable on death designations.

Tennessee provides an alternative to regular probate if the estate is small. The simplified procedure is available if the total probate estate is worth no more than $50,000, not counting real estate.

Under Tennessee law, real property is not included in the probate estate and vests immediately in the heirs or devisees upon death of the owner, unless the will specifically directs for the real property to be administered through the estate and gives the executor the powers and authority to do so.

Probate is a legal process that is often required in the state of Tennessee after a person's death.In terms of filing for probate, if the estate is small and has a value of $50,000 or less, a small estate affidavit can be filed 45 days after the death of the property owner.

The Will must be filed with the probate court in the county where the decedent lived. A Petition for Probate must be filed with the probate court as well. This requests the appointment of an executor.