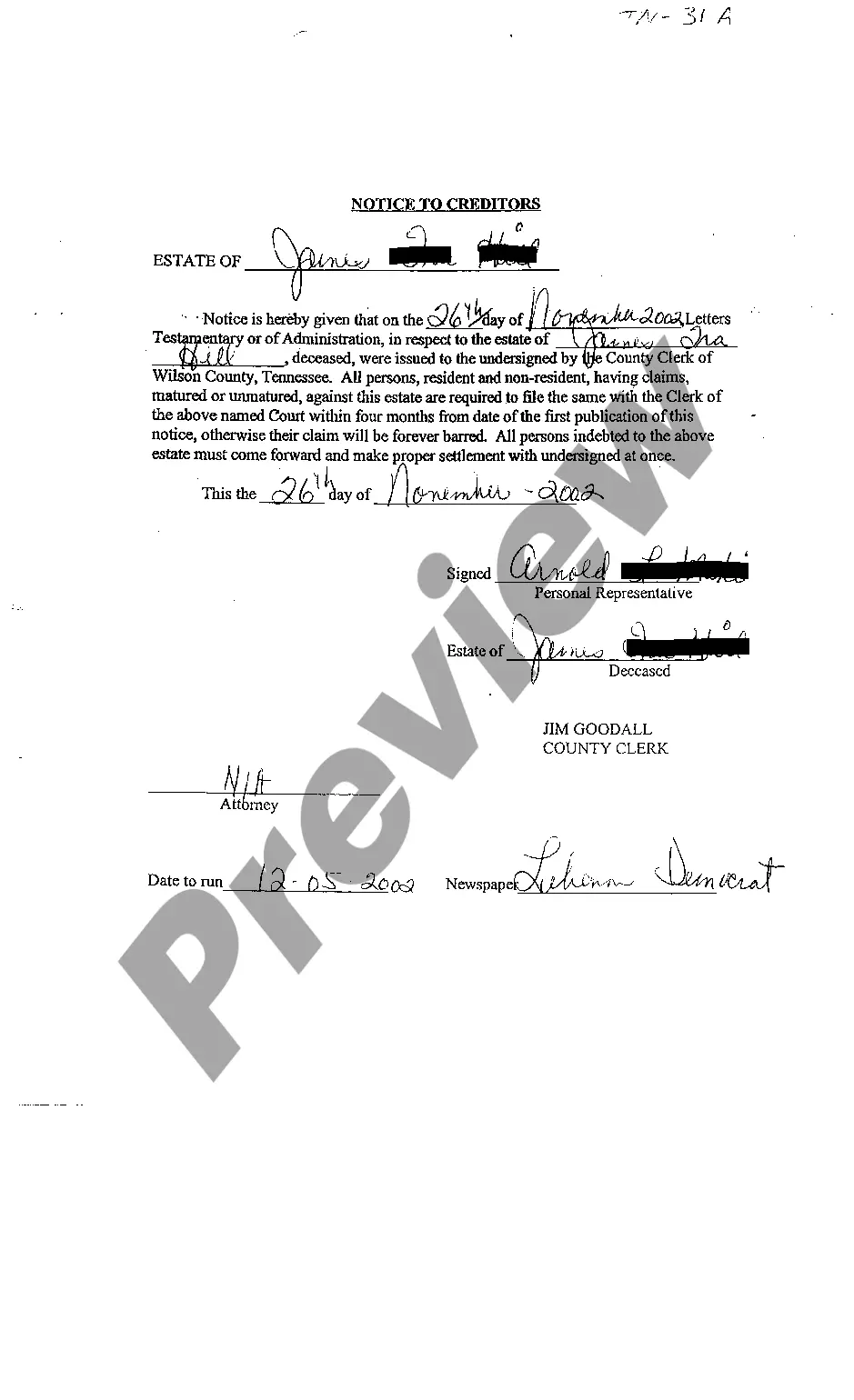

Tennessee Notice To Creditors

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Tennessee Notice To Creditors?

Access to top quality Tennessee Notice To Creditors templates online with US Legal Forms. Avoid days of wasted time browsing the internet and lost money on forms that aren’t updated. US Legal Forms offers you a solution to exactly that. Find around 85,000 state-specific authorized and tax samples that you could download and complete in clicks in the Forms library.

To find the example, log in to your account and click on Download button. The document will be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Check if the Tennessee Notice To Creditors you’re considering is appropriate for your state.

- Look at the form using the Preview function and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to sign up.

- Pay out by card or PayPal to complete creating an account.

- Choose a preferred file format to download the document (.pdf or .docx).

Now you can open the Tennessee Notice To Creditors sample and fill it out online or print it and get it done yourself. Take into account giving the document to your legal counsel to be certain everything is filled in appropriately. If you make a error, print and fill application once again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and get a lot more forms.

Form popularity

FAQ

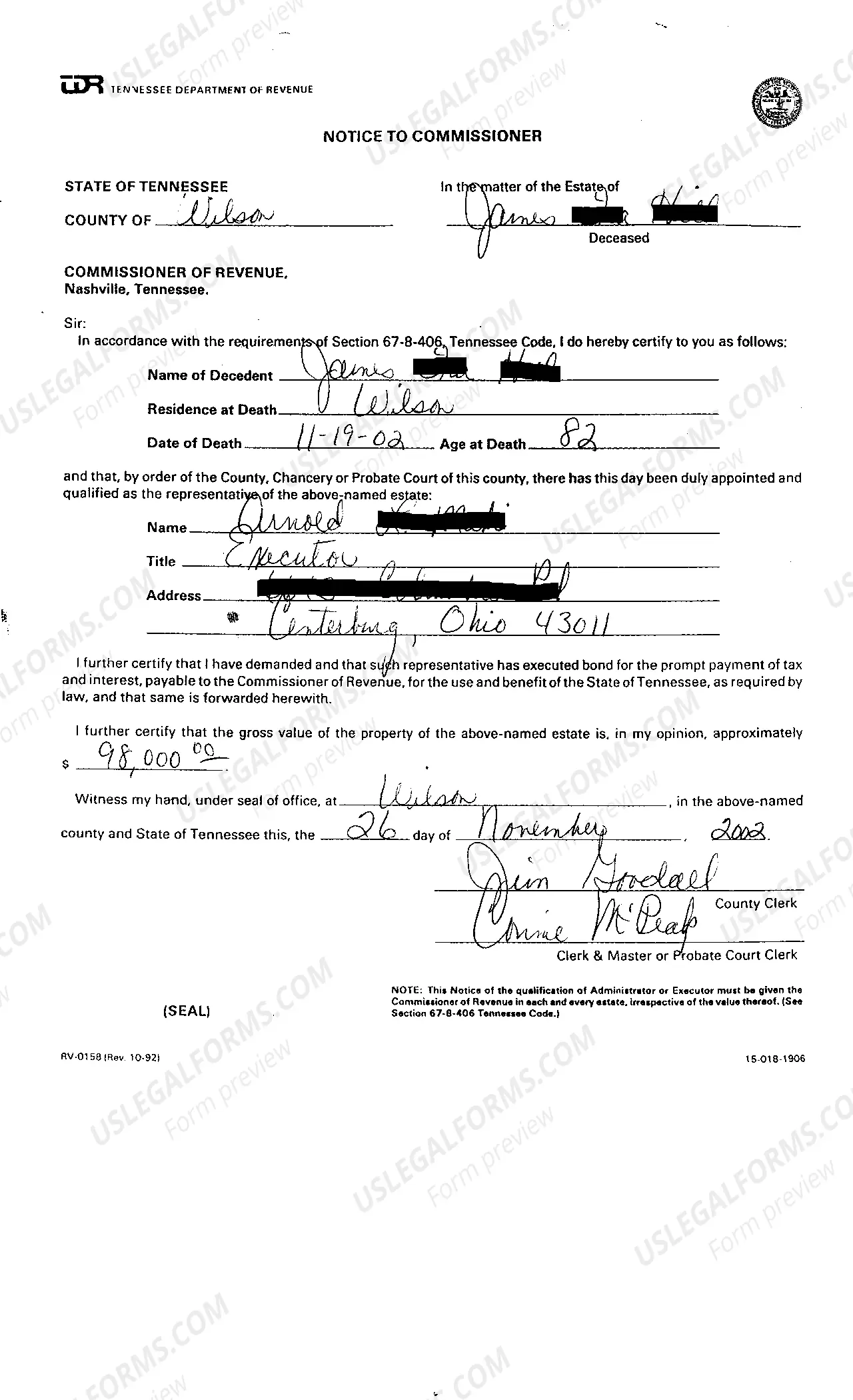

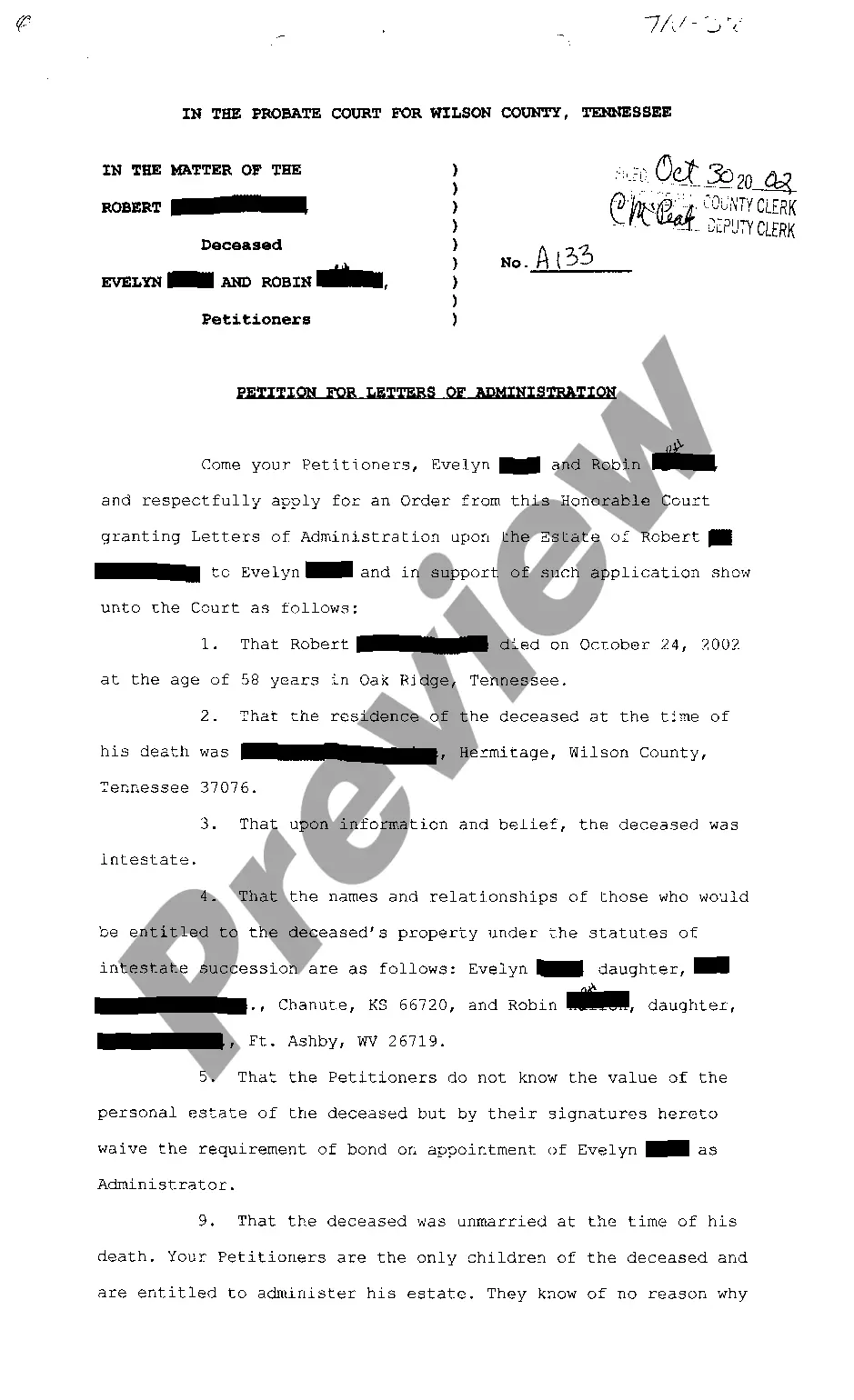

Generally speaking, creditors try to collect on what's owed them by going after the estate of the decedent in a process called probate. However, there are instances where the surviving spouse (or other heir) may be legally responsible. Not all assets are counted as part of a person's estate for probate purposes.

In Tennessee, the longest period that a creditor ever has to file a claim against an estate is twelve months from the date of the death of the deceased. That time period may be shorter (as discussed below).

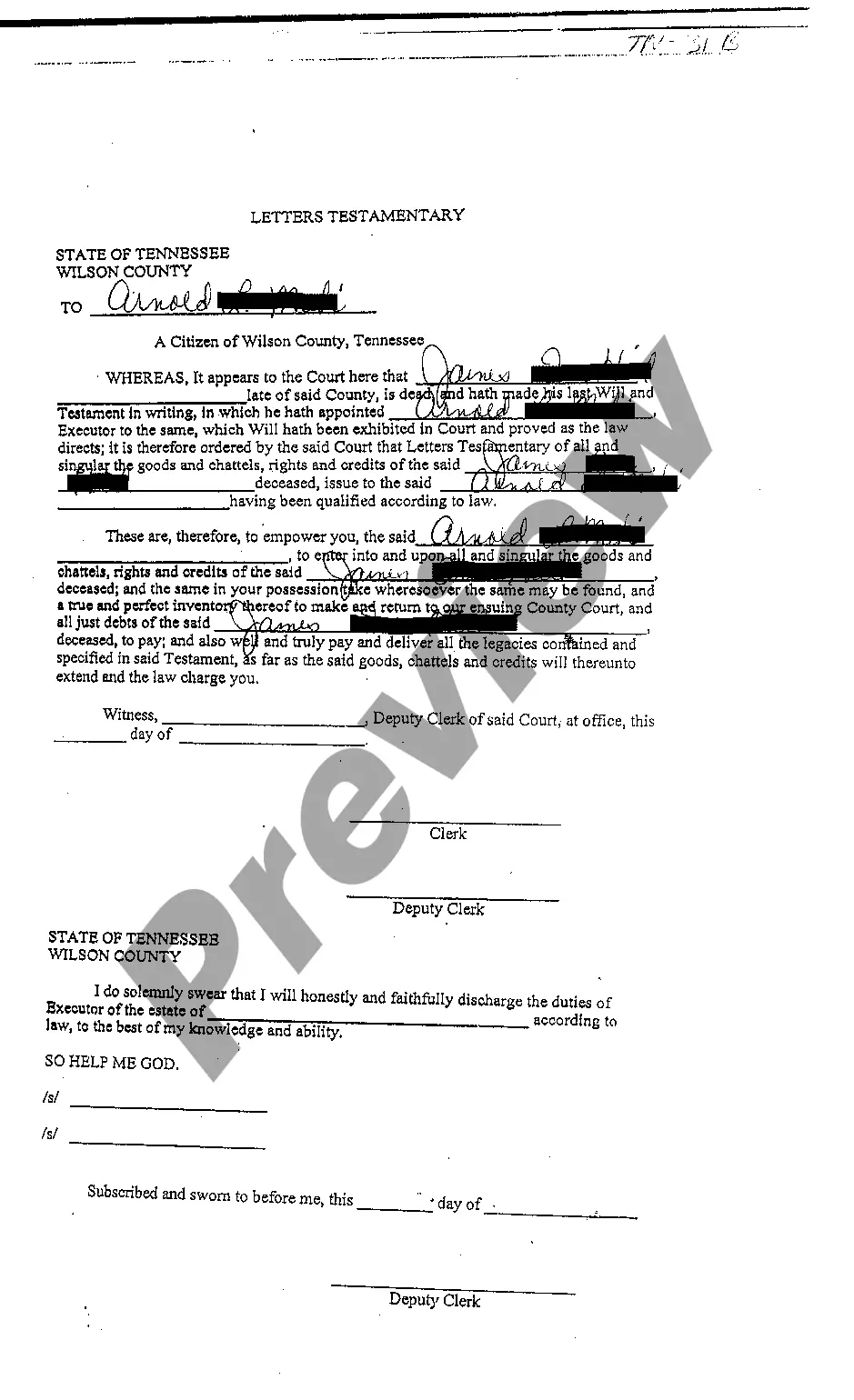

Tennessee, however, has no statutory time limit for when an executor must submit the will for probate. There is no penalty for not probating a will. That means if the will is never submitted to probate, the assets remain in the decedent's name so long as the estate continues to pay the required taxes.

First things first: At death, your assets become your estate. The process of dividing up debt after your death is called probate. The length of time creditors have to make a claim against the estate depends on where you live. It can range anywhere from three months to nine months.

A notice to creditors is a public statement noting the death of an individual in order to alert potential creditors to the situation. Still published in local newspapers, the notice is filed by the estate's executor and meant to facilitate the probate proceedings.

Paying off debts from the estate Well-established practice is that an executor will wait six months after the date of death to allow for any creditors to intimate their claims before making payment to beneficiaries.

How to Notify Creditors of Death. Once your debts have been established, your surviving family members or the executor of your estate will need to notify your creditors of your death. They can do this by sending a copy of your death certificate to each creditor.

This four-month period must pass before the estate can be closed. Even under the best of circumstances, a simple estate will usually take at least six months to close.