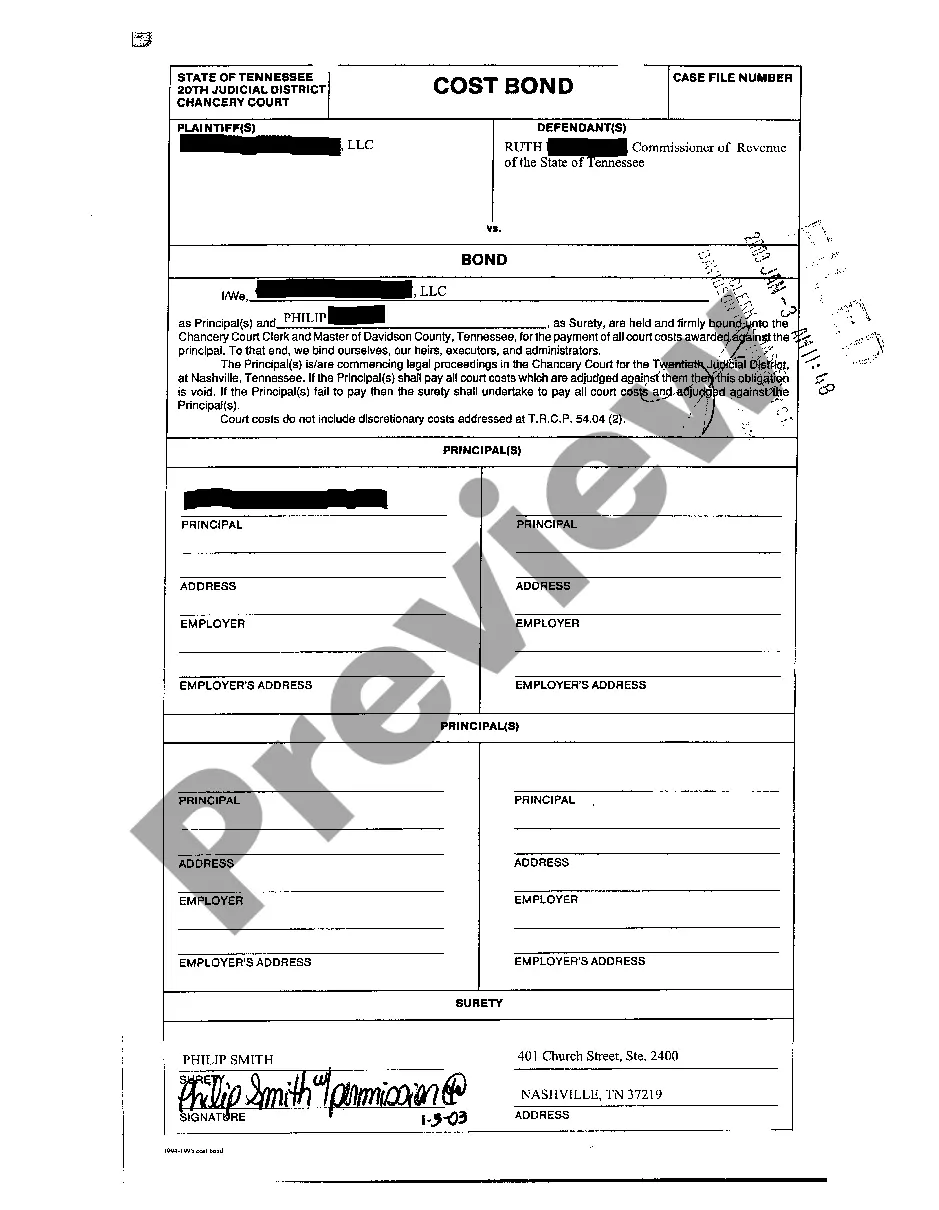

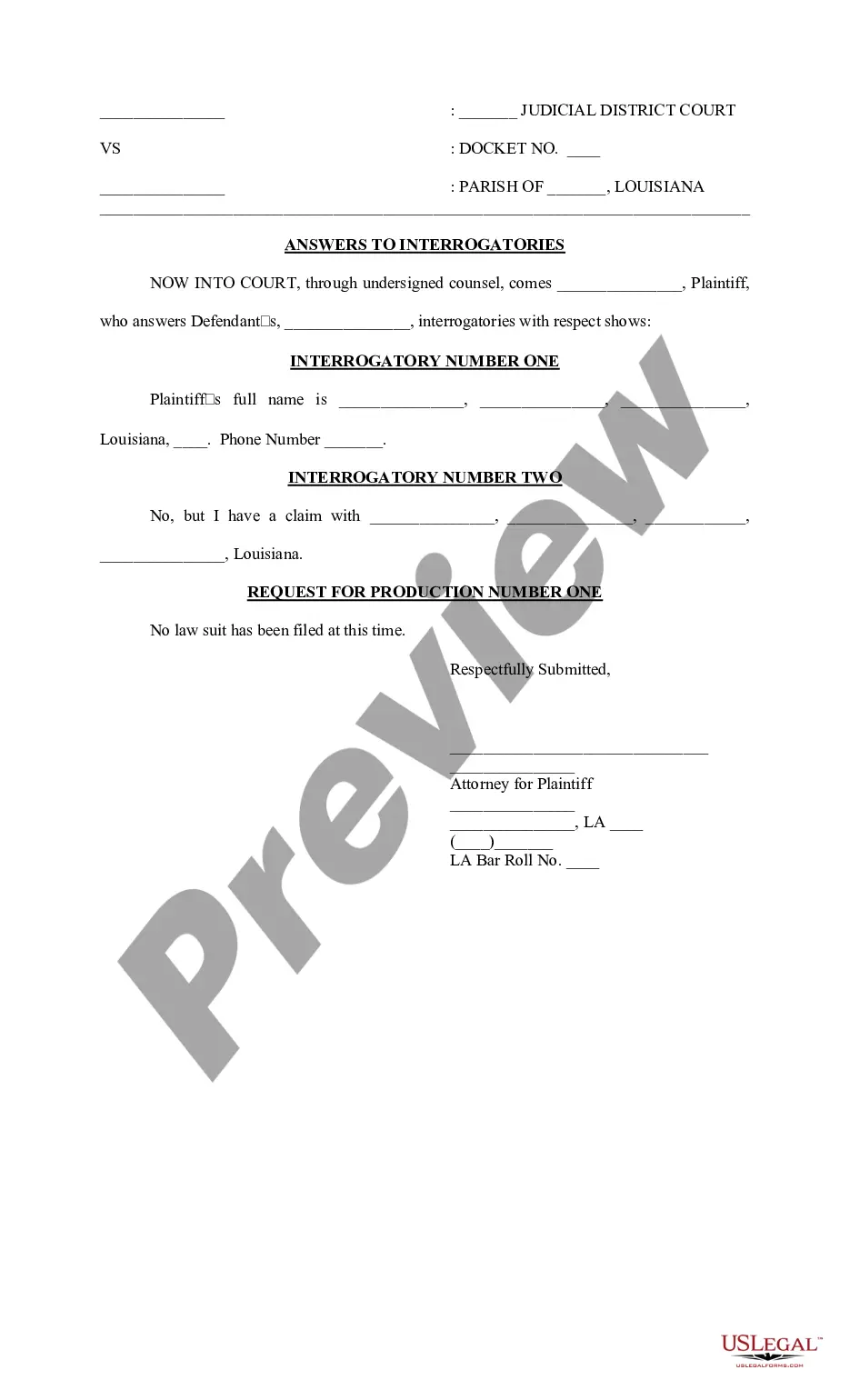

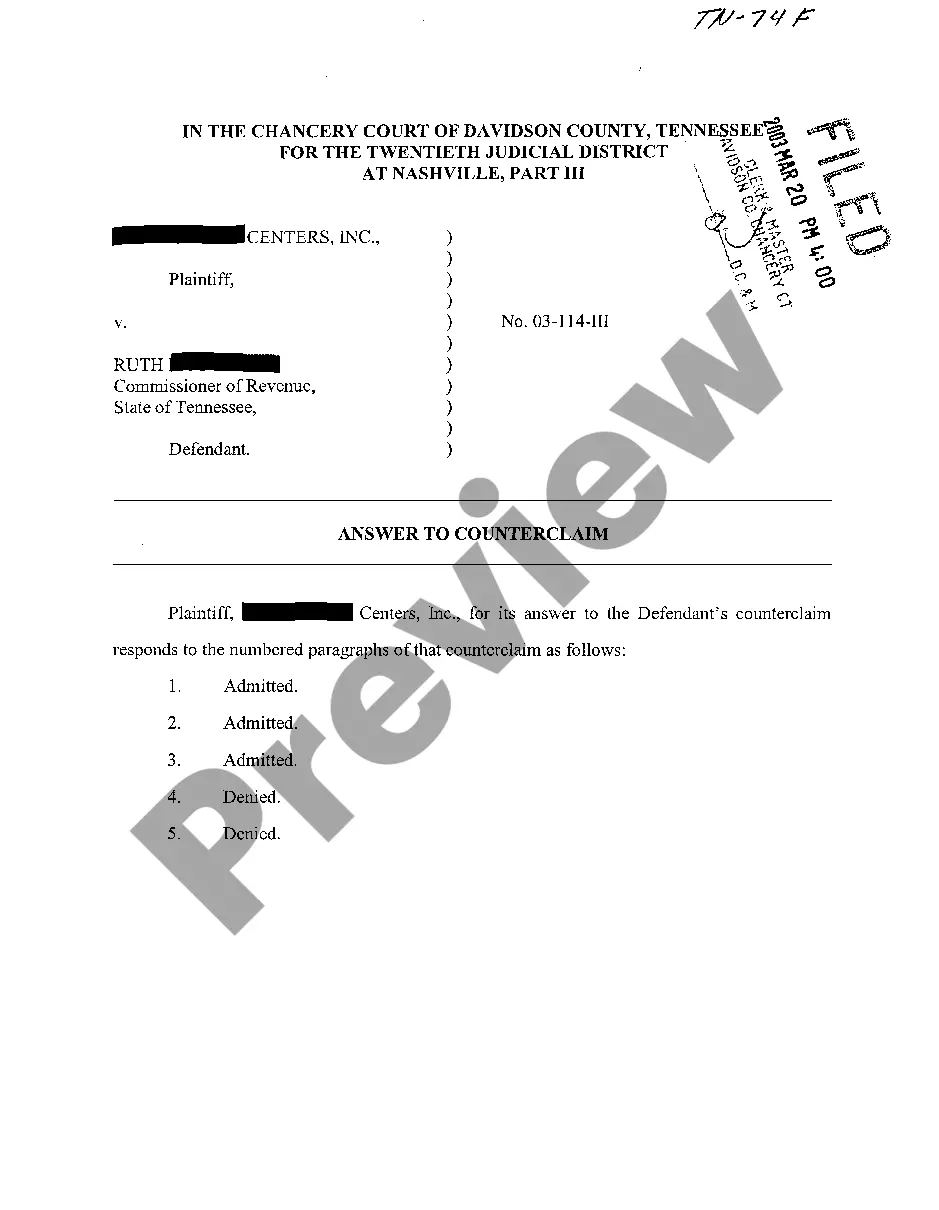

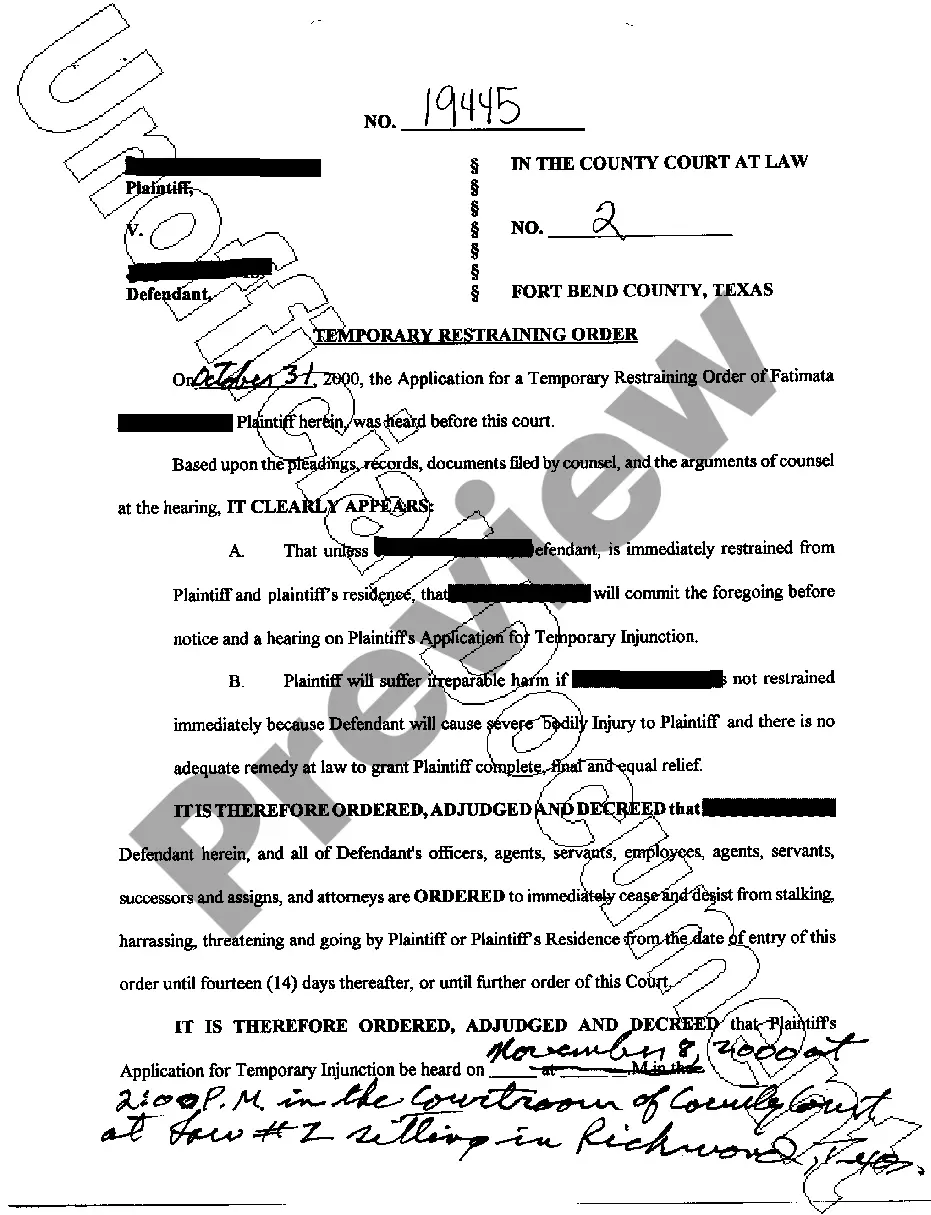

Tennessee Complaint regarding sales, use, liquor, business taxes

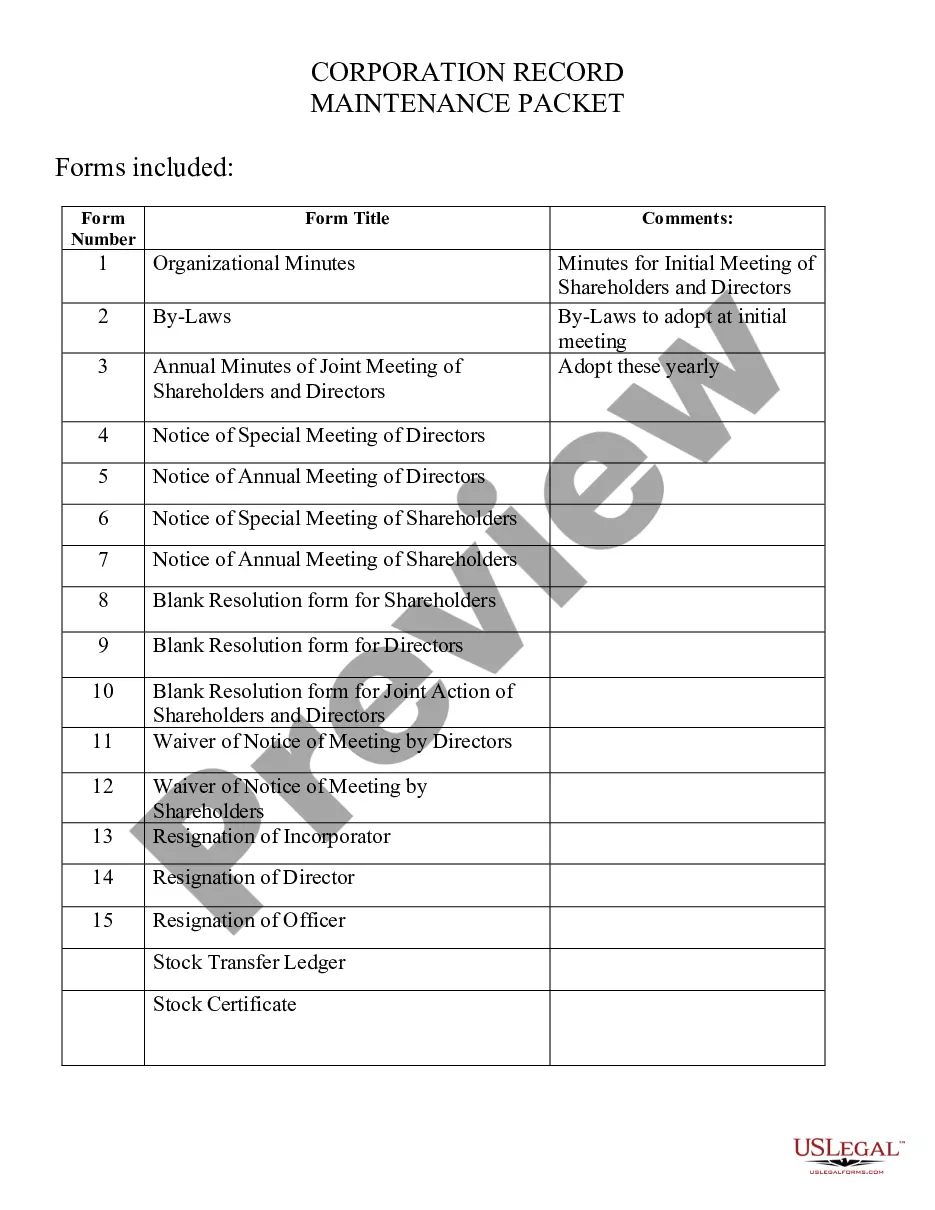

Description

How to fill out Tennessee Complaint Regarding Sales, Use, Liquor, Business Taxes?

Get access to quality Tennessee Complaint regarding sales, use, liquor, business taxes forms online with US Legal Forms. Steer clear of days of misused time seeking the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to just that. Get above 85,000 state-specific legal and tax forms that you can download and submit in clicks within the Forms library.

To find the sample, log in to your account and click Download. The document will be stored in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- Find out if the Tennessee Complaint regarding sales, use, liquor, business taxes you’re looking at is appropriate for your state.

- View the form making use of the Preview option and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to register.

- Pay out by credit card or PayPal to complete making an account.

- Pick a favored file format to save the document (.pdf or .docx).

Now you can open up the Tennessee Complaint regarding sales, use, liquor, business taxes example and fill it out online or print it and do it by hand. Take into account mailing the file to your legal counsel to make sure all things are filled in correctly. If you make a mistake, print out and complete sample again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and access a lot more templates.

Form popularity

FAQ

Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies, certain groceries and food items, and items which are used in the process of packaging. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

Tennessee Liquor Tax - $4.40 / gallon 2714 Tennessee's general sales tax of 7% also applies to the purchase of liquor. In Tennessee, liquor vendors are responsible for paying a state excise tax of $4.40 per gallon, plus Federal excise taxes, for all liquor sold.

In Tennessee, you have a 15 percent LBD tax. LBD stands for 'liquor-by-the-drink." The state also has a 7 percent state sales tax on the drink. Remember, the food and drinks at restaurants are not taxed at the lower rate that food and drinks at supermarkets are taxed.

2714 Tennessee's general sales tax of 7% also applies to the purchase of liquor. In Tennessee, liquor vendors are responsible for paying a state excise tax of $4.40 per gallon, plus Federal excise taxes, for all liquor sold.

California. Customers in California pay an extra $3.30 a gallon excise tax. But if the spirit is over 50% alcohol, the tax doubles to $6.60.

Spirits are taxed the least in Wyoming and New Hampshire. These two control states gain revenue directly from alcohol sales through government-run stores and have set prices low enough that they are comparable to buying spirits without taxes.

In Tennessee, you have a 15 percent LBD tax. LBD stands for 'liquor-by-the-drink." The state also has a 7 percent state sales tax on the drink. Remember, the food and drinks at restaurants are not taxed at the lower rate that food and drinks at supermarkets are taxed.

Generally, the sales tax applies to the retail sale of tangible personal property and certain services such as lodging services, telecommunications services and installation and repair of tangible personal property.

Washington ($32.52) Oregon ($21.98) Virginia ($19.93) Alabama ($19.15) Utah ($15.96) North Carolina ($14.63) Iowa ($13.07) Alaska ($12.80)