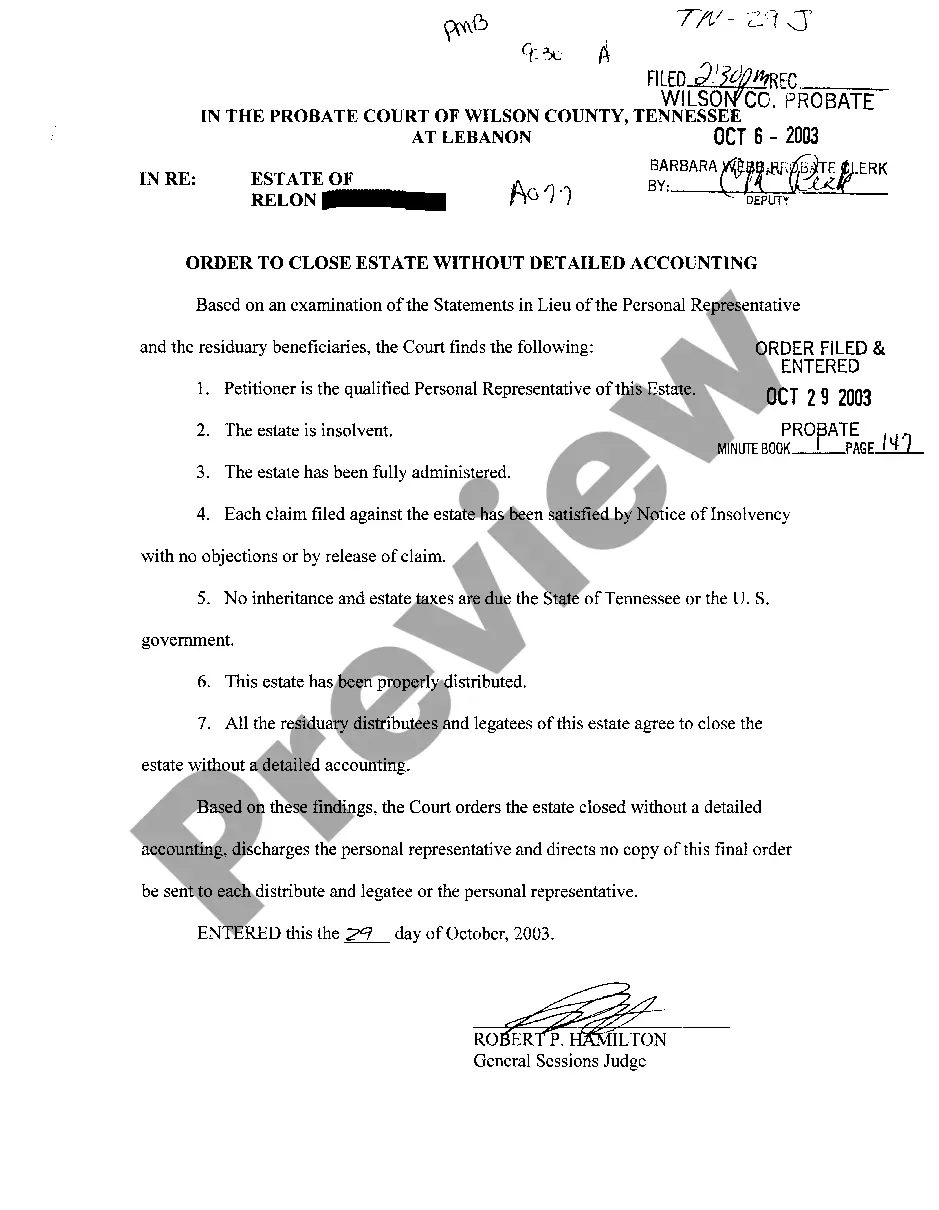

Tennessee Order To Close Estate Without Detailed Accounting

Description

How to fill out Tennessee Order To Close Estate Without Detailed Accounting?

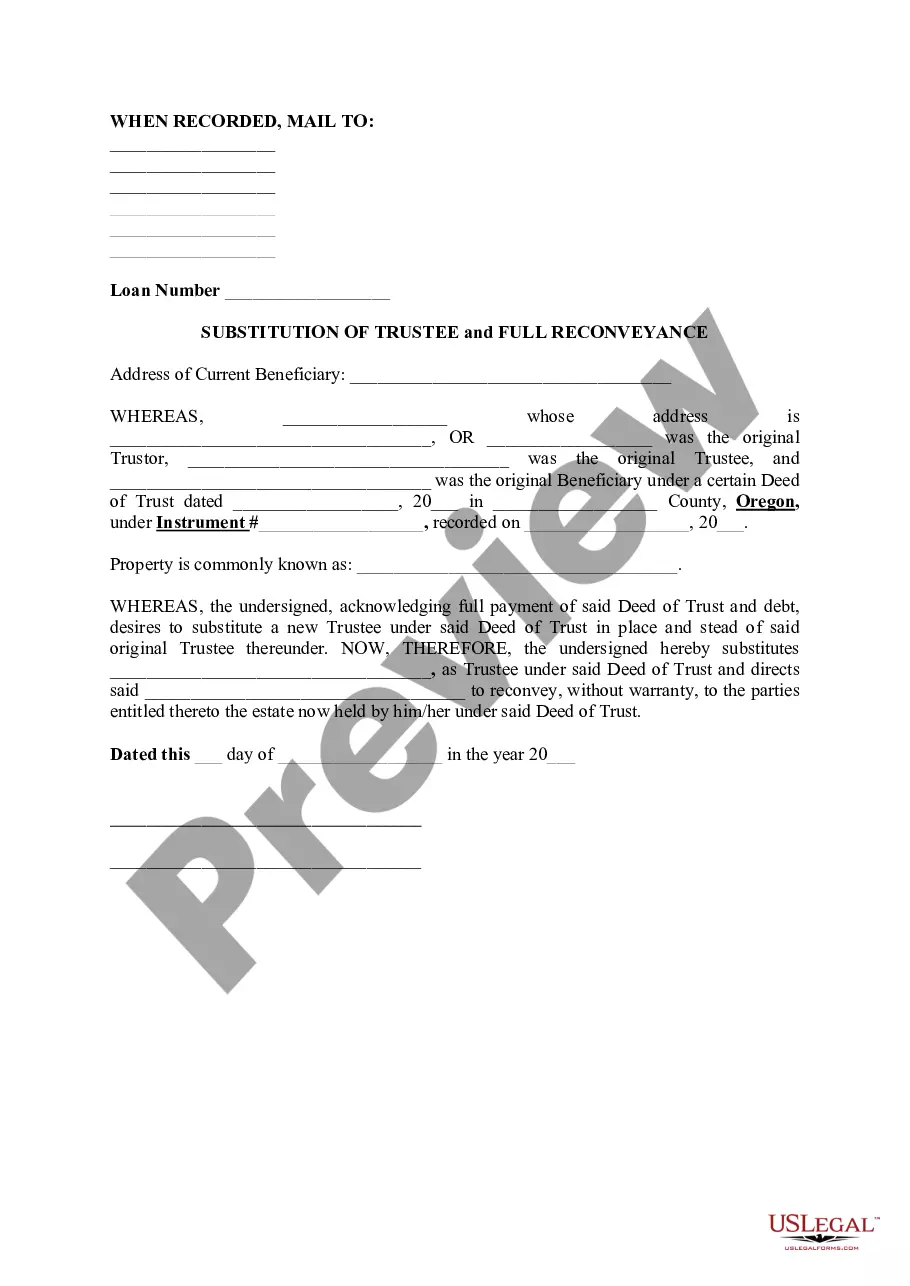

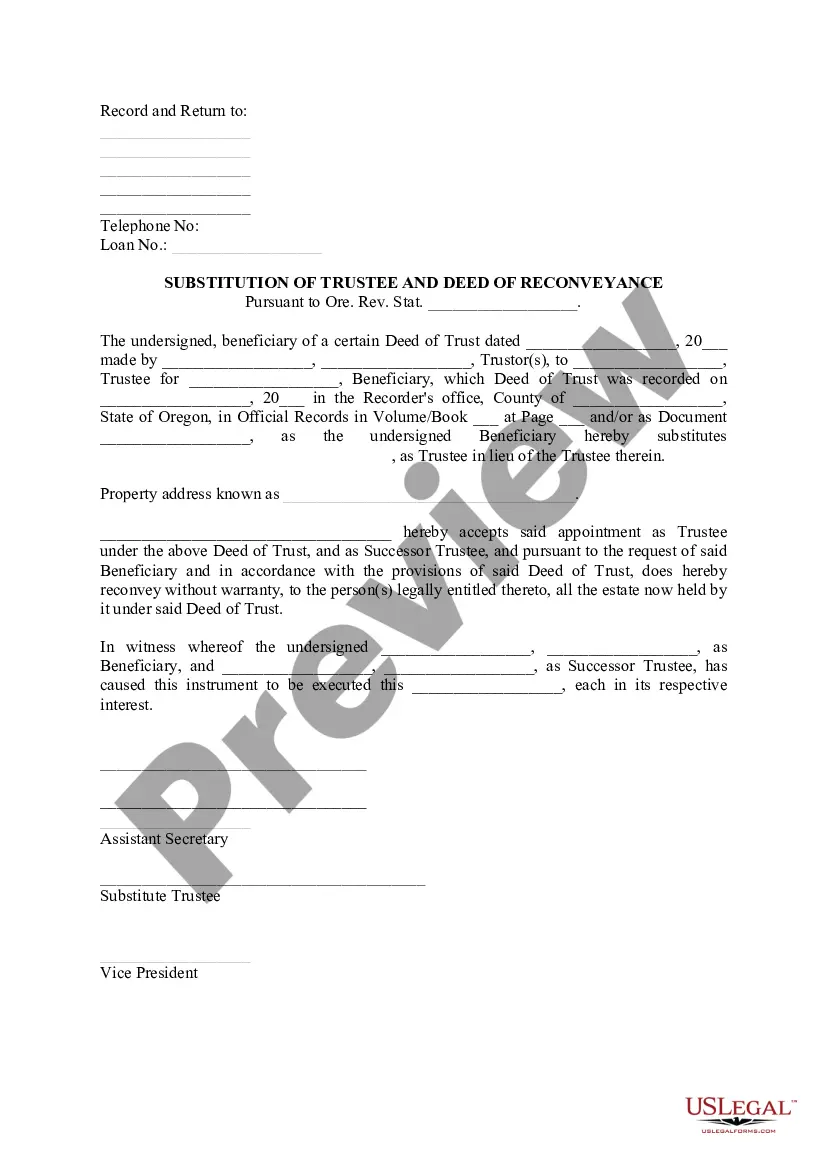

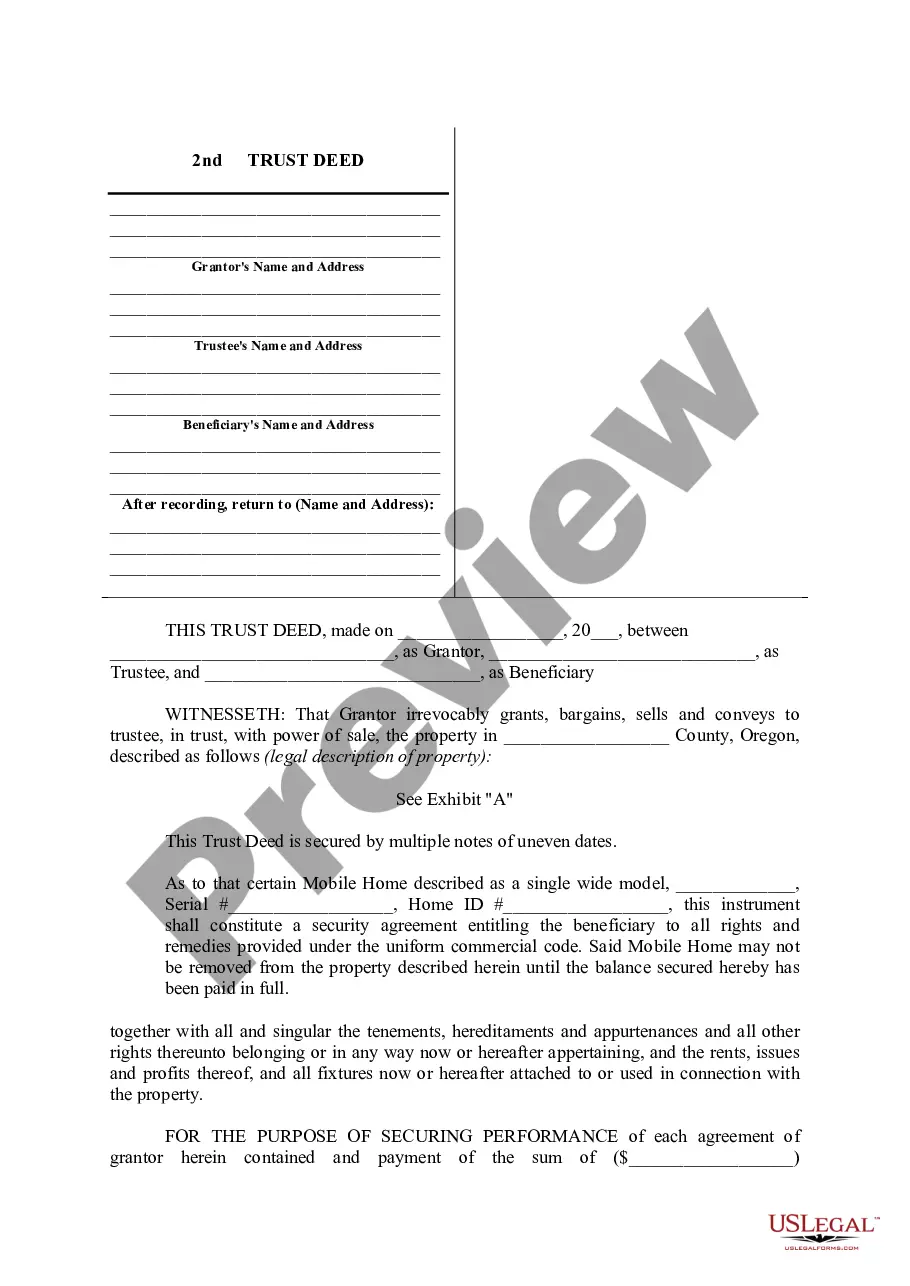

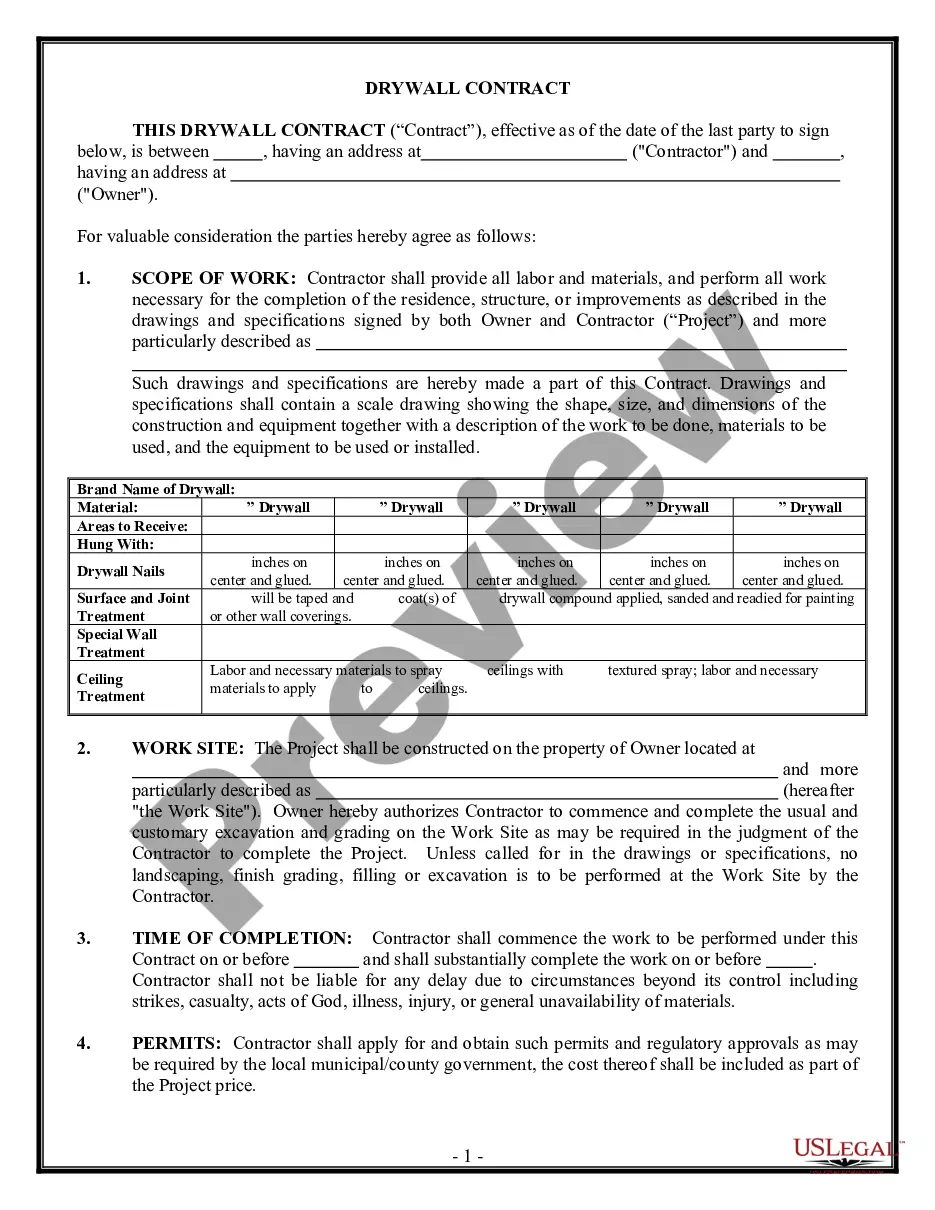

Access to top quality Tennessee Order To Close Estate Without Detailed Accounting samples online with US Legal Forms. Prevent days of misused time looking the internet and dropped money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get above 85,000 state-specific authorized and tax forms you can download and fill out in clicks in the Forms library.

To get the example, log in to your account and then click Download. The document will be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Verify that the Tennessee Order To Close Estate Without Detailed Accounting you’re looking at is suitable for your state.

- View the sample utilizing the Preview function and read its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay out by card or PayPal to finish creating an account.

- Pick a preferred file format to save the file (.pdf or .docx).

You can now open up the Tennessee Order To Close Estate Without Detailed Accounting sample and fill it out online or print it out and do it yourself. Take into account mailing the file to your legal counsel to be certain things are filled out correctly. If you make a mistake, print and fill application once again (once you’ve made an account all documents you save is reusable). Make your US Legal Forms account now and get a lot more templates.

Form popularity

FAQ

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Beneficiaries often must sign off on the inheritance they receive to acknowledge receipt of the distribution. For example, if you inherit a portion of real estate from the decedent, you must sign a deed accepting that real estate.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

The Executor's Final Act, Closing an Estate The personal representative, now without any estate funds to pay his lawyer, must respond. Even if the charges are baseless, the executor is stuck paying the legal bill. Instead, before making any distribution, the administrator should insist on receiving a release.

Each beneficiary is entitled to a trustee's accounting, at least annually, at termination of the trust, and on upon a change of trustee. (California Probate Code 16062). Unfortunately, not all beneficiaries are entitled to automatic accounting, nevertheless, the court may force the trustee to provide an accounting.

Beneficiaries are entitled to receive a financial accounting of the trust, including bank statements, regularly. When statements are not received as requested, a beneficiary must submit a written demand to the trustee.The court will review the trust account for any discrepancies or irregular activity.

The Will must be filed with the probate court in the county where the decedent lived. A Petition for Probate must be filed with the probate court as well. This requests the appointment of an executor.