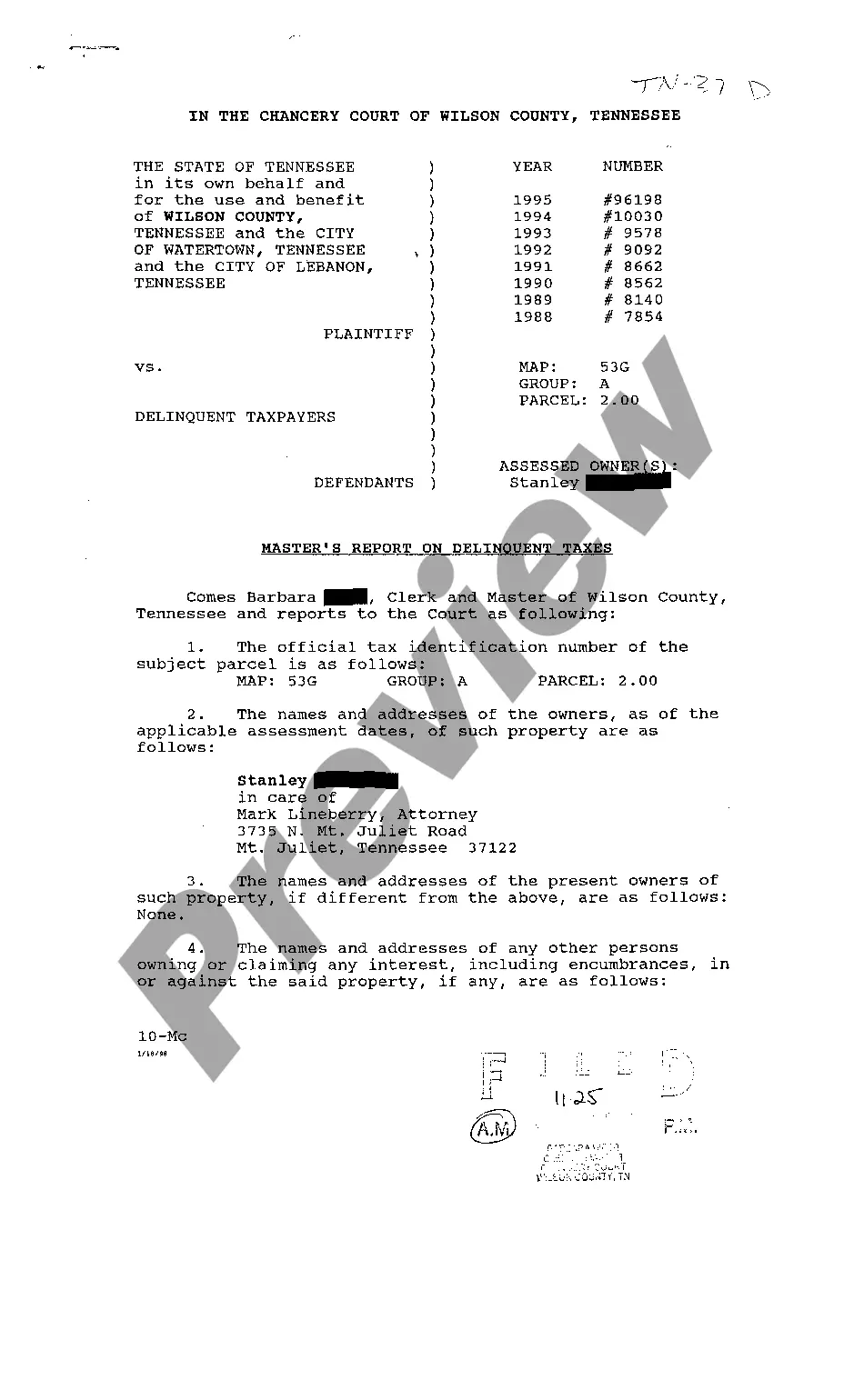

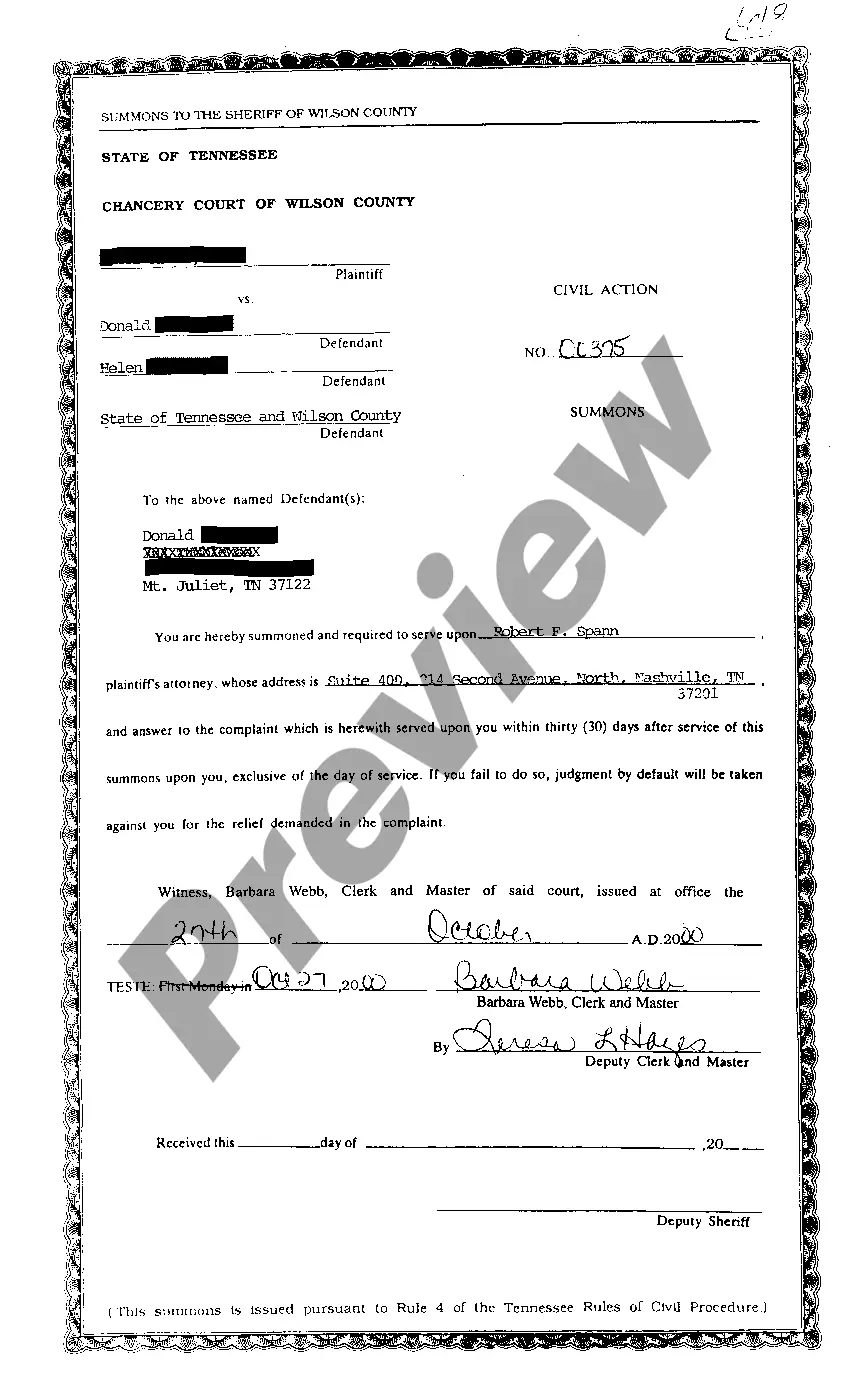

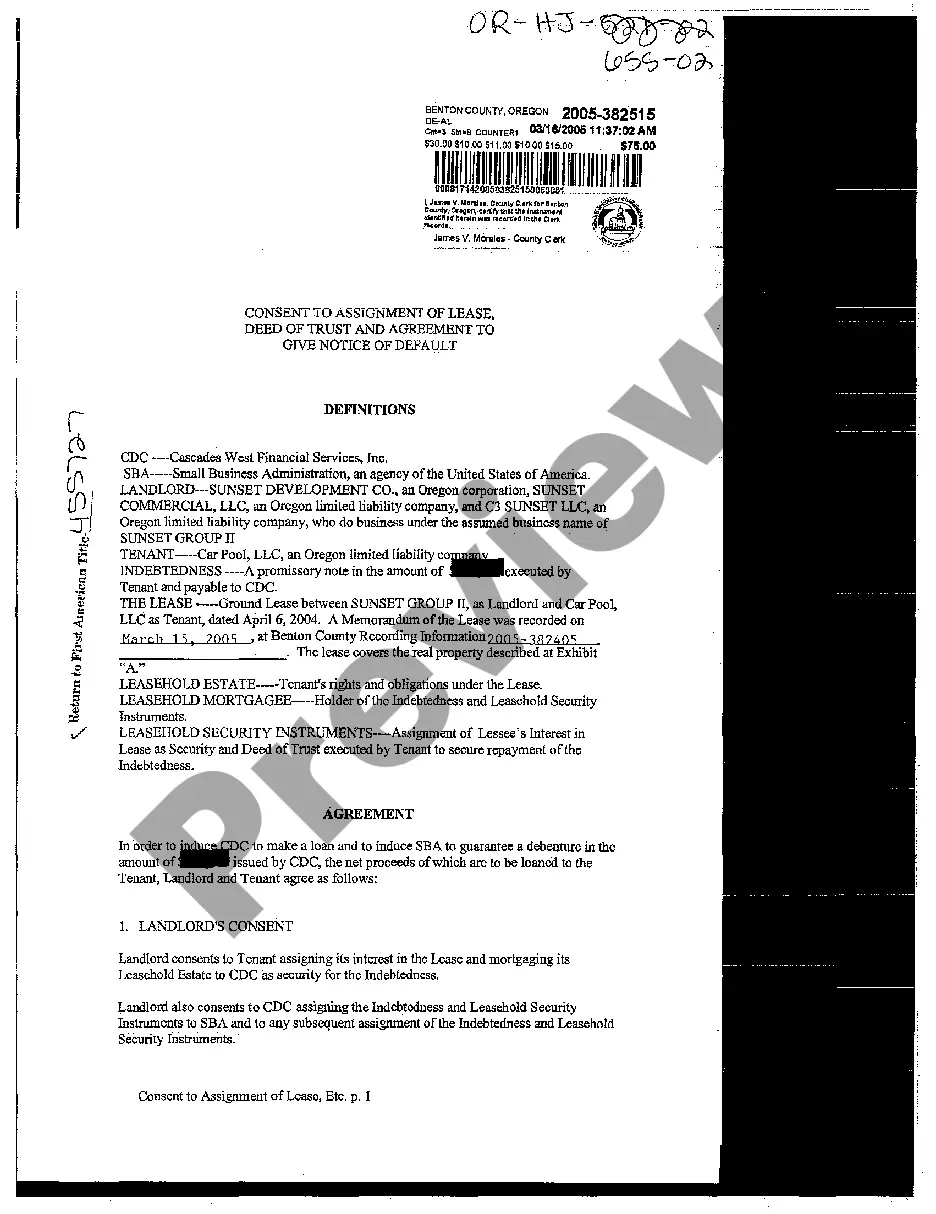

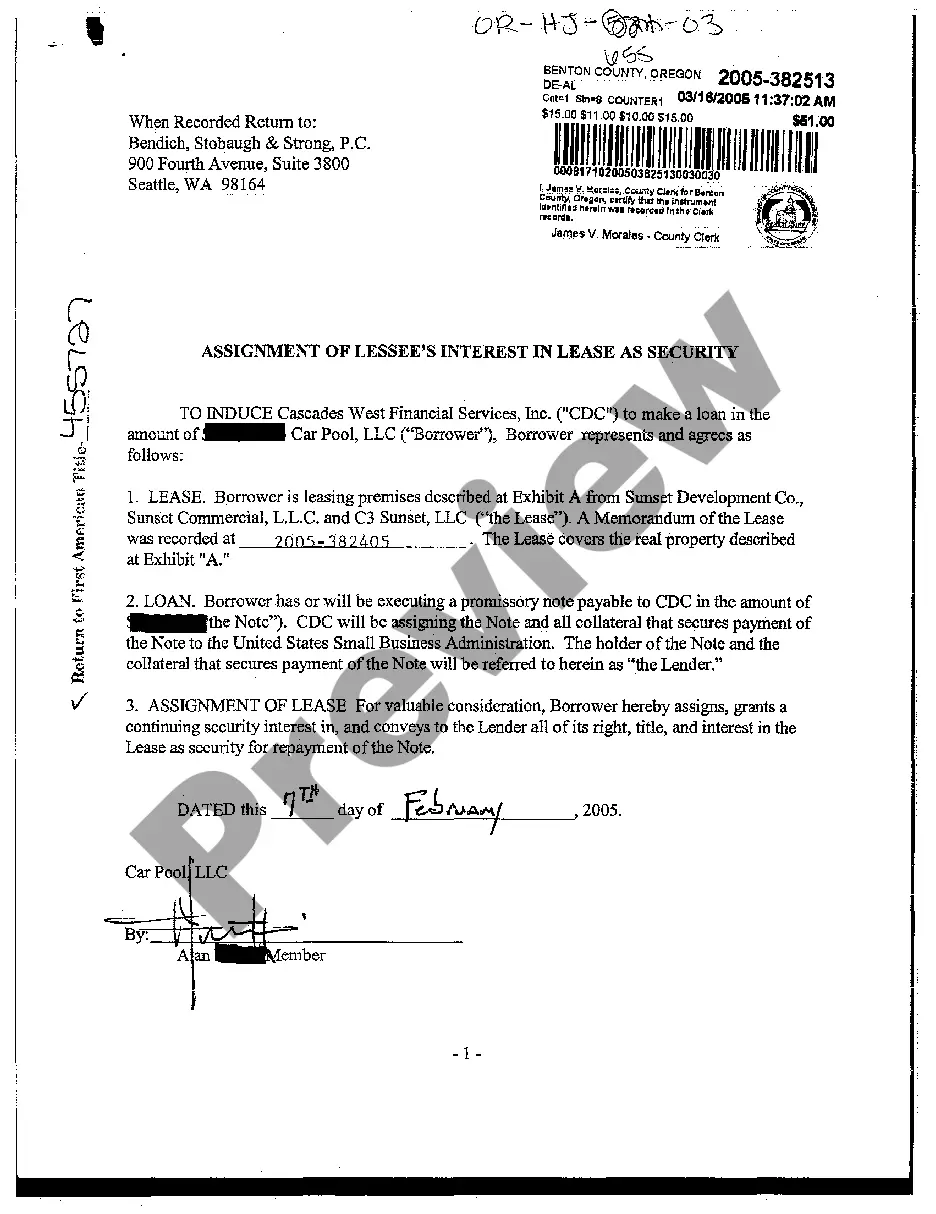

Tennessee Masters Report of Delinquent Taxes

Description

How to fill out Tennessee Masters Report Of Delinquent Taxes?

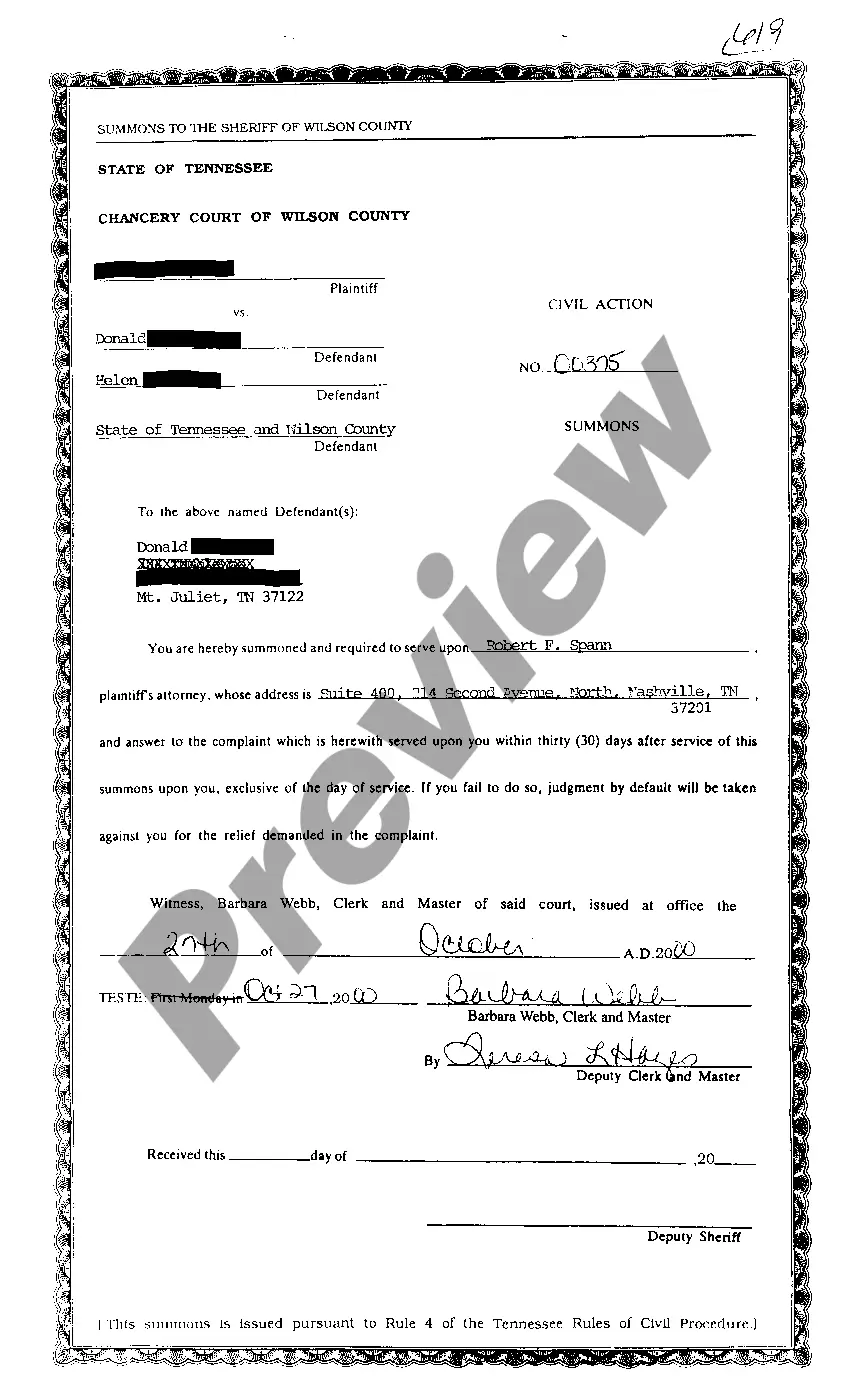

Access to top quality Tennessee Masters Report of Delinquent Taxes forms online with US Legal Forms. Avoid days of lost time seeking the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find around 85,000 state-specific legal and tax templates you can save and fill out in clicks in the Forms library.

To find the example, log in to your account and click Download. The file will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- Verify that the Tennessee Masters Report of Delinquent Taxes you’re looking at is appropriate for your state.

- Look at the form using the Preview option and browse its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay out by card or PayPal to finish making an account.

- Select a preferred file format to download the document (.pdf or .docx).

You can now open the Tennessee Masters Report of Delinquent Taxes sample and fill it out online or print it out and get it done by hand. Consider giving the document to your legal counsel to make sure all things are filled in properly. If you make a mistake, print and complete application once again (once you’ve made an account all documents you save is reusable). Create your US Legal Forms account now and get more samples.

Form popularity

FAQ

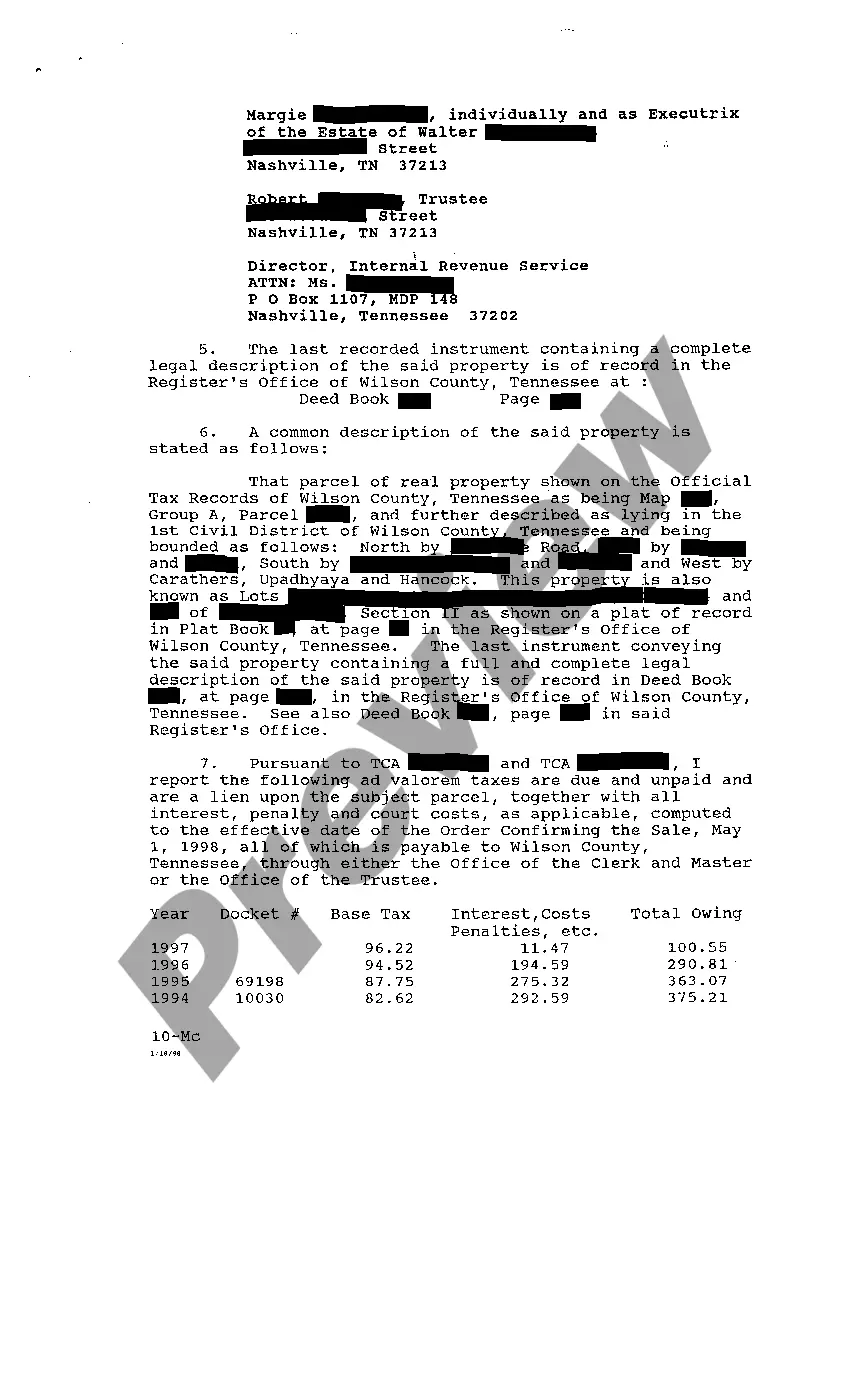

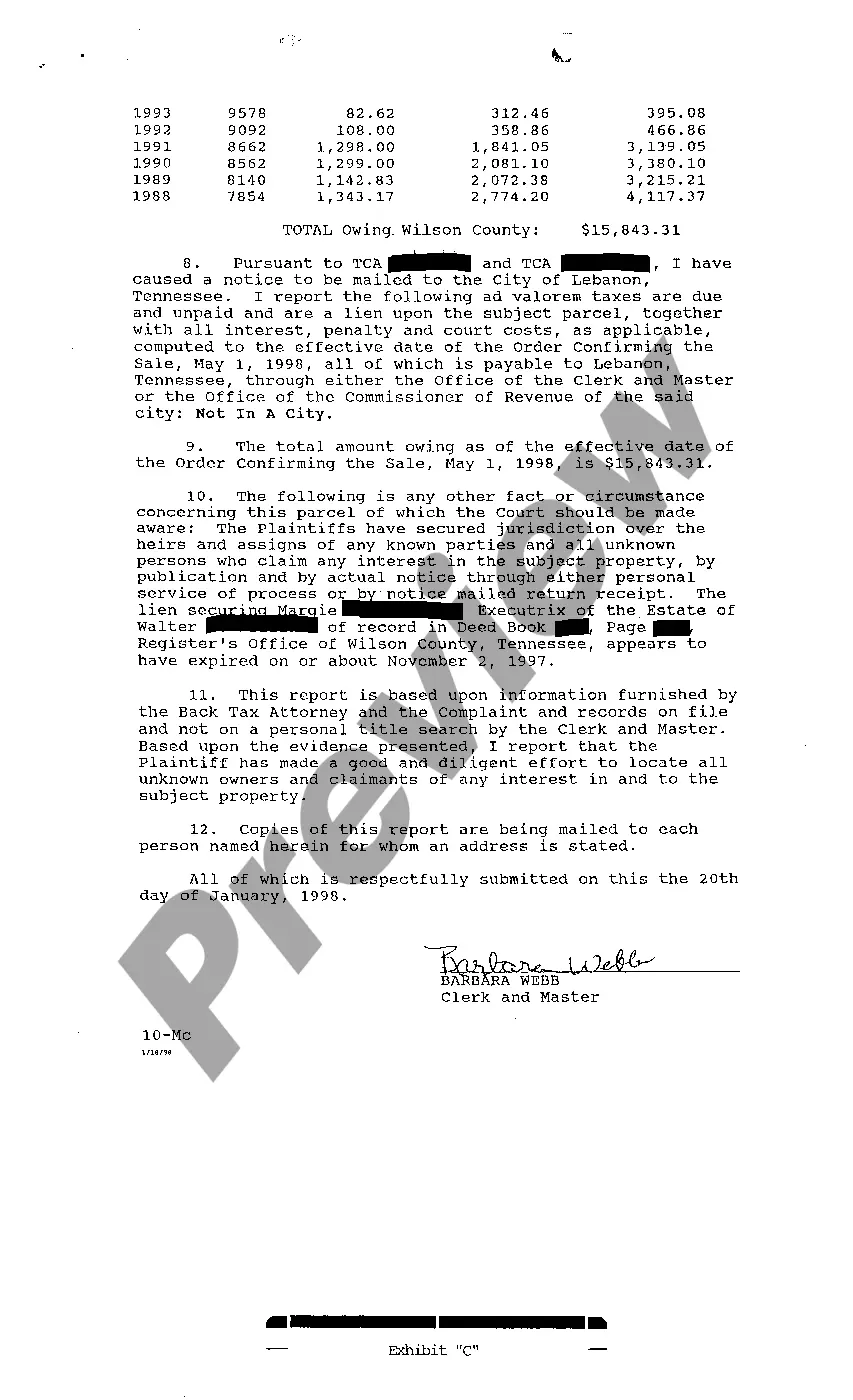

Tennessee is a redeemable tax deed state. In a redeemable tax deed state the actual property is sold after tax foreclosure and then the former owner has one last opportunity to redeem the property (pay the delinquent taxes).

When a lender institutes foreclosure proceedings, most states give the borrower a period of time to pay off the entire amount owed and thus recover the property. In Tennessee, this period is two years after foreclosure. However, many Tennessee borrowers sign a deed of trust that waives this right to redemption.

If you fall behind in making the property tax payments for your home, you might end up losing the place. The taxing authority could sell your home, perhaps through a foreclosure process, to satisfy the debt. Or the taxing authority might sell the tax lien that it holds, and the purchaser might be able to foreclose.

Generally, the redemption period is one year. However, this time frame may be reduced under some circumstances, like if the taxes are more than five years overdue or if the home is vacant and abandoned. (Tenn.

Applications for the Tax Freeze must be filed by April 5, each year, and applicants may contact the Office of the Trustee at 615-862-6330. If you need information concerning the program, please feel free to call us with any questions.

When homeowners fail to pay their property taxes, some tax jurisdictions choose to hold tax deed home sales to make back the money they are owed. Interested buyers can register to participate as a bidder on these homes in a tax deed auction.

Code Ann. § 28-2-101). A person can also establish this type of presumptive ownership under color of title after having paid the taxes on a piece of property for 20 years or more without the original owner, or the government, objecting. (See Tenn.

There are a few ways to find tax liens on your property. First, you can search your local county assessor's website. Next, you can visit your local county assessor's office. Third, you can hire a title company to conduct a lien search on your property.