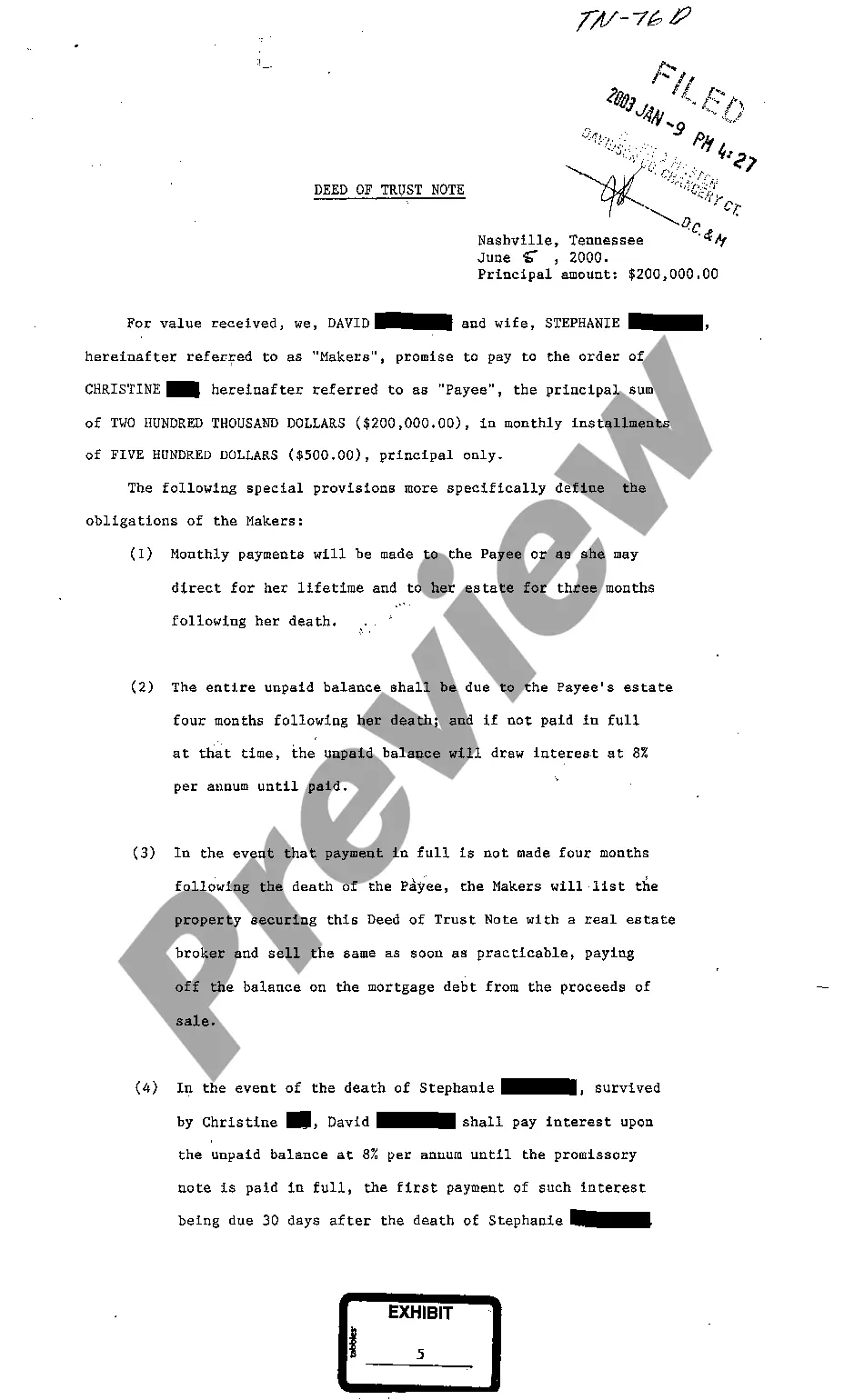

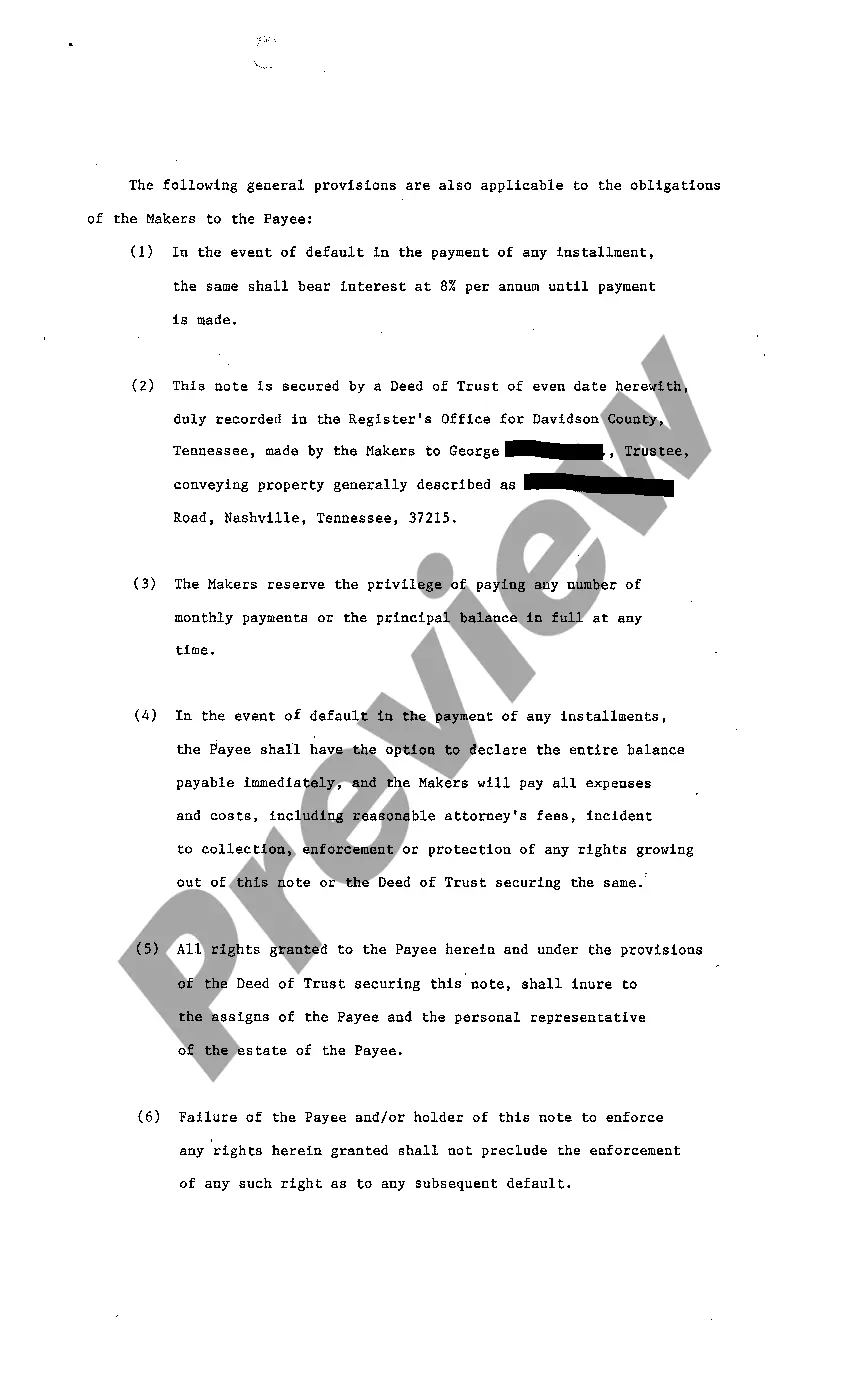

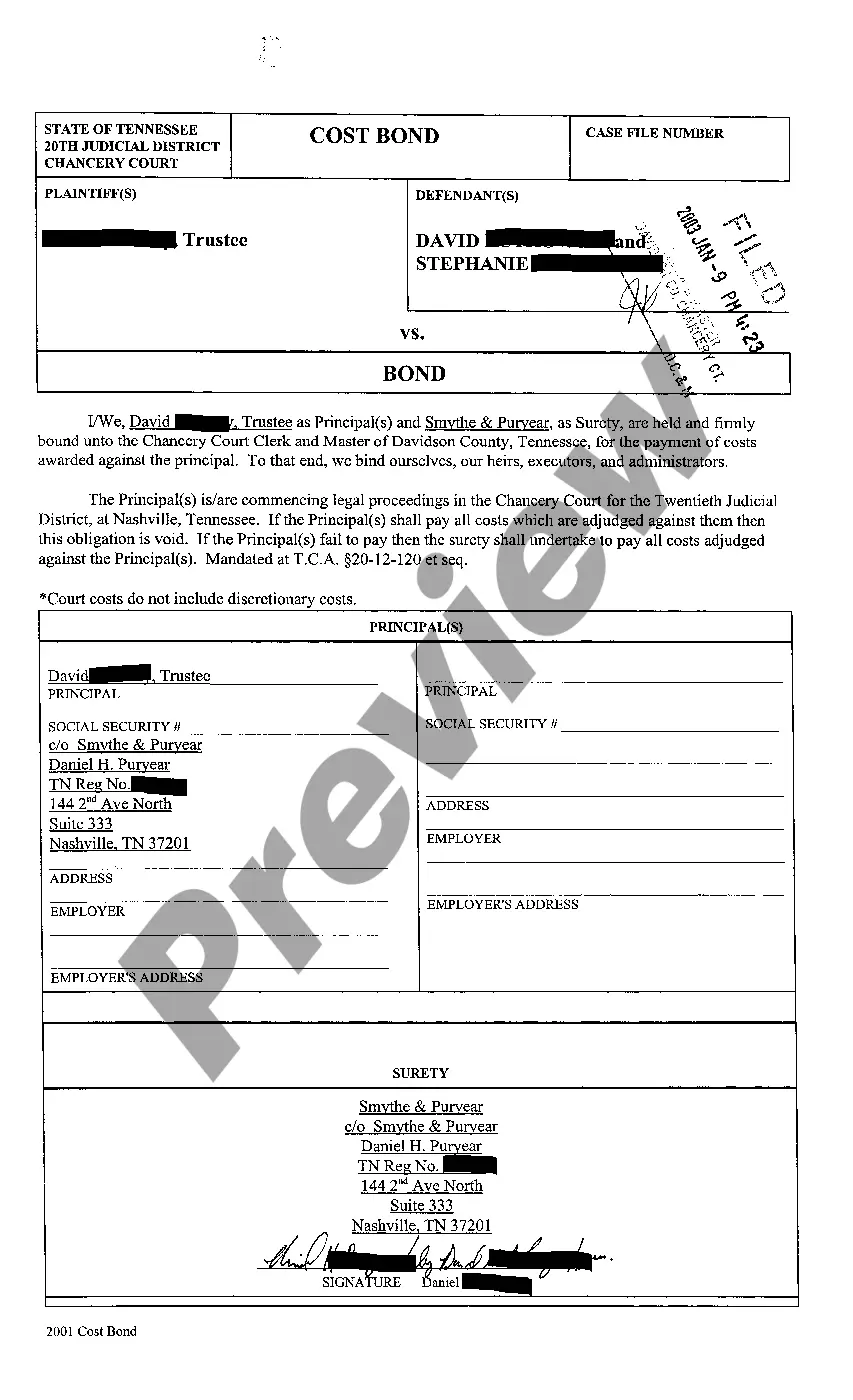

Tennessee Deed of Trust Note for Monthly Installments on Loan

Description

How to fill out Tennessee Deed Of Trust Note For Monthly Installments On Loan?

Access to high quality Tennessee Deed of Trust Note for Monthly Installments on Loan samples online with US Legal Forms. Avoid hours of lost time searching the internet and dropped money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Get over 85,000 state-specific authorized and tax forms that you could download and fill out in clicks in the Forms library.

To get the example, log in to your account and click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide listed below to make getting started easier:

- See if the Tennessee Deed of Trust Note for Monthly Installments on Loan you’re considering is suitable for your state.

- View the sample making use of the Preview option and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to register.

- Pay by credit card or PayPal to complete creating an account.

- Pick a favored file format to download the document (.pdf or .docx).

Now you can open the Tennessee Deed of Trust Note for Monthly Installments on Loan example and fill it out online or print it out and get it done yourself. Take into account giving the document to your legal counsel to make sure all things are filled in appropriately. If you make a mistake, print and complete application again (once you’ve created an account all documents you save is reusable). Create your US Legal Forms account now and get much more samples.

Form popularity

FAQ

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

Mortgages and deeds of trust are both agreements in which a borrower puts up title to real estate as security (collateral) for a loan.Some states use mortgages to create the lien, while others use deeds of trust or another similar-sounding instrument.

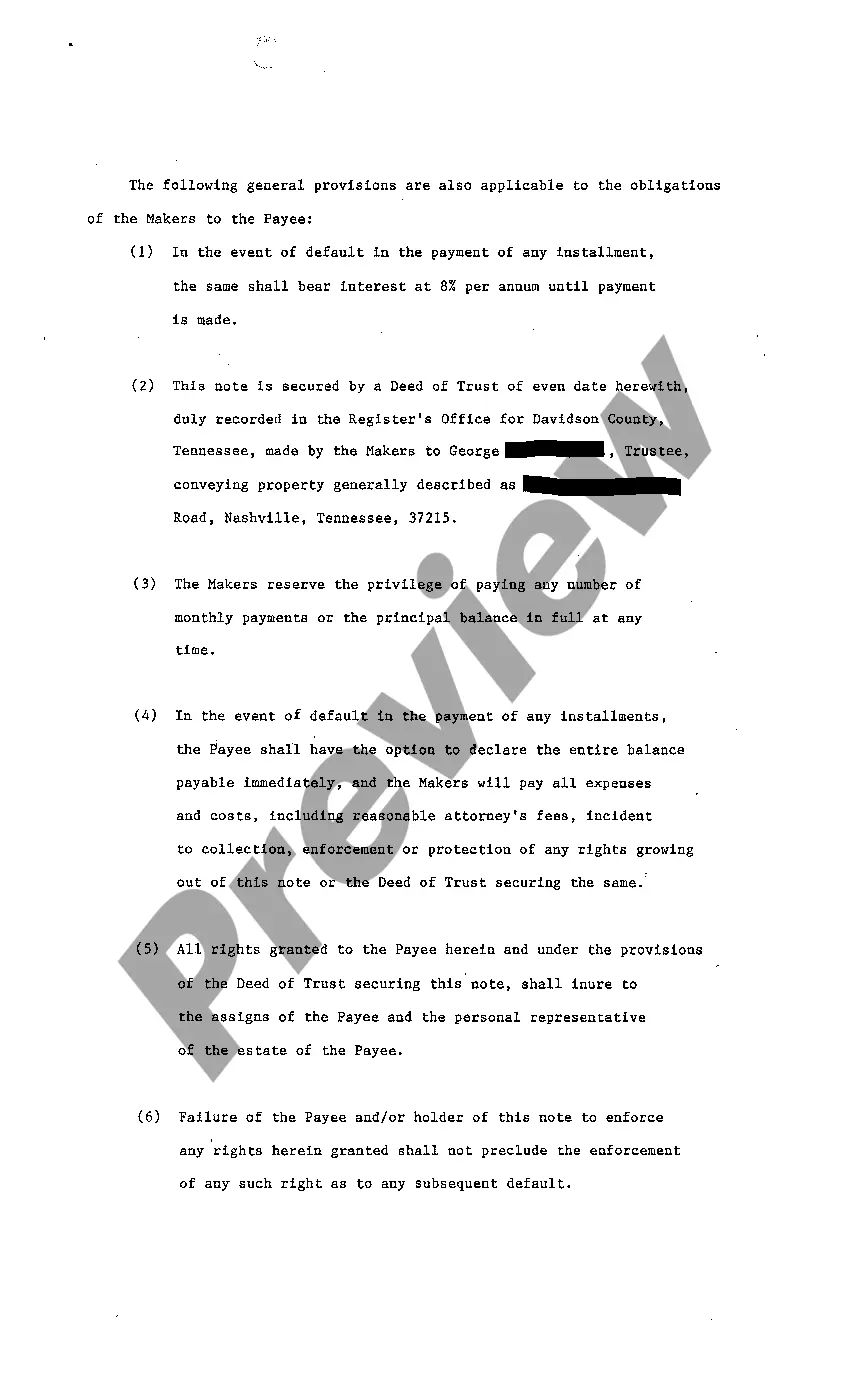

Deeds of trust are used in conjunction with promissory notes. The deed of trust is the security for the amount loaned to finance the real estate purchase, and is secured by the underlying piece of real estate. The deed of trust is what secures the promissory note.

1. What is the Difference Between the Note and Deed of Trust? A note, usually known as a promissory note, which is a written promise to repay a loan. Whereas, a trust deed is a document used to protect paying back of a loan that is being documented as a lien counter to the borrowers real estate.

Small businesses frequently borrow money, or extend credit, in the course of their operations. A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

Neither is a loan. Neither a mortgage nor a deed of trust is the same thing as a home loan. Your loan is an agreement to pay back a certain amount of money to your lender. A deed of trust or mortgage is a contract that places a lien on your property.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.

However, most mortgage lenders prefer that all borrowers appear on the title.However, mortgage borrowers that are not on the title deed become guarantors, not co-borrowers. Since they do not have a legal interest in the real estate, they cannot execute a mortgage, pledging the property as collateral for the loan.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.