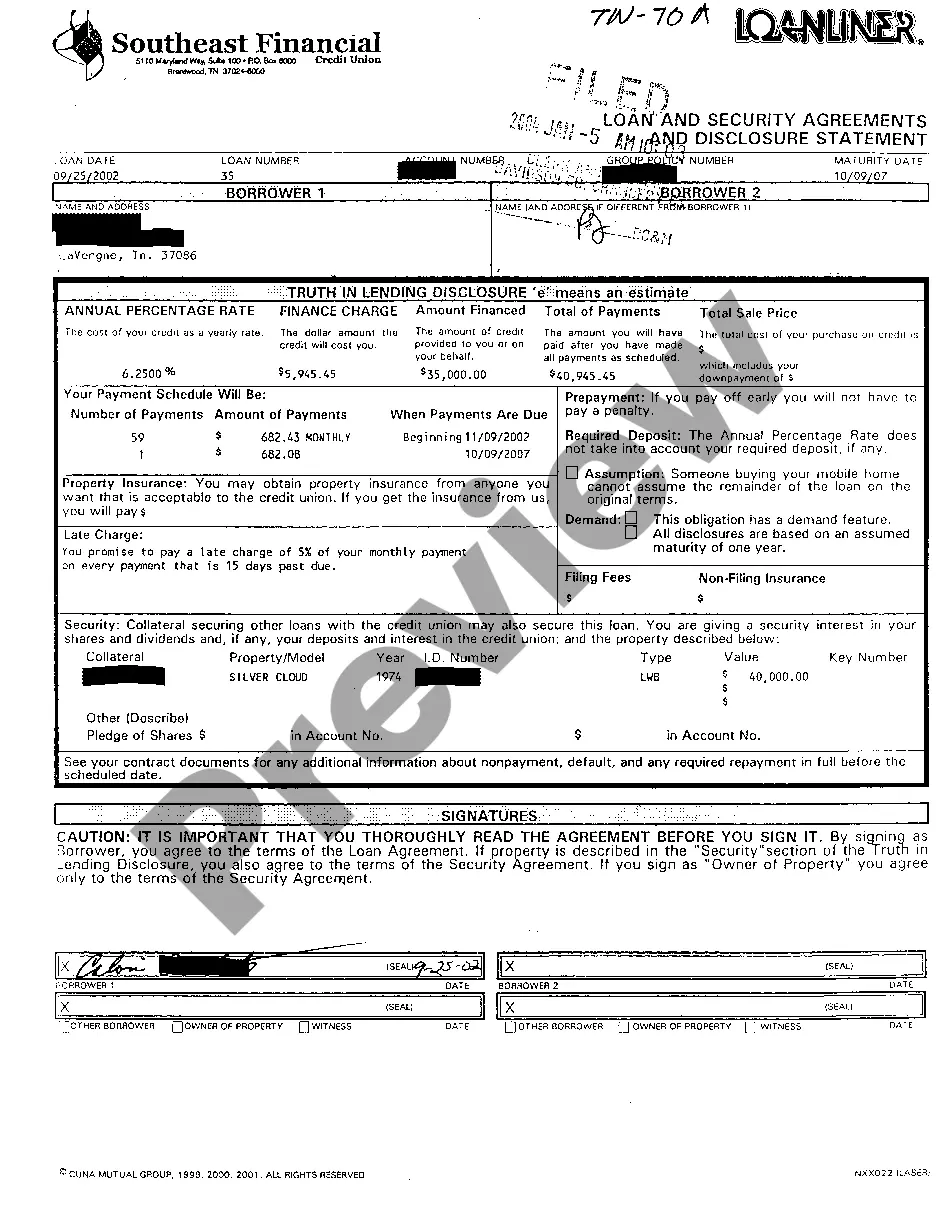

Tennessee Loan And Security Agreement

Description Auto Loan Template

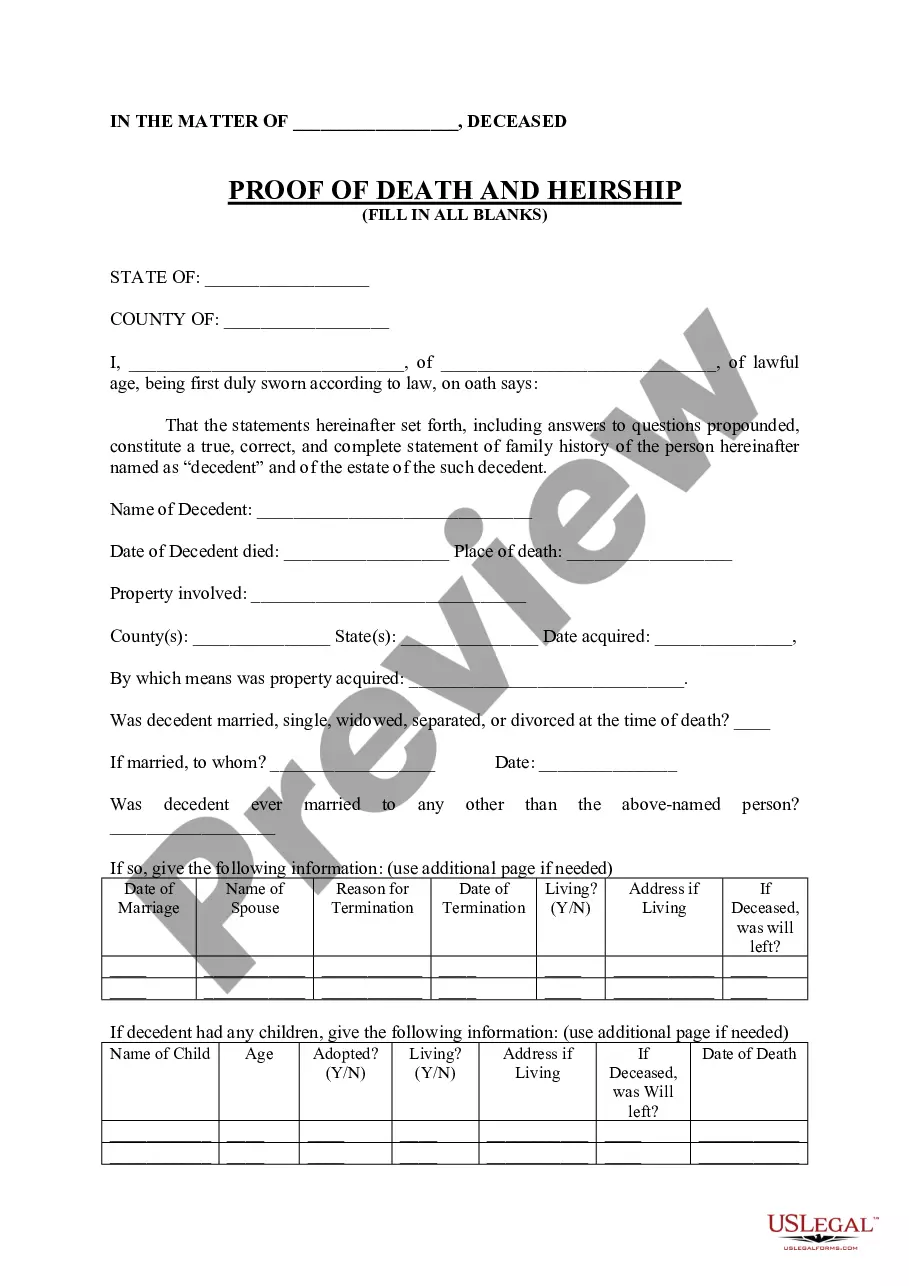

How to fill out Tennessee Loan And Security Agreement?

Access to high quality Tennessee Loan And Security Agreement samples online with US Legal Forms. Steer clear of days of wasted time searching the internet and dropped money on files that aren’t updated. US Legal Forms provides you with a solution to just that. Find more than 85,000 state-specific legal and tax samples that you can save and complete in clicks within the Forms library.

To get the sample, log in to your account and then click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide below to make getting started simpler:

- Find out if the Tennessee Loan And Security Agreement you’re looking at is appropriate for your state.

- Look at the sample utilizing the Preview option and browse its description.

- Go to the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay by card or PayPal to finish creating an account.

- Choose a preferred file format to download the document (.pdf or .docx).

Now you can open the Tennessee Loan And Security Agreement template and fill it out online or print it and do it yourself. Consider sending the papers to your legal counsel to ensure all things are completed appropriately. If you make a error, print and fill sample again (once you’ve made an account all documents you download is reusable). Make your US Legal Forms account now and get more samples.

Sample Of Car Title Form popularity

How To Write A Loan Contract Agreement Other Form Names

FAQ

With reference to lending, security or collateral, is an asset that is pledged by the borrower as protection in case he or she defaults on the repayment.Security should be important to the lender, whether the borrower is an individual, or a company.

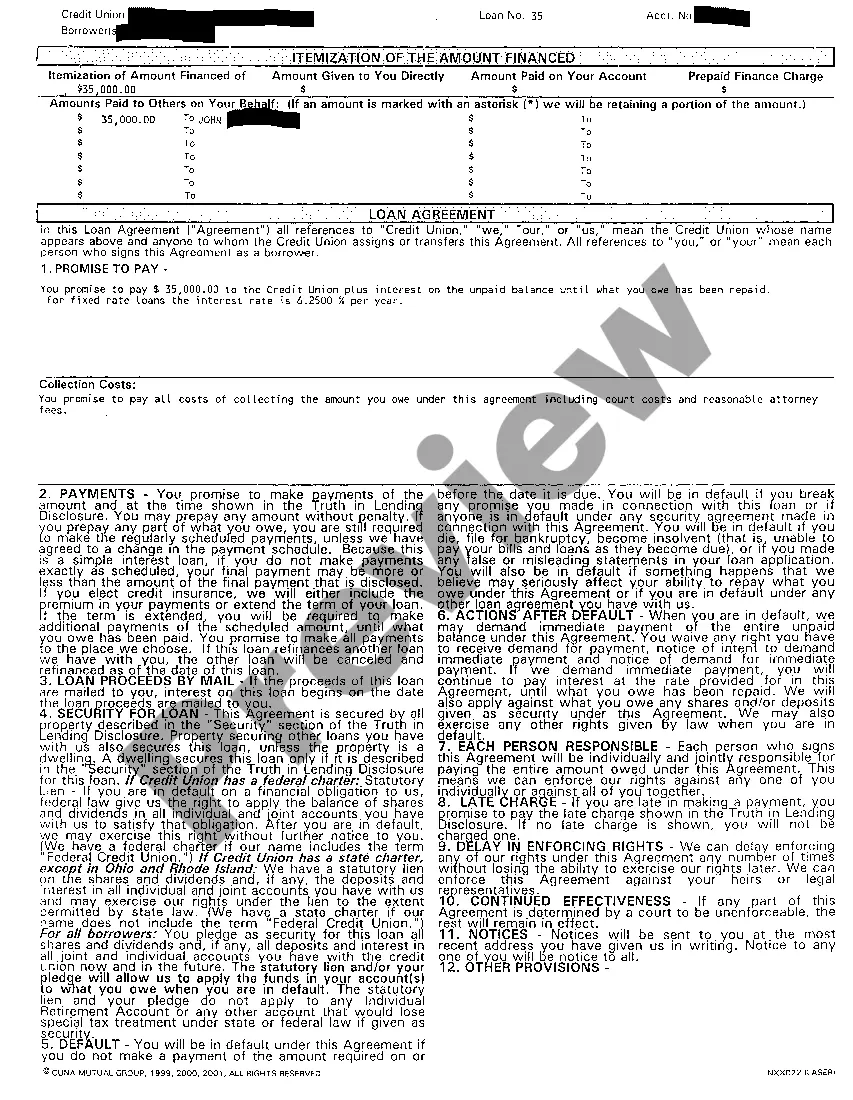

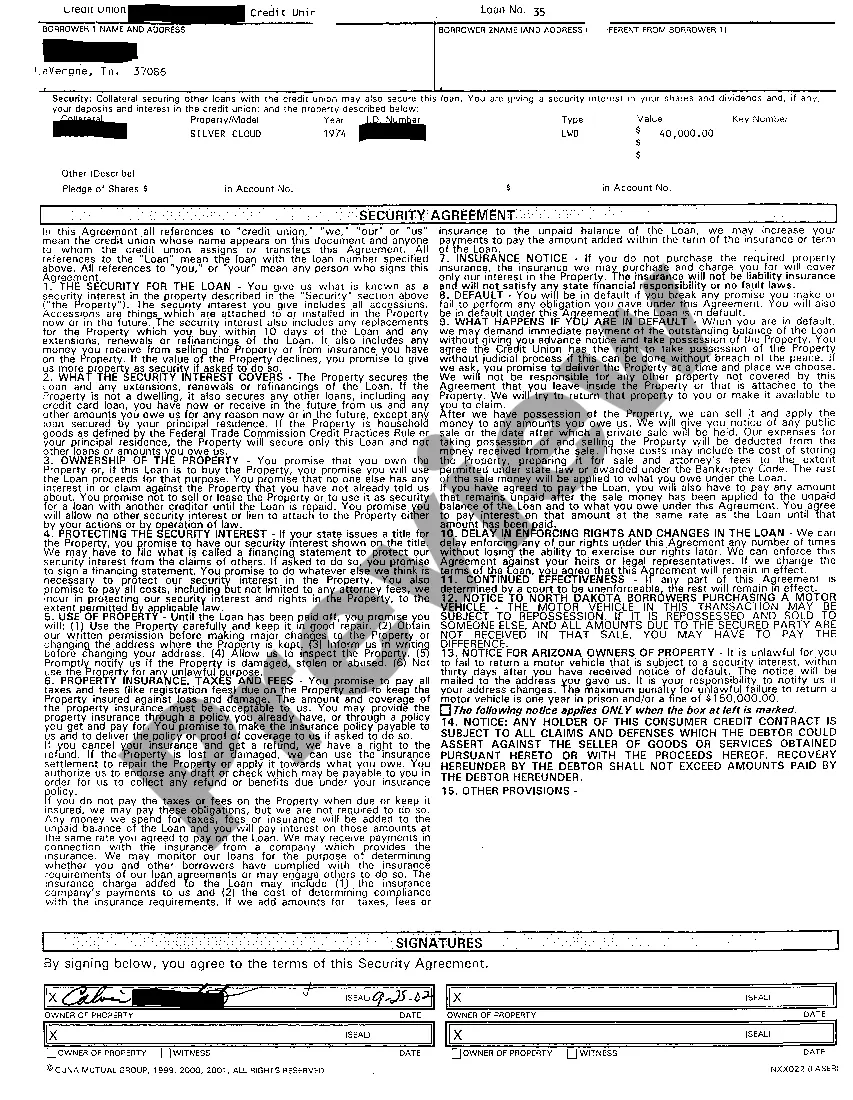

A security agreement refers to a document that provides a lender a security interest in a specified asset or property that is pledged as collateral.In the event that the borrower defaults, the pledged collateral can be seized by the lender and sold.

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.

Mortgage and security interest are two similar terms, both referring to a collateral created in order to secure a debt by one party to the other.The basic difference is that mortgage is a traditional way of securing obligations under the common law, typically used in property transactions.

Identity of the Parties. The names of the lender and borrower need to be stated. Date of the Agreement. Interest Rate. Repayment Terms. Default provisions. Signatures. Choice of Law. Severability.

Three things must be present in order for the secured party to obtain a protected security interest in the collateral: 1) the secured party must pay for or give something of value in exchange for receiving the security interest, 2) the debtor must own the collateral or have proper authority over the collateral in order

Loan agreements are binding contracts between two or more parties to formalize a loan process.Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

A general security agreement creates a security interest in all present and future assets of the borrower. This means the lender would have access to all assets your business owns now and any future assets your business purchases as collateral for the loan issued.